10 Creative Ways to Fund Your Emergency Savings This Month

Discover Unique Funding Approaches

Ever feel like your savings plan just isn’t moving fast enough? Maybe you’re looking for creative emergency fund ideas that go beyond pinching pennies. We’ve all hit that point—where money is tight, yet there’s still a desire to build a safety net. You’re certainly not alone in wanting to set aside a cushion for those unpredictable moments, from medical bills to car repairs to the random “kid-does-something-expensive” scenario. The good news is there are plenty of ways to grow your emergency savings, even if it feels like there’s never quite enough left over at the end of the month.

Let’s take this journey together, exploring how you can stash away extra cash without completely overhauling your lifestyle. Think of this as your friendly roadmap—no shame, no judgment, just practical and occasionally fun strategies. Before we dive in, remember that building an emergency fund is rarely a one-size-fits-all endeavor. Some of us have busy schedules and can only dabble in side opportunities, while others prefer a hands-on approach like selling unused items at a local market. Whatever your situation, the real magic happens when you find an approach that meshes well with your daily life.

By the way, if you’re just getting started, it might help to check out our start emergency fund resource. It’s a good place to understand the basics, like how much you should consider saving in the first place and why an emergency stash matters—especially for women and families who want to stay prepared for life’s curveballs. But for now, let’s zoom in on 10 fresh, practical ways to fund that cushion this month. Each of these ideas can fit into your life in a flexible way, so you can choose whether you want something quick and fun or a more long-term solution.

The truth is, building your emergency fund takes a bit of determination and maybe some creativity. You might discover that simply adjusting your daily habits can produce much better results than you ever expected. Or you may realize there’s a whole world of side income possibilities out there. Let’s explore them all. Trust me, once you find a strategy that resonates with your personality and schedule, you’ll feel a new sense of empowerment. Ready to get started? Let’s go!

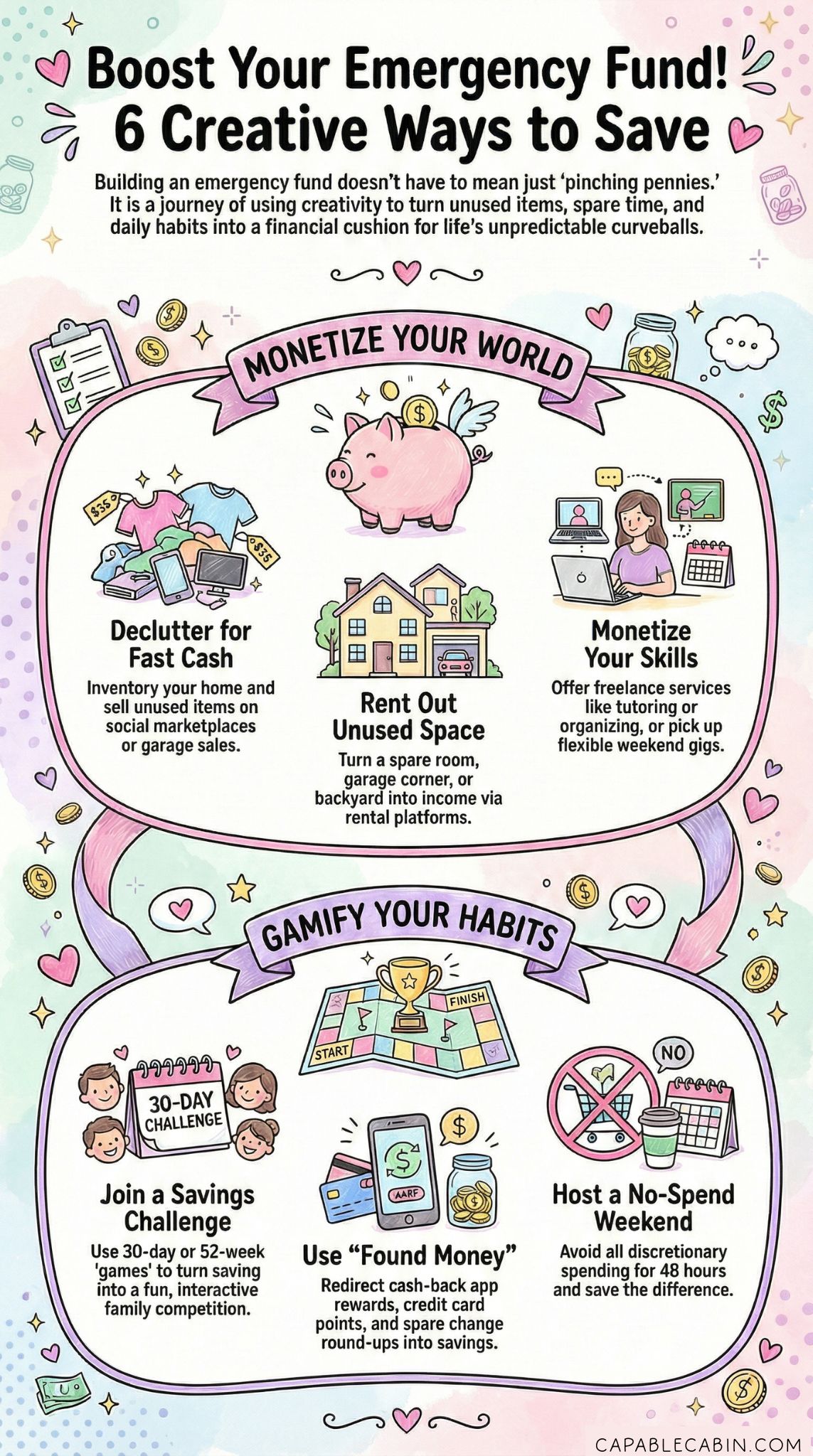

Declutter and Sell

One of the easiest and most satisfying ways to jumpstart your emergency savings is by decluttering your home and selling what you no longer need. Whether it’s an idle treadmill in the basement or an outgrown stack of baby clothes, your items can turn into quick cash that you can funnel straight into your nest egg.

Start With a Home Inventory

Gathering items that you’re no longer using can feel overwhelming at first—everything has a memory attached. But approach it as a friendly challenge: walk through each room with a box or laundry basket, tossing in things that are simply collecting dust. Old toys, electronics, gently used clothing, you name it. Once you finish, sort your discoveries into categories. Perhaps separate the items into “sell,” “donate,” or “trash.” This step keeps your selling strategy organized and ensures you’re only offering items in relatively good condition.

Choose Your Selling Platform

We live in a golden age of online marketplaces, so you’ve got plenty of options. Neighborhood groups on social media are great for quick pickups, while major platforms help you reach a broader audience. If you’re feeling nostalgic, consider hosting a garage sale for a more personal, community-based approach. Each method has its pros and cons. Online listings can be posted anytime, but you’ll need to take good pictures and manage shipping or local pickups. Garage sales require a Saturday morning and possibly some homemade signage, but you get cash right on the spot.

Turn Things into Cash

A few dollars here and there might not feel life-changing, but it adds up surprisingly fast. Let’s say you make $10 on an unused waffle iron, $15 on a set of gently-worn shoes, and $20 on various decor items. The final sum can quickly climb to a couple hundred dollars. And that money can be deposited directly into your new or existing emergency fund. Even if it feels like a small amount, remember you’re taking a tangible step toward financial security. Decluttering also gives you immediate gratification: a fresher space at home and a fatter savings pot.

Set a Savings Challenge

For those who thrive on goals, competition, or simply the thrill of accomplishing something new, a savings challenge can be a perfect fit. Think of it as a game—for yourself, or even with your family—to nudge each other into setting aside small amounts that will accumulate into a meaningful sum.

Pick Your Challenge Style

Savings challenges come in all shapes and sizes. Maybe you’ve heard of the 52-week challenge, where you deposit a small increasing amount each week. If you’re looking for something quicker, a 30-day version might do the trick. And if you need some structure, you could try our emergency fund challenge, which offers milestones and tips to keep you motivated along the way. If you’re in it for the long haul, the year-long emergency fund challenge might be more your speed. The important part is to pick a challenge that feels realistic, not anxiety-inducing.

Make It Interactive

Turn your challenge into a shared event. If you have kids, let them contribute their spare coins—this teaches them valuable lessons about money and delayed gratification, too. If you have a partner or a group of friends, set up friendly competitions. You’d be amazed how motivating it is to see everyone’s totals creep up week by week. Keep track on a chart or a simple spreadsheet. That small act of logging your progress turns abstract savings into something you can see and celebrate.

Celebrate Each Milestone

The idea is to set mini-goals over the course of your challenge. Maybe celebrate every time you add an extra $50 or $100 to your fund. A celebration doesn’t have to be pricey—maybe it’s a homemade fancy dessert or a family movie night. The point is to reward yourself for sticking to the plan. Challenges are supposed to be fun, not a source of stress. Embrace the playful side of it, and before you know it, you’ll have a tidy sum in your emergency pot.

Optimize Cash-Back Apps

These days, there’s an app for everything—grocery shopping, taking surveys, scanning receipts. If you’re already using your phone throughout the day, tapping into cash-back or rebate apps could be a simple route to build your emergency savings.

Make Everyday Purchases Count

Chances are, you buy groceries, household goods, or even clothes for your family on a regular basis. Apps that give you cash back for scanning your receipts or using specific coupons can direct a small amount of money back into your pocket each time you shop. It might seem small—like 50 cents here or a couple of dollars there—but over the course of a month or two, this becomes a nice chunk of change. Transfer it directly into your emergency fund so there’s no temptation to spend it elsewhere.

Try Surveys and Micro-Tasks

Some apps also offer quick tasks to earn points or extra rebates. It might be a short survey about your shopping experience or an offer to watch a short ad to unlock a coupon. Sure, it may take a bit of time, but if you find yourself scrolling social media anyway, why not use those few minutes to earn a little cash? You’d be surprised how quickly you can gather enough rewards to redeem for bank deposits or gift cards.

Avoid App Overwhelm

Yes, you can get carried away downloading every app in the world. That can lead to confusion or forgetting to use them altogether. Instead, pick one or two that align with your shopping habits. Enjoy the convenience, and keep your eye on your monthly totals. Once you get used to snapping photos of receipts or tapping into deals, it becomes second nature. Then, just like that, you’re fueling your emergency savings a few dollars at a time.

Rent Out Unused Space

If you’ve got an extra room, a garage corner, or even a decent-sized backyard, there are ways to turn that space into income. Whether you’re renting out a spare bedroom to short-term guests or storing someone’s RV, this approach can be surprisingly lucrative.

Short-Term vs. Long-Term Rentals

Short-term platforms offer flexibility and can bring in extra cash if you don’t mind hosting strangers for a few days or weeks. Long-term rentals, like leasing your garage to someone who needs storage, typically involve less traffic in and out of your property. You’ll want to research local rules and regulations. Some areas have specific laws for short-term rentals, especially if you’re considering renting out a room in your home. If everything checks out, you can share your listing and watch your schedule fill up with bookings that translate to money for your emergency fund.

Keep It Simple and Safe

You don’t have to become a full-fledged landlord. If you’re introducing a short-term guest into your home, it’s wise to invest in locks, safety devices, and maybe even a tiny welcome kit. This not only keeps potential issues at bay but also boosts your rating if you’re using a rental platform. If you’re renting for storage, draw up a small contract outlining the terms, like how long the items can stay and what types of items are allowed. Clarity helps avoid confusion down the road.

Turn Earnings Into Savings

It might feel tempting to use your newly earned rental money on a weekend getaway or a new gadget. Keep your eyes on the goal—your emergency fund. Setting up an automated transfer to your savings account is a powerful habit. The moment rental income hits your checking account, you can designate a portion (or all) of it to go straight to that safety cushion. Before you know it, you’ve made a big leap toward financial preparedness.

Offer Freelance Services

If you’ve got a skill—like graphic design, writing, tutoring, or even organizing homes—turning it into a side hustle is one of the most direct ways to grow your emergency savings. With the internet as your playground, it’s easier than ever to connect with people who need what you offer.

Identify Your Marketable Talents

First, take a quick inventory of your strengths. Are you a whiz at proofreading school essays? Can you create custom artwork? Do you know how to set up an efficient filing system for a home office? Sometimes, your everyday skills feel ordinary to you, but they can be really valuable to someone else. And if you already have a day job, you don’t need to quit—it can be a part-time gig during your free hours.

Find Your Clients

Social media communities, freelancing websites, and local community boards are all places where potential clients congregate. Don’t be shy. Post a simple description of your services, set a fair rate, and let word of mouth guide you. Friends can be your first customers—maybe your neighbor needs help creating a new logo or your cousin wants meal plans for a special diet. Over time, you might expand to paying strangers who are just thrilled to discover your efficient, personalized services.

Keep the Momentum

Freelancing can be uneven. Some months you’ll have multiple projects, other times it slows down. That’s why it’s best to stay proactive—maintain a small portfolio of your work and keep it updated on social media or a personal website if you have one. Each time you complete a project, stash a percentage of your earnings in your emergency fund. Consistency will help smooth out the ups and downs, ensuring your safety net grows steadily, no matter the season.

Try a Weekend Gig

If you’d rather keep your hobbies and personal interests separate from your income, consider a simple weekend gig. This could be delivering groceries or meals, driving for a rideshare service, or participating in local event staffing. It’s straightforward, often requires minimal setup, and can be turned on or off based on your schedule.

Why Weekend Work?

For many families, weekdays can be overwhelming with day jobs, school runs, and extracurricular activities. But on weekends, you might have a few open hours. Doing a couple of shifts can bring a steady stream of income that’s dedicated solely to your emergency savings. And you don’t need specialized training—often a driver’s license or a friendly smile is enough for many short-term part-time roles.

Pick a Role You Won’t Dread

Let’s be real: the extra money helps, but if you hate your weekend gig, it’s going to drain your energy quickly. Instead, pick something that aligns with your personality. Enjoy social interactions? Rideshare or hosting an open house for a real estate friend could be excellent. Prefer solitude? Dog walking, food deliveries, or weekend warehouse gigs might fit better. Take a breath and reflect on what kind of environment you’d be comfortable in, then go for it.

Funnel Earnings Toward Savings

It’s easy to treat weekend gig money as “fun cash.” Resist that temptation—at least until you’ve met your emergency fund goal. A clever approach is to set up a separate checking account for your weekend earnings, and then automatically transfer it to your emergency stash. By ring-fencing the money, you’ll see tangible progress each month, and it won’t get mixed into your usual bills or routine spending.

Automate Spare Change

Saving isn’t always about big gestures. Sometimes it’s those tiny steps—like saving your spare change—that become your quiet heroes over the long haul. This method is especially handy if you feel like every time you try to manually stash money, it ends up going somewhere else.

The Power of Round-Ups

Many banks and apps offer round-up features. Each purchase you make with your debit card is rounded up to the nearest dollar, with the difference transferred into a linked savings account. For instance, if you spend $2.50 on coffee, the feature rounds that to $3 and drops the extra 50 cents into your savings. It’s low-effort and pro-consistency. Those cents accumulate surprisingly fast, turning even your small purchases into an opportunity to pad your emergency fund.

Old-School Coin Jars

Not a fan of digital? That’s okay! Sometimes, a simple coin jar at home does the trick. At the end of each day, empty your pockets or purse into the jar and watch your loose change grow. With so many of us favoring card payments, physical coin jars might fill up slower these days. But if you still handle cash for certain errands, it’s a great tactic that involves little mental work.

Consider Automatic Transfers

Another version of “spare change” is deciding on a small, set amount—say, $10—and instructing your bank to move it from your checking to your savings account every week. It doesn’t have to be literal spare change, just an amount that feels nearly invisible to your budget. You can also match any “found money” you get, like birthday gifts or small rebates. It all works to keep your emergency fund climbing steadily in the background.

Collect Reward Points

If you’re already shopping with credit cards or store loyalty programs, you can convert those reward points into meaningful dollars for your emergency fund. People often think of rewards as a way to snag discounted flights or gift cards, but funneling that value into a cash equivalent can be just as beneficial.

Leverage Points Strategically

Be mindful that credit cards carry interest if not paid off every month. If you have a card that offers points or cashback, pay your balance in full and let your bonuses build up. Once you switch your mindset from “How can I spend these points on fun stuff?” to “How can I boost my emergency fund?”, you’ll find plenty of ways to push those perks into a savings account. Some programs let you redeem points for statement credits, which free up the initial money to be placed directly into your fund.

Store Loyalty Programs

Grocery and pharmacy stores often have loyalty programs that translate into money off future purchases, or even direct payouts. If your store offers a $5 gift certificate for every certain amount spent, consider depositing that equivalent amount into your emergency savings each time it unlocks. It’s almost like getting a small paycheck for your disguised shopping habit.

Keep Tabs on Expiration

Sometimes points expire if they’re not used, so monitor your totals. Mark calendar reminders if you have to, ensuring you don’t lose out on a chunk of rewards that could have bolstered your safety net. Also, read the fine print on how to redeem them for actually useful conversions—like direct statement credits or bank deposits—because turning that value into actual cash can make a real difference in an emergency situation.

Organize a No-Spend Weekend

A no-spend weekend is exactly what it sounds like: challenging yourself (and possibly your loved ones) to avoid spending any money from Friday night through Monday morning. While it may sound daunting in our spend-happy world, it’s an excellent way to free up funds to put directly into your emergency stash.

Plan Ahead

You’ll want to prep in advance—stock up on groceries, fill up the gas tank if needed, and map out your entertainment. If you have kids, let them help brainstorm fun, cost-free activities, like a backyard campout or a board game tournament. The idea is to get creative with resources you already have at home.

Track Savings in Real Time

During the weekend, note any expenses you would have made but didn’t. Maybe you skipped the takeout meal or delayed a shopping trip. Tally up the total, then transfer that exact amount to your emergency fund. It’s a satisfying feeling to see those potential costs instantly morph into savings. Seeing those numbers can spark the realization that a lot of discretionary spending is actually optional.

Make It a Regular Habit

No-spend weekends work well as a monthly or bi-weekly event. Each time, you get a short break from the typical hustle of spending. Plus, it encourages resourcefulness—discovering new ways to have fun with family or friends might become part of your normal routine. And yes, you’ll likely see your emergency fund grow faster. Over time, you might graduate to longer “low-spend” challenges if you’re eager to see bigger gains.

Crowdfund Unexpected Expenses

Yes, crowdfunding is usually linked with big charity drives or creative projects, but it can also be a viable option to help cover unexpected expenses—and potentially free up your own funds to stay in the emergency account. While it’s not the most traditional route, it’s growing more common to see families reach out for small amounts when an urgent financial hit arrives.

Be Transparent and Respectful

If you’re turning to your community—be it friends, coworkers, or an online network—transparency is key. Explain why you need the support, outline exactly how the funds will be used, and make it clear that you appreciate any contribution. This can feel a bit vulnerable, and it’s not everyone’s cup of tea. However, in tight times, having a circle that’s willing to chip in a little bit can be a real lifeline.

Explore Alternative Approaches

Sometimes, crowdfunding doesn’t have to be a public campaign on a major platform. You might pool resources privately with close family members or neighbors if the situation is urgent (like a medical expense). That can reduce potential embarrassment or the burden of explaining your situation to strangers. Meanwhile, the money you would have withdrawn from your emergency fund can stay put, protecting you for future needs.

Pay It Forward

If you do receive financial help, consider paying it forward when you’re in a better place. Even if you can’t repay every donor, you might help others facing a tough situation down the road. Reciprocity builds strong communities, reminding everyone that giving and receiving support is normal. It’s just another way to maintain the spirit of collective care.

Keep the Momentum Going

By now, you’ve seen at least one method that might help you sneak more money into your emergency savings this month. The challenge is to keep that momentum alive. After all, these 10 creative emergency fund ideas are most powerful when woven into your everyday life. With a consistent approach, you’ll notice that what used to feel like an impossible goal becomes easier. Bit by bit, you build a financial cushion that can provide major peace of mind for you and your family.

Celebrate Your Wins

When you successfully complete a no-spend weekend or declutter and make a few hundred extra bucks, take a moment to give yourself a pat on the back. That sense of accomplishment is what keeps you motivated. Maybe treat the family to a low-cost pizza night or watch a favorite movie at home. A small ritual of celebrating helps cement your progress and reminds you that saving doesn’t have to feel like punishment.

Revisit and Adjust

Some strategies may work better than others, depending on your schedule, personality, and family life. If renting out unused space feels overwhelming, try focusing on cash-back apps or short-term freelance gigs. If freelancing steals all your family time, maybe switch to a no-spend weekend approach for a while. The goal is to keep exploring until you find the mix that suits you best. And as life evolves—maybe you switch jobs or move to a new area—it’s okay to pivot your tactics accordingly.

Build a Forward-Looking Plan

Ultimately, your emergency fund is just one part of a greater financial ecosystem. You might also want to explore deeper topics like where to keep emergency fund or how to differentiate emergency fund vs savings. If you already have some savings, you can even look into how to rebuild emergency fund after using it in a real emergency. Taking these steps refines your overall preparedness, ensuring that even if life throws a curveball, you’ll have a financial cushion to land on.

Above all, remember that you’re not in this alone. We’re in it together—cheering each other on, sharing stories, and offering a shoulder to lean on when times are tough. Building up an emergency fund can be a long journey, but each deposit, challenge, or side hustle you embrace is progress worth celebrating. You’ve got this. And each action you take moves you closer to a sense of financial security that will support you and your family, no matter what tomorrow brings.