How to Build an Emergency Fund When You Live Paycheck to Paycheck

Recognize the Importance of an Emergency Fund

Ever had that feeling that your next paycheck seems spent before it even touches your bank account? You are definitely not alone. In fact, many of us feel like we are walking a tightrope each month, juggling bills, rent, groceries, and other must-haves without a safety net. But here’s the thing: when you begin to explore the idea of building a paycheck to paycheck emergency fund, it might be easier than you think. Sure, it can feel intimidating at first, but trust me, we have all been there in some form or another.

Let’s talk about why an emergency fund really matters. When you have cash set aside for unexpected surprises—like a sudden medical bill or a necessary car repair—you gain a sense of peace. Instead of feeling like your whole world is thrown off track when life throws a curveball, you will have a bit of cushion that can keep you steady. In that sense, an emergency fund is not just about the money, it is about the freedom and confidence that come with knowing you can handle life’s surprises.

And the best part? You do not need to be rolling in cash to get started. Even if you are living paycheck to paycheck, you can still piece together a small fund. It may be slow-going, but every dollar you save is a step closer to financial resilience. We are going to explore practical steps, from tiny tweaks in your budget to creative earning strategies. Let’s jump in together and start building this lifeline.

Understand Your Current Financial Picture

Before you dive into saving, it helps to know exactly where your money is going. Think of it like taking inventory. Sure, it can be a bit scary to look at every bill, subscription, or late fee, but trust me, it is worth it. When you see the full picture, you will spot patterns you did not notice before.

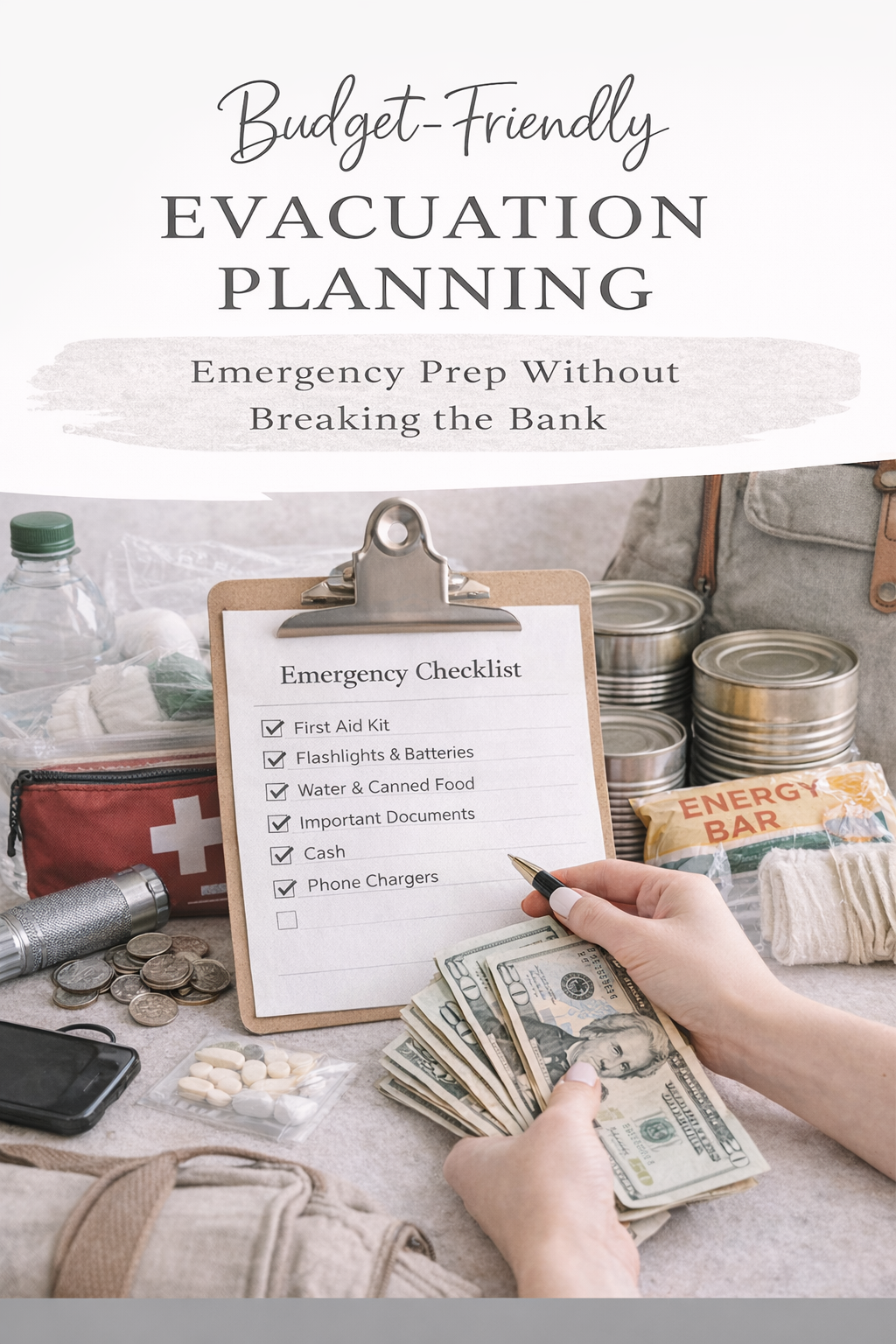

- List every single monthly expense. This includes major things—like rent, utilities, and groceries—as well as smaller costs such as streaming services or morning coffee runs.

- Tally up all your monthly income sources. Whether you have a single job or multiple side gigs, note everything you earn.

- Subtract your monthly costs from your total income. This helps you see what is left over (if anything) before you resort to credit cards or other forms of debt.

That leftover amount is your baseline for savings. If the end result is zero or negative, that is your signal to make adjustments. You might explore ways to trim spending or earn a bit more. Even a few extra bucks each month can turn into the seed for your emergency fund. We will talk about specific tactics soon, so do not stress if you are not seeing a surplus right now.

Set a Realistic Savings Goal

Once you have identified where things stand, it is time to set a target—something that feels doable, but worthwhile. It is common to hear you should save three to six months of expenses, but that might seem out of reach if you live paycheck to paycheck. So here is a suggestion: focus on a smaller initial goal, like $500 or $1,000. That amount can make a huge difference when an emergency hits.

Remember, this is not a fitness boot camp or rigid diet. Think of it more like a friendly “let’s get started together” approach. If $1,000 sounds unrealistic right now, pick a smaller figure and celebrate when you get there. Then, you can aim for a bigger sum. It is all about building momentum.

Some people find it helpful to set a deadline for that first mini-goal, like three months from now. If that feels motivating, go for it. But if deadlines trigger your stress response, then just commit to saving a minimum amount each month—like $25, $50, or more if you can afford it. The key is consistency so that saving becomes an everyday habit, not a once-in-a-while event.

Trim Your Expenses Without Feeling Deprived

When money is tight, the idea of cutting back can feel like punishment. But let’s reframe that—rather than calling it “cutting back,” think of it as “reallocating funds” toward your future. Because truly, skipping a few takeout meals is a lot easier when you know every dollar you keep will go into your emergency fund.

- Review your subscriptions: Do you actually use all those streaming services? Are you really benefiting from that gym membership?

- Shop around for better rates: Compare insurance premiums, cellphone plans, and internet providers. A few phone calls can save you quite a bit each month.

- Meal plan and cook in bulk: Cooking at home not only saves money, it can also be healthier. Try making a big batch of something you love. Then store single-serving portions in the freezer.

- Embrace secondhand shopping: Whether you need clothes, furniture, or tech gadgets, check resale websites or local thrift stores before buying new.

The idea is to free up some funds that you can reroute directly to your emergency savings. Just be sure you do not eliminate every comfort. Life is about balance, and if you are too strict, you might rebel against your plan. Keep a small “just for fun” allowance, even if it is $10 a week, so you do not feel deprived. After all, building this paycheck to paycheck emergency fund should enhance your life, not make it miserable.

Start Small and Celebrate Milestones

If you are living paycheck to paycheck, you might be wondering how you can possibly sock away money—let alone celebrate. But trust me, even $5 or $10 saved here and there makes a difference over time. You do not have to wait until you have a large chunk of change to give yourself a pat on the back.

Here’s a simple approach:

- Set a weekly or biweekly savings target, however modest.

- When you hit that target, celebrate in a low-cost way. Maybe you treat yourself to a favorite homemade dessert, or you take a leisurely walk in the park to mark the occasion.

- Track your savings progress visually. A progress bar or a jar with physical cash can remind you how far you have come.

These small celebrations keep you motivated, showing that progress is happening, no matter how slow. Over time, each little deposit grows, and that jar (or account balance) becomes more impressive by the week.

Earn Extra Income on the Side

We all have limited hours in a day, and the idea of adding yet another job can sound exhausting. But you do not necessarily have to take on a full-blown side hustle. Think about small, flexible gigs or creative ways to boost income without sacrificing all your free time.

- Sell unused items: Have clothes you never wear? Electronics gathering dust? You can list them online and turn clutter into cash.

- Take on micro-jobs: Apps that let you deliver groceries, walk dogs, or do short tasks may be worth a look. You set your schedule, and every bit you earn can funnel into savings.

- Leverage your skills: Are you good at graphic design, writing, or tutoring? Offering freelance services can earn you extra funds. If you rely heavily on freelance work, consider looking into how a freelancer emergency fund might help.

- Rent out a room or space: If you have an extra area in your home, renting it short-term could bring in a decent chunk of revenue.

The goal here is to create enough income padding so you can stash something away without tightening your budget beyond comfort. Even an extra $50 to $100 a month can give your emergency fund a healthy boost over the course of a year.

Automate Your Savings for Peace of Mind

One of the easiest ways to stick to a savings plan is to make it automatic. If your payroll system allows it, arrange for a small portion of each paycheck to deposit directly into your emergency fund account. That way, you will not even see that chunk of money in your regular checking account, and you are less likely to spend it.

Alternatively, there are plenty of budgeting apps or online banking tools that let you set up automatic transfers. Once a week or once a month, a set amount goes straight into savings. The beauty of automation is that it removes the temptation to put off saving “until later.” It just happens in the background while you live your life.

If you are living with a partner, you might decide to coordinate your efforts. A couple emergency fund can reduce stress for both of you. Contributions from both incomes—no matter how small—can add up quickly. And automating those transfers can help keep you accountable to each other.

Break Down Different Life Situations

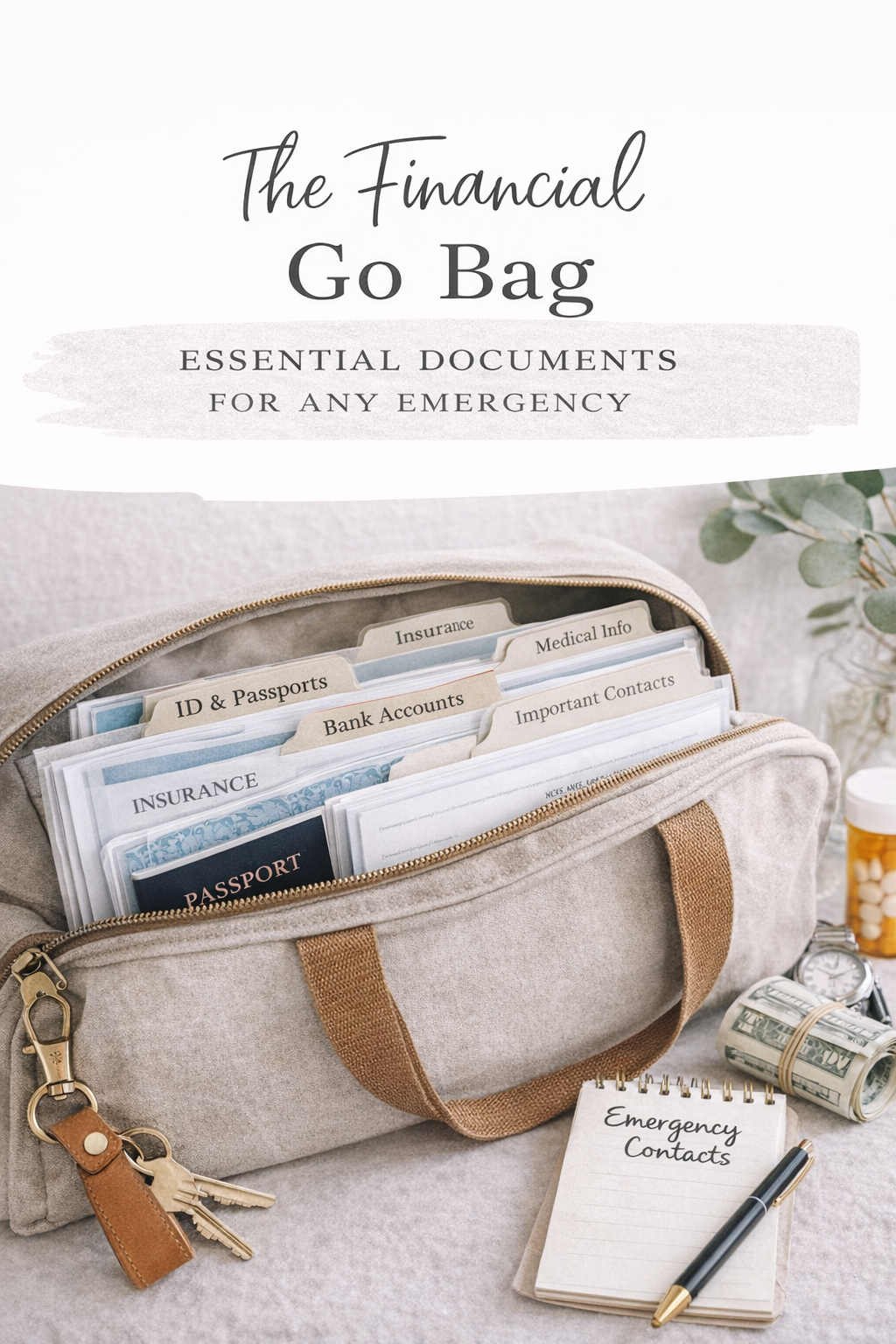

Every household has unique needs and challenges. That is why your emergency fund might look quite different from your neighbor’s. If you are a single parent, for example, you might be concerned about staying afloat after a sudden expense hits. In that case, you could explore how a single mom emergency fund can offer a safety net. Or if you have kids, you might plan for emergencies related to their schooling or extracurricular expenses, which is where a kids emergency fund education strategy becomes useful.

If you have multiple streams of income—like a main job, a side business, and perhaps rental income—a multiple income emergency fund approach can help you track each source and build a savings plan that accounts for varied cash flow. The point is, do not assume one single strategy fits all. Tailor your emergency fund to your specific situation so it truly serves your needs.

Tackle Unexpected Setbacks Strategically

Let’s be real. Even when you have the best intentions, financial emergencies can happen faster than you can say “car trouble.” A hospital bill here, a leaky roof there—life has a funny way of throwing us off balance. That is why it is so important to have some form of safety net, even if it is just a couple hundred dollars at first.

When an emergency does come knocking, here are a few tips to handle it without derailing your entire plan:

- Stay calm and assess the situation: Is this truly urgent, or can it wait until the next paycheck? Sometimes what feels like an emergency can wait a little while.

- Use what you have: If you have even a small emergency fund, apply it to the most pressing parts of the bill or repair. Temporarily scaling back on non-essentials can help you avoid taking on additional debt.

- Negotiate or seek alternatives: Call your provider and ask if you can set up a payment plan or get a discount by paying promptly. Many companies are open to negotiation, so it never hurts to ask.

If your emergency fund is wiped out in the process, do not feel discouraged. That is precisely what the fund is for. Think of it as a victory that you had saved enough to handle the situation in the first place. Afterward, you can rebuild your cushion one small step at a time.

Keep the Motivation Going

Let’s face it, saving money can sometimes feel like an uphill battle. It is easy to question whether your efforts will really pay off. That is where motivation hacks come in handy. Think of them like booster shots for your enthusiasm:

- Visual Reminders: Post a savings thermometer on your fridge. Every time you contribute money, color in that thermometer just a bit more.

- Accountability Buddies: If you have a friend who is also trying to save, check in with each other regularly. Share wins, laugh about slip-ups, and offer fresh ideas.

- Positive Self-Talk: Keep reminding yourself why you are doing this. Maybe it is for added security, peace of mind, or a long-term dream.

- Try a Savings Challenge: Commit to setting aside a specific amount each day for one month—as little as $1 a day can still make a difference. These challenges can feel fun and energizing.

Of course, each of us has moments of weakness. If you overspend or skip a week of saving, do not let that derail the whole plan. Mistakes happen, and every new day is a chance to refocus. The key is progress, not perfection.

Plan for Long-Term Stability

Building an emergency fund is one thing, but nurturing it over the long haul is another. Eventually, you may want to expand your fund to a few months’ worth of living expenses. Sure, that can feel far off if you are just now starting with $100. But as you gradually improve your financial habits and securely grow your fund, you will realize that bigger goals may not be as out of reach as you once thought.

Here are some longer-term strategies you might explore once you have a decent foundation:

- Pay Off High-Interest Debt First: Interest charges on credit cards or personal loans can eat into your savings potential. Try to tackle them methodically.

- Consider a Separate Savings Account: Keep your emergency fund in a high-yield savings account if you can, so your money grows (even if just a bit) and remains separate from daily spending.

- Review and Adjust Occasionally: Life changes, so your emergency fund plan should too. Getting married, having kids, or switching jobs all influence how much you might need.

- Plan for Other Goals: While your emergency fund is crucial, you may also start saving for big purchases or future events. Just ensure your emergency fund remains its own line item—treat it as non-negotiable.

As you move forward, remember that this process is like training for a marathon. You do not sprint the entire 26 miles; you build endurance bit by bit. And along the way, you discover more about your finances, your relationship with money, and your personal resilience.

Remind Yourself You Are Not Alone

We are all in this together. Seriously, the number of people living paycheck to paycheck is higher than you might think. And yet, many of us do not talk about it openly. There can be shame or fear around admitting that one unexpected expense could topple our finances.

But once you realize that you are not the only one in that boat, it is easier to let go of self-judgment and focus on positive change. Talking to someone you trust—like a friend, a family member, or even an online community—can help you feel supported. You might even pick up new ideas for saving that you have never considered before.

Keep Going, One Step at a Time

By now, you see that building a paycheck to paycheck emergency fund is not just about collecting dollars, it is about forming a new mindset. A mindset where you watch for small cracks in your budget, nudge your income a bit higher when possible, and learn to handle setbacks calmly. It is also about celebrating progress—even when that progress might seem modest to an outsider.

When you slip up—and it is totally normal—treat that slip as a learning moment rather than a reason to quit. Reflect on what triggered the lapse. Maybe it was a stressful week, or you forgot to cancel a subscription. Then, rebound quickly. You can always adjust and keep moving. Each challenge you face and each small victory you achieve make you better prepared for the future.

So, let’s make this simple. Here is the essential game plan:

- Know your monthly inflows and outflows.

- Pick a realistic first savings goal.

- Cut expenses, but not every joy in life.

- Add side income if you can—big or small.

- Automate whatever you can.

- Plan for speed bumps.

- Celebrate each step forward.

- Keep aiming higher as you grow in confidence.

You are not alone. Whether you are a single parent, a couple, a freelancer, or someone juggling multiple jobs, the path to financial security can be navigated together. By breaking the process into manageable steps and leaning on resources like single mom emergency fund, a multiple income emergency fund, or a kids emergency fund education plan, you will see that your emergency fund is far more attainable than you might have believed.

There is true comfort in knowing you have a buffer in case life throws the unexpected your way. Let this vision of a steady, reliable emergency fund remind you that you deserve financial peace—and you already have what it takes to get there, one paycheck at a time. You have got this, and I am right there with you, cheering you on.