The Emergency Fund Envelope System for Cash-Only Families

Embrace The Cash-Only Mindset

Ever find yourself swiping a debit card and then, an hour later, forgetting how much you spent?

Trust me, you’re not alone. One of the biggest reasons many families fall into financial stress is the invisible nature of digital transactions. When you tap or swipe, it doesn’t always register in your mind as “money leaving my hands.” That’s exactly why using a cash-only approach can offer a powerful wake-up call. You feel those bills leaving your wallet, and the physical act of counting out your money helps you become more intentional about each purchase.

If you’re new to cash-based budgeting, don’t worry. We’re in this together, and the idea isn’t to abandon all modern conveniences—some bills may need to be paid online, after all. Think of this as a fresh start, one that dials back the noise of credit cards and random online shopping. Focusing on real paper money can be surprisingly freeing, especially when it comes to building a dedicated “emergency fund envelope system.” When you watch every dollar you set aside—literally—you gain clarity that virtual numbers on a screen sometimes don’t provide.

Switching from the usual tap-and-go world to cold, hard cash might feel daunting at first. But a cash-only approach can empower you in ways you might not expect. You’ll notice spending patterns more quickly, and small daily habits, like grabbing that coffee on the run, suddenly become very tangible decisions. Over time, you may even discover you’re spending less and saving more without feeling deprived. And isn’t that the goal here? A more secure, steady future for you and your family, one envelope at a time.

Understand The Envelope System

Before we dive into actually assembling your envelopes, let’s talk about why this system works so well.

The “emergency fund envelope system” is a straightforward way to manage your funds by categorizing them into different envelopes (literal or symbolic). Each envelope represents a specific purpose—your groceries, utilities, or that all-important emergency fund. By separating the money into distinct categories, you take the guesswork out of daily spending decisions. You also create a clear boundary between funds that must remain intact for emergencies and funds that you can spend on everyday costs.

Picture this scenario: you’ve got a big grocery envelope and a smaller personal envelope. When you head to the store, you take only what’s in your grocery envelope. In that moment, you’re giving yourself a built-in spending limit, making it easier to stay consistent with your plan. No more “just one more treat” that adds up on the card. You’ll see at a glance if you’re running low for the month, which immediately encourages you to either adjust your spending or find ways to cut costs. It’s like having a built-in accountability partner nudging you to stick to your budget.

Now, a big part of the envelope approach is understanding which envelopes are truly essential and why a specific envelope—like your emergency fund envelope—should be kept off-limits until real emergencies strike. Many of us have heard the advice: “Build an emergency fund,” but it’s easy to mix that money with a general savings account or even your checking account, where it mingles with everything else. That’s how you end up dipping into it for a casual purchase here or there. Envelopes, on the other hand, create a physical (or at least conceptual) barrier, reminding you daily of the importance of keeping this cash safe for unforeseen events.

If you’re unsure how much to save, you can start small. Some people begin with a starter emergency fund of $500 or $1,000. Others aim for a 3-month emergency fund or more. Whatever route you take, having an envelope dedicated to emergencies ensures that you see those funds as a separate category—one that isn’t to be touched unless life truly throws a curveball.

Set Up Your Envelopes

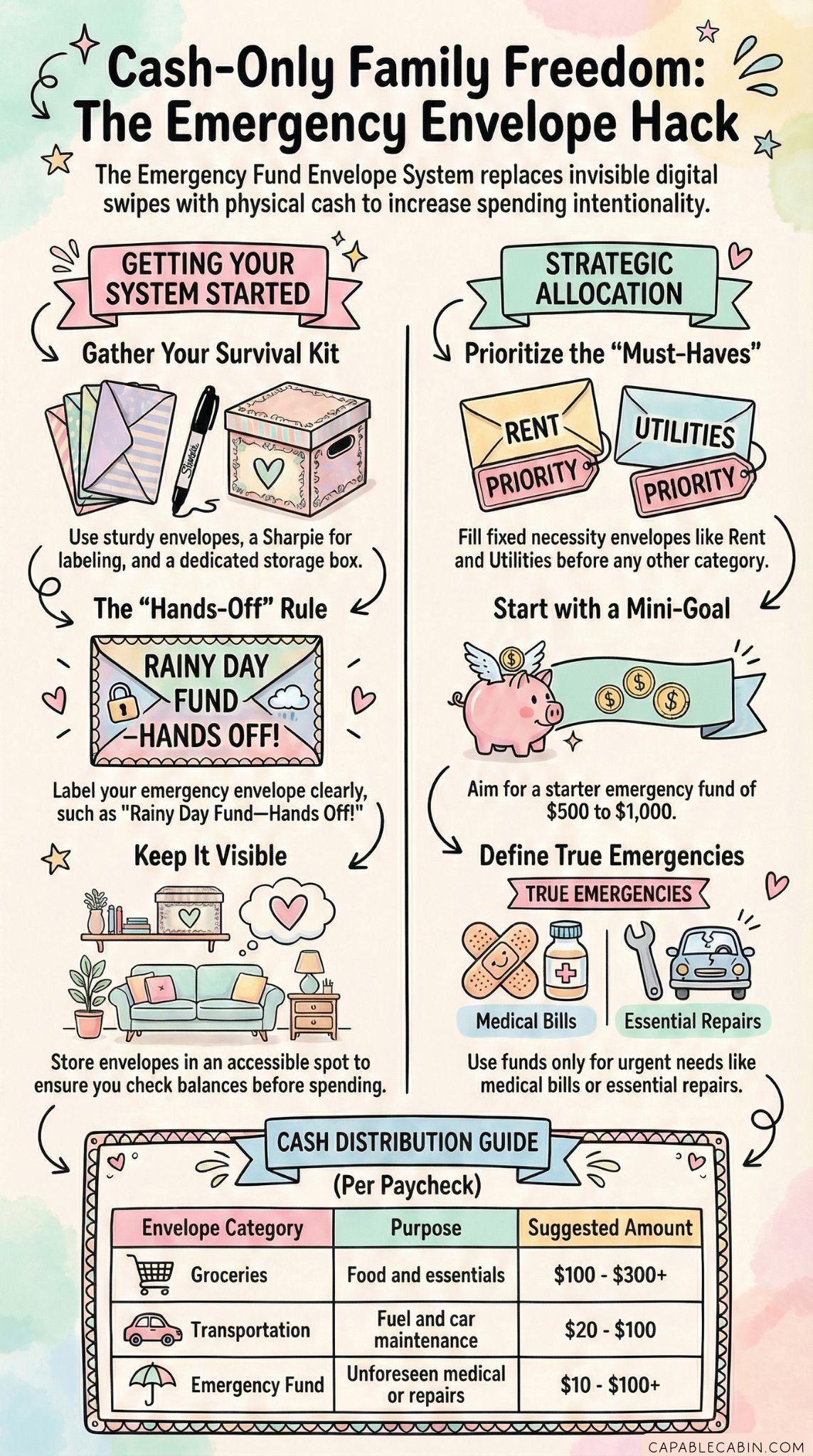

Let’s get to the fun part—actually putting your emergency fund envelope system together. First, you’ll want to gather a few basic supplies:

- Standard letter-sized envelopes or sturdy “cash envelopes” designed for budgeting.

- A small folder or box to keep your envelopes organized.

- Sharpies or labels so you can mark each envelope distinctly.

- An optional notebook or budgeting app (where you can note how much goes in and out of each envelope).

Because we’re focusing on cash-only budgeting, you’ll benefit from planning out exactly how much money you’re bringing home each pay period. Start with your monthly or bi-weekly net income, then decide how much you can realistically allocate to each category. Key envelopes could include:

- Groceries

- Utilities (like water, gas, electric)

- Rent or mortgage

- Transportation (fuel, maintenance)

- Personal care or clothing

- Fun or entertainment

- Emergency fund

You can adjust this list to suit your needs. Some families might have pet care envelopes, while others may separate out special occasions like birthdays or holidays. The goal is to keep your system as simple as possible, especially when you’re just starting. If you create too many categories right away, you might find it overwhelming. Focus on the main priorities first, and you can always add envelopes over time.

When labeling each envelope, choose titles that make sense to you. For the emergency fund envelope, you could write something like “Family Emergencies,” “Rainy Day Fund,” or simply “Emergency Fund—Hands Off!” Whatever resonates with you and your family is perfect—it just needs to be clear that this money is intended for true emergencies only, like a sudden job loss or an urgent medical bill. Placing a visual reminder (like an exclamation mark or small note to yourself) can reinforce the idea that this envelope is off-limits in everyday life.

If you’re curious about how much of your income to put toward emergencies, you might want to check out emergency fund amount. It’s normal to feel uncertain about setting aside money when life has so many daily expenses, but trust me, any amount can make a difference. Even if it’s just $20 a month to start, that little bit can build into something that saves you from bigger financial headaches down the road. And the beauty of the envelope system is that you’ll see those $20 increments add up in a very visible, motivating way.

Allocate Funds Strategically

Once your envelopes are labeled, it’s time to fill them. How much goes into each envelope? Well, that depends entirely on your family’s unique situation. Let’s walk through a quick approach you can adapt:

Identify fixed necessities: These are your must-pay expenses like housing, utilities, transportation, insurance, and groceries. Estimate how much you spend on these each month (using past bills or receipts as guidance) and prioritize stuffing these envelopes first.

Tackle your emergency fund: After covering fixed necessities, set aside a certain portion for emergencies. Even if it’s modest, commit to that amount each time you get paid. Think of it as an investment in your family’s peace of mind.

Add flexible envelopes: These might include personal spending, entertainment, or dining out. Decide how much you’re comfortable spending in these areas. If you want to boost your emergency fund faster, you could trim your dining-out budget and funnel those extra dollars toward emergencies.

Adjust if needed: Once your envelopes are filled for the pay period, track your spending. If an envelope runs dry, you’ll either have to do without until next payday or shuffle funds between envelopes. Shuffling is perfectly okay when absolutely necessary—just remember to keep that emergency envelope locked away from casual reallocation.

For instance, let’s say you set aside $150 per paycheck for groceries, $60 for entertainment, and $50 for your emergency fund. That’s just an example. You decide how much you can commit so it feels realistic rather than daunting. If $50 is too high, start with $20 or even $10—it’s all about establishing the habit. There’s no one-size-fits-all formula. The key is to do it consistently, so over time, your emergency envelope grows and becomes a true safety net.

Potential Envelope Categories Table

Below is an example of how you could categorize your envelopes. Tailor these columns to match your family’s income, lifestyle, and emergencies you anticipate.

| Envelope Name | Purpose | Suggested Allocation (per paycheck) |

|---|---|---|

| Rent/Mortgage | Cover monthly housing payments | Varies by rent/mortgage amount |

| Utilities | Electric, water, gas, phone, internet | Varies (estimate from past bills) |

| Groceries | Food and household essentials | $100 – $300+ (based on family size) |

| Transportation | Fuel, car maintenance, bus fare | $20 – $100 |

| Personal/Clothing | Personal care items (shampoo, clothes, etc.) | $20 – $50 |

| Entertainment/Fun | Family outings, movies, hobbies | $20 – $60 |

| Emergency Fund | Unforeseen medical, job loss, repairs | $10 – $100 or more |

Feel free to break down or combine categories. Some families prefer to keep internet costs separate, while others may group everything as “utilities.” The main point is that you assign realistic amounts to each envelope and stick to the plan as faithfully as you can.

Stay On Track Daily

Now that your envelopes are all set up and your money is neatly tucked away, how do you actually stick with this approach? Consistency is where the envelope system really shines, but only if you create habits that keep you on track. Here are a few quick tips:

- Keep the envelopes visible: Store them in a safe but easily accessible place. If you stash them in a box at the back of the closet, you might forget to use them.

- Check them before spending: Whenever you plan to buy something, ask yourself, “Is there enough in the envelope?” If the answer is no, either find a creative workaround or wait until the next pay period.

- Update your totals: If you like pen-and-paper methods, jot down how much you spent. If you’re more tech-friendly, use a simple budget app. The pivotal part is acknowledging every expense so you don’t lose track.

- Refill consistently: On payday, refill your envelopes right away. If you delay stuffing your envelopes, you might spend impulsively before settling amounts into each category.

One of the most significant perks here is clarity. When you open your grocery envelope and see exactly how much is left for the week, you’ll naturally shift your spending habits. This daily awareness can help curb impulse buys, reduce waste, and strengthen your overall commitment to building that emergency fund.

If you’re still feeling a bit shaky about following through, consider pairing this strategy with a structured challenge, such as a year-long emergency fund challenge. Combining daily envelope checks with a monthly or weekly challenge can give you the motivational boost to keep going, especially during the early weeks when forming new habits can be tricky.

Tackle Emergencies Confidently

An emergency fund is all about preparing for those “uh-oh” moments—unexpected medical bills, car troubles, or a sudden dip in household income. But here’s a crucial point: not every inconvenience qualifies as an “emergency.” Splurging on takeout because you’re tired to cook? That’s not an emergency (though we’ve all been there). A surprise weekend getaway? Tempting, but still not an emergency. A broken heater in the middle of winter, though, absolutely is. Drawing these boundaries helps protect your emergency envelope from getting used prematurely.

If an actual crisis pops up, you’ll be so grateful to have a designated envelope with cash ready to go. The feeling of relief you get from reaching into your emergency fund (rather than scrambling to borrow money or maxing out a credit card) is priceless. Plus, once you handle the situation, you won’t necessarily have a massive financial hangover. Instead, you might just need to rebuild what you took out. In other words, you skip the burden of long-term debt, which can snowball into stress and additional expenses.

There’s another component here too: If you have multiple small crises in a row—like your car breaks down, then your washing machine gives up on life—it helps to know exactly how much you have left for emergencies. Rather than mixing everything into one big pot, an envelope system ensures you’ve got a clear picture. Sure, you’ll need to replenish the fund, but you’ll know precisely what your next target is (or if you need additional support from family, friends, or community resources).

If you’re curious about how much cushion you actually need for these crises, check out a more detailed breakdown in our emergency fund guide. Sometimes aiming for a specific amount helps you stay motivated—like building up three months’ worth of essential expenses. The key is to keep your approach flexible, adjusting it to match your family size, living costs, and comfort level.

Overcome Common Challenges

It’s entirely normal to stumble a few times when you’re first getting started. Maybe you forget to bring the right envelope to the store, or your spouse accidentally uses a debit card for groceries. Don’t let these speed bumps discourage you. Building a habit takes time, and that means you’ll probably need to pivot and refine your system as you learn what works best for your family.

Here are a few common pitfalls and ways to handle them:

Envelope Overstuffing: You’ve allocated too much to a certain envelope, which leaves you short for other needs. Use a budgeting app or do a weekly review to see if the amounts are truly balanced. You may need to reallocate more to the emergency envelope and less to the “fun” envelope, for instance.

Dipping Into Emergencies Too Often: Sometimes it’s easy to label personal wants as “emergencies.” Combat this by writing down exactly what qualifies as an emergency. Maybe you define it as “unavoidable, urgent expenses that affect health, safety, or livelihood.”

Ignoring Smaller Envelope Categories: Overlooking smaller but important categories—like car maintenance—can lead to raiding your emergency fund for routine tasks. Instead, create a modest envelope for these anticipated costs (oil changes, new tires, etc.) so they don’t take a chunk out of your main emergency pot.

Running Out of Cash: If you find yourself constantly short because your paycheck doesn’t stretch, consider trimming non-essentials or finding ways to boost income. This might be a part-time gig, selling unused items, or taking advantage of a financial preparedness checklist to see where you can optimize your budget.

Forgetting to Refill: You might get busy on payday, and before you know it, a week has passed with money still in your main checking account. Set an alarm on your phone or mark your calendar. Consistency is the name of the game.

If you catch yourself making repeated missteps, don’t worry. That doesn’t mean the envelope method isn’t for you. Instead, it’s a signal to tweak your approach. Maybe you need more or fewer envelopes. Maybe weekly envelope checks work better than monthly ones. You’ll find the rhythm that clicks with your lifestyle if you keep trying.

Refresh And Adjust Regularly

Life is always changing—new jobs, new family members, shifting expenses. So your envelope system shouldn’t be set in stone. In fact, regularly reviewing how much you’re allocating can save you lots of headaches down the line. If your child joins a soccer league, you might want to create a new “Kids’ Activities” envelope. If you receive a raise at work, consider increasing your monthly contribution to the emergency fund. On the flip side, if you suddenly have higher rent, you may need to reduce entertainment spending to ensure you still meet your emergency savings goals.

Perform a quick monthly or quarterly check-in at a minimum. Look at how much you’ve spent in each category and whether your actual spending aligns with the amounts you set aside. Ask yourself:

- Am I constantly running out of cash in a specific envelope?

- Are certain envelopes rarely used, and could that money be better allocated elsewhere?

- Have my monthly bills changed significantly?

- Can I increase or decrease my emergency envelope’s allotment without sacrificing other necessities?

These questions help you refine your approach so that each paycheck serves your family’s evolving priorities. This step also stops you from falling into the trap of “set it and forget it,” a situation where your budget no longer matches your real financial situation. Staying nimble is key, especially when it comes to building and preserving a strong emergency fund.

And if at any point you realize you’ve messed up—like you forgot to track expenses for a week or borrowed from the emergency fund for something non-essential—show yourself some grace. We’re all human, and slip-ups happen. The important thing is to look back, learn, and do better next time.

Keep Your Momentum Strong

A major part of using the emergency fund envelope system is momentum. It feels good to watch your savings grow and your daily spending stabilize, but that excitement can fizzle if life throws several unexpected costs your way. Here’s how to keep that forward progress:

Set Small Achievable Goals: Rather than focusing solely on a big end number—like $5,000 in your emergency fund—celebrate each mini-milestone. Every extra $100 or $200 tucked away is a cause for a little victory dance. Even if you can only stash $10 here or there, it adds up.

Reward Progress: Let’s say you committed to adding $40 per paycheck into your emergency envelope and stuck to it for two months straight. That’s worthy of a tiny treat, maybe your favorite latte or a rented movie for family night. The reward signals to your brain that you’re doing something worthwhile.

Share Wins With Others: If you have a spouse, friend, or group that’s also working toward better money habits, talk about your envelope experiences. Swap tips, hold each other accountable, and cheer on each other’s progress. Sometimes simply talking about it keeps you more committed.

Learn From Mistakes: If you dip into your emergency fund for a non-emergency, note the reason. Were you feeling stressed or tempted by something? Identifying the root cause helps you prevent future slip-ups. You can also read about emergency fund mistakes to see if other families’ experiences shed light on solutions for you.

Continue Educating Yourself: Browse more resources—like exploring how to start emergency fund strategies or discovering if your family might benefit from a financial emergency binder. The more you learn, the easier it is to refine your approach and stay motivated.

Maintaining that energy is often about mindset, too. Remind yourself regularly why you’re doing this: You want greater peace of mind, and you want a financial cushion that protects your family from the curveballs life tends to throw. That vision alone can keep that momentum going strong.

Avoid Comparing Your Progress

It’s tempting to compare your emergency fund or envelope balance to that of your coworkers, neighbors, or friends on social media. But your financial situation is uniquely yours. Everything from your monthly income to your debt obligations shapes your ability to stuff those envelopes. If you see someone bragging about stashing three months’ worth of expenses in just a few short weeks, good for them—but that doesn’t reflect on where you are or what’s possible for you.

In reality, many families take months, even years, to reach a comfortable emergency fund amount. So celebrate each increment you save, no matter how small. If you do notice that your pace is slower than you’d like, consider brainstorming creative strategies:

- Cut one subscription or streaming service you don’t use enough.

- Attempt a short “no-spend” challenge for a weekend or week.

- Participate in a 5 savings challenge where you stash away every $5 bill that passes through your hands.

All these little tricks can accelerate your savings without demanding a total lifestyle overhaul. The goal isn’t to live like a miser. It’s to gain a sense of control and ensure you have a cushion waiting for true emergencies. So long as you’re making progress, that’s a victory worth celebrating.

Create A Safety Net For The Future

When you first embrace a cash-only system, you might feel like you’re stepping back in time—there’s a certain old-fashioned vibe to physically handling each dollar. But ironically, this “old-school” technique can give you a modern advantage: a clearer perspective on your financial habits, less reliance on credit, and a more direct connection to your emergency savings. By tucking away your cash into carefully labeled envelopes, you’re giving yourself structure. Structure leads to discipline, which in turn can lead to freedom from financial worry.

Imagine having three or four envelopes, each carefully preserved for life’s big surprises. Your “Car Troubles” envelope sits with a healthy sum in it, your “Medical Expense” envelope has grown over the months, and your main “Emergency Fund” stands at the ready. When something does go wrong—and let’s face it, things will go wrong at some point—you’ll have the relief of knowing you’ve got a cushion. Of course, you may still feel stress or frustration about the situation, but at least it won’t spiral into a massive financial crisis that sets you back for months or years.

Building an emergency buffer also brings intangible benefits, like better sleep and a calmer mindset. There’s real peace in knowing you’re working toward a solution, not just drifting along hoping nothing bad happens. You might even find that planning for the worst makes you more optimistic about the future. After all, you’re not denying that unexpected bills can happen; you’re simply refusing to let them upend your life. And that sense of control is priceless.

Reflect On Your Progress

Every few months, sit down with your envelopes laid out on the kitchen table. See how each one has changed since you started this journey. If your grocery envelope consistently runs out before the month is over, maybe you need to plan cheaper meals or look for coupons and sales. If your emergency envelope has barely budged, perhaps you need to adjust other envelopes so you can feed it more aggressively. Money, after all, is a moving target—one that mirrors the shifting demands of family life.

Ask yourself how you feel about it all. Do you feel less stressed when you check out at the store? More confident in your ability to handle an urgent car repair? Is your family jumping on board with the system or do you need to inspire them more? Keep a little journal of these reflections if you can. That way, you can track how your mindset progresses alongside your bankroll. It becomes a record of how you overcame old habits and found deeper satisfaction in budgeting.

If you find that you’re still uncertain about certain categories—like whether you should stash more of your income in envelopes or keep it in a bank account—explore other resources or talk to your spouse or partner. Sometimes a compromise approach works: depositing some funds in a secure account while keeping day-to-day envelopes at home. You can learn more about balancing these choices in articles like emergency fund vs savings or where to keep emergency fund.

No matter how you fine-tune your system, remember the proud moment when you first decided to take charge of your finances. That intention alone sets you on a path toward sustainability. And each tweak you make is a sign that you’re still fully engaged, not just passively letting your money flow in and out without awareness.

Practice Long-Term Consistency

The trickiest part about financial habits is sustaining them when life gets chaotic—holidays roll around, family gatherings happen, or sudden expenses pop up. But if you can keep up the envelope routine during those busier seasons, you’ll emerge stronger on the other side. Here are a few tips for maintaining long-term consistency:

- Plan for Holidays in Advance: Create a “Holiday” envelope months before the busiest season. Even a small amount saved each paycheck can cushion seasonal spending.

- Leave Breathing Room: If you have an especially tight month, try not to drop the emergency saving to zero. Even putting away $5 is better than nothing, because it reinforces the habit.

- Stay Open to Adjustments: Life changes fast. If your child starts needing extra medical care, shift your allocations to accommodate that new priority.

- Review Yearly: At least once a year, go through all your envelopes and see if the categories still match your family’s needs. Revisit your big goals—maybe you’re now aiming to rebuild your emergency fund after using it, or perhaps you have leftover funds that can be redirected to pay down debt.

When you remain flexible and engaged, your cash envelopes become a guiding tool rather than a restrictive burden. You’ll feel more secure, especially when you see that emergency envelope steadily growing. That readiness is something you’ll cherish once a real crisis hits—and trust me, being prepared feels a million times better than flying by the seat of your pants.

Stay Motivated With Challenges

Sometimes, you just need a dash of fun to keep your budgeting game fresh. That’s where challenges come in. Have you ever tried a short-term savings challenge where you put aside a specific amount each week or every day for a month? Or a 5 savings challenge? These mini-goals can ignite a friendly spirit of competition, even if it’s just with yourself. Every day you toss a $5 bill into your emergency envelope, you’ll get that satisfying mental high of checking a box.

If you prefer a more structured approach, consider a year-long emergency fund challenge. This type of challenge lays out a schedule where you deposit a certain sum each week or month, often incrementally increasing the amount over time. By the end of the year, you could have a substantial total saved up in your emergency envelope—enough to handle a major financial setback.

These challenges can double as a game for the whole family, too. Involve your partner or kids if appropriate. For instance, you might have a rule: every time someone in the house says a certain word, they owe a dollar toward the envelope. Or maybe you collaborate to find household items to sell online, funneling the proceeds into emergencies. It can be light-hearted while also driving real financial results.

Rebuild After Emergencies

At some point, your emergency fund envelope may come to the rescue—whether it’s a blown tire or an urgent dental procedure. Instead of feeling dread at the money you just had to spend, appreciate that you had a cushion ready. Then move forward with a plan to rebuild.

- Pause on Non-Essentials: Temporarily reduce non-essential envelopes (like entertainment or dining out) to free up more cash for refilling the emergency envelope.

- Set Clear Targets: Decide how quickly you want to replenish the funds. If you used $700 from your emergency envelope, aim to replace at least $200 per month until you’re back where you started.

- Celebrate Small Wins: Each step back toward your original total is an achievement. Don’t wait until you’re fully replenished to acknowledge your efforts. Reward small increments, like each $100 milestone.

This rebuild phase can feel like starting over, but the difference is now you know what it’s like to have that financial shield. That knowledge alone often fuels a stronger commitment the second time around. If you need inspiration, rebuild emergency fund can offer additional tips.

Confidence In Your Hands

Setting up an emergency fund envelope system is about so much more than tucking away cash. It’s about shifting your entire relationship with money. By choosing a tangible, cash-based approach, you’re rejecting the mindless swipes that can lead to blurred spending and unexpected overdrafts. You’re telling yourself—and your family, if you share finances—that intention and clarity matter. You’re also giving future-you a gift: the peace of knowing you won’t have to scramble if life throws you a financial curveball.

Remember that this is a journey, not a one-and-done task. Your envelopes will evolve as your family grows, jobs change, or priorities shift. If you slip up or borrow from the emergency envelope for something that’s not quite urgent, resist the urge to beat yourself up. Acknowledge it, learn from it, and pledge to do better next time. Adjust the categories or try a new challenge if you find your enthusiasm waning.

You’ve got all the tools in your hands—literally. Each envelope is a mini-statement of your values and goals. Whether you’re just starting with a single envelope or juggling a few dozen for different categories, the key remains the same: commit to the process, be patient with yourself, and celebrate every step forward. This system isn’t meant to box you in, but to free you from the stress of guesswork and lingering debt.

So, here’s to you and your family forging a healthier, more confident relationship with finances. Keep filling those envelopes, one paycheck at a time. Treat yourself with kindness when mistakes happen. Over time, you’ll see just how empowering it is to know you have cash on hand for emergencies—and how that sense of security will ripple through every corner of your life. You’re in control now, friend, and that’s a pretty amazing place to be.