How Much Emergency Cash Should You Really Keep at Home?

Welcome! If you have ever wondered about keeping emergency cash at home, trust me, you are not alone. It is easy to feel torn between wanting immediate funds on hand for urgent situations and worrying you might not be using your savings effectively. We have all been there, weighing the comfort of having physical money in a drawer against the risk of keeping too much out of the bank. In this ultimate guide, we will walk through why having some cash at the ready can be smart, how to figure out the right amount, and how to store it securely without losing sleep over safety or missed financial opportunities. You have got this, and we are in this together.

Understand The Need

We all crave a sense of security, especially when it comes to money. Emergencies can crop up unexpectedly—think power outages, natural disasters, or sudden medical issues that require immediate cash payments. If you rely solely on digital transactions, you might find yourself stuck if the internet is down or ATMs are not working. Having tangible bills on hand can make all the difference in these moments.

Why Even Bother With Cash?

Many of us have gotten so familiar with swiping cards and using digital payment apps that carrying large sums of cash can feel almost old-fashioned. Yet physical currency remains a reassuring backup. It is not only about preparing for doomsday scenarios. Sometimes you might need quick cash for a neighborhood vendor, last-minute school fees, or an unexpected house repair that requires immediate payment. By having a stash ready, you save yourself the scramble of looking for working ATMs or borrowing from friends.

Finding Comfort And Confidence

Having a modest sum of money at home can reduce panic when faced with sudden expenses. You do not have to drop everything and find a bank; you can just open that discreet spot and handle the situation. This sense of control can also ease your mind during broader emergencies. For instance, if a storm knocks out power for a few days, you are less likely to feel stranded if you cannot access online banking or card payments. Ultimately, it is about bolstering a broader sense of financial freedom—you get to say, “I am prepared, and I do not have to worry about minor crises derailing my finances.”

Weigh The Potential Risks

Every approach to handling money has its caveats, so it is important to understand the possible downsides of keeping money at home. By balancing these risks against the benefits, you can make informed decisions that fit your life and comfort level.

The Threat Of Theft

Though rare, burglars can target households if they suspect valuables are inside. This does not mean you should be paranoid, but it is wise to acknowledge the possibility. The trick is to store your emergency reserves discreetly—without announcing to everyone that you keep physical cash at home. Even if this scenario sounds unlikely, it is better to set up sensible security measures now instead of wishing later that you had.

Erosion From Inflation

Cash locked in a drawer or safe does not earn interest. In fact, it can lose purchasing power over time due to inflation. For most households, it is not ideal to keep large amounts of money at home for very long. That is why you want a balanced approach. Using an interest-bearing account for bigger chunks of your emergency fund can help combat inflation, while still holding onto a smaller, practical amount for immediate use.

Decide Your Ideal Amount

The question everyone asks is, “How much emergency cash at home should I have?” The answer varies based on personal circumstances—like family size, neighborhood conditions, and risk tolerance. But let us explore the factors that can help you find a ballpark figure that fits your unique needs.

Key Factors To Consider

- Family Size And Needs

- Larger families might want more on hand for supplies, food, and other short-notice expenses.

- If you live alone or with just one other person, you might manage with a smaller stash.

- Frequency Of Possible Emergencies

- Think hurricanes, power outages, or snowstorms—are they common in your region?

- Those living in disaster-prone areas might prefer a more sizable amount close by.

- Dependence On Digital Access

- Some of us conduct nearly all our transactions through online banking or cards.

- If that sounds like you, reflect on how tough it would be if these systems went down.

- Overall Budget And Goals

- Your total emergency fund might run a few months’ worth of household expenses.

- You do not have to keep all of it in cash—strike a healthy balance that makes sense for you.

Starting Small And Growing

Experts often recommend anywhere from a few days’ worth of cash to a full month’s basic expenses in your home stash, depending on your comfort. If that feels intimidating, think in steps:

- Begin with a modest cushion—maybe $100 to $300—enough to cover groceries or urgent costs.

- Gradually inflate that number as you become more comfortable and your budget allows.

- Periodically review your finances and family situation to decide if you need more.

You do not have to figure it all out overnight. Start with a small, manageable amount, then build on that as you learn what works for you. This way, you steer clear of feeling overwhelmed and can build your emergency stash at a steady, confident pace.

Scenario-Based Examples

Why not walk through a few hypothetical situations?

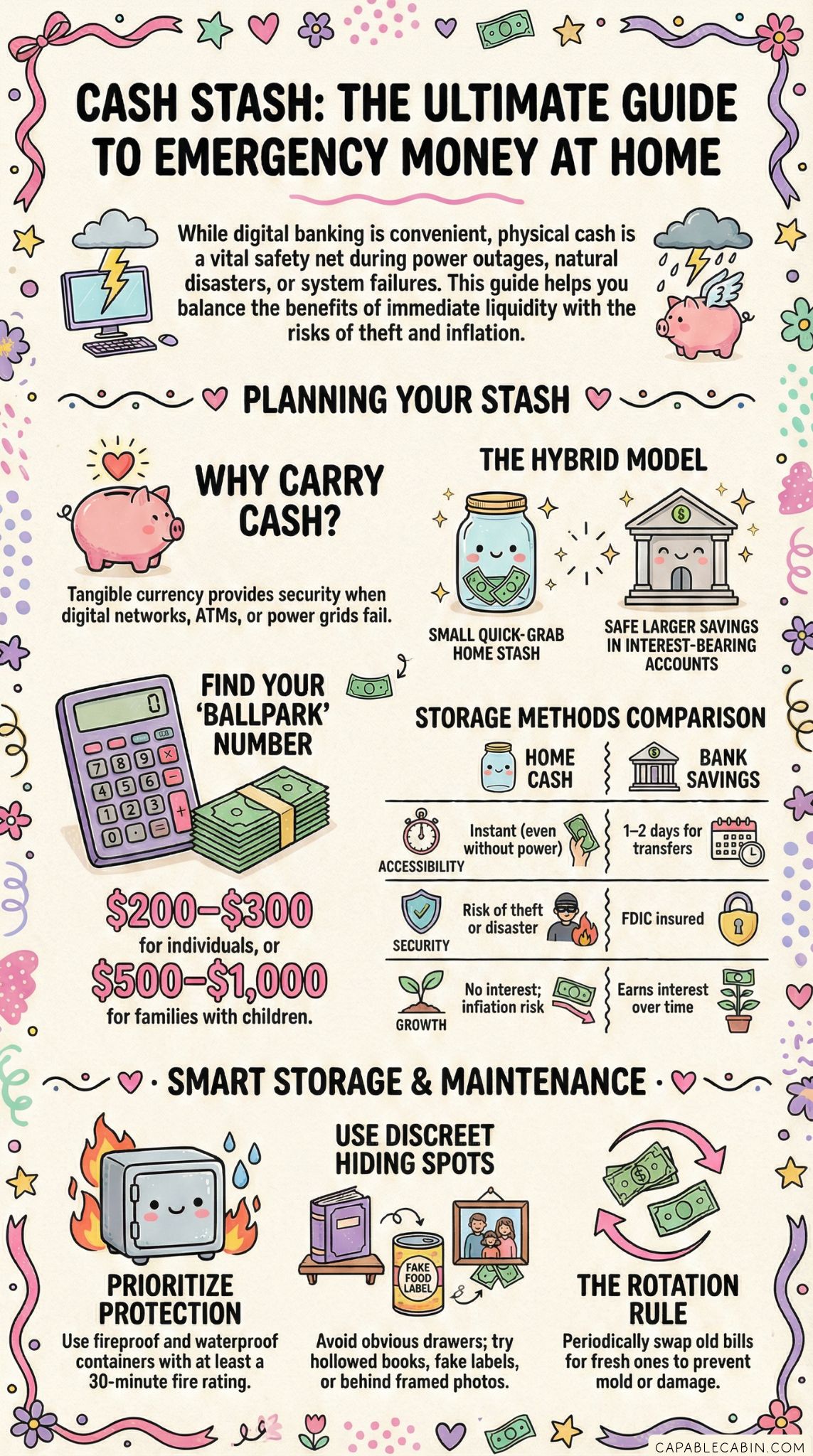

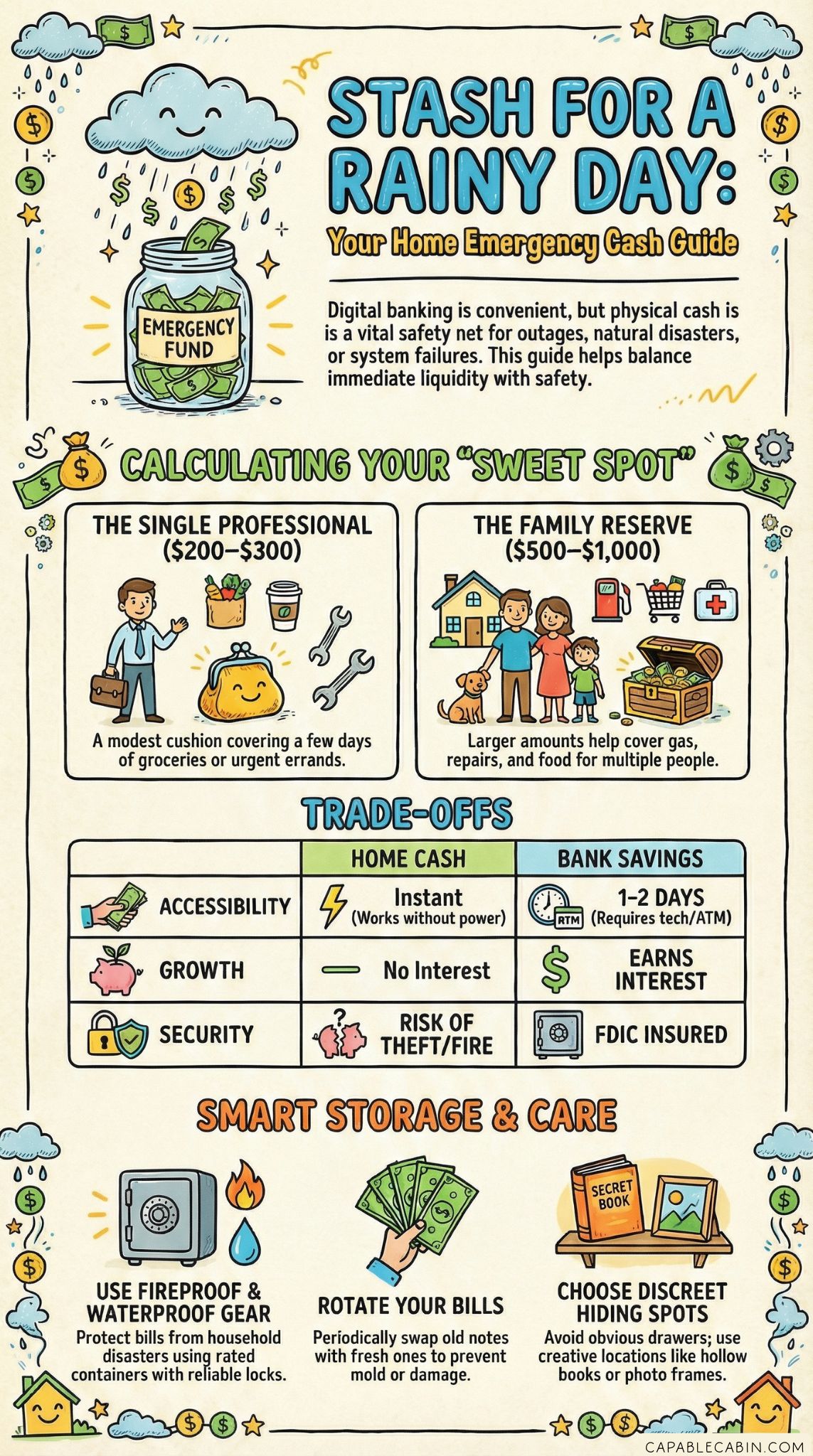

- Single Professional: You are living solo for the first time. You might only need around $200-$300 in cash at home for sudden errands or a handful of groceries in an emergency.

- Family Of Four: You have kids, so unexpected expenses can pop up anytime. Keeping $500-$1,000 in a safe spot might help cover food, gas, or minor household repairs if electronic payments are not an option.

- Elder Care: Families who care for elders or individuals with medical challenges may want closer to $1,500 on hand. This could help ensure they can quickly pay for services, repairs, or critical supplies.

Remember, these examples are just ballpark figures. Your ultimate goal is to strike a balance that offers both safety and immediate access without robbing your bank accounts of the chance to grow.

Choose Safe Storage Methods

So, you have decided on a realistic amount. The next step is figuring out where to tuck it away so it is protected from prying eyes, natural disasters, or even your own forgetfulness. Let us explore some practical ways to keep your money secure at home.

Use A Fireproof, Waterproof Container

One of the most popular methods for storing physical cash is using a container that can withstand fire and water damage. You can find these in various sizes, from small document boxes to more substantial safes, so pick one that fits your space and security needs. Not only does this protect your bills from household accidents, but it also makes them less vulnerable if a large-scale emergency (like flooding) occurs.

Key considerations for a sturdy container:

- Fireproof rating of at least 30 minutes, ideally up to an hour

- Water-sealing or waterproof lining to keep moisture out

- A reliable lock or code for extra deterrence

Discreet Hiding Spots

Some people prefer to be creative: a hollowed-out book on the shelf, a small box labeled “winter socks,” or tucked behind a framed family photo. While these are not as secure as a locked container, they add an extra layer of discretion. Potential thieves generally look in obvious places like nightstands or top drawers, so be strategic about where you hide your stash.

Pro tip:

- Avoid spaces that experience extreme temperature or moisture swings, such as attics or basements.

- Leave no hints that you store physical money at home—casually mentioning it can make you a target.

- Consider having more than one small hiding spot so you do not keep everything in a single place.

Integrate With Overall Emergency Planning

While physical cash can be a lifesaver in certain crisis moments, it is only one piece of your broader safety puzzle. An all-encompassing plan ensures you can handle everything from minor hiccups to serious emergencies without feeling overwhelmed.

Pair With A Financial Roadmap

If your overarching financial safety net could use a review, you might want to check out resources like the emergency fund guide. It can walk you through setting up a robust emergency reserve, typically stored in a bank or similar institution. The point is to have both a quick-grab sum for immediate crises and a more substantial backup earning interest on the side.

Other helpful internal resources might include:

These guides can help fine-tune your money management approach so that your family’s financial stability does not hinge on one single method.

Secure Your Documents Too

Money is not the only thing you need quick access to in a crisis. Storing key paperwork—like IDs, insurance policies, and mortgage documents—in a safe, organized manner can speed up recovery after life’s surprises. For a head start, see the financial preparedness checklist. It spells out everything you need to gather—from birth certificates to medical directives—to see your family through thick and thin. Combining essential documents with your emergency cash at home is a great way to stay prepared and calm, no matter what life decides to dish out.

Keep It Updated And Accessible

One challenge people face is forgetting about the money they stashed away. Months or years can roll by, and when an emergency finally hits, they might discover that some bills are damaged or missing. Maintaining your “cash corner” does not have to be complicated, though—it just calls for a little routine.

Schedule Routine Check-Ins

Consider setting a reminder on your phone—or marking your calendar every few months—to open your safe or hidden spot and see what shape your bills are in. Confirm that you still have the amount you planned. If any note looks worn, swap it out at a bank. This is also a good time to add or remove money if your financial situation has changed.

During these reviews, ask yourself:

- Have my expenses grown?

- Did my risk factors (like medical needs or location hazards) shift?

- Does the container or hiding place still make sense?

Rotate Bills For Freshness

Some people like to keep notes in circulation. For instance, if you have stashed $300, take it out periodically and replace it with fresh bills from your checking account. This does not affect your net worth, but it ensures you are not left with bills that look weathered when you need them for payments. If you live where humidity is high, rotating your cash can also prevent mold or mildew buildup.

Incorporate Family In The Plan

It might be tempting to keep your emergency stash a secret, but consider letting at least one trusted family member know where to find it. In times of crisis, you do not want to be the only one aware of its location, especially if you are away for business or unwell. Clear communication can spare family members from fumbling through every cupboard in a frantic hunt for funds.

Teaching Kids About Preparedness

Kids can benefit from basic money lessons—even at a young age. Explaining why you keep emergency cash at home and how it fits into your overall financial safety plan can demystify money for them. Teach older children how to handle small errands or community purchases that arise when digital payments are unavailable, fostering independence and responsibility.

Setting Boundaries For Access

If you worry about daily temptations (sometimes we spot that extra cash and think of a new coat or a family pizza night), lay down rules. You might decide that this money is only for true emergencies—like unexpected medical visits or urgent home repairs. Ensuring everyone understands these guidelines can prevent the slow depletion of your stash on everyday expenses.

Enhance Your Safety Net Over Time

As your circumstances evolve—maybe you buy a larger home, start a new business, or have another child—you might want to adjust how much money you keep on hand. It is perfectly okay for your plan to shift over time. That is the essence of personal finance: it is personal and dynamic.

Expand With Challenges And Goals

If you are looking to ramp up your broader emergency funds, try checking out the emergency fund challenge. Challenges can gamify the saving process, motivating you to set goals and track progress in fun, manageable increments. Once you have built a big enough reserve, you can afford to store a bit more at home if that feels right.

Be Open To New Methods

The financial world changes fast. Mobile wallets, online banks, and other blossoming tech solutions might reduce your need for keeping too much physical cash. On the flip side, changing times can also bring new disruptions—cyberattacks or widespread internet outages, for example—underscoring the value of having tangible funds. Keep your finger on the pulse, adapting as needed.

Compare Home Cash Vs. Bank Savings

Sticking money under your mattress for the long haul is not generally recommended. Strings of inflation can wear away its value, and you miss out on interest. However, bank-based emergency funds come with their own trade-offs, like possible delays in transferring money out of savings accounts. Here is a quick side-by-side view:

| Aspect | Home Cash | Bank Savings |

|---|---|---|

| Accessibility | Instant, even if power or ATMs go down | Usually 1-2 days to transfer (or immediate with ATM) |

| Security | Risk of theft or disaster | FDIC insured (up to statutory limit) |

| Growth Potential | Does not earn interest | Earns interest based on account |

| Liquidity Fees | None | Sometimes penalty for more frequent withdrawals |

Use this table as a quick reference to clarify how each method fits into your plan. Most families land on a hybrid model: a small stash at home integrated into a broader savings or bank-based emergency fund.

Stay Motivated And Confident

It is easy to get excited about building an emergency plan, then lose steam when you realize life is hectic. We all know that feeling—so many daily demands, so little time. But trust me, you have more control than you think, and every small step can bring big peace of mind.

Celebrate Tiny Wins

Once you have tucked away your first $50 or your first $500, give yourself a high-five. Start acknowledging these moments so your brain associates responsible moves with success and positivity. Think about small treats: a favorite snack, a walk in nature, or a relaxing day off from chores. Rewarding yourself keeps the momentum going.

Share Experiences With Others

Open up conversations about financial preparedness with friends or relatives you trust. You might find they face similar hurdles—worrying about petty theft, not knowing where to stash money, or just forgetting to place emergency dollars aside until it is too late. By swapping tips and support, you build confidence and help each other navigate all these decisions.

Final Thoughts And Encouragement

Carving out emergency cash at home is not about panic or expecting the worst 24/7. It is about reassuring yourself that you have got options when times get bumpy. In a world focused on digital everything, physical bills remain a tangible anchor, bridging potential gaps between you and your savings institution. But remember, it is a balancing act. You do not want so much cash at home that your money stagnates—or becomes a magnet for theft—yet you also do not want so little that you are left unprepared when life throws its inevitable curveballs.

By understanding your household needs, planning wisely, keeping your steps manageable, and revisiting your approach over time, you will find that perfect sweet spot for your home safety net. We all start somewhere, and the fact that you are reading this now tells me you are already motivated to create a more secure future. Let that feeling guide you, and do not forget you are never alone in this journey. We are all making daily strides to protect our families, our finances, and our peace of mind.

So let us keep that light, optimistic vibe going. You have learned the basics of how to stash your emergency cash responsibly, and now you can blend it into your bigger financial plan. Whenever you feel doubts creeping in, remind yourself why you started: Family security. Personal peace. Flexibility when it matters most. Keep moving forward with care and confidence—your future self will thank you for it.