How to Rebuild Your Emergency Fund After Using It

Ever find yourself in a spot where you needed to dip into your safety net, and now you’re asking, “How do I rebuild my emergency fund?” Trust me, you’re not alone. Life has a way of throwing curveballs—hospital bills, unexpected home repairs, or even a sudden job shift—that demand a quick influx of cash. Using your emergency fund is exactly what it’s there for, but once the dust settles, you might find yourself staring at a near-empty savings account that once gave you peace of mind.

So here’s the thing: rebuilding your emergency fund can feel a bit daunting, especially if you’re juggling daily responsibilities and other financial goals. But you’re in good company. We’ve all been there, and together, we can walk through the essential steps to get that cushion back to a secure (and maybe even more solid) place. Let’s take a friendly, step-by-step look at how you can recover momentum and rebuild that essential layer of financial protection.

Acknowledge Why It Happened

It’s natural to feel frustrated or disappointed when you look at a depleted emergency fund. After all, you might’ve worked really hard to build it in the first place. But let’s remember: your emergency savings served its exact purpose. It prevented you from going into debt, or turning to high-interest loans, or sacrificing other necessities. That’s worth celebrating. By acknowledging the valid reasons you had to withdraw those funds—job loss, sudden medical costs, urgent family matters—you take the first step toward easing any guilt or stress that may be lurking.

Reflect on the Event

Start by jotting down what led you to use your emergency fund. Was it a home repair that ballooned in cost? A major car breakdown? Maybe you faced back-to-back bills that left no other option. This can be a quick exercise you do over coffee, just to understand which specific circumstances drained your savings. If it feels right, talk it out with your partner or a trusted friend. Sometimes sharing helps you see the situation more clearly.

- Was the expense truly unexpected, or could it have been planned for?

- Did you have enough set aside in the first place, or was the emergency fund already smaller than what you needed?

- What was your emotional response at the time—panic, calm acceptance, or somewhere in between?

Having these answers helps you prepare for the next steps.

Own the Emotion, Then Let It Go

We’re all human, and our emotions can stick around long after the crisis has passed. You might still feel a little anxious about money. That’s completely normal. But once you’ve acknowledged those feelings, try to let them go. This is your chance to move forward without the weight of regret. After all, if you stay stuck in guilt or frustration, it’s harder to channel energy into rebuilding a fresh safety net.

Recognize Your Fund’s Value

Often, you realize the true power of an emergency fund only after you’ve had to use it. A quick reminder never hurts: your savings literally saved you from worse consequences. Keep that perspective in mind as you head into the rebuilding process. It’s not a burden to save again, but rather a smart strategy that will serve you well the next time life throws a curveball.

Assess Your Current Situation

Before you dive back into serious saving mode, it’s a good idea to take stock of where you stand financially. Think of it like you’re mapping out a road trip: you need to know your starting point to plan the best path forward. So let’s take an honest look at your current expenses, income, and any leftover debts.

Check Your Cash Flow

Look at how much money comes in vs. how much goes out each month. This might sound obvious, but sometimes we lose track of the little drip-drips of spending (that streaming subscription you forgot about, the coffee habit that’s grown into a daily luxury). A quick budgeting exercise can reveal extra dollars that could be funneled into your emergency savings. At the very least, it shows you where you can tighten up if necessary.

- List your monthly take-home pay.

- Subtract essential expenses: rent/mortgage, utilities, groceries, transportation.

- Factor in debt payments (credit cards, loans).

- Consider variable costs like dining out, entertainment, hobbies.

Once you see your net balance, it’s easier to pinpoint how much you can comfortably set aside each month.

Evaluate Existing Debts

Do you have high-interest debts that need attention? Some people prefer to knock those out before padding their emergency fund beyond a certain minimal threshold, because interest can snowball quickly. Others balance saving and debt repayment simultaneously. While there’s no one-size-fits-all strategy, it helps to be clear about priorities. For instance, if a significant chunk of your budget goes toward credit card payments, you might benefit from a balanced approach:

- Keep a mini emergency fund while aggressively tackling debt.

- Then, once that’s under better control, shift into full rebuild mode.

You can also compare saving vs. debt strategies in our resource: emergency fund vs debt.

Gauge Your Immediate Needs

Take a moment to see if there are any short-term financial obligations looming. Maybe your car insurance renewal is coming up, or your child’s birthday party is right around the corner. Being prepared for predictable near-future costs helps you avoid dipping into the fund you’re trying to rebuild. If it’s a big-ticket item, plan for it separately so you don’t sabotage your own momentum.

Set a Meaningful Goal

When you used your emergency fund, you discovered how crucial it is. Now it’s time to figure out exactly how much you want (and need) to replenish. A random number like “I’ll just save up $500 again” isn’t as motivating or accurate as a thoughtful target based on your monthly expenses and personal comfort level.

Define Your New Savings Target

You’ve probably heard various rules of thumb: three months of living expenses, six months, or even more. Your magic number might be different depending on job stability, the size of your household, and medical considerations. For a more personalized approach:

- Calculate a bare-minimum budget where you cover essential bills.

- Decide how many months’ worth of coverage you want your emergency fund to handle.

- Multiply monthly essentials by that number to get your rebuild target.

If you’re not sure how much is right for you, try referencing our emergency fund amount resource. Even aiming for a 3-month emergency fund can set a strong foundation if you’re restarting.

Make It Personal and Tangible

Attaching real-life reasons to your savings goal can boost your motivation. Sure, “Save $2,000” is fine, but “Have $2,000 by June so I can keep my kids’ routine stable if I lose my job” is more emotionally compelling. Write that reason down somewhere visible—a sticky note on your desk, a note in your phone, or a little sign on your fridge. Yes, it’s a small gesture, but it can keep your ‘why’ front and center when you’re tempted to skip a deposit.

Consider a Timeline

Finally, give yourself a realistic timeline. Maybe you plan to replenish your emergency fund within six months, or perhaps you need a year. Without a deadline, it’s easy to let life’s daily demands take priority over saving. If you meet your goal sooner, that’s even better! And if you need more time, you can adjust as you go, but at least you’ll have a target period to aim for.

Craft a Fresh Savings Plan

Now that you know your target, it’s time to get practical about how to make it happen. This is where you create a savings roadmap—one that fits your current life and doesn’t feel like an impossible climb. Remember, even a small step in the right direction is a win.

Automate Your Contributions

One of the easiest ways to build your emergency nest egg is to set up an automated transfer from your checking account to your savings once or twice a month. It might be $50, $100, or even more. Automation removes the guesswork and the temptation. When the money moves itself, you’re less likely to notice the absence, and your emergency fund grows quietly in the background.

Use Separate Savings Tools

If you store all your money in one checking account, it’s easy to dip into your emergency savings for non-emergencies. Consider a dedicated high-yield savings account, or look into strategies like the emergency fund envelope system. By physically or digitally separating your savings for emergencies, you’ll be less tempted to blur the lines between “must-have” and “nice-to-have.”

Tweak the Plan as Needed

Starting with a modest monthly contribution is okay if that’s what your budget can handle right now. Review the arrangement every few months and see if you can bump up the amount. Maybe you got a small raise or paid off a minor debt—those freed-up dollars can flow into your emergency fund. Flexibility is key. Saving is rarely a one-and-done setup since life keeps evolving.

Consider a Savings Challenge

If you crave a bit of excitement or structure, try out a year-long emergency fund challenge. These challenges often break down your savings goal into weekly or monthly tasks, making it less intimidating. It’s like friendly competition with yourself—each small win feels like a little victory parade that keeps you going.

Find Extra Sources of Income

If beefing up your savings is a priority, adding some fresh streams of income can speed up the process. Think of it as giving your emergency fund a “protein shake,” a boost that helps it grow stronger faster. The key is to find opportunities that align with your lifestyle and don’t overwhelm you.

Explore Side Gigs

From freelancing online to selling handmade crafts, side gigs come in all shapes. You might deliver groceries on weekends, tutor a subject you’re good at, or walk neighborhood dogs. The beauty of a side gig is you decide how much time and energy to invest. Every extra dollar can funnel straight into your emergency fund.

Here are a few ideas:

- Online freelancing: Writing, graphic design, social media management.

- Local services: Childcare, pet sitting, yard work.

- Gig apps: Rideshare, food delivery, grocery shopping.

If you find yourself with spare time, these can be a quick injection into your savings buffer. Keep track of how much you’re earning so you don’t accidentally shortchange yourself at tax time.

Sell or Rent Out Assets

Have a spare room in your home? Renting it out for short-term stays could net you extra cash. If you’re not comfortable hosting strangers, maybe you have tools, sports equipment, or even party supplies that others might pay to borrow. Extra stuff collecting dust in your garage could become an easy source of income if you’re willing to part with it.

Negotiate or Increase Your Main Income

Sometimes, we forget the most direct route: asking for a raise at your current job or looking for a higher-paying role elsewhere. If you haven’t had a performance review lately, it might be time to highlight your accomplishments and negotiate better compensation. Though it can feel intimidating, a successful conversation can lead to significant financial gains over the long haul—money that can go straight into your emergency savings.

Trim Expenses For Faster Results

Raising your earning power is one side of the coin. The other side is cutting unneeded expenses so your dollars stretch further. Don’t worry, this doesn’t have to mean living in a constant state of deprivation. It’s more about minimizing wasteful or impulsive spending while still enjoying a comfortable lifestyle.

Take a Look at Your Subscriptions

Streaming services, subscription boxes, fitness apps—these ten-dollar charges add up fast when you have multiple subscriptions happening at once. Make a list of every subscription you pay for, then ask if you use it enough to justify the cost. Be honest. If you’re only logging into that streaming service once a month, it might be time to pause or cancel until you really need it again.

Plan Meals and Shop Smart

Food costs can be a major budget-buster. One common strategy is meal planning. It not only reduces the temptation to eat out but also helps you shop for groceries more efficiently. When you know exactly what’s on the menu for the week, you can buy ingredients in bulk, watch for sales, and minimize wasted produce. You don’t have to cook gourmet meals every night—just a bit of planning can trim hundreds of dollars from your monthly bill.

Batch Your Errands

Little things like driving across town multiple times a week, paying for extra gas, or forgetting to return library books (and racking up fees) can drain your budget. By organizing errands—like hitting the grocery store, dropping off donations, picking up a prescription, and visiting the post office—into a single trip, you save time and money. It sounds tiny, but over a month, these decisions add up.

Manage Impulse Purchases

We’ve all done the “I deserve a treat” splurge. A latte here, a quick online sale there… it’s easy to lose track. One tactic is implementing a 24-hour rule for non-essential buys. If you still want that item a day later, give yourself permission to purchase it. Often, the urge fades once the moment passes. Another approach is storing your credit card details in fewer places so it’s not so easy to click “Buy Now.”

Sample Expense Table

Below is a simple example of how much you might save by making small changes:

| Item | Monthly Cost | Potential Savings |

|---|---|---|

| 2 Streaming Services | $20 | $10 (cancel one) |

| Premium Coffee Daily | $60 | $30 (cut in half) |

| Gym Membership | $40 | $20 (switch plan) |

| Meal Delivery Fees | $40 | $20 (reduce apps) |

| Unused Magazine App | $5 | $5 (cancel) |

| Total | $165 | $85 |

If you saved $85 in one month, that’s $1,020 in a year. Not a bad chunk to tack onto your emergency fund, right?

Monitor and Adjust Regularly

Life changes, so does your income and your financial needs. Monitoring your progress is crucial. It’s like getting a health check for your money. Instead of letting months slip by without looking at your fund, schedule quick check-ins—maybe once a month or at least quarterly.

Use Tracking Tools

Budgeting apps and spreadsheets can give you a snapshot of your financial health at any moment. You’ll see how much your savings have grown, whether your expenses have crept up again, and if your goals need a bit of recalibration. Even a simple spreadsheet with columns for income, expenses, and emergency fund balance can do the trick.

Revisit Your Goals

Maybe your initial goal was to save $3,000, but you’re already at $2,500 and still have momentum. Could you aim higher to cover more months of expenses? Or perhaps an unexpected life change—like a medical bill—means you need to slow down for a bit. Adjusting your plan isn’t failure; it’s just responsible management. Think of it as tuning up a car that’s still driving forward.

Celebrate Milestones

If you decided your milestone was every $500 you save, honor that achievement. You don’t have to go overboard, but something as simple as treating yourself to a favorite home-cooked meal or giving yourself an afternoon off from chores can reinforce your progress. Small rewards keep you motivated, reminding you that what you’re doing truly matters for your future.

Prepare For Future Emergencies

You used your emergency fund once, and you’ll likely use it again at some point (hopefully not for a while). The difference this time is you’ll be more prepared for the chaos life might throw your way. Think of it as leveling up your overall financial readiness.

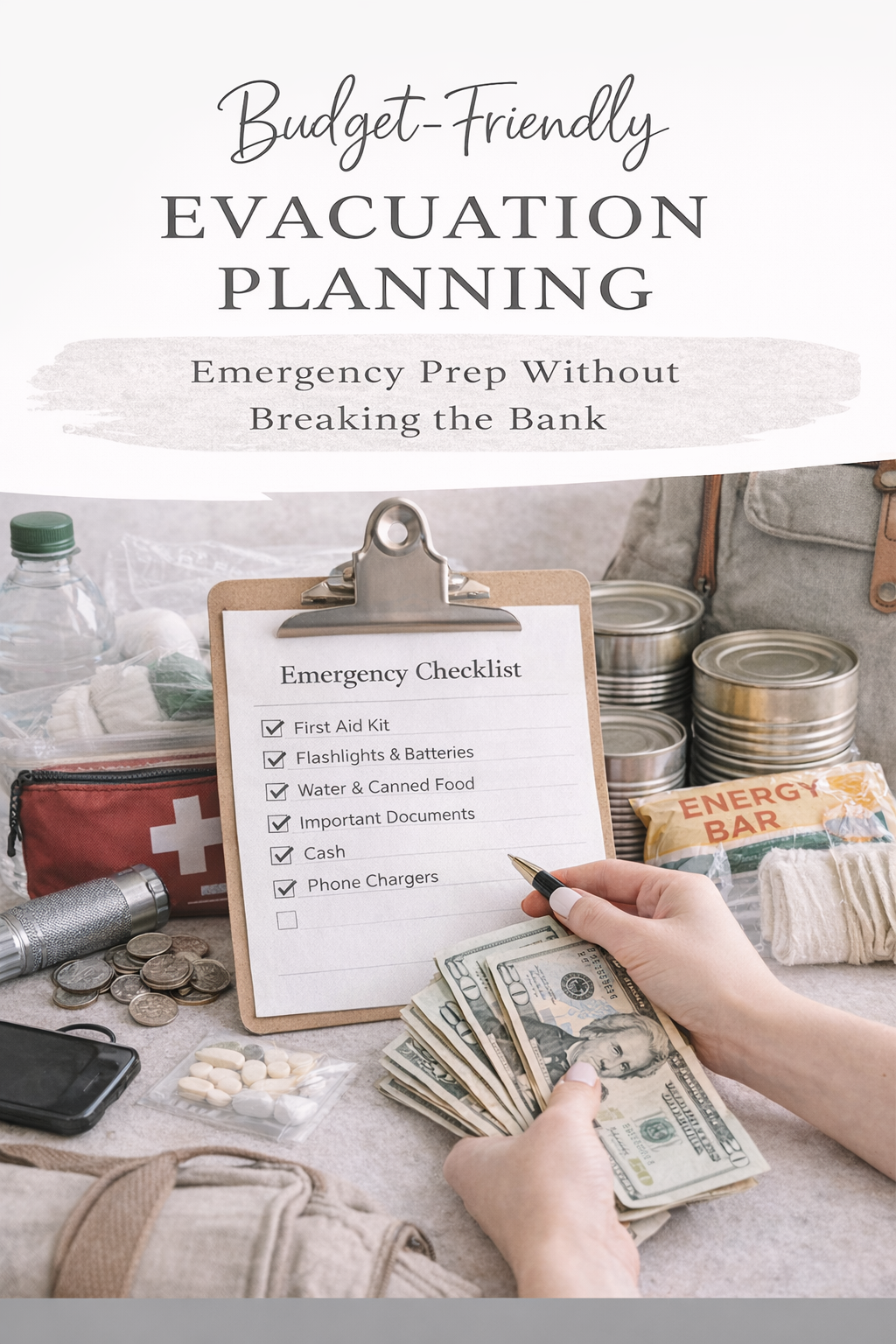

Build Multiple Layers of Preparedness

Your emergency fund is a fantastic first layer, but you can strengthen your resilience even further by assembling a financial emergency preparedness kit or creating a financial go bag. This might include:

- Essential documents (IDs, birth certificates)

- Key financial records or account details

- A small amount of emergency cash at home hidden securely

- Contact lists for family, close friends, and support services

All of these are part of a comprehensive approach, so you’re never scrambling to find critical info during a tough moment.

Diversify Your Savings Locations

If you’re wary of placing all emergency funds in one type of account, consider diversifying. You can keep a portion in a high-yield online savings account and another fraction in a traditional bank you can quickly access in person. That way, if you ever face technical glitches with one financial institution or a region-wide issue, you can still access some funds. For more details on where to store your stash, check out where to keep emergency fund.

Know Your Withdrawal Rules

When the next surprise expense arises, it helps to have a clear plan in place for accessing your funds. Some accounts have limits on how often you can withdraw. Others might have special fees. Make sure your chosen accounts won’t put you in a pinch when time is of the essence. You can explore more about this in our guide to emergency fund withdrawal rules.

Maintain Insurance Coverage

You might also want to review your insurance plans—health, home, auto, or life. Sometimes having the right coverage can prevent you from draining your emergency fund for expenses that insurance could partially or fully handle. It might mean paying a slightly higher premium, but it could save you big time down the road.

Celebrate and Stay Motivated

Let’s be honest—saving money regularly and resisting the urge to dip into it takes intentional effort. You deserve credit for every single deposit you make. A positive mindset can help keep you going, especially when life’s challenges pop up. So let’s chat about staying motivated for the long haul.

Track Your Progress Visually

Sometimes, seeing the growth of your fund tangibly makes all the difference. You could use a chart pinned to the fridge, an app with fun visuals, or even a simple notebook where you color in boxes for each $100 saved. Little visuals have a big psychological impact, reinforcing that you’re moving closer to your goal day by day.

Engage With a Supportive Community

Tell a friend or family member about your plan. If you’re feeling ambitious, share weekly or monthly updates. You’ll be more inclined to stay consistent when someone else is cheering you on. Online communities can help too—there are many spaces where people swap tips for rebuilding savings, reducing debt, and tackling big goals. Having people who “get it” can be a real motivator.

Try New Challenges

Once you’ve built some momentum, keep the energy going. If you feel you’re losing steam, shake things up with a different savings approach. Maybe you try a $5 savings challenge or come up with a game that rewards you each time you skip a takeout meal. Novelty keeps saving from becoming stale, and it reminds you that personal finance can be creative and even fun at times.

Give Yourself Grace

Yes, slip-ups happen. You might have a month where your car breaks down or there’s a costly family event, and you can’t put as much into savings as you hoped. Don’t sweat it. A small detour doesn’t erase all your progress. Give yourself permission to be human, recalibrate, and resume your saving pattern as soon as you can.

Final Thoughts

Rebuilding your emergency fund after using it is absolutely doable, even if it doesn’t feel that way at first. Life’s ups and downs happen to all of us, and the fact that you’re here, actively taking steps toward rebuilding, says a lot about your commitment to financial well-being. The key is keeping a realistic view of your situation, setting a clear goal, and adjusting along the way. Remember, each small deposit, each trimmed expense, and each mindful choice to earn extra income adds up over the months.

You’ve got this. Whether you’re aiming for a modest amount or a more robust buffer that covers half a year, every bit of progress counts. If you ever need fresh ideas, consider exploring our start emergency fund or financial preparedness checklist. Above all, trust yourself. You’ve already navigated one emergency. With these strategies and a determined mindset, you’ll be back on your feet in no time—feeling secure, empowered, and ready for whatever surprises life throws your way. Go ahead, give yourself a high-five for taking these steps. You deserve it.