The Money Mistake Costing You Financial Security: Emergency Funds Explained

Ever find yourself asking, “What’s really the difference between an emergency fund vs savings?” Trust me, you’re not alone. We all know it’s smart to stash something away for unexpected bills or important goals, but it can get confusing sorting out which pot of money goes where. Is the money you set aside for an upcoming vacation the same as the money you keep for, say, a sudden hospital bill? Not exactly.

The good news is, once you understand how both of these financial tools work, you’ll feel much more confident about managing life’s twists and turns without constantly worrying over every little expense. Let’s talk through how you can keep financial stress in check by setting up an emergency fund, saving for future plans, and knowing how to strike the ideal balance between those two goals.

Think of us like old friends chatting over coffee, aiming to simplify all the money stuff that used to feel intimidating. By the end of this article, you’ll not only see the difference between an emergency fund and a regular savings account, but you’ll also pick up practical, relatable tips to keep your finances on track—no complicated jargon or “strict lecture” vibe here.

Understand the Basic Differences

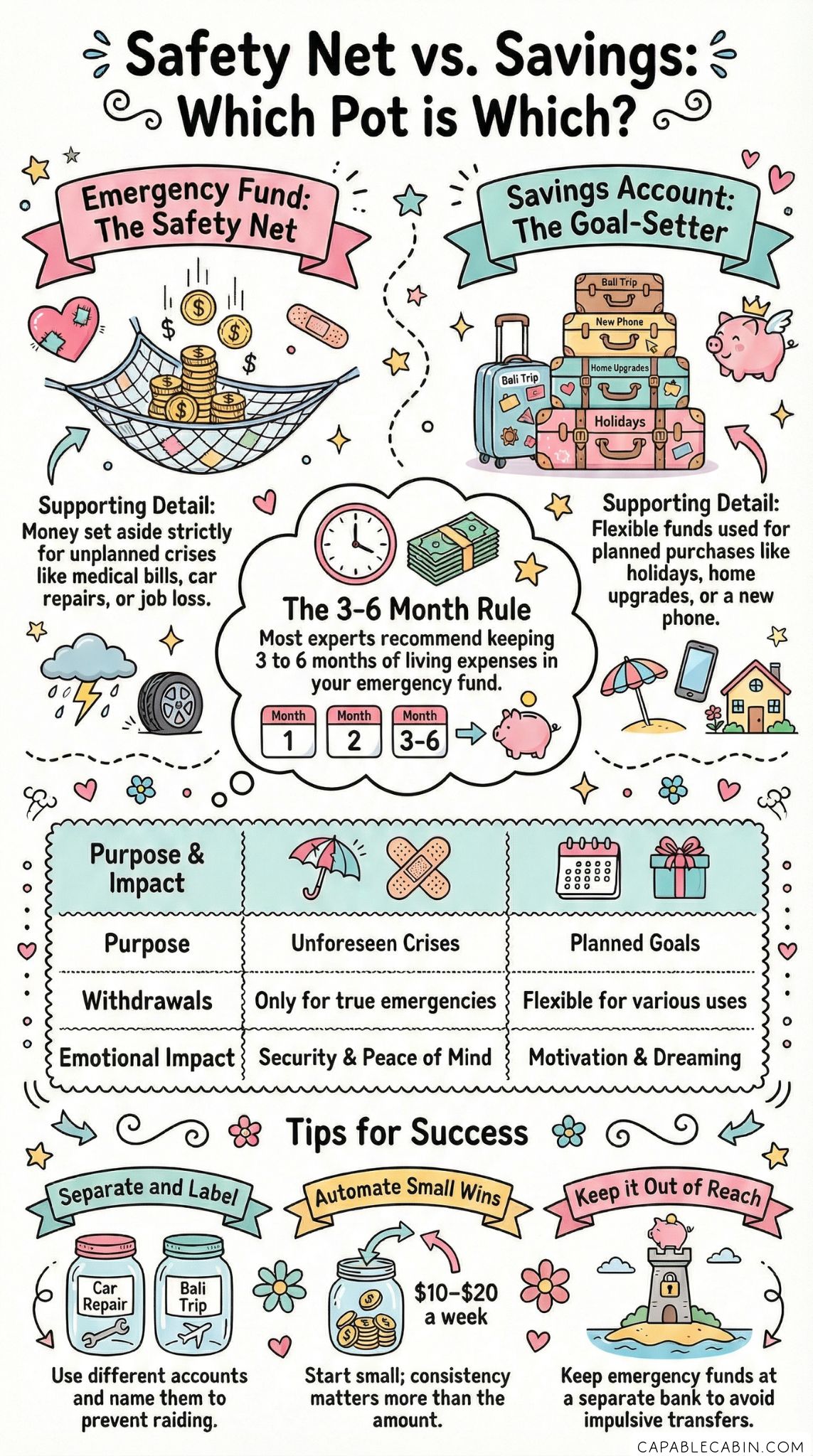

Before we get into the nitty-gritty, let’s make sure we’re both on the same page about what we mean by “emergency fund” and “savings.” Although both involve putting money aside, they serve different purposes in your life, and that matters more than you might think.

Defining an Emergency Fund

An emergency fund is money you set aside specifically for those big, unexpected costs that pop up out of nowhere. Think about medical bills you didn’t see coming, a car repair that can’t wait, or an urgent home fix like a leaky roof. The idea is that you shouldn’t have to scramble, stress, or dip into high-interest debt whenever life hands you a curveball.

- It’s strictly for emergencies

- It’s not meant to be tapped for everyday expenses

- It helps you maintain peace of mind during financial storms

In other words, this fund is like your personal safety net. You hope you don’t need it, but you’ll be relieved to have it if something goes wrong.

Defining a Savings Account

Your savings account is more general. You can dip into it for all kinds of goals—both short-term wants (like a new phone) and long-term milestones (like a down payment on a home). Typically, savings accounts are easy to open, and many people start by setting aside a small chunk of each paycheck.

- Ideal for planned purchases or short-term financial targets

- Usually has fewer withdrawal restrictions than your emergency fund

- Can be used for anything from holiday shopping to a dream vacation

That said, sometimes people assume the money in a standard savings account can double as an emergency fund. And while it’s better than no cushion at all, mixing your emergency stash with your regular savings can get complicated. Whenever you dip into that all-purpose savings for non-emergencies, you risk whittling down the buffer you’d need in a genuine crisis.

So, the starting point is clear: your emergency fund is your first line of defense for true surprises; your savings account is more flexible and can accommodate everyday wants and needs. Let’s hop into why these distinctions matter so much.

Focus on Unexpected Costs

When we talk about an “emergency,” we’re talking about legitimate financial surprises. These expenses usually can’t be ignored or delayed without consequences. If your car breaks down, for example, it’s tough to live life as usual if you can’t get around. Similarly, if your refrigerator gives up the ghost and everything inside is spoiling, you really can’t hold off on getting a new one for too long.

Why “Emergency” Is Key

This is why so many money experts recommend carving out a separate fund devoted strictly to scenarios like these. Think of it as creating boundaries for yourself. If your only savings is a general pot of money, it’s tempting to raid it for spontaneous shopping sprees, fancy dinners, or that shiny gadget you’ve been eyeing. There’s no alarm bell telling you, “Hold up, which part of your purpose does this spending fulfill?”

When you have a dedicated emergency fund, you remove the guesswork. If it’s not a bona fide emergency, you avoid touching that account. This mental separation might seem small, but it can make a huge difference when you’re trying to keep your finances steady and stress levels low.

Examples of True Emergencies

- Medical bills: Whether it’s an unexpected procedure or an urgent trip to the ER

- Home repairs: Broken water heaters, leaks, or serious mold issues

- Job loss or income gap: A cushion to help you pay rent and buy groceries

- Major car trouble: A new transmission isn’t cheap, and you need your vehicle running

The goal is to ensure you’re not left panicking or using high-interest credit cards when these situations arise. It’s a lot easier to breathe when you know you have a little buffer to tap into.

How Much to Keep in an Emergency Fund

Experts generally suggest three to six months’ worth of living expenses. But let’s keep it real: that might feel overwhelming at first. If you’re just getting started, tackling even one month’s worth of basic costs can be a big win. The key is consistency. Add small amounts whenever you can, and celebrate each milestone. If you’d like to see how much might work for your circumstances, feel free to check out helpful resources like emergency fund amount, which can guide you on setting an amount that fits your lifestyle.

We’re all busy, and life throws curveballs. Even small progress is still progress. Remember, your emergency fund is about crafting financial security and reducing those “Oh no, now what?” moments.

Use Savings for Goals

Now let’s chat about your savings account. You could technically keep your emergency fund in a standard savings account, but it’s smart to separate the two so you don’t mix up your motivations. A “goals-based” savings approach can lighten the guilt or confusion that arises when you want to tap into your savings for something fun or meaningful. After all, that’s what it’s there for.

Short-Term Goals

Think about the near future—maybe it’s a family vacation, a new laptop, or that phone you’ve been eyeing for months. Putting a little money aside consistently for these purposes means you can make those purchases without feeling like you’re yanking money out of an emergency reserve. Plus, having a separate savings account can help you track your progress more precisely.

- Family trip next summer? Contribute a set amount from every paycheck.

- Home decor upgrade? Tuck away a fixed percentage specifically for that.

- Holiday gifts? Plan ahead and avoid the dreaded credit card scramble in December.

Long-Term Goals

Your savings account can also help you fund bigger dreams, like a down payment on a house or your child’s future education expenses. While these goals may be more substantial, it’s still the same principle: set aside consistent contributions in a designated account. Watching that balance grow is a motivational push in the right direction.

Benefit of Keeping It Separate

It’s like sorting your gear before a big trip. You wouldn’t pack your hiking boots in the same pocket as your swimwear. By having multiple savings accounts (often at the same bank), each one can serve a distinct purpose. If you label them accordingly (e.g., “vacation fund,” “car upgrade”), you’ll be less tempted to touch the emergency pot when a tempting purchase pops into your mind.

The beauty of saving money for goals is that it makes those goals feel more attainable. Instead of “Maybe one day I’ll do that,” you’re saying, “I’m setting aside cash every month, and eventually, I’ll reach my target.” That sense of control helps keep your financial life calm and purposeful, rather than anxious or chaotic.

Compare in a Quick Table

Sometimes, seeing the differences in one place can make everything click. Here’s a straightforward comparison that sums up why you really need separate buckets for an emergency fund vs savings:

| Category | Emergency Fund | Savings Account |

|---|---|---|

| Purpose | Unforeseen expenses (car repairs, job loss, medical) | Planned goals (vacation, down payment, holiday gifts) |

| Access | Quick, but not for daily habits | Flexible for various uses |

| Ideal Amount | 3-6 months of living expenses (start smaller if needed) | Depends on specific goals (both short-term and long-term) |

| Emotional Impact | Provides security, peace of mind | Encourages goal-setting and future planning |

| Restrictions | Generally stricter self-imposed limits on withdrawal | Fewer restrictions, more freedom to spend as needed |

As you can see, each plays its own role. When someone treats their single savings account as a catch-all for emergencies and personal goals, it can lead to confusion or accidental overspending. Splitting them is a simple yet powerful step that keeps your finances organized and your mental well-being stronger.

Identify Common Pitfalls

Even when you know the differences, life happens. Emergencies strike—or sometimes we just get carried away with spending. It’s easy to feel demoralized if you see your carefully saved money slip through your fingers. Trust me, I’ve been there, and it’s not exactly fun. Let’s walk through a few mistakes that people commonly run into and figure out some solutions together.

Mixing Everything in One Pot

A huge pitfall is dumping all your extra cash in a single savings account without any distinction for emergencies. When that big sale at your favorite store hits, it’s tempting to think, “I have enough in savings,” and suddenly you notice half the account is gone. By the time a real emergency comes around, your balance might be too low.

- Solution: Keep them separate with different account labels.

Underestimating Emergencies

Sometimes we think, “Oh, I’ll just put a thousand dollars aside, that’ll cover most disasters.” But medical bills or major home repairs can easily surpass that. Having only a small cushion might lull you into a false sense of security, and you could end up in debt should a bigger crisis arise.

- Solution: Gradually aim for at least three months of basic expenses if you can. Start emergency fund with small steps and build from there.

Raiding the Emergency Fund for Non-Urgent Spends

We’ve all felt that temptation. Maybe a friend invites you on a spontaneous trip, or you see a limited-time concert opportunity. If you dip into your emergency fund just for fun or convenience, you risk not having it when your car’s transmission fails.

- Solution: Label each account, set ground rules, and try to stick to them. It might help to keep your emergency account slightly out of immediate reach—preferably at a bank separate from your primary checking so that it’s not too easy to transfer money at the slightest whim.

Failing to Replenish After an Emergency

Sometimes, you do everything right, only to face a genuine emergency and have to dip into the fund. That’s exactly what it’s there for, so no worries. But some folks forget to rebuild it afterward, which sets them up for trouble if a second crisis arises soon after.

- Solution: Treat your emergency fund contributions like a bill. If you’ve used part of the fund, prioritize restoring it over non-essentials. If you need guidance, you can explore ways to rebuild emergency fund step by step.

Remember that small solutions compound over time. The important thing is you recognize these pitfalls and set up guardrails against them. There’s no need to be perfect all the time—just conscious and proactive.

Build Your Emergency Fund

Alright, now we know emergency funds are for urgent situations. But how do you get started, especially if you’re juggling rent, groceries, and maybe even daycare costs along with everything else? It can feel lofty to say, “Set aside six months’ worth of expenses,” especially if you’re relatively new to money management or living paycheck to paycheck.

Start Small, Celebrate Wins

You don’t have to pour hundreds of dollars straight into an emergency account from the get-go. Even $5, $10, or $20 a week starts to add up. If you can automate it, that’s even better—like having a portion of each paycheck deposited directly into your emergency account.

- Start with a modest goal, such as $500 or $1,000

- Once you hit it, aim for one month’s worth of expenses

- Increase it from there to three months, and so on

If you’re looking for a structured approach, a challenge might be your style. Check out something like the emergency fund challenge or the year-long emergency fund challenge, both of which break down saving into manageable steps.

Keep Your Fund Accessible, But Not Too Accessible

Emergencies don’t schedule themselves; they often drop in unannounced. So you need to be able to access that money quickly, usually within a day or two at most. Many folks keep their emergency fund in a high-yield savings or money market account for easy access.

However, you might not want it in the exact same bank as your checking account. Why? Because that makes it super easy to click “transfer” whenever temptation calls. Instead, consider an online bank you trust so you still have relatively quick access but can’t impulsively dip into it for a midnight pizza craving or last-minute sale.

If you’re curious, take a look at where to keep emergency fund, which can help you decide what type of account or location is right for your situation.

Commit to Regular Check-Ins

Life evolves. You might switch jobs, grow your family, reduce your monthly bills, or encounter major changes in your routine. That means your emergency fund goals should adjust too. Make a habit of reviewing your accounts at least twice a year:

- Are your living expenses higher or lower?

- Do you have new financial responsibilities like a mortgage or childcare?

- Has your risk level changed?

By recalculating how much you might need in an actual crisis, you’ll keep your savings relevant rather than letting it become outdated. This helps you avoid that sinking feeling when you realize your safety net isn’t as effective as you hoped.

Grow and Protect Savings

Now on to your “regular” savings, where you put money aside for personal goals, both big and small. Whether you want to remodel your kitchen or treat yourself to a well-deserved solo weekend getaway, savings accounts are your friend. Yet, it’s easy for those plans to stall or for everyday life to chip away at your balance.

Prioritize Your Goals

Creating a list of your top goals helps you focus. Maybe you want to upgrade your car next year or start setting aside tuition for your child’s future. List these goals in order of personal importance. Some might be urgent—like that car upgrade if your current vehicle is on its last legs. Others might be more long-term or purely for fun. The point is to ensure your savings aligns with your real-world priorities.

- Make a short list of your top targets

- Assign a rough timeline and dollar figure to each

- Set an automatic transfer for each goal

Explore Different Methods

Just as you have different ways to build an emergency fund, you can also choose different strategies for everyday savings:

- Automatic Transfers: Schedule your bank to move a set amount from checking to savings each payday.

- Savings Challenges: These can be fun, like the 5 savings challenge approach that encourages small but consistent contributions.

- Envelope System: Good old-fashioned cash envelopes can keep you on track if you prefer something more tangible. You can try the emergency fund envelope system approach if you love the structure of physical cash management.

Keep It Safe From Fees

Saving money loses some sparkle if fees chew away at your balance. Many banks offer fee-free savings accounts, especially online institutions. If you notice monthly maintenance costs or limited withdrawals that trigger penalties, consider moving your money to a more favorable environment.

An ongoing theme here is to make it harder for you to accidentally sabotage yourself. If you keep layering simple, mindful habits, you’ll find it much easier to meet your savings goals.

Balance Both for Peace of Mind

It might sound like a lot to juggle: an emergency fund for the unexpected, plus a separate savings plan for your personal goals. But many of us do it every day, and you can too. The good news is these two money tools don’t compete. They actually complement each other.

When you have a dedicated emergency buffer, you can tap into your everyday savings account guilt-free for fun stuff or planned expenses. Meanwhile, you still feel secure knowing a big car repair bill or urgent family need won’t wipe out your finances entirely.

Alternate Contributions

One approach that people find useful is alternating contributions: one month, you focus on your emergency fund. The next month, you direct your extra cash toward personal savings goals. Over time, both grow, and you don’t feel like you’re neglecting either.

If you’re feeling especially motivated or come into extra money (like a tax refund or a holiday bonus), you can split it. Send some portion—say 50%—directly to your emergency account and divide the remaining bit among your savings goals. This way, it’s less tempting to blow that entire windfall on something impulsive, while still indulging a bit.

Check in With Your Partner or Family

Financial discussions can be uncomfortable, but if you share expenses with a spouse or family members, talk about the difference between your emergency stash and general savings. You’ll avoid misunderstandings like, “I thought we could tap that fund for an anniversary trip,” when in reality it’s reserved for emergencies only.

Consider a Financial Preparedness Plan

Want to tie everything into a neat package? A financial preparedness plan is like a roadmap for tackling life’s uncertainty. You outline your emergency fund, your monthly budget, your savings goals, and how you’ll handle it if unexpected events occur. Some folks find it helpful to keep a financial preparedness checklist or create a financial emergency preparedness kit.

It may sound official, but it can be as simple as writing your plan down in a notebook or storing it digitally. Having something to refer back to keeps you from winging it when stress levels are high.

Wrap Up With Confidence

At the end of the day, “emergency fund vs savings” doesn’t have to be some confusing conundrum. The key difference lies in purpose. Your emergency fund stands guard for life’s genuine curveballs. It keeps you and your loved ones from financial chaos when urgent needs arise. Meanwhile, your savings account is the fun, flexible sidekick that helps you reach milestones—be it a new gadget, a memorable family trip, or a down payment on a home.

Will life still throw you surprises? Of course. There may be moments when you feel behind on your goals or face an emergency before you’re fully prepared. That’s okay. Each step you take today makes tomorrow a bit less stressful. Add even a small sum to your emergency fund and watch it grow, or label your savings account for your next big dream to keep your motivation alive.

Remember, this isn’t a one-and-done scenario. You’re going to tweak, adjust, and revisit your approach periodically. If money gets tight, you can temporarily decrease your contributions, then ramp them back up when things improve. It’s all about staying flexible while keeping an eye on your overarching financial health.

Throughout this journey, give yourself credit for each reported success, no matter how small. Every single dollar you set aside is a vote for your future stability and dreams. Whenever you feel uncertain, just remind yourself that you’re not alone on this journey. We’ve all wrestled with balancing finances. One mindful step at a time goes a long way. Keep your focus on both security and growth, and you’ll develop a habit of looking ahead with optimism. Trust me, you’re doing better than you realize, and you deserve a pat on the back for taking charge of your money story.

If you need more motivation or aren’t sure where to begin, explore resources like start emergency fund for actionable tips, or check out handy articles like emergency fund mistakes to see what to avoid when building your stash. Keep refining your plan, set realistic goals, and give yourself grace whenever you stumble. With time, you’ll navigate any unexpected bumps in your financial road like a pro, all while inching closer to the things that truly matter to you. You’ve got this.