The Complete Emergency Fund Guide for Busy Families

Ever feel like you’re juggling all the spinning plates of family life—childcare schedules, grocery runs, unexpected car repairs—and wondering how to handle a sudden financial surprise?

Trust me, you’re not alone. That’s exactly why this emergency fund guide exists.

When life throws curveballs, having a dedicated fund offers a cushion that can help you sleep better at night. Everything you need to know, from determining the right savings goal to figuring out where to stash that money and how to access it without jumping through too many hoops. By the end, you’ll have the tools, confidence, and encouragement to start (or strengthen) an emergency fund that suits your busy schedule and keeps your family’s future intact.

We’re in this together. Think of this as a warm conversation over coffee—no jargon or complicated math lessons. Just down-to-earth strategies to help you safeguard your finances when things get tough. So, let’s dive in and talk about how families like yours can build a strong safety net without feeling overwhelmed.

Start With The Basics

It’s easy to toss around the phrase “emergency fund,” but let’s break it down so there’s no confusion. At its core, an emergency fund is a pool of money you reserve for truly urgent moments—medical expenses, job loss, or a big car repair. You don’t need to label every small inconvenience as an emergency; think of it more like a lifeboat that’s there when real storms hit.

What Is An Emergency Fund?

An emergency fund is simply money you set aside for the unexpected. Picture it as your personal safety cushion. You deposit regular contributions (however modest or grand they may be) and don’t touch it unless necessary. This ensures you’re not scrambling to pay for emergencies through credit cards or loans.

Why You Need One

Most of us have faced the stress of an unplanned bill. Maybe it was a sudden medical procedure that insurance didn’t fully cover or a home maintenance crisis that popped up at the worst possible time. Without an emergency fund, these situations can snowball into bigger financial burdens. Having extra cash to fall back on offers peace of mind—and let’s face it, there’s something incredibly comforting about knowing you don’t have to panic if life throws you a curve.

Plus, an emergency fund can help you avoid high-interest debt. By covering surprise expenses from your own stash, you sidestep ballooning credit card balances. Over time, that means less stress and more money saved for what truly matters—like family vacations or your kids’ education fund.

Calculate How Much You Need

One of the biggest questions people have is determining the right emergency fund amount. Let’s take a step-by-step look at how much might be enough and what factors go into that decision.

Consider Your Monthly Expenses

Start by listing all your essential monthly costs: rent or mortgage, utilities, groceries, car payments, insurance, and anything else you absolutely have to pay. You can jot these down on paper or type them into a spreadsheet. Seeing those numbers in black and white helps ground your savings goal in reality.

- Housing (rent/mortgage)

- Utilities (electricity, water, internet)

- Transportation (car payments, fuel, public transit)

- Groceries

- Insurance (health, auto)

- Childcare (if applicable)

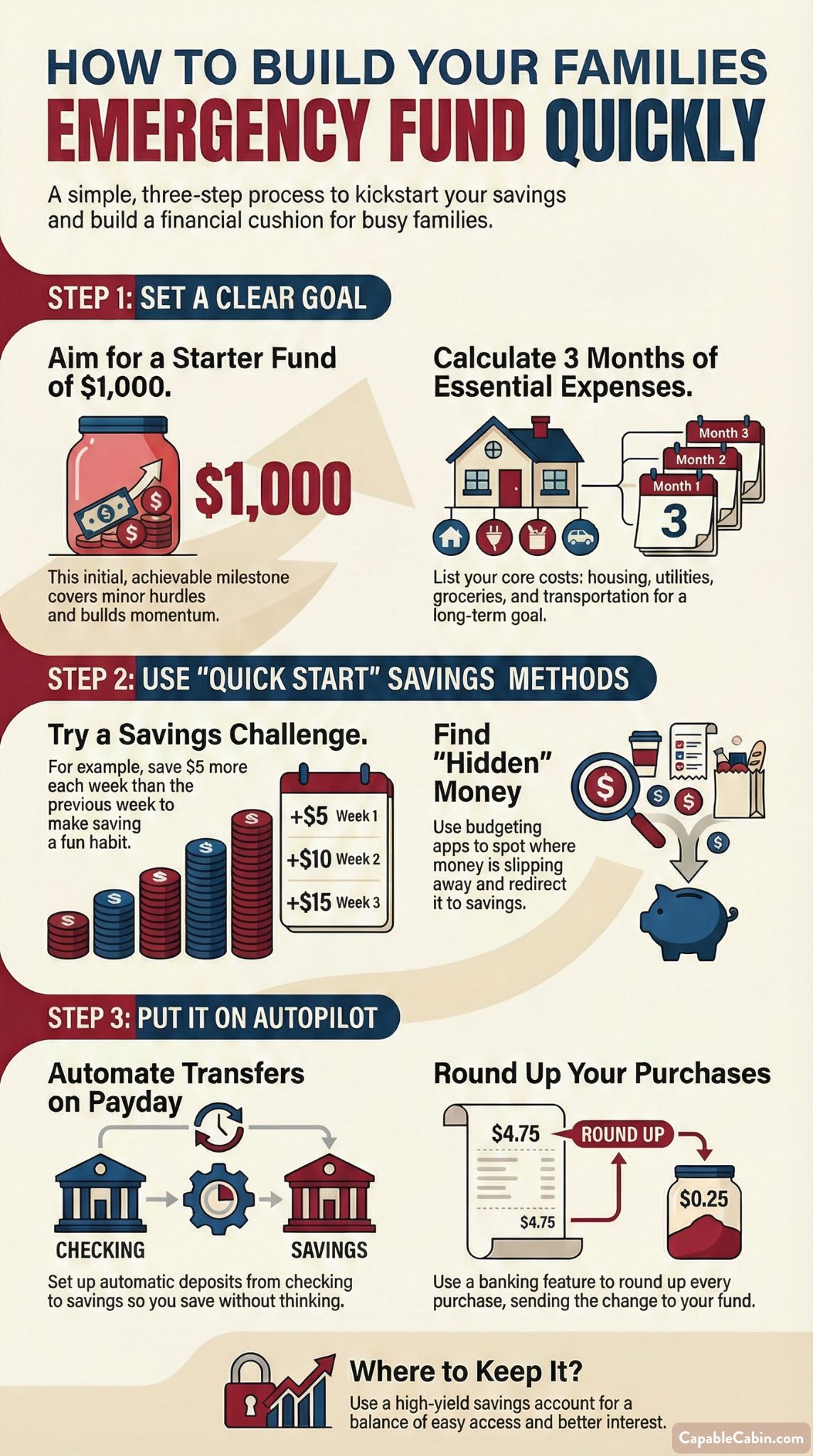

If you’re looking for a quick starting point, many families aim for around three months’ worth of expenses. For a more precise calculation, check out a resource like 3-month emergency fund, which dives into the details of hitting that initial milestone.

Account For Unexpected Costs

Monthly bills are predictable, but emergencies aren’t. Do you live somewhere prone to harsh winters that often damage the roof or freeze the pipes? Do your kids play sports that could lead to unexpected medical costs? Factor in these unique circumstances. Also consider setting a goal for a slightly larger buffer if you have variable or commission-based income. That way, you’ll be prepared for financial ebbs and flows without feeling the pinch.

Set Achievable Savings Targets

Ready to start saving? Setting realistic goals can keep you focused instead of overwhelmed. Think of your emergency fund as a step-by-step journey—like climbing a short staircase to reach a taller landing.

Semiformal Targets

Some people find it helpful to pick a number that feels doable right now. For example, you might aim for a starter emergency fund of $1,000 to handle minor hurdles, or follow a $1000 emergency fund plan that breaks your savings into smaller weekly or monthly amounts. Once you hit that, you can celebrate and then shoot for a bigger milestone, like one month’s worth of expenses.

Use Challenges And Tools

Sometimes, a little motivation can make all the difference. If you like structure, consider trying a 5 savings challenge. Each week, save $5 more than the previous week. Another great option is a year-long emergency fund challenge if you appreciate an organized approach that maps out weekly or monthly deposits. These fun, bite-sized steps encourage consistent progress.

- Automate contributions: Set up an automatic transfer from your checking to a separate emergency fund account. This takes the guesswork out of saving.

- Round up purchases: If your bank or financial app allows it, have every purchase rounded up to the nearest dollar, with the difference going into your savings.

- Reward yourself: After meeting mini-milestones, treat yourself to small, guilt-free perks—a nice coffee or relaxing bath with a new scented candle.

Consider Gradual Increases

When you see progress, you’ll likely feel motivated to do more. After a few months of steady saving, see if you can add an extra $20, $50, or $100 per pay period to speed up your fund’s growth. Remember, every little bit matters, and momentum is your friend. Don’t underestimate the power of small, consistent actions—they really do add up.

Where To Keep Your Fund

Choosing the best place to store your emergency fund can be trickier than it sounds. You want the money to grow at least a little bit but still stay easily accessible for sudden expenses. Let’s talk about some popular options.

High-Yield Savings Accounts

Many people prefer a high-yield savings account because it offers a fair balance between accessibility and earning potential. You typically can withdraw from it at any time, but the interest rate is often better than a traditional checking account. If you’re curious, where to keep emergency fund dives deeper into various storage methods and their pros and cons.

Emergency Cash At Home

Keeping a portion of your fund in cash could come in handy during natural disasters or power outages. Think small amounts though, because there’s always the risk of theft or loss in a home emergency. If this idea appeals to you, check out how emergency cash at home can complement your overall savings strategy.

Using An Envelope System

The emergency fund envelope system is another option if you’re a tactile person who likes seeing physical money accumulate. Similar to a tangible budgeting method, you’d literally fill envelopes with cash labeled for different purposes. It can be motivating, but make sure you’re safeguarding that envelope from prying eyes or accidental misuse.

Establish A System That Works

Even when you know the why and where of an emergency fund, sometimes the how is still a challenge. Between busy schedules, family obligations, and everything else life throws at us, you want a system that’s sustainable.

Automate Your Savings

One of the best things you can do is set up automated transfers from your main checking account to your emergency fund. That way, you don’t have to remember to move the money yourself—it happens behind the scenes. This “set it and forget it” approach helps ensure consistent progress.

- Automatic deposits on payday can ensure you never “see” the money, making you less tempted to spend it.

- You can increase the amount gradually without feeling a pinch if you tie automation to any pay raises or bonuses you receive.

Try Budgetary Tools And Apps

Free (or low-cost) budgeting tools can help you spot the hidden corners where money might be slipping away. Plenty of apps let you link your bank accounts, automatically categorize transactions, and offer visual breakdowns of your spending. This is incredibly helpful if you’re looking to free up extra funds for your emergency savings. If you’d like a structured plan for an emergency fund, you might explore a financial preparedness checklist or pull insights from a financial emergency preparedness kit.

Make It A Family Affair

Get everyone on board, including older kids who might be able to grasp the concept of saving. This transforms your emergency fund journey into a team effort, and it teaches kids valuable life lessons about money management. For instance, you can involve them in couponing or let them help plan budget-friendly meal ideas. By doing this, you’re instilling crucial financial habits early on and turning saving into a shared goal rather than a solo task.

Manage Unexpected Situations

Emergencies come in all shapes and sizes—health issues, car breakdowns, job changes. Even a sudden spike in inflation can hit your family’s finances. An emergency fund is mostly about preparation, but you also need a plan for how to manage those moments when they happen.

Access Funds When Needed

You never want to be in a position where accessing your emergency fund becomes complicated or time-consuming. That’s why it’s wise to understand your financial institution’s withdrawal requirements. Take a look at specific guidelines in emergency fund withdrawal rules to avoid any unpleasant surprises when speed matters.

Keep Essential Documents Handy

When crises strike, it’s not just about the cash; you might also need quick access to important financial documents—insurance policies, ID copies, receipts for major bills you’ve paid. That’s where a financial go bag or effective emergency financial information storage strategy can make your life infinitely easier. Having everything in one place allows you to respond quickly and focus on solving the issue at hand, rather than hunting down paperwork.

Think About Inflation

It’s no secret that prices can rise, and your emergency fund might not stretch as far as it did a year or two ago. That’s why some families choose to keep part of their savings in slightly higher-interest-bearing accounts or regularly contribute a bit more to stay ahead of inflation. You can learn more strategies in inflation emergency fund if you’re looking to protect your purchasing power over time.

Rebuild After You Use It

Funneling funds into a savings account is one thing, but what if you actually need to tap into that emergency money? It can feel like you’re starting over. However, using your emergency fund for its intended purpose isn’t a failure; it’s the whole point. The crucial step is making sure you rebuild once the dust settles.

Reflect On The Situation

Before you jump into rebuilding, take a moment to reflect. Was the expense truly unavoidable or was it a gray area? There’s no shame here—just think about whether you want to adjust your expenses or saving habits moving forward. This helps you learn from the experience so you’re even more prepared next time.

Create A Replenishment Plan

Try to treat the rebuilding process with the same seriousness as you first did when stacking the funds. Check out rebuild emergency fund for tips on systematically replenishing what you spent. You could temporarily trim a few budget categories or pick up a side gig if you need to accelerate your savings. By forming a solid plan, you’ll bounce back with minimal stress.

Avoid Common Pitfalls

Everyone’s emergency fund journey is unique, but there are a few common mistakes that can slow you down or derail your progress. Let’s pinpoint these issues so you can stay on the right track.

Dipping Into Funds Too Early

It’s tempting to see a nice chunk of cash and think, “We could totally use this for a vacation!” But doing so undermines the entire point of an emergency fund. If you’re tempted, maybe start a separate account labeled “Fun Fund” or “Anniversary Trip” so your emergency fund remains just that—money set aside for genuine emergencies.

Mixing Debt Repayment And Emergency Savings

You might be wondering whether to knock out high-interest debt first or put money away for a rainy day. Though it can feel like a juggling act, it’s often wise to do a bit of both. Building some savings (like a starter emergency fund) keeps you from going further into debt if a crisis hits. For a deeper discussion, check out emergency fund vs debt to explore how to strike a balance that fits your family’s needs.

Ignoring A Better Option

All savings are not created equal. Sometimes families mistake regular savings for an emergency fund. While it’s true that having money set aside is better than nothing, you’d be surprised how quickly general savings can get spent on everyday items. Explore emergency fund vs savings to see which approach serves you best in a true crisis.

Underestimating Real Costs

Ever felt like your monthly spending is under control, only to realize you forgot about seasonal expenses, or that annual subscription service? It’s easy to overlook hidden costs. This can lead to setting an emergency fund target that’s too low. Regularly revisit your finances to see if you should adjust the goal upward. If you find yourself missing the mark often, consider a tool like a financial preparedness checklist to cover all the bases.

Stay Motivated For The Long Haul

Building and maintaining an emergency fund isn’t a one-and-done task. It’s more like forming a healthy habit—something you nurture over time.

Celebrate Milestones

When you reach half of your target or complete a structured program like the emergency fund challenge, it’s okay to pat yourself on the back. Share your win with family or friends, treat the family to a low-cost celebration, or mark the occasion with a heartfelt note on your fridge. Positive reinforcement helps keep you moving forward.

Experiment With Creative Ideas

Feeling stuck or bored with your savings approach? Consider looking at creative emergency fund ideas for fresh takes on how to set aside money. Maybe you start a small side hustle or sell items you no longer need. Or you take advantage of store loyalty programs that give cash-back rewards which you funnel straight into your emergency fund.

Keep An Eye On Your Goals

Life changes, and so do our financial needs. If you have a new baby on the way or a child heading to college, your idea of an “adequate” emergency fund might shift. Periodically reassess how much you should keep on hand. If your budget can handle it, bump up those savings. On the flip side, if money feels tighter due to new expenses, maintaining your existing fund might be enough until things settle down.

Build A Family Strategy

We often talk about an emergency fund as an individual effort, but it’s so much more powerful when you bring the whole household on board. Collaborating helps you share the load and keeps everyone aligned on the goal.

Delegate Tasks

If a partner or older child is good with numbers, let them help track and categorize your monthly expenses. Another family member might have an eagle eye for deals or coupons. By delegating tasks according to strengths, you cultivate a sense of ownership and teamwork.

Discuss Priorities Together

Gather for a quick family meeting—snacks encouraged—and chat about how you’ll use the emergency fund if something unexpected pops up. Would you prioritize covering a job loss over other expenses? Would you draw from it to help extended family in dire circumstances? These questions might seem heavy, but having clarity prevents disagreements during high-stress moments.

Include Positive Reinforcement

It’s rewarding to see your family collaborating on financial well-being. Encourage one another to celebrate small wins—whether it’s transferring a little extra cash this week or skipping takeout to funnel that money into savings. Each bit of progress is worth recognizing.

Safely Access Your Funds

When an emergency hits, stress levels can skyrocket. The last thing you want is to fumble around trying to get your hands on money you’ve diligently saved.

Setting Up Multiple Access Points

While you want your emergency fund to be slightly out of sight so you’re not dipping into it casually, it’s also wise to ensure you can quickly retrieve funds in a crisis. For instance, having a checkbook, an ATM card, or online transfer capabilities can reduce friction during urgent situations. You can read specifics at accessing emergency fund to avoid any hiccups.

Consider A Small Cash Reserve

Sometimes digital methods fail—power outages or issues with the banking system can leave you temporarily locked out of your accounts. Having a small amount of physical cash can be a lifesaver. Just remember to keep it secure, perhaps alongside your financial emergency preparedness kit, so it remains safe from damage or theft.

Mistakes To Avoid

Even with the best intentions, we can all slip up. Identifying common errors ahead of time gives you a better chance of steering clear of them.

Treating The Fund Like A Piggy Bank

It’s easy to think, “I’ll just borrow a little, and I’ll pay it back later.” But small, casual withdrawals can eat away at your balance surprisingly fast. If you find yourself doing this regularly, it might be time to revisit your overall budget. Also, emergency fund mistakes goes in-depth on pitfalls you’ll want to steer clear of.

Forgetting To Update Beneficiaries

If you store your money in a savings account, make sure your spouse or another trusted person can access it if you’re incapacitated. This can be as simple as adding them to the account or filling out a beneficiary form. It’s a small step that can save a lot of stress in an already difficult situation.

Move Forward With Confidence

You’ve come such a long way in understanding how an emergency fund can truly support you and your family. Whether you’re just getting started or leveling up your existing cushion, you have a wealth of options—from automated transfers to high-yield accounts, or even something as hands-on as the envelope system. There’s no one-size-fits-all solution here, but there is a guiding principle: keep it consistent, keep it realistic, and keep it separate from your everyday spending.

We’re all in this together. Balancing household expenses, life’s curveballs, and long-term goals is no small feat, but an emergency fund helps you do just that with less anxiety. If you slip, don’t worry. Simply pick yourself back up, reread the tips, and rebuild. This journey is about progress, not perfection.

Think of your family’s financial health as a team effort. Share your experiences, celebrate your successes, and encourage each other when it feels tough. Keep setting milestones, and give yourself a pat on the back every time you meet them. Before you know it, you’ll have built a safety net that’s sturdy enough to weather life’s storms—and that, my friend, is something to be very proud of. You’ve got this!