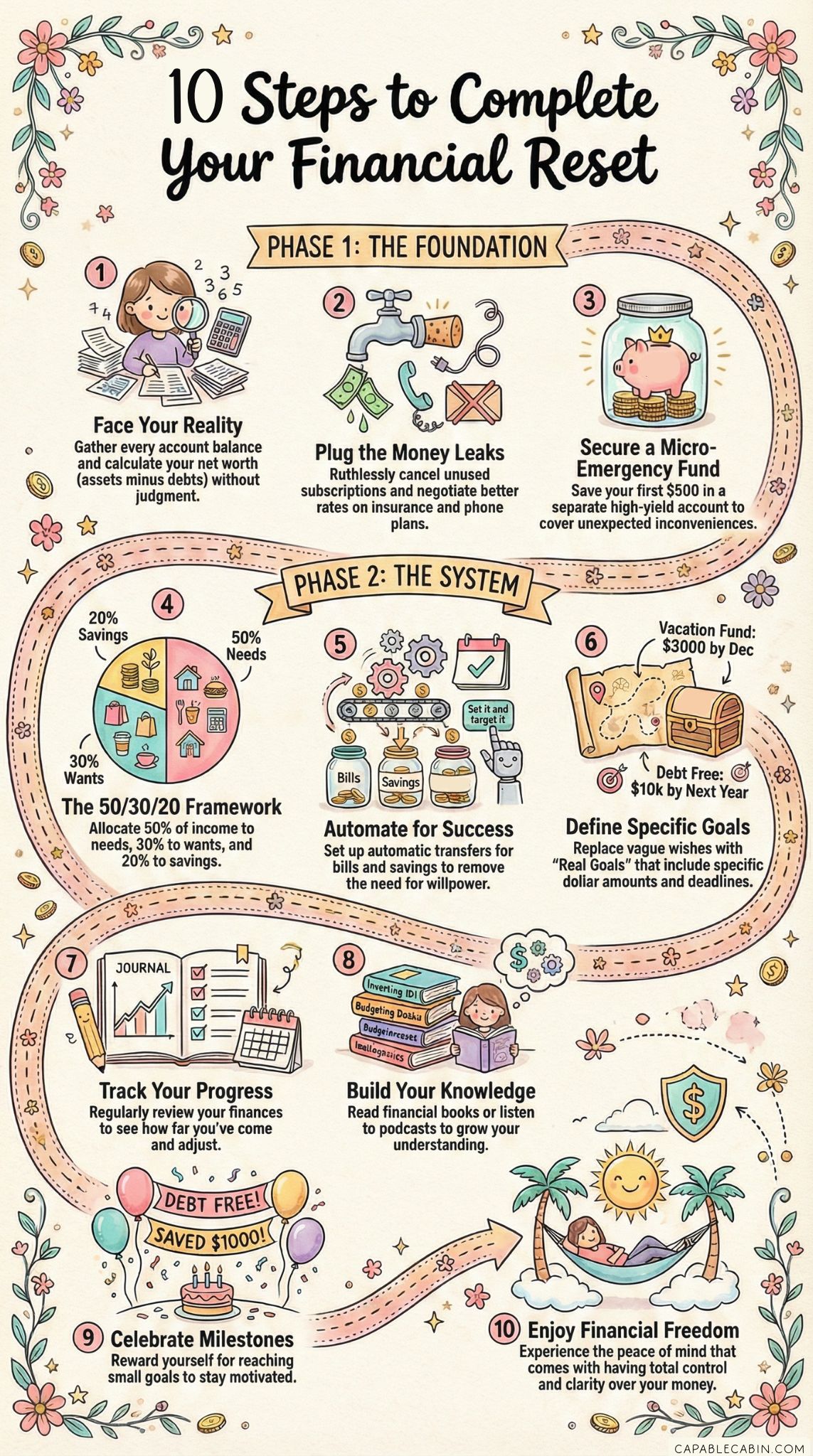

10 Steps to Complete Your Financial Reset and Take Control of Your Money

Let’s talk about something most of us need but rarely execute: a complete financial reset.

You know that feeling when your finances feel like a tangled mess of subscriptions, mystery charges, and “I’ll deal with it later” decisions? Yeah, that ends today.

A financial reset isn’t about perfection. It’s about creating clarity, taking control, and building momentum. Whether you’re recovering from a tough year, starting fresh after a major life change, or just ready to get your money right—this is your roadmap.

Why You Need a Financial Reset (Like, Actually)

Here’s the truth: financial chaos doesn’t fix itself. That credit card statement you’ve been avoiding? Still there. Those savings goals you set in January? Still sitting at zero.

A money reset gives you three critical things:

- Clarity on where you actually stand (no more guessing)

- Control over where your money goes (instead of wondering where it went)

- Confidence to make bigger financial moves without second-guessing everything

The best part? You don’t need to be a finance expert. You just need to be honest with yourself and willing to put in the work.

Your Complete Financial Reset Checklist

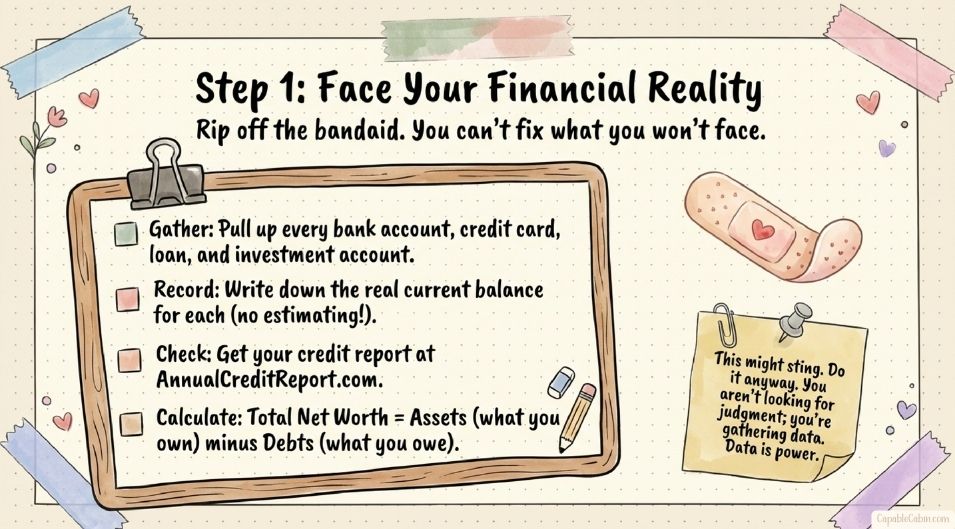

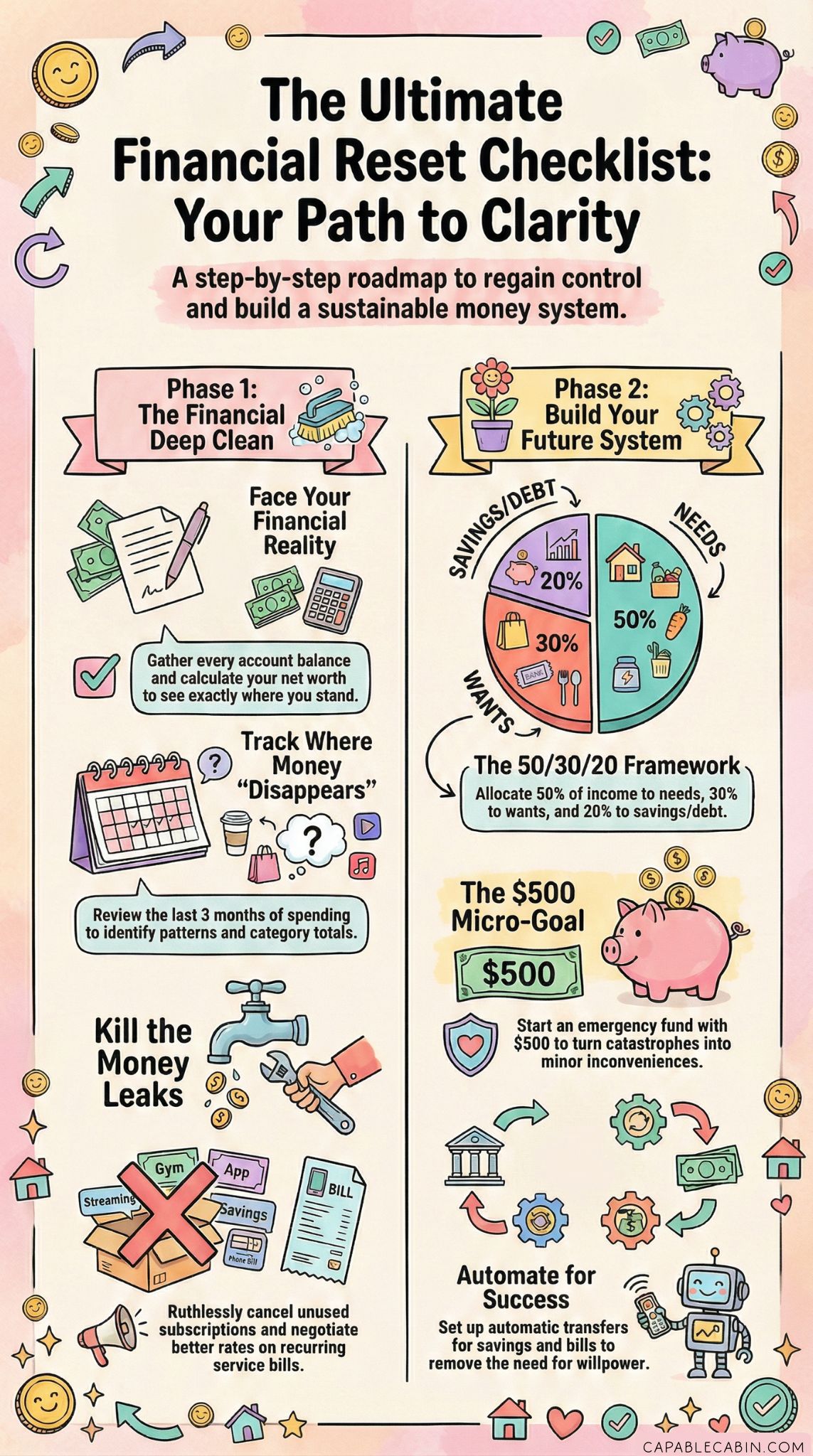

1. Face Your Financial Reality (Yes, All of It)

First step: rip off the bandaid. You can’t fix what you won’t face.

Action items:

- Pull up every bank account, credit card, loan, and investment account you have

- Write down the current balance for each (the real numbers, not what you hope they are)

- Check your credit report at AnnualCreditReport.com (it’s free, use it)

- Calculate your total net worth: assets minus debts

This might sting. Do it anyway. You’re not looking for judgment here—you’re gathering data. And data is power.

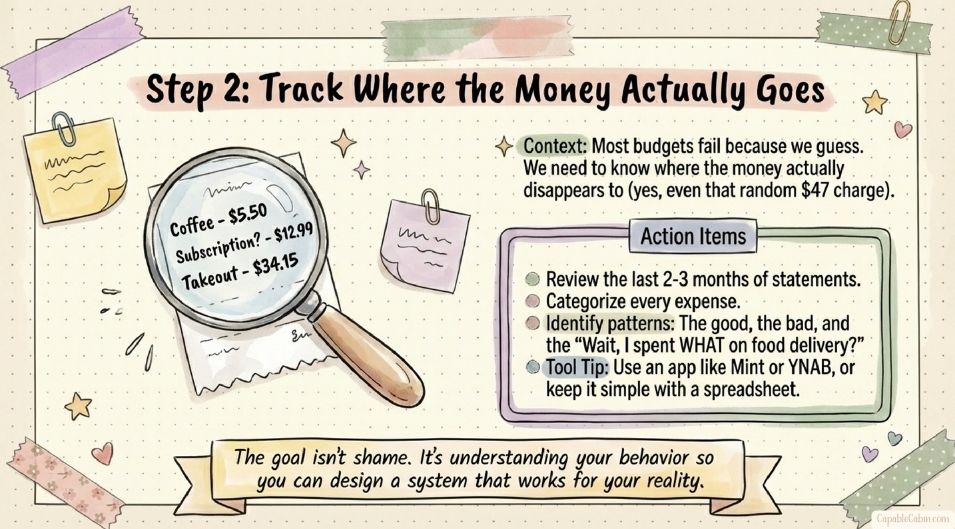

2. Track Where Your Money Actually Goes

Most people have zero clue where their money disappears to each month. That’s why budgets fail.

Action items:

- Review the last 2-3 months of bank and credit card statements

- Categorize every expense (yes, including that random $47 charge you don’t remember)

- Identify your spending patterns—the good, the bad, and the “wait, I spent WHAT on food delivery?”

- Use an app like Mint, YNAB, or even a simple spreadsheet to track going forward

The goal isn’t to shame yourself. It’s to understand your actual spending behavior so you can design a system that works with your reality, not against it.

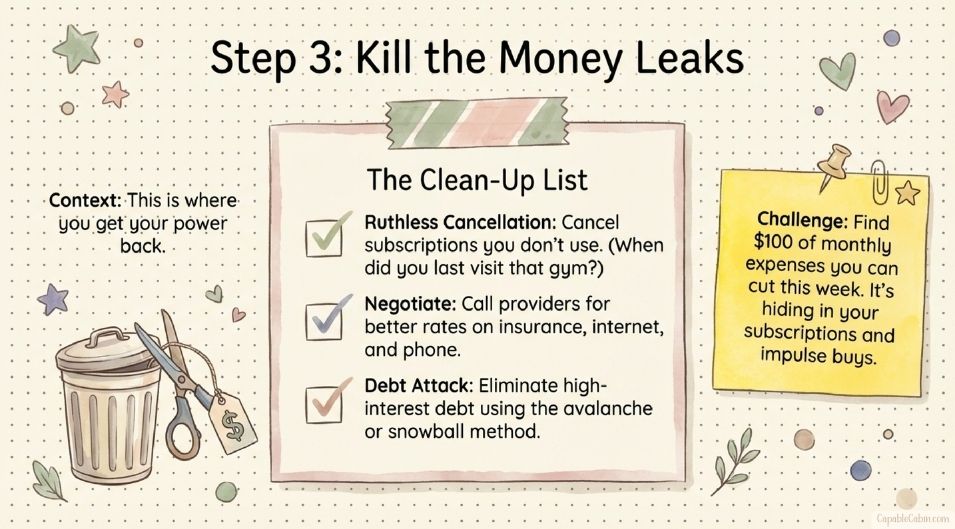

3. Kill the Money Leaks

This is where you get your power back.

Action items:

- Cancel subscriptions you don’t use (be ruthless—when’s the last time you actually used that gym membership?)

- Call service providers and negotiate better rates on insurance, internet, phone plans

- Eliminate one high-interest debt using the avalanche or snowball method

- Set up automatic transfers so bills get paid before you can spend the money elsewhere

Quick win challenge: Find $100 of monthly expenses you can cut this week. I promise it’s hiding in your subscriptions and impulse purchases.

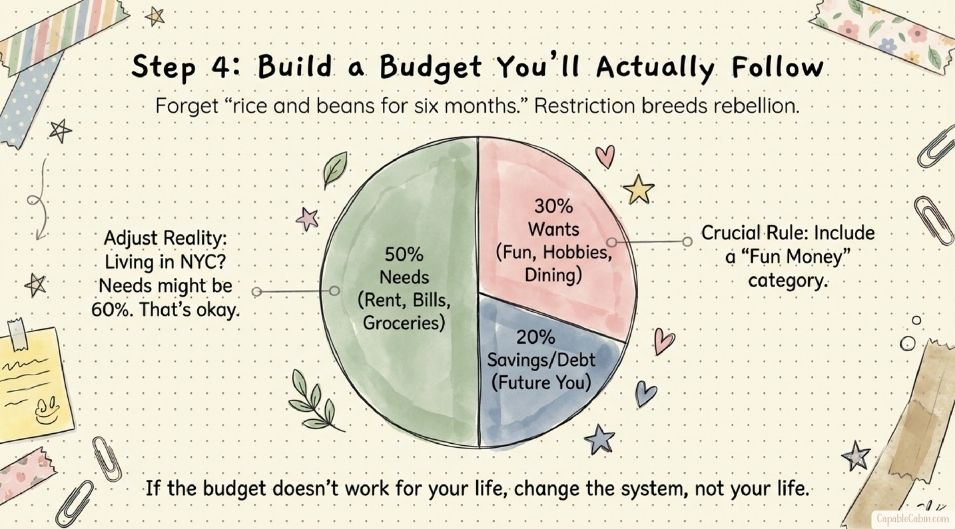

4. Build Your Budget (That You’ll Actually Follow)

Forget the restrictive “rice and beans for six months” approach. That’s not sustainable, and you’ll quit in three weeks.

Action items:

- Start with the 50/30/20 rule as a framework: 50% needs, 30% wants, 20% savings/debt payoff

- Adjust based on your reality (living in NYC? Your needs might be 60%)

- Include a “fun money” category—restriction breeds rebellion

- Review and adjust monthly (your budget should evolve with you)

Your budgeting checklist should feel like a tool, not a prison sentence. If it doesn’t work for your life, change the system—not your life.

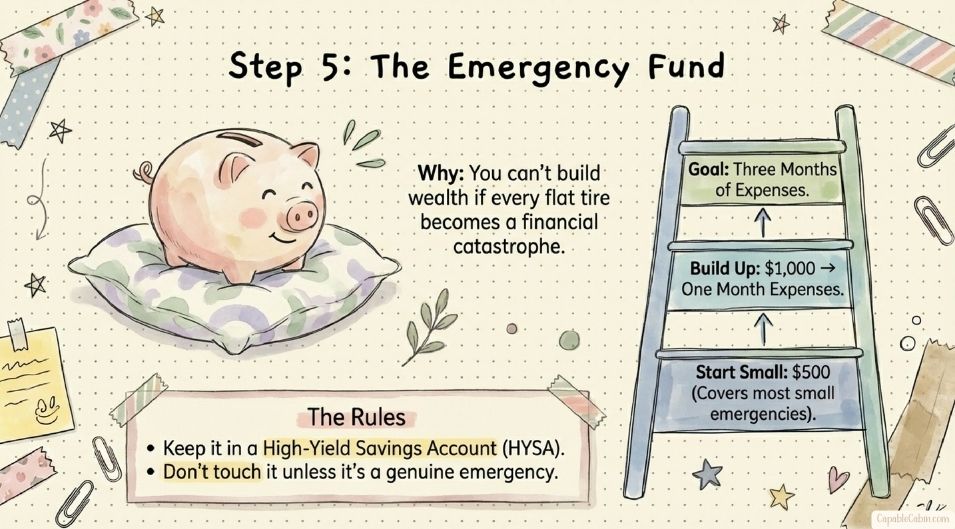

5. Create Your Emergency Fund (Before Anything Else)

Real talk: you can’t build wealth if every unexpected expense becomes a crisis.

Action items:

- Start with a micro-goal: $500 emergency fund (this covers most small emergencies)

- Build to $1,000, then one month of expenses, then three months

- Keep it in a high-yield savings account (separate from your regular checking)

- Don’t touch it unless it’s a genuine emergency (no, a sale at your favorite store doesn’t count)

Having this cushion changes everything. Suddenly, a flat tire is an inconvenience, not a catastrophe.

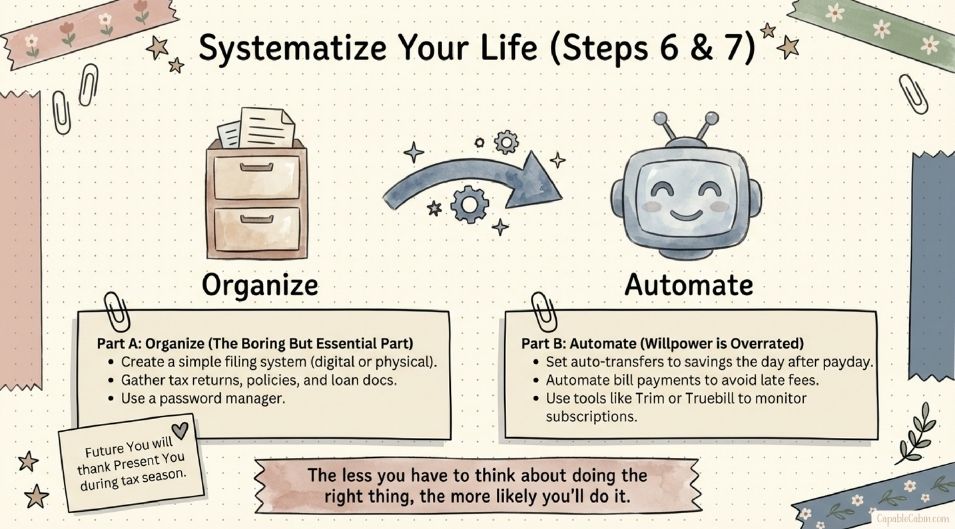

6. Organize Your Financial Documents

You can’t manage what’s scattered across seventeen folders and three email accounts.

Action items:

- Create a simple filing system (digital or physical—whatever you’ll actually use)

- Gather tax returns, insurance policies, loan documents, investment statements

- Set up a password manager for all your financial logins

- Schedule quarterly “money dates” with yourself to review everything

This sounds boring. It is boring. It’s also essential. Future you will thank present you when tax season hits.

7. Automate Your Financial Success

Willpower is overrated. Systems win every time.

Action items:

- Set up automatic transfers to savings the day after payday

- Automate bill payments to avoid late fees

- Schedule automatic investment contributions (even if it’s just $25/month to start)

- Use tools like Trim or Truebill to monitor and optimize subscriptions automatically

The less you have to think about doing the right thing with money, the more likely you’ll actually do it.

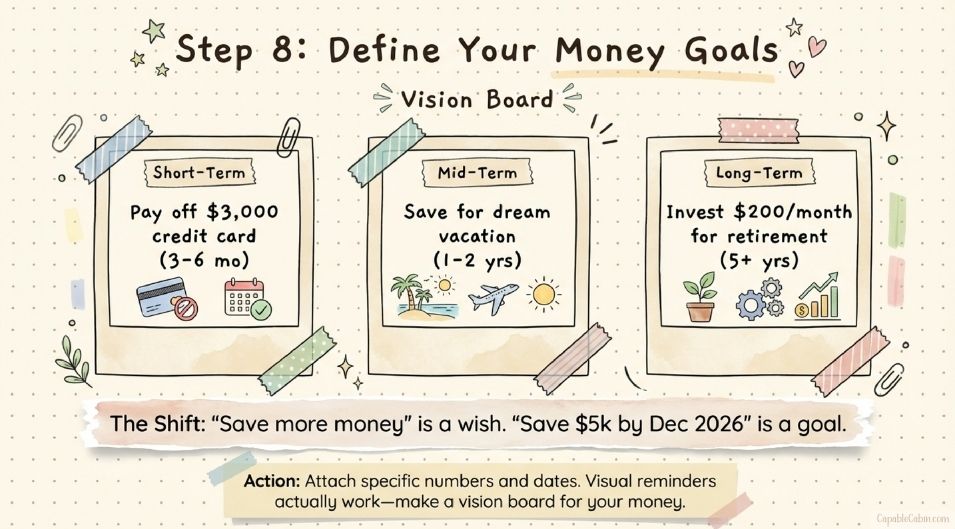

8. Define Your Money Goals (The Real Ones)

“Save more money” isn’t a goal. It’s a wish. Let’s get specific.

Action items:

- Write down 3 financial goals: one short-term (3-6 months), one mid-term (1-2 years), one long-term (5+ years)

- Attach specific numbers and dates to each

- Break each goal into monthly action steps

- Create visual reminders (yes, a vision board for your money actually works)

Examples: “Save $5,000 for emergency fund by December 2026” or “Pay off $3,000 credit card debt by September 2026” or “Invest $200/month for retirement starting next month.”

Specific goals create specific actions. Vague goals create vague results.

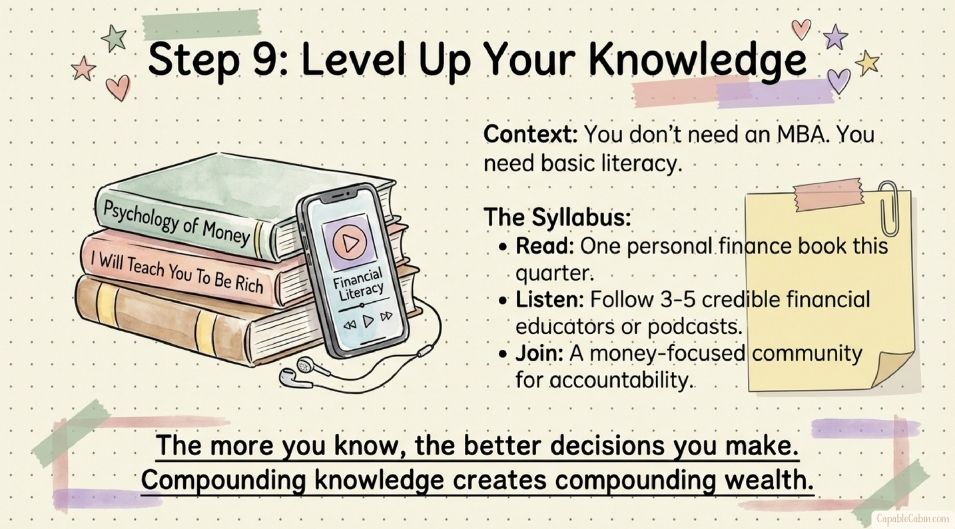

9. Level Up Your Financial Knowledge

You don’t need an MBA. You need basic financial literacy and the willingness to keep learning.

Action items:

- Read one personal finance book this quarter (start with “The Psychology of Money” or “I Will Teach You to Be Rich”)

- Follow 3-5 credible financial educators on social media or podcasts

- Take a free financial literacy course online

- Join a money-focused community for accountability and support

The more you know, the better decisions you make. Compounding knowledge creates compounding wealth.

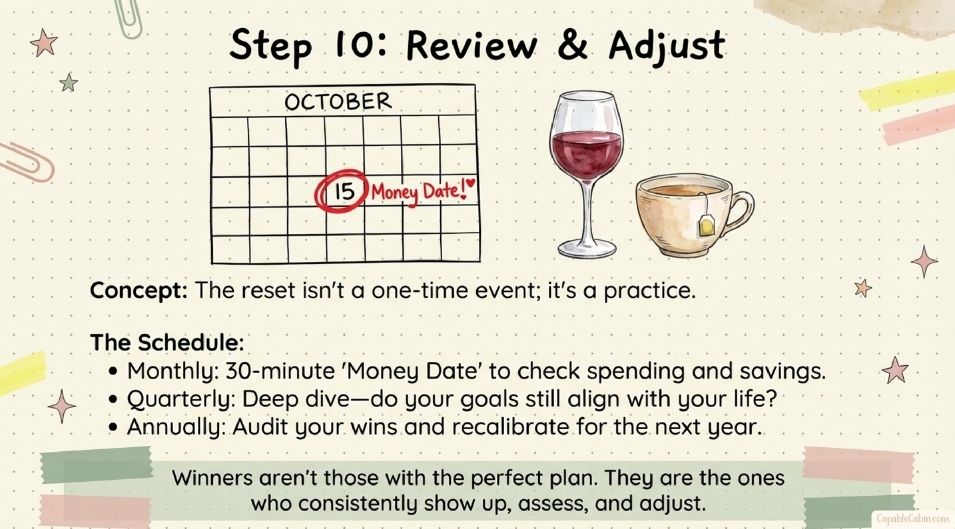

10. Review and Adjust Regularly

Your financial reset isn’t a one-time event. It’s a practice.

Action items:

- Schedule monthly money check-ins (30 minutes to review spending, savings, progress)

- Quarterly deep dives to assess if your budget and goals still align with your life

- Annual financial “audits” to celebrate wins and recalibrate for the next year

- Adjust your strategy when life changes (new job, relationship, goals, priorities)

The people who win with money aren’t the ones who create the perfect plan once. They’re the ones who consistently show up, assess, and adjust.

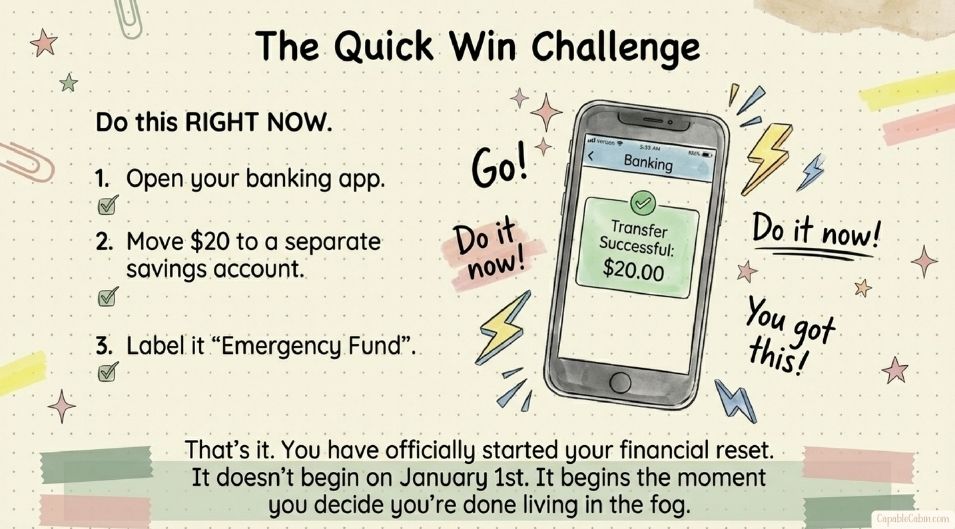

Your Financial Reset Starts Now

Here’s what I need you to understand: you don’t have to have it all figured out. You don’t need to execute this entire checklist perfectly in one weekend.

But you do need to start.

Your immediate action plan:

- This week: Face your numbers (step 1) and track your spending (step 2)

- Next week: Cut three money leaks (step 3) and start your emergency fund with whatever you can (step 5)

- This month: Set up your budget (step 4) and automate one financial win (step 7)

A financial reset isn’t about deprivation. It’s about liberation—from stress, from uncertainty, from that nagging feeling that you should be doing better with your money.

You’ve got the checklist. You’ve got the framework. Now you just need to take the first step.

Quick Win Challenge: Right now, open your banking app and move $20 to a separate savings account. Label it “Emergency Fund.” That’s it. You’ve officially started your financial reset.

The fresh start you’re looking for? It doesn’t begin on January 1st or next Monday or when everything is perfect. It begins the moment you decide you’re done living in financial fog.

You’ve got this.