365-Day Emergency Fund Challenge: Save $1500 in One Year

Picture Your Emergency Fund

Ever dream of having a comfortable cushion for life’s unexpected moments? You’re not alone. Many of us imagine a future where a sudden car repair or medical bill isn’t such a huge blow. The best way to get there often starts with a simple plan to build an emergency fund, one tiny step at a time. If you’re ready to give it a go, a year-long emergency fund challenge is a fantastic way to save $1,500 over 365 days, without feeling too much financial strain all at once.

Now, let’s face it: saving money can feel daunting, especially when family responsibilities or personal desires tug at your wallet. But here’s the good news. You don’t need to earn a massive salary or overhaul your budget overnight. Instead, you can take this challenge at your own pace, gradually upping your savings each week. By the end, you’ll have a solid emergency fund that can cover anything from a minor home repair to a surprise vet bill.

Throughout this guide, we’ll walk alongside you like a trusted friend who’s been through it before. We’ll break down each piece of the journey, from mapping out your weekly deposits to celebrating your wins. You’ll find tips on budgeting, resources for staying motivated, and even strategies to keep going once you’ve hit your $1,500 target. Ready to see how it all works? Take a deep breath, grab a cozy seat, and let’s start planning your first step toward emergency preparedness.

Accept The 365-Day Challenge

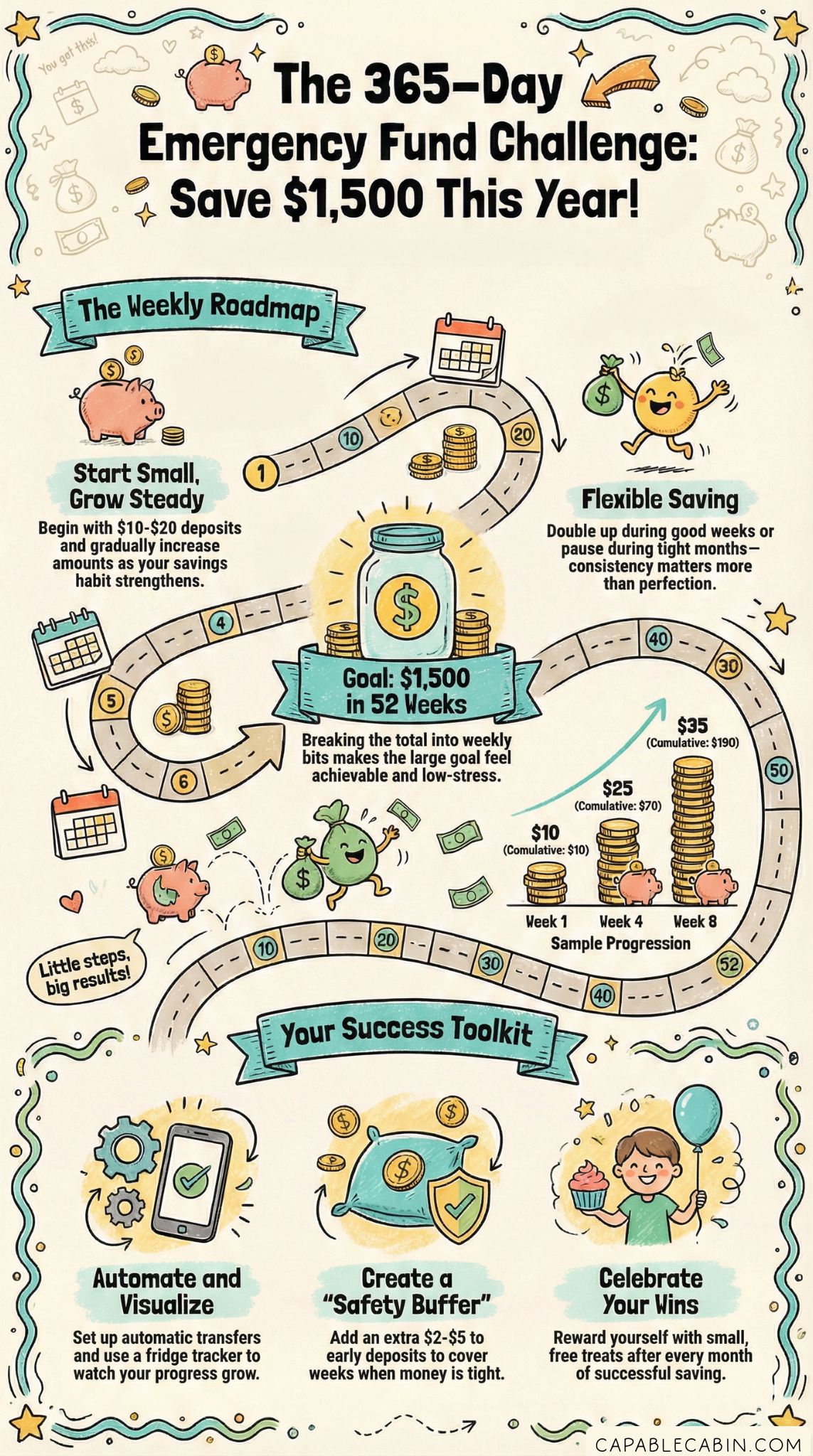

The idea behind a 365-day approach is simple: you gradually accumulate money over a full year instead of trying to stash away a big lump sum in one go. This kind of slow-and-steady plan is especially helpful if you have a busy household or if you’re juggling other goals like paying down debt or saving for a future event.

Why A Full Year?

Stretching your goal across 52 weeks helps you manage smaller bits of money at a time. If you try to save everything in a month or two, it might become overwhelming, especially when life’s daily expenses keep rolling in. With a year-long format, you can space out your contributions, track steady progress, and adapt as you learn what works best for you.

Who Benefits From This?

• Families with tight monthly budgets.

• Individuals working part-time or on flexible hours.

• Anyone who wants a step-by-step savings approach with minimal stress.

Whether you’ve just decided to start emergency fund efforts or you’ve been thinking about it for a while, this challenge makes it easier to keep consistent, no matter your lifestyle or income level.

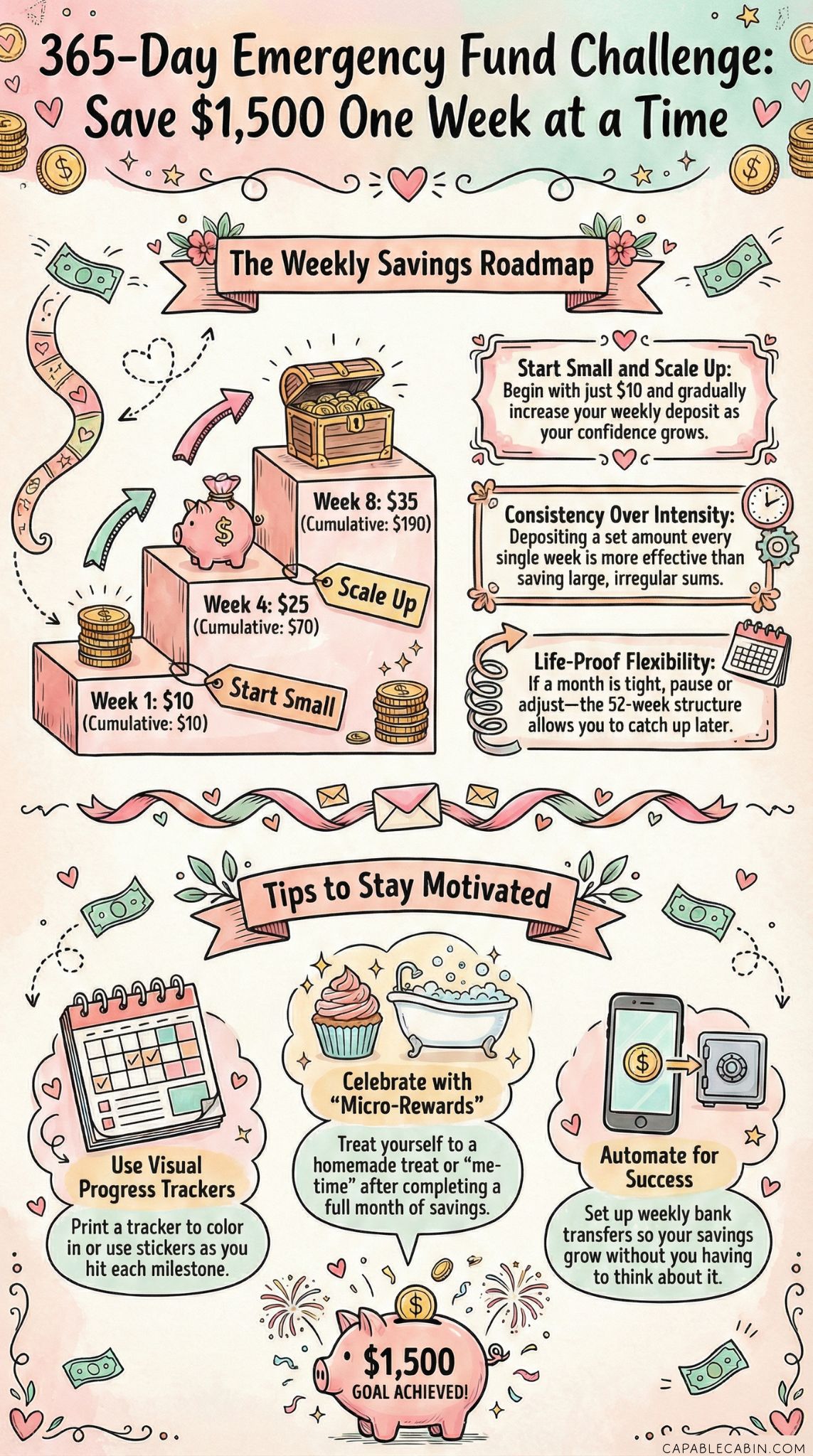

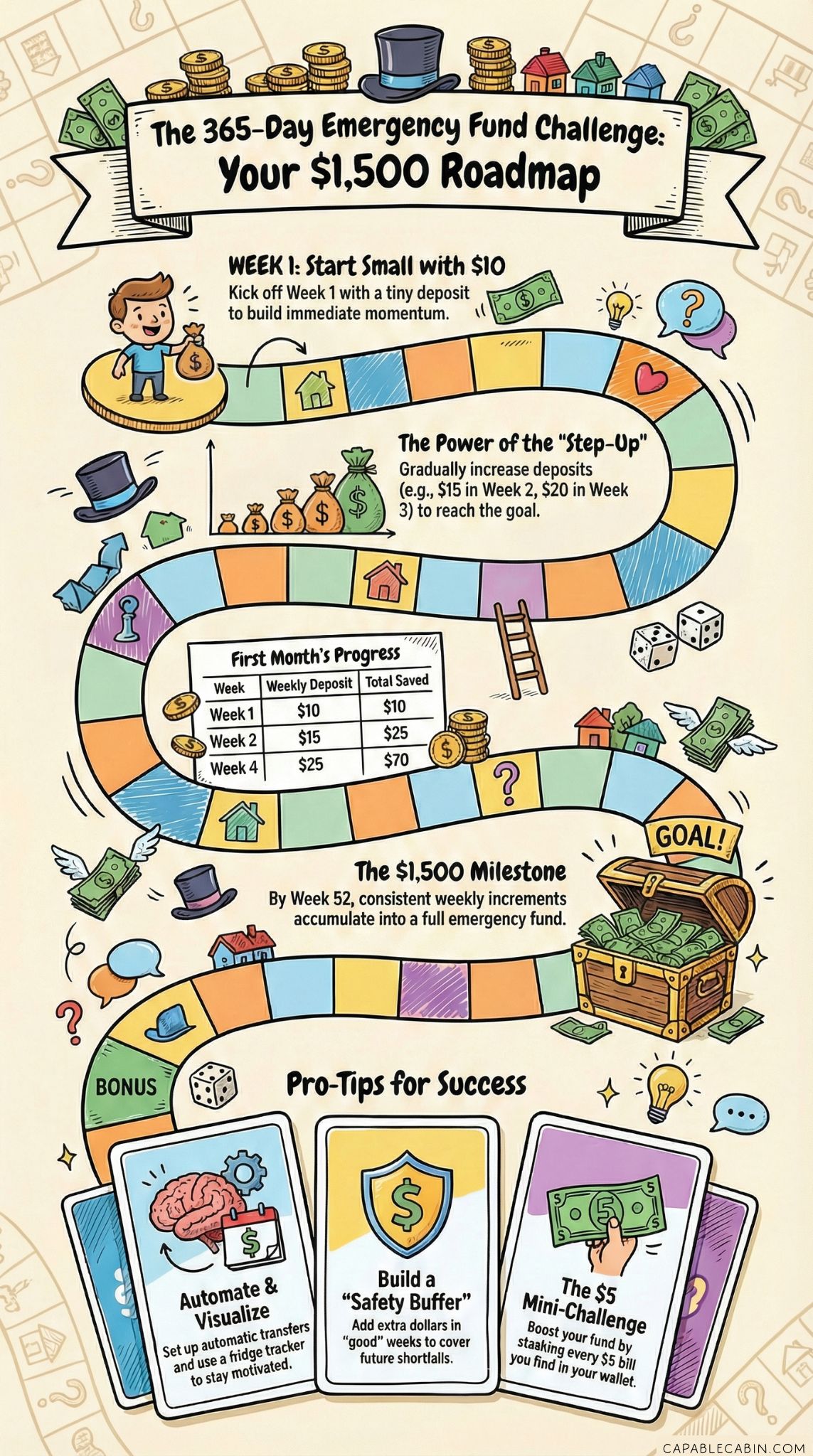

Break Each Week Down

Big dreams become a lot more doable when you split them into manageable steps. The key to saving $1,500 in a year is to deposit smaller amounts every week, typically increasing as time goes on.

A Sample Weekly Breakdown

Below is an example table that shows how you might schedule your savings. The amounts are just suggestions, so feel free to tweak them based on your financial comfort zone. You can also reverse the schedule by saving the highest amounts in the first weeks, then tapering down over time.

| Week | Deposit | Cumulative Total |

|---|---|---|

| 1 | $10 | $10 |

| 2 | $15 | $25 |

| 3 | $20 | $45 |

| 4 | $25 | $70 |

| 5 | $25 | $95 |

| 6 | $30 | $125 |

| 7 | $30 | $155 |

| 8 | $35 | $190 |

| … | … | … |

| 52 | Varies | $1,500 |

You can see how small increments build up nicely over the weeks. Even if you change how much you contribute, the entire process remains the same: deposit a set amount consistently, watch your total grow, and celebrate as you inch closer to your $1,500 goal.

Adjust For Your Lifestyle

Feeling the urge to get it done more quickly? Try doubling a few deposits whenever you have extra money. Got a tight month ahead? Pause additions for a week and catch up down the road. The beauty of a 52-week structure is that it offers room for flexibility. If you do miss a week, simply restart and adjust as you go. No shame, no guilt, no rush.

Plan For Setbacks

Let’s face it: life happens. An unplanned trip to the doctor or a friend’s wedding invitation can derail even the best-laid plans. Rather than letting these events discourage you, plan for them from the get-go. It’s better to imagine how you’ll handle setbacks now than to feel overwhelmed later.

Build A Safety Buffer

One trick is to add a small extra amount to your first few weeks of savings. For instance, if you usually plan to deposit $10, aim for $12 or $15. That small bump can serve as a buffer for weeks when money is tight. Over a year, these mini-boosts can cover occasional shortfalls. This is similar to having emergency cash at home in a safe spot, so you can handle minor hiccups without dipping into your newly formed savings.

Revisit Your Budget Regularly

A lot can change over the course of a year, from your income to your family’s priorities. Maybe you get a raise at work or decide to cut back on certain expenses. Revisit your weekly deposits from time to time and see if you can increase them. If raising the contribution doesn’t feel right, stay the course. Consistency matters more than hitting big weekly numbers, especially for a challenge that spans a full year.

Keep Motivation Alive

Saving money, even in small increments, can be a challenge when the thrill of starting wears off. How do you stay excited about something that only shows gradual progress? The answer lies in setting up a supportive environment.

Visual Cues And Rewards

• Print out a progress tracker and hang it on your fridge to watch your total grow.

• Color in each milestone or mark it off with a sticker as you hit every week’s goal.

• Reward yourself with something small (a homemade treat, a guilt-free TV break, or a little me-time) once you complete a month of savings.

By tying your deposits to positive rewards, you’ll rewire your brain to see saving as a fun win rather than a boring chore. Even the simplest pleasures can give you a boost when you deposit that money on schedule.

Involve Loved Ones

Have a partner or older kids who can chip in? Let them track weekly amounts with you. If you’re the financial decision-maker in your family, consider including everyone in a quick monthly “money chat.” Celebrate the progress and discuss ways to tighten the budget for the upcoming month. When you make it a shared mission, you’ll all feel more committed to the big picture.

Adopt Smart Saving Habits

A year of steady deposits can transform the way you approach money. Over time, you’ll discover practical ways to shave down costs at the grocery store or skip that pricey coffee on your way to work. Embrace these new habits. They’ll not only help you fund this challenge but also secure a healthier financial life.

Tweak Your Spending

One effective approach is to look for everyday items you can either do without or buy for less. Spot a weekly subscription you barely use? Cancel it. Notice you’re eating out multiple times a week? Switch to cooking an extra meal at home. These small adjustments might save you $5 here, $10 there, which can quickly form a sizable deposit for your challenge.

Shop With A Strategy

If you’re a member of a large family, grocery bills can turn into a budget-buster. Before shopping, plan your meals and make a list. Compare prices online or in store flyers, then stock up on discounted essentials. Bulk-buying nonperishables can reduce frequent trips to the store, where it’s all too easy to toss impulses into the cart.

Automate When Possible

One of the simplest ways to stay consistent is to set up an automatic transfer from your checking to a savings account. If you don’t see the money in your main balance, you’re less likely to spend it impulsively. Many banks let you schedule weekly or monthly transfers, so look into that if you prefer a hands-off saving style.

Use A Support System

We all have days (or weeks) when we wonder if saving is even worth it. That’s exactly when your support system can make a huge difference. Turn to friends, family, or online communities for encouragement, advice, and a morale boost.

Accountability Buddies

Finding someone else who’s taking on a similar savings challenge can ramp up your motivation. Check if a friend is interested in starting their own version of a 365-day deposit plan. You can compare savings goals, cheer each other on, and share creative ideas for cutting costs. When there’s another person expecting you to make that deposit each week, you’re more likely to stay on track.

Financial Preparedness Community

If you like connecting with people online, consider joining a group or forum focused on emergency fund mistakes, budgeting hacks, or overall financial wellness. These communities often have daily or weekly prompts to help you stay on course. They’re also a great resource if you need help prioritizing your goal when unexpected bills pop up. You’ll quickly see that plenty of others have faced similar hurdles and found ways to succeed.

Expand Your Strategy

While the core mission is to save $1,500 in a year, you might discover you want an even broader safety net. Perhaps you’re thinking about building a financial go bag or exploring a financial emergency binder. An emergency fund doesn’t always have to be just about having cash in the bank. Sometimes, it also involves organizing essential documents or creating a system in case of real emergencies.

Consider Additional Funds

If you have room in your budget, think about initiating more than one pot of money. You can maintain a separate sinking fund for upcoming expenses like holidays, while your main emergency fund stays untouched. Families often benefit from having different savings categories to manage various life events without mixing it all in one place.

Compare Savings Versus Emergencies

Not sure if you should focus on credit card debt before bulking up your emergency account? It might help to weigh the pros and cons in a decision like emergency fund vs debt. While paying off high-interest credit balances is crucial, having some cash on hand prevents you from slipping deeper into debt when an unexpected cost surfaces. There’s no one-size-fits-all method, so feel free to adapt your strategy as your needs evolve.

Celebrate And Sustain

As the final milestones of your challenge approach, you’ll feel a sense of pride and relief that can’t be overstated. You’ve built a financial cushion from scratch, one deposit at a time. Now it’s time to celebrate your progress without losing sight of what’s next.

Mark The End Of The Year

When you see that $1,500 balance, let yourself feel proud. You’ve accomplished something big. Celebrate in a way that doesn’t derail your financial goals. Maybe bake a special dessert at home or plan a family movie night. If you really want to splurge on a small treat, keep it modest. The idea is to honor the work you’ve done while remaining mindful of why you saved in the first place.

Keep Growing After 365 Days

Don’t be surprised if you find yourself wanting to continue once the challenge officially ends. After all, saving can be addictive in the best way possible. If so, take a moment to explore next steps:

- Increase the amount. Decide on a new weekly or monthly figure based on your comfort level.

- Aim for a larger goal. Maybe you want to push that $1,500 to $3,000 or even aim for a 3-month emergency fund.

- Diversify your savings. Consider certificates of deposit, high-yield savings accounts, or even a low-risk investment plan if you’re comfortable.

Over time, you’ll gain clarity on how much money protects your family best. Checking out emergency fund amount guidelines can help you figure out what suits your needs. Some people like to keep a few months’ worth of living expenses on hand, while others need more or less depending on lifestyle and job stability.

Tackle Common Hurdles Mid-Challenge

Even with the best intentions, you might hit a lull somewhere around month four or five. Maybe a mini-crisis pulls cash from your savings, or you get caught in the excitement of another project. Whatever the reason, it’s totally normal to feel a dip in motivation. Here are some common obstacles and ways to handle them.

“I Had To Tap Into My Fund”

So you ended up withdrawing some amount when the car broke down or something unexpected happened. That’s what an emergency fund is for! The important step is to reassess and keep going. Try to repay yourself by increasing your deposits for the next few weeks. If that feels like too big a leap, just replace what you withdrew over a few months. The momentum from your previous progress doesn’t vanish because you had to use the money. It’s all about renewing your commitment.

“I’m Temporarily Out Of Work”

Losing a job or dealing with reduced hours is tough. If your earnings shrink, pause your challenge for a week or two to focus on your immediate needs like groceries, utilities, and housing. Once you’re back on your feet, resume your routine. Even then, contribute smaller amounts if that’s all you can afford. As long as you stay flexible, you can still reach that year-end goal or close to it.

Strengthen Your Emergency Systems

The year you’ll spend building your emergency fund is also the perfect time to refine other aspects of your financial safety net. After all, being prepared isn’t just about putting money aside. It’s about making sure you have quick access to important documents, understanding your insurance coverage, and knowing exactly where your funds are stored.

Where To Keep Your Money

Deciding on the best place for your fund is often a balancing act between accessibility and growth. A high-yield savings account offers a better interest rate than a typical checking account, while still letting you withdraw funds quickly. Check out different ideas for where to keep emergency fund options, like money market accounts or even an emergency fund envelope system if you prefer physical cash. The biggest priority is: can you reach the money when you truly need it?

Protect Critical Information

Many families ignore how crucial documents can be during a crisis. Prepare a small binder (or a digital equivalent) with insurance policies, birth certificates, passports, medical specifics, and any other must-have details. A financial emergency preparedness kit can save you hours of stress if you ever need proof of identity or quick verification of assets. Pairing your new savings habit with better storage of vital information is a win-win for peace of mind.

Keep An Eye On The Bigger Picture

By now, you’ve learned the basics: deposit steadily, plan for pitfalls, and stay motivated. But how does this all fit into your broader financial journey? Building an emergency fund is often step one in a bigger plan that might include investing for retirement, saving for your kids’ education, or paying off a mortgage.

Coordinate With Other Savings

If you also want to put money aside for a specific project, like a kitchen remodel or next year’s vacation, consider creating separate accounts. This way, your emergency fund remains dedicated to true emergencies, and your other savings can grow for their intended purpose. You can also keep an eye on emergency fund guide resources that detail best practices for dividing your money among various goals.

Know When To Rebuild

Sometimes an emergency will wipe out a big chunk of what you’ve saved, bringing you back near zero. That’s why having a plan to rebuild emergency fund savings is so important. Once you’ve recovered from that setback—say, after you’ve replaced a broken appliance or covered a medical expense—pick up the pace again. Think of this as a cycle rather than a one-and-done project. Each time you build that fund, you gain more confidence in your ability to handle life’s curveballs.

Lean On Fun Challenges And Tools

A year can be a long time to stay focused, so don’t hesitate to use playful strategies and helpful tools to break the routine. You might already be tracking your progress on paper, but there are plenty of other ways to liven up the process.

The $5 Savings Challenge

If you’re ever bored with your normal routine, try tacking on a mini challenge. Every time you find a $5 bill in your wallet, stash it away in a jar or envelope. At the end of each month, deposit that into your emergency fund account. You can even combine this with a 5 savings challenge that runs alongside your main year-long plan.

Go Digital For Ease

There are loads of apps available to track your daily expenses, round up purchases to the nearest dollar, or automate micro-deposits into your savings. These tools act like little cheerleaders, reminding you of your progress and prompting you to save whenever you can. An app might notice that your grocery run was cheaper than usual this week and suggest you deposit the difference right away.

Gamify Your Journey

Some families create a friendly competition around at-home money saving. Each member tries to come up with the most creative ways to cut costs, with a small prize for the biggest saver at the end of the month. It could be as simple as “winner chooses our Friday night dinner spot.” This playful angle keeps everyone excited to see what they can do next.

Stay Flexible Yet Focused

Life rarely follows the perfect script. With a year-long plan, you’ll experience holidays, birthdays, school events, and unexpected fees along the way. The trick is to remain flexible without losing sight of your ultimate goal.

Adapt To Economic Changes

If inflation spikes or groceries become more expensive, you may need to recalculate your weekly deposit. At times, a strong push might feel unrealistic, especially if your income doesn’t match rising costs. On the flip side, if a surprise windfall arrives—a bonus at work or a tax refund—treat yourself to a deposit bonus. For strategies to handle cost-of-living increases, consider reading up on an inflation emergency fund approach.

Reinforce Your Boundaries

When you’ve got extra cash in a separate account, it can be tempting to borrow for non-emergencies. Keep your guidelines crystal clear. If the purchase is not urgent, resist dipping into your savings. Some people set up separate rules for emergency fund withdrawal rules. This ensures you only use the money when it’s truly warranted, which preserves your fund for real crises.

Reflect On Your New Mindset

While the main result of this challenge is a $1,500 emergency fund, the hidden gem is the transformed mindset you’ll gain. By showing up every week—even on those days when you’re tempted to spend that deposit on a small indulgence—you train your brain to think about long-term security over short-term pleasure.

Celebrate Personal Growth

Saving money is more than a practical move. It often sparks confidence and a sense of empowerment. You’ll realize that you don’t have to live paycheck to paycheck or fear the next financial curveball. As you wrap up this challenge, take time to reflect on how your perspective around money has evolved. Maybe you’re no longer anxious about paying bills, or you’re more comfortable discussing finances with family members.

Inspire Others

You never know who’s watching and learning from your journey. Friends or coworkers might notice that you seem calmer about finances and wonder how you managed it. By sharing your story, you encourage others to do the same. You can recommend they look into a starter emergency fund if they feel intimidated by a full year’s commitment. Sometimes just seeing that someone else did it can spark a surge of confidence.

Keep The Momentum Going

Once you reach the finish line, you’ll feel a spark to keep up the good work. After all, you went through the ups and downs, overcame obstacles, and landed on solid financial ground. Nobody wants to lose that momentum. So, what are your options now?

Extend Your Challenge

Think about adding another 26 weeks to your journey or launching a fresh 365-day goal. If your budget allows, could you double the weekly deposit amounts? Experiment with an approach that fits your finances and family’s lifestyle. As you upgrade your goals, you’ll uncover an even stronger financial safety net.

Explore Other Preparedness Steps

Saving cash is just one part of the bigger picture. You could expand your readiness by exploring a financial preparedness checklist, organizing an emergency financial information storage system, or building a robust financial emergency preparedness kit. These measures ensure you’re not only equipped with money but also the information and tools you need when life throws you a curveball.

Secure Your Peace Of Mind

Finally, give yourself permission to feel relieved and proud. With an emergency fund in place, it’s easier to relax about those “what ifs.” Knowing you have a buffer means you can handle home repairs, medical bills, or car troubles with less stress. This sense of security is what pulls many people back into ongoing savings challenges year after year.

A Bit Of Encouragement For Your Journey

As you walk through this 365-day challenge, remember that every deposit—big or small—counts toward your family’s security. There may be moments when saving feels too slow or your progress stalls, but that’s just part of the process. Each dip is an opportunity to learn, adapt, and refine your approach. Keep your eyes on the goal, track your weekly steps, and give yourself credit for the effort.

If you ever feel down or stuck, remind yourself that finishing this year-long mission isn’t just about having $1,500 in an account. It’s about embracing your capacity to protect your loved ones, handle life’s bumps, and enjoy the peace of mind that comes with being prepared. Even if it seems like a small sum, that $1,500 can be the difference between scrambling to pay a bill and breathing easy when an unexpected cost arrives. You’re taking control, one deposit at a time.

So keep going, stay flexible, and celebrate each mini victory along the way. You’re definitely not alone in this. And when the year is up, you’ll look at that balance with a sense of pride, knowing you made it happen. This year-long emergency fund challenge isn’t just about the money—it’s about proving to yourself that you can set a goal and see it through to the end. You’ve got this. Now go for it, and let’s see how far you can grow your emergency safety net in just 365 days!