Building Your First $1000 Emergency Fund in 6 Months

We all know the feeling: that moment when you realize you need a cushion for unexpected bills or emergencies, but you’re not sure where to start. Building your first $1000 emergency fund can feel like climbing a mountain—especially if you’re juggling everyday responsibilities, maybe looking after a family, or carefully stretching each paycheck.

Trust me, you’re not alone. The good news is that saving up this initial emergency fund in six months is more manageable than it sounds.

Let’s walk through it step-by-step, just like two friends chatting over coffee. By the end, you’ll have a clear path, a sense of motivation, and the confidence to actually get it done.

Understand The Role Of An Emergency Fund

Before we dive into the nuts and bolts, let’s pause and remember why an emergency fund matters. Emergencies don’t always come with a polite warning: it could be a car repair, a medical expense, or even that huge power bill you weren’t expecting. Having a small cash reserve—like your first thousand dollars set aside—can bring real peace of mind.

Sure, a thousand bucks may not solve every crisis. But it’s the first line of defense that helps you avoid racking up high-interest debt or scrambling to borrow at the worst possible moment. An emergency fund also signals to your brain that you’re ready to handle life’s surprises without derailing your future goals. It’s about stability and confidence, not just a number in the bank.

Why $1000 Is a Meaningful Start

Of course, there’s debate about the exact amount to save, and many folks aim for more than 1000 dollars. You might have heard of a starter emergency fund or different recommended totals. But if you’re brand-new to saving, $1000 is a realistic milestone—like the first rung of a ladder. Once you cross that threshold, you’ll have tangible proof that you can make saving a habit.

Setting a smaller, achievable benchmark also helps you avoid feeling overwhelmed. Think of your 1000 dollars as a safety buoy in choppy waters. Then, if you need to go larger—like a 3-month emergency fund—you can build from there. But first, let’s tackle this crucial stepping stone.

Set A Six-Month Timeline

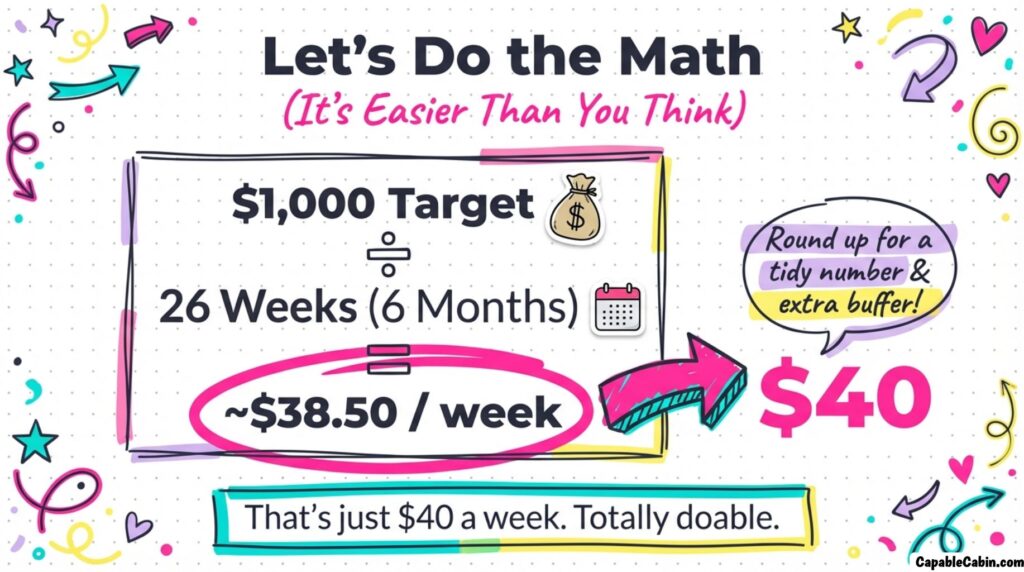

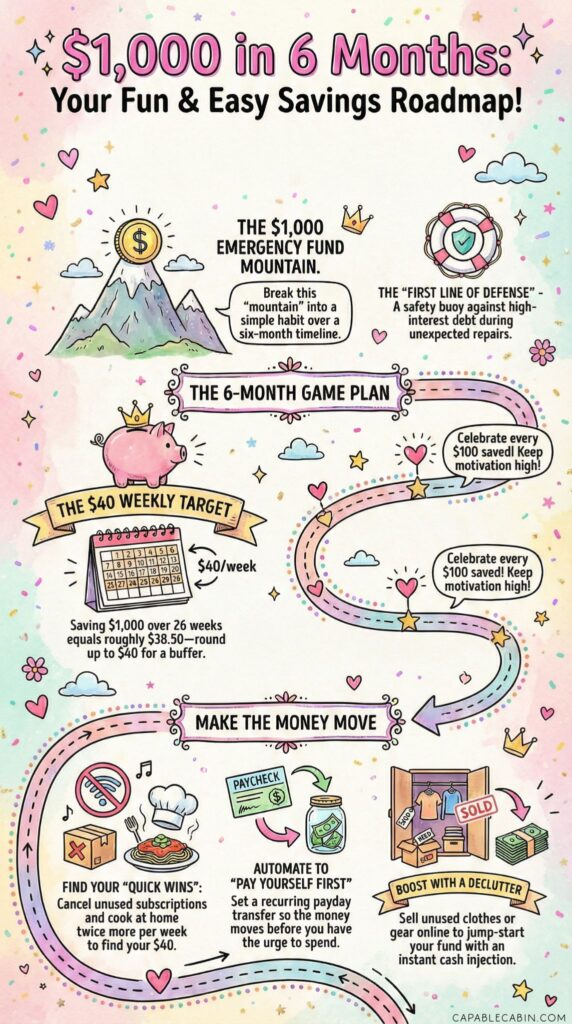

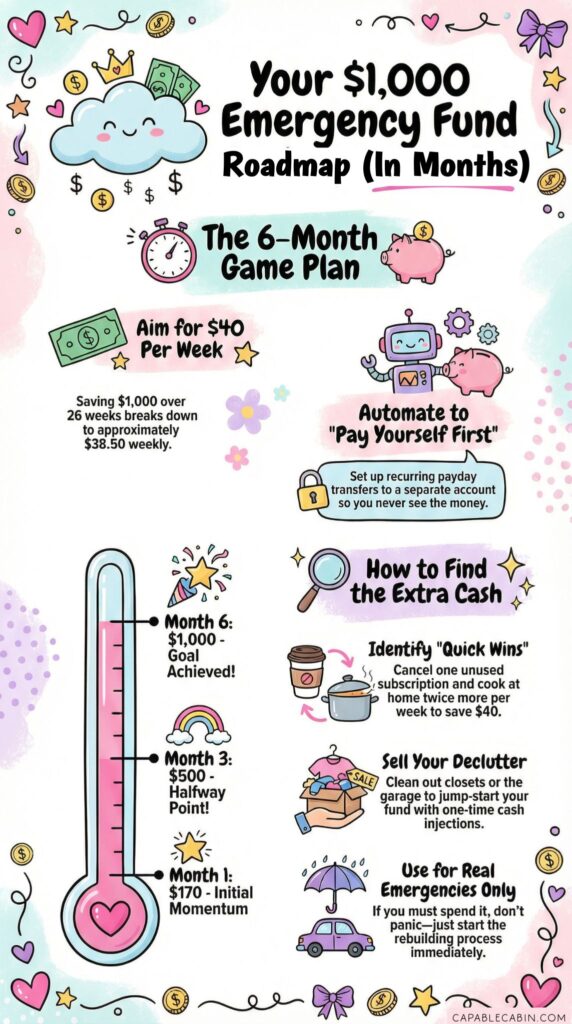

When you’re aiming for $1000, “six months” can sound like a lifetime—until you do the math. Breaking things down by months or weeks makes the goal more tangible and less intimidating.

- 6 months means roughly 26 weeks.

- If you divide $1,000 by 26, that’s about $38.50 per week.

- Rounding up to 40 dollars gives you a tidier number and a bit of extra buffer.

That’s the beauty of having a concrete target date. Whether you pick a milestone (like a birthday or a holiday) or just mark your calendar six months from now, it gives structure to your savings. And when you have structure, you can track your progress and actually see the finish line coming closer each month.

Building Momentum With Mini-Milestones

To keep your motivation high, set smaller checkpoints along the way. Maybe it’s at the end of each month, you want to see at least $150 or $170 stashed away. This habit of checking in helps you stay focused. It also makes it easier to celebrate each small victory—like hitting the first $100 saved, then $200, and so on. Small wins add up quickly, and before you know it, you’ll see that total climbing toward $1000.

Examine Your Cash Flow

Now that you’ve set your sights on six months, let’s figure out how to find that extra cash without cramping your lifestyle too much. The first step is all about awareness. Let’s look at where your money is going each month in a friendly, no-judgment kind of way.

Track Your Income And Expenses

If you’ve never done a deep dive on your budget, it can feel like rummaging through a messy closet. The good news is, once you see exactly how much is coming in and how much is going out, you unlock tons of power. You’ll spot hidden leaks in your finances and pinpoint areas that can be optimized.

- Gather all your monthly bills, statements, and receipts.

- Note each source of income.

- Make a list of your essential expenses (rent, utilities, groceries).

- Make another list of discretionary expenses (streaming subscriptions, dining out, hobbies).

If you like visuals, a spreadsheet or budgeting app can help you see patterns. Maybe you realize you’re spending way more on takeout than you thought, or multiple streaming services that overlap. This is just an information-finding mission—no need for blame here. We’ve all been in this spot at one point or another.

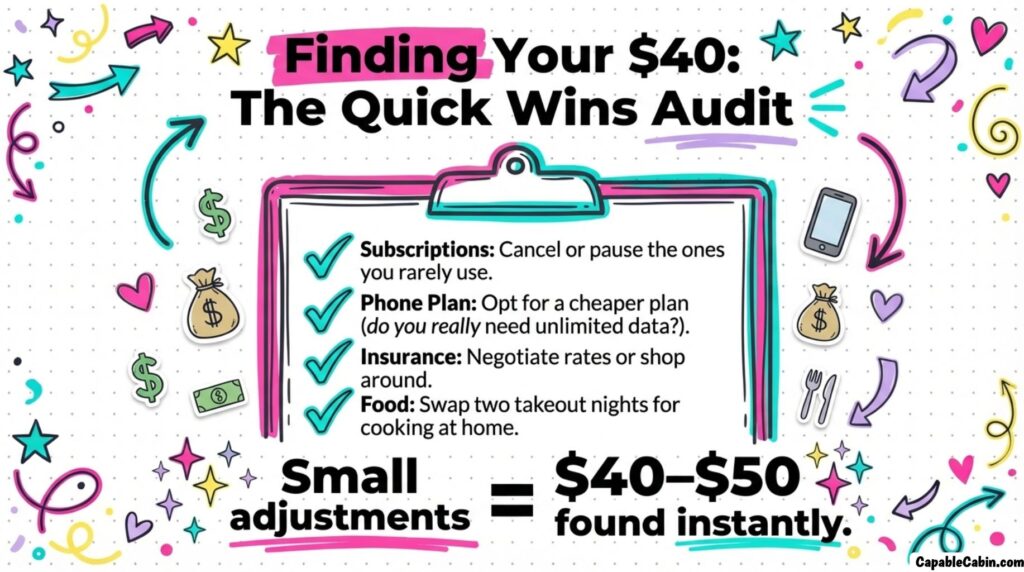

Identify Quick Wins

Even small adjustments can free up extra money to put directly into your emergency reserve. For instance:

- Cancel or pause a subscription you rarely use.

- Opt for a cheaper phone plan if you’re not using all those data perks.

- Negotiate insurance rates or shop around for better deals.

- Cook at home a couple more nights per week.

By making a few changes, you might find $40 to $50 a week that you didn’t even realize you had available. That alone could be your weekly contribution toward your $1000 goal. Sometimes, just a tiny bit of effort can yield big results.

At this point, you know how much money you can redirect and why hitting that $1000 mark in six months is crucial. Let’s turn that knowledge into a plan. Rather than waiting until the end of the month to save “whatever’s leftover,” consider paying yourself first. In other words, treat your savings contribution as a mandatory bill that comes out of your account before you start spending on optional stuff.

Automate Your Savings

Create A Savings Strategy

Automatic transfers are a lifesaver. You can set up a recurring transfer from your checking account to your designated emergency fund account every payday. Just pick an amount, like $40, and your bank will move it without you needing to lift a finger. After a while, you may not even notice that money leaving your checking account.

If you’re brand-new to saving, you can start with a smaller weekly or biweekly transfer and gradually increase it. The idea is to make this so seamless that you don’t get the urge to skip a deposit. If you need a little inspiration to stay consistent, check out our emergency fund challenge or even the year-long emergency fund challenge for more structured savings ideas.

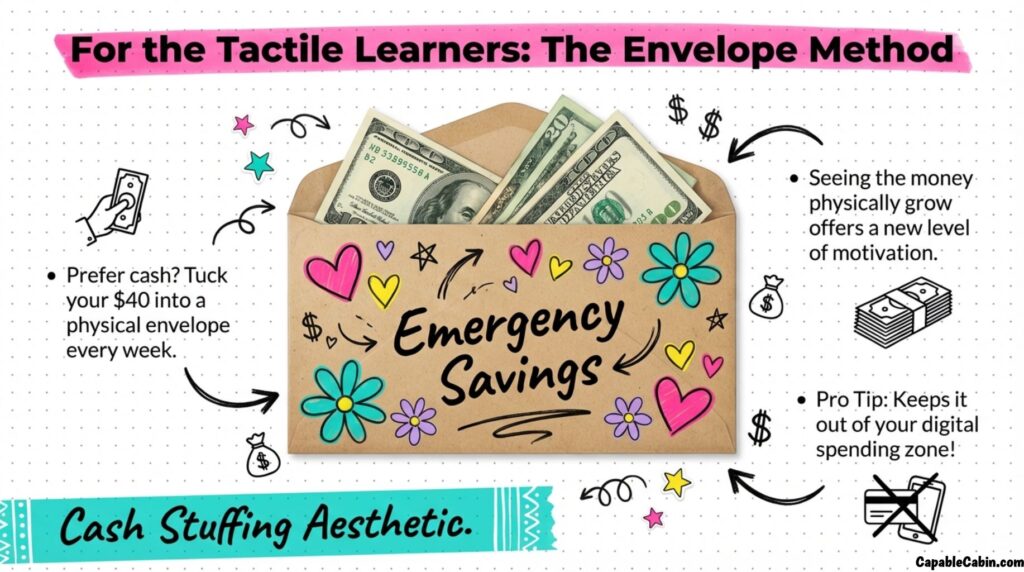

Consider The Envelope Method

If you’re more of a cash-in-hand person, using the emergency fund envelope system can be a game-changer. Label an envelope “Emergency Savings” and tuck away your chosen deposit each week in actual bills. It may sound old-school, but physically seeing the money grow in that envelope offers a new level of motivation. Plus, you can physically remove it from your spending zone, which lowers the temptation to dip into it for daily extras.

Find Additional Income Sources

Sometimes, you just can’t trim your budget further without feeling deprived. If that’s the case, adding a little extra income can tip the scales in your favor. Don’t worry—you don’t need to overhaul your entire lifestyle or pick up a second full-time job.

Try A Side Gig

Think about skills you already have. Are you good at baking, crafting, or doing design work? Could you take on freelance projects on weekends or sell homemade items online? Even offering tutoring or babysitting in the neighborhood can bring in extra dollars you can funnel directly into your emergency stash.

The key is to keep it manageable. You don’t want to burn out, especially if you have a busy household. Look for small, consistent ways to earn so you can stay motivated for the entire six months without overwhelming yourself. Each extra hour or two of paid work can inch you closer to that $1000 goal.

Sell Items You No Longer Need

A quick declutter session can also boost your progress. Go through closets or the garage and see if there’s anything worth selling—like gently used clothing, old furniture, or gear you don’t use anymore. Online marketplaces make it easier than ever to find buyers, and you can stash these earnings right into your emergency fund. Not only do you tidy your home, but you jump-start your savings too.

Overcome Common Obstacles

Like most worthwhile goals, building your first thousand can come with surprises. Maybe your car unexpectedly needs new tires, or your best friend decides to get married, and you’re suddenly shelling out for a bridesmaid dress. Life happens. The important part is recognizing these obstacles and having a plan to deal with them without hitting the panic button.

When Your Savings Take A Hit

Let’s say you’ve been doing great, depositing your $40 each week, and then out of nowhere, you need $200 to fix the family car. It’s frustrating, but it doesn’t have to derail everything. Give yourself a moment to feel that disappointment—I get it, it stings—then adjust your plan. You might need a week or two to recoup, or you might need to find a quick side hustle to make up the gap.

Remember, an emergency fund is there to help cushion you for these very moments. So if you do dip into it for a genuine emergency, that doesn’t mean you’ve failed. It means your fund is doing its job. Once you’re back on track, keep moving forward.

Balancing Debt And Saving

A lot of us carry some form of debt, whether it’s a credit card or a car loan. Figuring out how to save while also chipping away at debt can feel like a tightrope walk. One approach is to set a modest emergency fund goal first—like that $1000—and then focus on accelerating your debt payments. Or you might split your monthly money to do both gradually. If you’re weighing the two, check out our guide on emergency fund vs debt to help you figure out a strategy that makes sense for your situation.

Sometimes, the peace of mind that comes with an emergency reserve justifies taking a slower path to debt freedom. If high-interest debt is draining your finances, though, you might prioritize paying off a chunk of it alongside building your small cushion. Either way, having even a little bit saved up can prevent you from falling deeper into debt when life surprises you.

Stay Motivated Over Six Months

Keeping your eye on the prize is easier said than done—especially a couple of months in, when you’re used to that initial excitement wearing off. Here’s how to keep the spark alive:

- Track your progress visually. It could be a chart on your fridge or a savings thermometer you color in each week.

- Set fun reminders on your phone that say things like, “You’re crushing it, keep going!”

- Talk to a friend or family member who’s also saving. You can celebrate each other’s milestones and share tips.

Tracking progress might feel like a small thing, but it’s so powerful. Every time you color in a bit more of that chart, your brain gets a hit of accomplishment. Think of it as your friendly pep talk that you’re getting closer to finishing your $1000 emergency fund.

Embrace Intentional Spending

Another tactic to keep momentum is to get more mindful about each purchase. Ask yourself, “Will this purchase make me happier long-term, or is it just a quick fix?” Having a clear picture of your priorities can help you filter out mindless spending and keep more money in your account for real-life security.

That doesn’t mean you can’t treat yourself at all. Some folks lose motivation if they clamp down too firmly on every single purchase. The sweet spot is finding balance: if you skip a fancy coffee run four times in a row, maybe grab one as a small reward at the end of the week. You’re in control, deciding what’s truly worth it and what can wait.

Protect And Store Your Savings

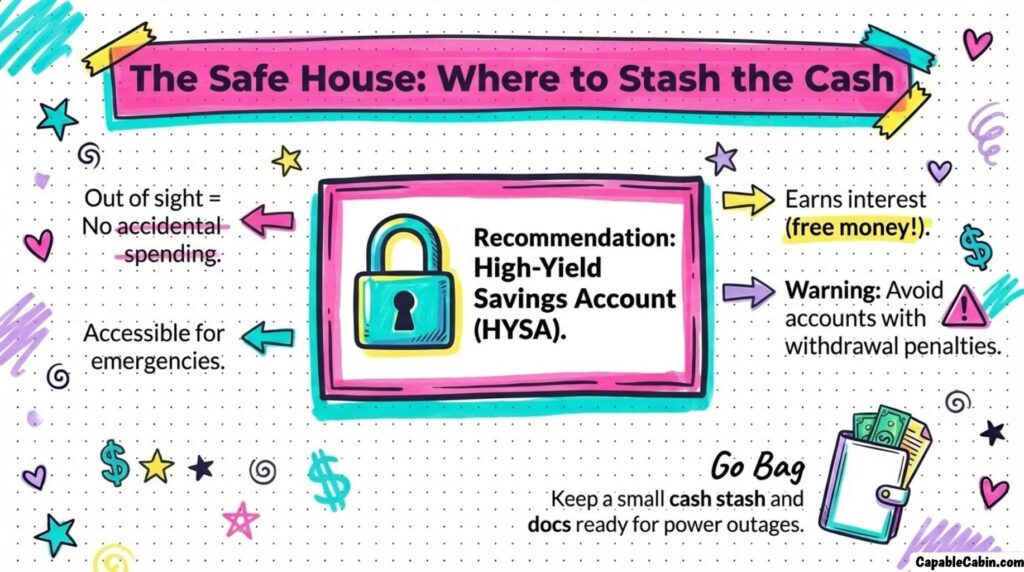

Where you stash your emergency money can make a difference in how easy it is to access—and how safe it remains. Storing it under the mattress might be too tempting, and mixing it with regular checking can lead to accidental spending.

Choose The Right Account

Many people like a separate high-yield savings account for an emergency fund because it stays out of sight and potentially earns a bit of interest. But you also want it relatively accessible so you can pull cash quickly if an emergency arises. Check out where to keep emergency fund for a deeper look at choosing an account type that fits your needs.

Just remember not to lock it up in an account that comes with hefty early withdrawal penalties—this is meant for genuine emergencies, not long-term investing.

Consider Secure Paper Documentation

If you like to keep a physical backup of important financial information, you might also explore a financial go bag or financial emergency binder. A binder is a handy place to store your important account details, emergency contacts, and copies of critical documents like insurance. Keep it in a safe spot at home, and update it whenever you make major changes to your finances. That way, you’re not scrambling in a crisis to find the info you need.

Prepare For Inflation And Other Shifts

It’s normal to worry about whether your $1000 will stretch as far in the future, especially in times of fluctuating prices. While it’s true that inflation can chip away at the purchasing power of your emergency stash, the critical element is still having something available quickly when you need it. For more specifics on how to handle rising costs, check out the inflation emergency fund.

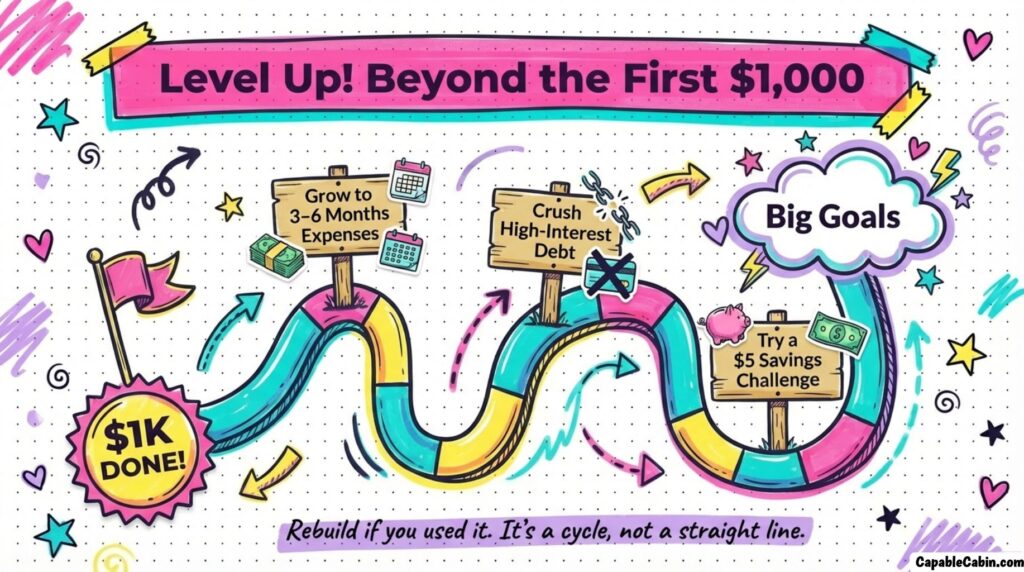

Think Beyond The First Thousand

Once you hit your milestone, you might wonder if you should boost your savings. That’s ultimately your call, and it might depend on your family size, your job security, or ongoing expenses. Some folks aim for three to six months’ worth of living costs saved up. Others might build a cushion large enough to weather more extensive emergencies, or they might shift focus to pay off debt after they have their starter fund in place.

For more perspective on how goals can shift over time, you could read up on the emergency fund amount or compare emergency fund vs savings. This will help you figure out if you’d like to save more in the future or simply maintain your initial safety net.

Navigate Emotional Ups And Downs

Saving money isn’t just about numbers—it’s also about feelings. You might feel anxious about whether you can stick to the plan or guilty if you dip into your funds. Sometimes, it helps to talk about these emotions with someone you trust, whether that’s a friend, a partner, or an online community. A bit of moral support can keep you grounded when things get tough.

Pat Yourself On The Back

It’s easy to fall into the trap of thinking, “I should have done this sooner,” or “I’m so far behind everyone else.” Those thoughts can undermine your progress. The truth is, you’re doing great just by setting your mind on this goal. Every deposit you make, every time you choose to cook at home instead of ordering takeout, you’re practicing a skill that will serve you for years. Celebrate that!

Don’t hesitate to acknowledge how far you’ve come, even if you’re just a month or two into your new routine. This shift in mindset—from focusing on what you lack to celebrating what you’re building—can transform the entire experience.

Guard Against Common Mistakes

As you continue your journey, keep an eye out for a few pitfalls. It’s normal to slip up now and then, but these reminders can help you avoid repeated missteps and stay on track.

Mixing Your Savings And Checking

- Some folks leave their emergency money in the same account they use for daily expenses, making it too easy to spend. Consider keeping them separate so you can’t accidentally dip into your fund for non-emergencies.

Forgetting To Review Your Budget

- Life changes, prices go up or down, and your budget should adapt accordingly. Check in at least quarterly to see if your plan still makes sense.

Dipping Into Savings Recklessly

- Real emergencies happen, but giving in to the temptation of a flashy sale or a spur-of-the-moment splurge can sabotage all your hard work. If you do need to use part of your fund, do so knowingly and with a plan to replenish it.

For more specific insights, you might want to skim through emergency fund mistakes, which goes deeper into pitfalls and how to handle them.

Maintain A Positive Mindset

Staying positive doesn’t mean ignoring challenges. It’s about recognizing that every little effort you make has value. Money can be emotional, and shifting how you think about it is half the battle. If you have a tough week where you only manage to save $10 instead of your usual $40, that’s still progress.

Lean On Support

Sometimes in the midst of frustration, it helps to remember that thousands of other people are on the same journey. You’re not the only one who has ever struggled to put away a consistent amount each month. If you can find an accountability partner—maybe someone in the community, a colleague, or a family member—that shared experience can keep your spirits up. You’ll both cheer each other on and share creative ideas when you hit a slump.

Celebrate As You Grow

One of the best parts about a structured, six-month goal is that you can watch yourself grow each month. Celebrations don’t need to break the bank! We’re talking a favorite treat, a small gift to yourself, or simply taking a moment to say, “Wow, look how far I’ve come.” That sense of accomplishment builds up your financial confidence.

Plan For The Future

Once you’ve achieved your initial thousand, think about how to build on your new habits. If you want to keep going, you could shift into a $5 savings challenge or set your sights on a bigger cushion and track your progress in the same way. Some people pivot to building a financial preparedness checklist or a financial emergency preparedness kit so they’re more prepared across various life events.

The point is, you’ve established a strong foundation, and that’s something to be proud of. If you want to increase your savings beyond $1000, keep that momentum rolling. If you’d rather pause to focus on paying down credit cards or other obligations, you can do that too. The important part is you’ve proven you can put money away consistently when you make it a priority.

Handle Withdrawals Wisely

A quick note on what happens if or when you need to pull money from this emergency stash. There may come a day when the car needs parts replaced, or your kiddo has an unexpected doctor visit. That’s the moment you realize how valuable your cushion is. Check out accessing emergency fund or emergency fund withdrawal rules for specific tips on how and when to tap into your reserve. Just remember, use it wisely and make a plan to refill the fund as soon as you’re able.

Rebuild If Needed

Life rarely stays the same from one year to the next. If you use part or all of your $1000 for a real emergency, rebuilding doesn’t mean you’re back at square one—it means you’re continuing the journey. You’ve already proven you can do it. Think of it like patching up a roof. You may have to fix a leak, but now you know exactly how to handle any future issues. For more insight, see rebuild emergency fund to get ideas on starting the process again if your account is ever depleted.

Keep Emergency Cash Accessible

Let’s talk about quick cash on hand. Though a bank account is typically the best spot for most of your emergency money, having a small stash at home can also help with immediate, unforeseen moments—like a power outage or a temporary bank system glitch. If you’re curious, check out emergency cash at home for guidelines on how much to keep on hand and how to store it safely. Just be cautious, since the more you keep around, the more tempting it can be to dip into it.

Build Long-Term Habits

Even after reaching the $1000 milestone, you don’t have to stop creating healthy money habits. An emergency buffer is just one piece of a broader financial puzzle. From exploring the emergency fund guide to checking out emergency fund vs savings, there’s always more to learn. You can also transition into saving for specific goals—like a vacation or a future home purchase—while keeping your emergency fund intact.

Keep It Simple And Steady

Complicated plans can be harder to maintain. If what you’re doing now is working—like automatically transferring a small amount each week—then keep it going. Eventually, you won’t even think twice about it. You’ll just notice your savings growing steadily in the background. And if you need a break or want to tweak something in your budget, you can quietly adjust your deposits without completely abandoning the habit.

Final Reflection: You’re In Control

Building a $1000 emergency fund in six months might seem like a tall order when you’re just looking at the big picture. But let’s break it down one final time: $40 dollars a week can get you to that milestone if you stay the course. Even if you miss a week here or there, you’ll still make consistent progress. Each deposit is a tiny success that pushes you closer to your safety net.

This whole process is about more than just having some money in the bank. It’s about feeling that shift in your mindset—where you realize that you don’t have to be constantly worried about unforeseen costs. You’ve done the work to prepare, and that alone can be a huge mental relief.

Will there be days you’d rather spend that $40 on a treat or skip a side hustle gig to relax? Absolutely. But the trade-off is the calm you experience when life lobs an expensive curveball your way. You can deal with it responsibly, without letting it wreck your peace of mind.

So, here’s the warmest congratulations for taking this step. Let’s keep it simple: track your budget, automate your savings, pivot when life throws surprises, and keep that six-month timeline in sight. Even if it takes a little longer than planned, or you reach it a bit earlier (yay!), the real win is committing to your own financial stability. Remember to celebrate every step, share your journey with people you trust, and remind yourself of that finish line whenever you feel tempted to throw in the towel. You’ve got this—one week, one deposit, and one encouraging pat on the back at a time.