Financial Preparedness 101: Documents to Grab in a Crisis

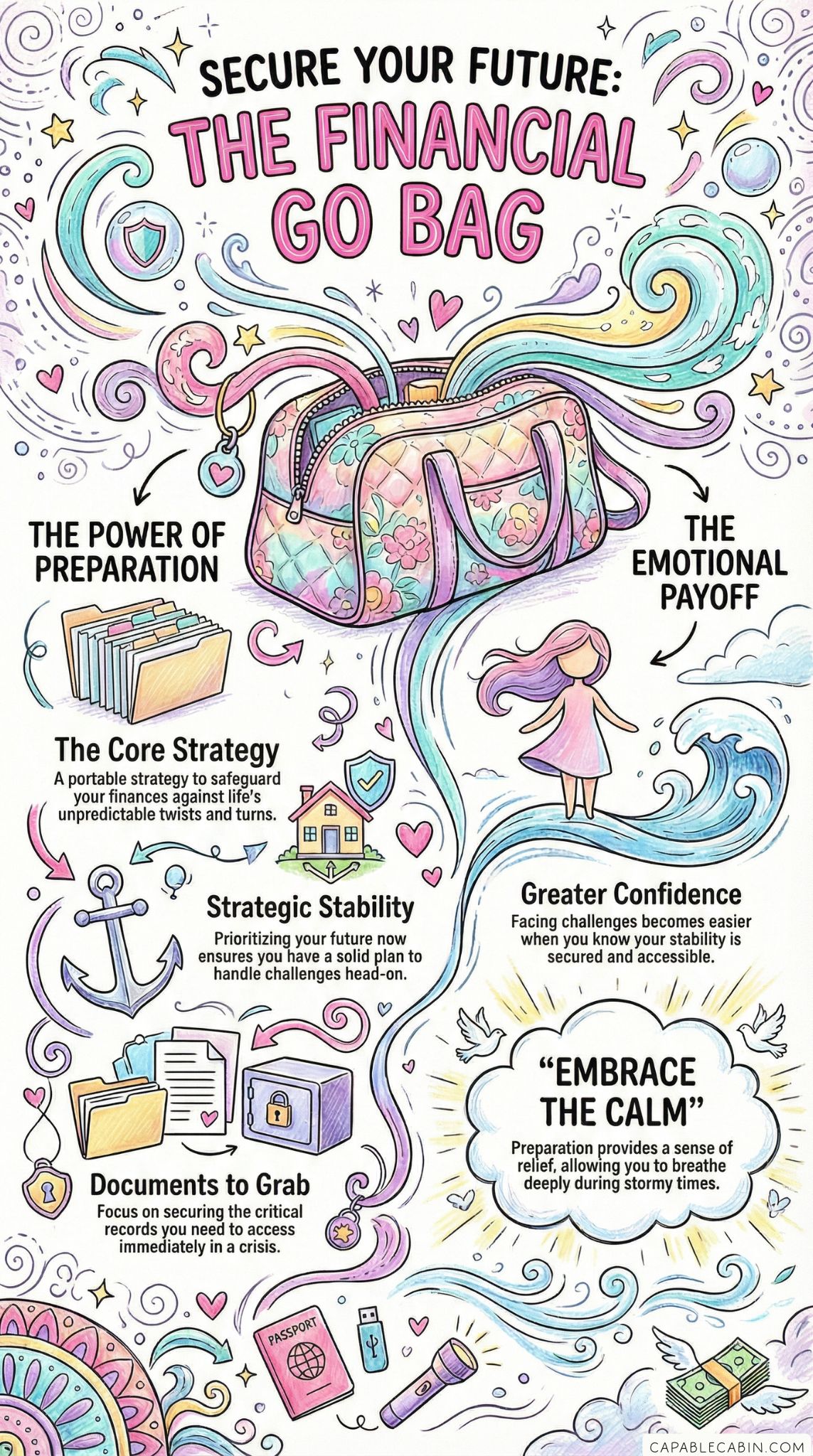

Ever find yourself questioning how prepared you would be if a sudden storm, medical emergency, or natural disaster turned your life upside down? You’re not alone. The truth is, building a proper safety net often goes beyond just stashing some extra bills in a drawer. While a solid emergency fund is essential, having a dedicated financial go bag can mean the difference between scrambling for scattered documents and confidently handling unexpected events. You deserve peace of mind, and that’s exactly what this guide is all about. Consider this your friendly companion to help you gather the right paperwork, organize it clearly, and feel secure knowing you can retrieve the entire packet at a moment’s notice. Let’s take a close look at why a financial go bag matters and how you can create one that rises to any challenge.

Meet Your Financial Go Bag

You’ve probably heard the term “go bag” in discussions about emergency preparedness: a backpack or small suitcase filled with essentials like water, spare clothing, flashlights, and non-perishable snacks. A financial go bag takes that concept one step further by focusing on the critical documents, data, and resources you would need to handle money matters during a crisis. That might include proof of identification, insurance policies, and important account details.

This single, centralized kit can be a lifesaver when you’re in a hurry. Whether it’s a mandatory evacuation, a sudden hospital stay, or a family emergency that requires immediate travel, you won’t have time to dig around your home for random sheets of paper or login credentials. If you’ve ever experienced the panic of searching for a birth certificate after you swore you tucked it away safely, you know exactly why this matters. So let’s paint a clearer picture:

- You’re about to relocate in a rush: maybe a wildfire or hurricane is on its way.

- You or a loved one has a medical crisis that prompts an unexpected trip.

- You face a burglary or a broken pipe at home, and you need quick access to your financial lifelines while you’re staying elsewhere.

Having a financial go-bag means you’re not frantically flipping through file cabinets or rummaging through drawers. You can simply grab one well-organized pouch or case, exhale a sigh of relief, and move forward confidently knowing you have everything in hand.

Still wondering if this is worth the effort? Picture how relieved you’ll feel when your family’s birth certificates, loan papers, insurance cards, and any crucial medical information are in one compact place. Not only does it save you the headache of reordering documents, but it also helps you manage stress during times that are already emotionally charged. By building this kit, you’re basically telling life’s emergencies, “I see you, and I’m ready.”

Include Critical Documents

Putting together your financial go bag begins with gathering the right paperwork. Think of it like building layers of protection for yourself and your loved ones. The goal here is to cover the essential identifying info that any institution or agency might ask for, as well as the documents that prove ownership, insurance coverage, and legal rights. Let’s break it down into key categories:

Personal Identification

- Copies of driver’s licenses, passports, or state IDs

- Social Security cards or copies

- Birth certificates and, if applicable, marriage certificates

- Immigration or naturalization documents if relevant

You want at least one official ID copy for each member of your family. While digital copies can be helpful, having a paper version on hand is priceless when systems are down or internet access is limited.

Insurance Policies

- Homeowners’ and renters’ insurance

- Health insurance cards

- Auto insurance

- Life insurance policies

- Disability, pet insurance, or any other specialized insurance

These policies spell out the details of your coverage, which is exactly what you need on short notice to file claims if something unexpected happens. Make sure that the policy numbers and contact information of the insurance providers are visible and easy to locate.

Financial and Banking Documents

- Recent bank statements

- Credit card statements (at least one or two recent ones)

- Checking and savings account details

- A list of all online banking login credentials (though you might store actual passwords in a safer format, which we’ll talk about soon)

You might also keep a small stash of emergency cash at home in your kit. If you do, consider storing something like 100 to 300 dollars (whatever you can manage). That little cushion may tide you over if you can’t immediately reach your bank or an ATM.

Property and Loan Papers

- Mortgage or lease agreements

- Car titles or loan paperwork

- Student loan documents

- Any other relevant financing documents

You want to be able to show who owns which assets, as well as any ongoing payment schedules. That way, if your living situation shifts, you can more easily arrange for forbearance or quick relocation.

Healthcare and Medical Info

- Medical insurance cards (or copies)

- List of medications and dosages

- Doctor’s contact information

- Proof of any ongoing treatments or allergies

If you have power-of-attorney documents or specific healthcare directives, keep copies in your financial go bag. These papers can protect you or a family member if urgent medical decisions come up.

Contact Information

- Names, phone numbers, and emails of trusted relatives and friends

- Professionals like lawyers, accountants, or insurance agents

- Work contacts (HR department, manager)

In times of crisis, you may need to let your workplace or important professionals know what’s going on. Having these contacts handy saves you from scrolling through a phone that might have lost power or service.

Below is a basic table to summarize some of the main must-haves in your bag:

| Category | Examples |

|---|---|

| Identification | Passports, driver’s licenses, birth certificates |

| Insurance | Health, home, auto, life policies |

| Financial & Banking | Mortgage, lease, car title, and loan agreements |

| Property & Loan | Mortgage, lease, car title, loan agreements |

| Medical Info | Medication lists, healthcare directives, insurance cards |

| Important Contacts | Family, friends, professionals (lawyer, accountant) |

By focusing on these categories, you’re covering the big picture of financial security. The best part? Once you have it all in one place, you’ll never need to scramble for it again—provided you keep it updated (we’ll get to that soon).

Assemble Digital Backups

You might be thinking, “Physical paperwork is awesome, but what if it gets damaged or lost?” That’s where digital backups come in. These days, many institutions assume you’ll have digital versions of documents stored somewhere, and it’s easier than ever to create them. The key is to do it securely.

Scan or Photograph Important Papers

A simple way to create backups is by scanning or photographing each page, front and back. Save these files to a password-protected folder on your computer. Ideally, you’d also upload them to an encrypted cloud storage solution. That extra step means that even if your devices are lost or broken, you still have a way to access critical information from another device.

Use Secure Password Managers

Writing passwords on sticky notes might seem convenient, but it’s hardly secure. A password manager keeps your login details encrypted, which you can then access via a single master password. This approach is especially handy for financial tasks like online banking or, say, uploading or updating your financial preparedness checklist. If you’re comfortable with technology, you might even store secure notes within the password manager detailing key account numbers or instructions.

Consider Encrypted USB Drives

Another idea is to store digital versions of important documents on an encrypted USB drive that you both password-protect and keep in the bag. This ensures you have offline access if the internet is spotty. Steps to follow might be:

- Purchase a reputable USB drive with encryption capability.

- Transfer your files to a password-protected folder.

- Securely label the USB (e.g., “Emergency Docs”) in a way that doesn’t draw unnecessary attention but is clear enough for you to recognize in a hurry.

Lock It Down

Whether you’re uploading files to the cloud or using thumb drives, always secure them. Check if your cloud service offers two-factor authentication. Make your master password something unique and strong. You’re aiming for a sweet spot where it’s easy enough for you to remember but nearly impossible for others to guess. Digital copies can give you huge peace of mind, but only if they’re properly protected.

Store And Protect Everything

Now that you have a mixture of physical documents and digital backups, the next question is: “Where does it all go?” A financial go bag is only as useful as its container. Here are some practical ways to store and protect your kit.

Choose a Durable Container

Aim for a waterproof, fire-resistant pouch or small lockbox. Many home goods stores sell these specifically labeled as “fireproof safes” or “document bags.” Depending on your preference, you might opt for:

- A zippered binder or padded folder with a water-resistant exterior

- A small portable safe with a combination lock

- A modestly sized backpack with sealed compartments

Whatever you choose, ensure it’s easy to carry. If the bag weighs a ton or is too bulky, you might hesitate to grab it in an urgent situation.

Add Basic Organization

Put documents in labeled envelopes or use tab dividers so you can flip right to “Birth Certificates” or “Insurance.” If sifting through the entire packet is too time-consuming, you’ll waste precious moments. You might also store certain documents in a financial emergency binder if that suits your style. The important thing is to keep it neat, consistent, and ready to go.

Consider Security vs. Accessibility

It’s tempting to lock your bag in some hidden corner, but remember, you’ll need quick access when trouble strikes. Find a safe yet grab-friendly location in your home—perhaps a hallway closet or underneath your nightstand. Strive for that ideal balance: parted from immediate view for security but not so hidden that you’ll forget about it or waste time rummaging for it.

Add a Little Cash

By now, you’re likely aware of the importance of having a bit of money on hand. If you haven’t yet set aside an emergency fund amount in a bank account, consider clarifying your budget so you can start one. While that’s a bigger, ongoing project, it’s still wise to keep a small amount of physical cash in your go bag. Emergencies can disrupt systems that process bank cards, making paper money a literal lifeline for buying food, gas, or other necessities.

Stay Ready With Updates

Remember that your documents are living records. They change every time you switch insurance providers, renew your passport, or sign new loan paperwork. If you don’t keep your go bag current, it loses its effectiveness. After all, outdated information can lead to confusion or holdups in emergency settings, and that’s the last thing you want.

Schedule Routine Checkups

Set a calendar reminder (monthly, quarterly, or at the very least biannually) to review your bag’s contents. Dump it out on the kitchen table, flip through each folder, and verify that details like account balances, insurance numbers, or contact information haven’t changed. This is also your chance to restock any items that might have been borrowed from the bag.

Note Major Life Events

Any time a big life shift happens, such as a marriage, divorce, birth of a child, or job change, check your bag. You may need to add or remove documents, update beneficiary info, or sign new policies. Keep an eye on expiration dates for items like driver’s licenses or passports. If your ID is no longer valid, it’s doing you no good in the kit.

Cross-Reference With Other Financial Tools

If you’ve started an emergency fund challenge or you’re following a year-long emergency fund challenge to bulk up your savings, it helps to ensure your quantity of physical cash matches your current readiness plan. Some folks prefer to keep larger sums in a protected bank account and emphasize digital backups. Others keep more cash in the bag. That’s entirely up to you as long as you remain consistent and secure.

Expand Your Preparedness

Once you’ve nailed the essentials of your financial go bag, take a moment to consider the broader context of emergency preparedness. Often, when you assemble your bag, you naturally become more aware of bigger questions like, “Where, exactly, should I store my funds?” or “How do I handle debt if I need to use my emergency resources?” Here are a few ways to grow your sense of readiness and security even further.

Align With a Solid Emergency Fund

A financial go bag is only part of the puzzle. You also want a dedicated savings cushion. If you’re just getting started, check out how to start emergency fund articles and resources. You could also look into the differences between a starter emergency fund and a fully formed one. Generally, experts recommend at least three months of living expenses tucked away, although your personal comfort level might push that number higher. Learn more about bigger savings strategies from an emergency fund guide.

Investigate Where to Keep Funds

Maybe you’ve heard conflicting advice about where to keep emergency fund. Some say a high-yield savings account is ideal, others recommend money market accounts or even short-term CDs for more interest. The right choice depends on your financial goals, your risk tolerance, and how quickly you need access to the money. Keep in mind that you want stable, liquid options—particularly if you’re transferring to a new city on short notice or dealing with real-life complications like medical bills.

Manage Common Pitfalls

We all slip up from time to time. Some folks tap into their emergency stash for non-essential expenses or dip into funds without a plan to refill them. If that rings a bell, you might benefit from reading about emergency fund mistakes. Another pitfall? Confusing your emergency fund with routine savings for vacations or big purchases. If you’re curious about the differences, check out emergency fund vs savings. The more you learn about these subjects, the easier it becomes to keep your go bag and your finances in top shape.

Factor Debt Into Your Strategy

Carrying debt during an emergency is extra stressful, which is why some folks wonder whether to pay off debt or build an emergency fund first. The answer typically depends on the interest rates and financial stability, but you can explore different perspectives in emergency fund vs debt. Sometimes, you’ll do a bit of both at once: pay down debts while also setting aside some money for surprise expenses.

Embrace Peace Of Mind

By now, you’re well on your way to creating a financial go bag that can handle nearly any storm. But before you zip up that pouch and call it a day, let’s talk about how this entire process can truly transform your sense of security and mental well-being.

Lower Stress, Improve Decision-Making

When disaster strikes—whether it’s a flooded basement, a close relative in ICU, or a voluntary evacuation—your ability to think clearly is often tested. Emotions run high, adrenaline spikes, and you might feel overwhelmed. Having a meticulously prepared go bag means eliminating a mountain of small but critical questions: “Where’s my insurance card?” “Did I update my medical directive?” “Am I sure I put the new mortgage statement in the folder?” By removing those unknowns ahead of time, you free up mental energy to handle other pressing tasks.

Empower Loved Ones

Encourage your family to understand what’s in the bag and why it matters. That way, if you’re the one dealing with a crisis and unable to reach the documents yourself, someone else in your household can easily step up. If you have older kids, you can even walk them through the big sections so they get an early education in financial literacy. Over time, these small lessons can foster a mindset of preparedness throughout your family.

Practice Confidence in Emergencies

Confidence grows when you trust your own ability to tackle challenges. Putting together a financial go bag prompts you to learn more about your finances, identify any gaps, and clarify the steps you’d take in a high-stakes scenario. That might mean rethinking how you store your funds, reconsidering your monthly budget, or planning ways to rebuild emergency fund levels after you use them. It’s a positive feedback loop: the more prepared you are, the more confidently you face adversity, which in turn encourages you to stay prepared.

Celebrate and Share

Creating a financial go bag may not feel as thrilling as booking a vacation or hitting a personal milestone, but it’s a big deal. You’re taking control of your future. That’s worth acknowledging. Give yourself a pat on the back (or a small reward—whatever helps you feel appreciated and motivated). Also, consider sharing this concept with your network. Friends and neighbors might be curious about how you set up your kit. Sometimes we all need that nudge. When you share what you’ve done, you’re providing them with a roadmap to readiness.

Make It a Lasting Habit

A financial go bag is never “done” in the sense that you can forget about it. Like any good habit, keeping everything updated and relevant takes consistency. In reality, maintaining your kit is easier than assembling it in the first place, so that should give you some relief. Here’s a quick recap of ways to stay on track:

- Do a mini-review each time you renew a passport, insurance policy, or any major document.

- Keep your financial emergency preparedness kit near your bag if you want a more all-encompassing approach.

- If you’re super active online, make sure your password manager is updated regularly, so you can access papers or accounts swiftly if required.

- Mark a date on your calendar, maybe every six months, to empty your go bag onto a table and ensure nothing is missing or outdated.

- If your living situation changes—like a new address or updated lease—reflect that shift in your documents right away instead of letting it go stale.

Eventually, flipping through your bag and verifying your data will become second nature. And that’s what you want: a low-stress, largely automatic way of staying prepared and protected.

Keep the Momentum Going

At the end of the day, a financial go bag is a testament to your readiness, but it’s also a doorway to broader financial security. Once you see how nurturing a habit of preparedness can lighten the weight of potential emergencies, you may feel inspired to tackle other goals: building a 3-month emergency fund, refining your emergency fund withdrawal rules, or experimenting with a 5 savings challenge to grow your reserves without straining your daily budget.

However you choose to proceed, remind yourself that every step counts. Even if you don’t have a perfect binder or you’re just starting to figure out emergency fund vs savings, your efforts today lay the groundwork for a more secure tomorrow. It’s okay if it takes time and fine-tuning—this isn’t about perfection. It’s about progress.

So give yourself some credit for prioritizing your future stability, especially with so many daily distractions. You’ve taken a giant leap toward safeguarding your finances. No matter what twists and turns life throws at you, you’ve got a strategy in place to handle them head-on. Just remember, you’re not alone in this: we’re all navigating unpredictable waters, and we’re doing our best to stay afloat. Together, let’s embrace the calm that comes from having a solid plan. You deserve that sense of relief knowing that when life gets stormy, you can grab your financial go bag, breathe deeply, and face the challenges with greater confidence. You’ve got this. Keep going, friend.