The Starter Emergency Fund: $500 That Changes Everything

Set The Stage For A Starter Emergency Fund

Ever catch yourself thinking, “I really should have something set aside for emergencies, but where do I even start?” Trust me, you are so not alone in that feeling. A starter emergency fund is one of the most practical ways to give you and your family a sense of security—they say $500 is enough to change everything, and we’re going to explore exactly why. Sure, it might not sound like a life-changing amount, but it can be a game-changer when your car battery dies at the worst time or a sudden medical bill appears.

We’re not talking about a flashy “get rich overnight” idea here. Instead, this is all about creating a small but mighty cushion that can soften life’s little blows. Maybe you have kids who occasionally need emergency field-trip money or a pet that might need an unexpected vet visit. We’ve all been there, shaking our heads at life’s curveballs and feeling that sting of, “I should’ve been ready.”

The goal with a starter emergency fund is simple: have a dedicated stash of at least $500 (or the approximate amount that feels right for you) to handle those mini crises without derailing your family’s financial stability. You will find that once you get the ball rolling, it’s easier to transition to bigger savings goals. Each deposit, no matter how small, is like a brick in a strong foundation. And guess what—that foundation will help you worry less and enjoy life more.

Before we dive into all the details, let’s acknowledge that kicking off any new financial habit can feel intimidating. Even coming up with $500 might seem like a tall order, but the hardest part is usually taking those first few steps. Our plan is to break everything down into manageable pieces, so you can see how straightforward building a starter emergency fund can be. Ready? Let’s explore how $500 can make a serious difference.

Understand Why $500 Is Significant

It might be easy to shrug off $500 as not enough to buffer your financial world, but it’s surprisingly effective as a first line of defense. This modest sum can handle many day-to-day emergencies that creep up, including smaller car repairs or a doctor visit copay. Not only does this mini-cushion prevent you from swiping a credit card (and plunging into high-interest debt), it also reduces that moment of panic many of us feel when faced with an unplanned bill.

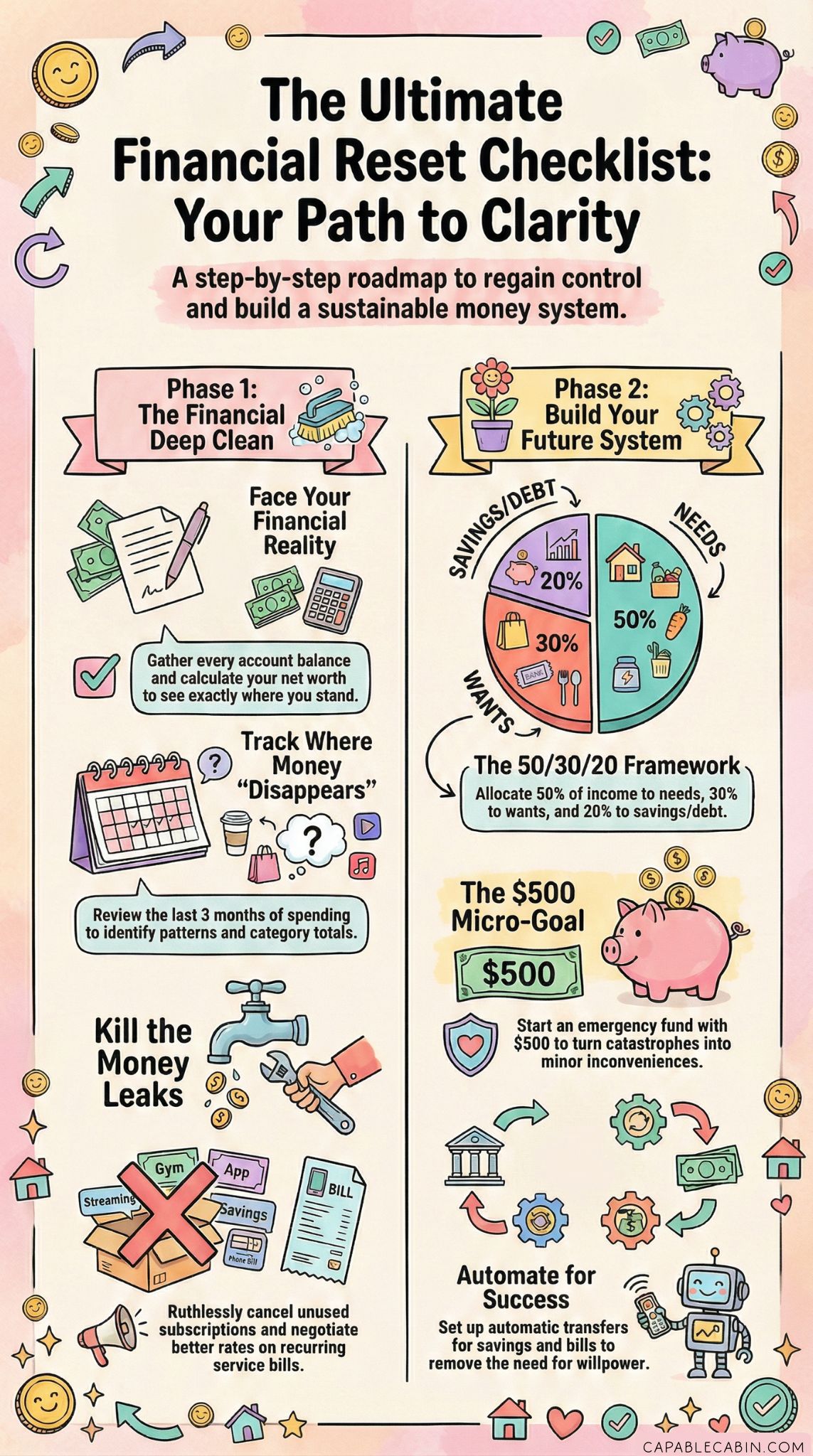

Plus, starting with a smaller goal can be less intimidating than say, a 1000 emergency fund or a full-blown three to six months’ worth of expenses. When goals feel achievable, you are more likely to stay consistent and keep moving forward. A $500 starter fund can offer immediate peace of mind, which is priceless for busy families juggling everyday responsibilities.

A Step Toward Bigger Goals

Maybe you are already thinking beyond $500, especially if you have kids or a mortgage. The truth is, this initial amount is just step one in your larger financial journey. Think of it like a key that unlocks better habits. Once you’ve proved to yourself that you can put aside $500, you will likely feel more motivated to aim for the next milestone, such as a 3-month emergency fund. By tackling things in stages, you build momentum in a way that feels doable rather than overwhelming.

Reducing Financial Anxiety

Ever lost sleep worrying about what you would do if your family had an urgent need, like a broken appliance or a roof repair? It’s stressful, right? That’s why it helps to think of this cushion as a stress-reliever more than anything else. True, it won’t solve every problem, but it will give you a strong sense of relief knowing it’s there. When anxiety flares up, you’ll have confidence in your ability to handle at least some setbacks without going into debt or borrowing from friends.

The beauty of a starter emergency fund is that it simultaneously settles your nerves and boosts your family’s financial independence. You get a taste of that relief every time you deposit even a small amount, and it can light a spark that leads to bigger and better saving habits. Let’s keep that spark alive by looking at common obstacles that might be keeping you from setting aside $500.

Tackle Common Hurdles Early

We all know that saving money can be easier said than done. Even when you are committed, life has a way of tossing extra bills, unexpected events, or mental roadblocks at you. Recognizing those hurdles early gives you a chance to strategize so they do not knock you off track.

Handling Unexpected Expenses

Sometimes, it feels like the moment you finally decide to start saving, your car needs new tires, your child’s sports registration fee is due, or the utility bill spikes out of nowhere. It’s just plain frustrating. However, consider these mini-emergencies as a reminder of exactly why you are building a starter emergency fund. Yes, you might have to slow your contributions for a month, but the long-term goal remains. Even if you only deposit $5 or $10 at a time, consistency eventually wins. The key is to view these moments as proof of why this fund is so crucial in the first place—then keep on saving.

Dealing With Self-Doubt

It’s normal to feel that flicker of “I’ll never be able to do this” especially if you are living paycheck to paycheck. But trust me, you can. Plenty of families have found creative ways to snip a little from here or there—like cutting down on streaming subscriptions or negotiating a better cell phone plan—to build that initial $500. Every small tweak gives you a boost of confidence.

Think of it as a journey rather than a fix-it-overnight scenario. If you celebrate the smallest wins, such as saving even $20 a week, you will be amazed at how quickly the total grows. The difference between wishing you had a safety net and actually having one is often just a change in mindset.

Balancing Other Financial Priorities

What if you’re already juggling debt, groceries for a family of four, and a million other expenses? That’s real life, and there’s no shame in feeling a bit stretched. One approach is to treat your starter emergency fund as an essential expense, not an afterthought. Yes, there might be pressure to prioritize paying off bills. But by dedicating even a small portion to savings, you ensure that you do not end up in deeper trouble if an unexpected event pops up. In fact, if you are curious about how to juggle both, you could explore the topic of emergency fund vs debt once you have your first buffer in place.

Begin With Simple Saving Strategies

So how do we actually get that $500? The simpler you make your plan, the more likely you are to stick with it. We’re going to start with small, attainable steps. When you see those funds build up—even if it’s just a trickle to start—you’ll realize it’s not as daunting as you thought.

Consider Automatic Transfers

If you have a checking account, try setting up an automatic transfer to a separate savings account every time you get paid. Even if it’s just $10 or $25 per payday, you’d be surprised how quickly it adds up when you don’t have to remember to do it manually. Automatic transfers remove that temptation to spend the money on something else because it’s practically out of sight, out of mind.

Try A Challenge

You know how a fun challenge can get everyone hyped up? The same logic applies to finances. If you want that extra spark, you could try an emergency fund challenge or even a year-long emergency fund challenge. These structured programs break down your savings goals into weekly or monthly tasks—perfect if you thrive on checklists or shared community experiences. Watching yourself meet each mini-milestone is a fantastic motivator.

Assign Specific Savings Goals

When money has a label, it’s easier to hold onto. One neat trick is to open a dedicated bank account and literally name it “Starter Emergency Fund.” Every time you log in to check your balance, you’ll see that label and remember its purpose. It’s a subtle but powerful reminder that this money has a specific job: to protect you from the unexpected.

Use Smarter Spending Habits

Saving does not have to be about complicated budgets or skipping every joy in life. Instead, clever spending helps you find extra resources for your new rainy-day stash without feeling deprived. Here are a few strategies to free up some funds.

Track And Trim

First things first: figure out where your money actually goes each month. Grab your statements and highlight every expense. Then ask yourself if each expense is a “need” or a “want.” You might see patterns—like a coffee habit that costs you $30 a week or a cable subscription you rarely use. By trimming just one or two areas (like downgrading your streaming plan or skipping takeout once a week), you can direct more money to your starter emergency fund.

Negotiate Or Shop Around

Is your insurance bill sky-high? How about that phone plan? In many cases, providers offer better deals if you simply ask. Call your service providers and explain that you are exploring options. Often, they’ll find a promotional rate or discount rather than lose your business. Likewise, look for deals or coupons before you make a purchase. A quick online code search or a cash-back app could save a few dollars here and there. When you collect all those small wins, eventually they pile up into something significant.

Try The Envelope Trick

If you prefer a tangible approach, you might want to explore methods like the emergency fund envelope system. It’s old-school but effective. You label envelopes for specific expenses or saving goals, then fill them with cash. Once the envelope is empty, you wait until your next paycheck to refill it. This method can really keep you aware of how much you spend on each category. Seeing real cash slip away sometimes has more impact than swiping a debit card.

Keep Your Fund Secure

Once you’ve begun building momentum, it’s important to make sure your newly earned cushion stays safe—and remains within easy reach for genuine emergencies. You do not want to go through the challenge of saving $500 only to discover you cannot access it when you really need it.

Where To Store Your Starter Emergency Fund

Convenience matters with an emergency fund, because you want to be able to act quickly if something urgent arises. However, too much convenience might tempt you to dip into it for non-emergencies. One practical approach is to open a separate savings account at your usual bank, or consider an online bank that offers higher interest rates. You can read more about where to keep emergency fund if you need tips on choosing the right account type. Just be sure you’re not locking up the money in a long-term account with withdrawal penalties.

Keep A Little Cash On Hand

Sometimes, especially if power outages or other unexpected events occur, you might need physical cash. If it’s safe for you, keep a small portion—maybe $50 to $100—hidden at home. That way you have immediate resources if ATMs or payment systems go down. You could also consider exploring how to maintain emergency cash at home in a secure yet accessible spot. The key is to find a balance between security and availability.

Build Momentum For The Future

After you get that first $500, you might feel unstoppable. And that’s a good thing. The next question is: what’s next? You can choose to keep growing your fund into a bigger safety net. Or, if you have pressing debt, you may decide to pay that down while maintaining your starter cushion. The idea is to give yourself enough breathing room so surprises don’t turn into emergencies.

Transitioning To A Larger Emergency Fund

At some point, you might want to move from a starter emergency fund to a more robust, multi-month fund. You’ve probably heard experts suggest saving anywhere from three to six months of living expenses. While that might feel like a mountain, you can climb it exactly the same way you tackled the first $500—one step at a time. For instance, once you have your initial cushion, channel extra income or windfalls (like tax refunds) into your savings. Another approach is exploring the 5 savings challenge, which can make the process fun and manageable by breaking it into bite-sized tasks.

Creating A Family Buffer

If you live with a partner, it could help to involve them when deciding how much you want to save next. After all, caring for a household often means coordinating finances. And if you have children, you might also consider preparing for kid-related surprises—like summer camps, back-to-school supplies, or medical costs. Sometimes people think “$500 won’t help if my family faces a huge emergency!” But remember, the starter fund is only the first rung on the ladder. As your life evolves, you’ll keep adjusting your plan.

Avoiding Common Pitfalls

We’re all in this together, so it helps to learn from each other’s mistakes. For instance, dipping into your fund for non-essentials can become a habit—one that defeats the purpose of your cushion. If you catch yourself using that money for new clothes or a fancy dinner, take a moment to remind yourself why you set it aside in the first place. If you need more insights about what to steer clear of, check out emergency fund mistakes. That extra knowledge can keep you on the right path.

Strengthen Your Overall Preparedness

A starter emergency fund is only part of a bigger picture. If you really want peace of mind, you can look into a more comprehensive financial plan. That might include setting up a financial emergency binder or a financial go bag, so all your key documents and contacts are readily available if something big happens. Having everyday essentials in place—from medical supplies to extra phone chargers—can also ease your mind, especially if you’re the primary caretaker for your household.

Think Long-Term Security

As you continue building your savings, you might start to explore investments, retirement accounts, or even side hustles that provide an extra cushion. But those steps feel a whole lot simpler once you have your initial $500 in place. Why? Because you’ll already be used to the habit of setting money aside. You’ll have proof that you can focus on a concrete goal and achieve it.

Keep It Personal

Every family’s situation is unique, so what works well for one person might not be ideal for another. If you’re someone who thrives on structure, a strict budget might be your best friend. If you find budgets stifling, maybe you do better with automated savings and a few general guidelines. Don’t compare your progress to someone else’s—your milestone is worth celebrating. The point is to have a plan that works in your real life, not an unattainable model of perfection.

Encouragement To Move Forward

It’s easy to get stuck in the loop of “I’ll start next month” when it comes to saving money. But starting now, even with the smallest amount, can set off a chain reaction of good habits. Even something as small as putting away $10 by the end of the week can spark a burst of “I can do this.” And that’s the kind of motivation you want to cultivate.

Keep The Momentum

Saving is not a static goal. Life changes, expenses pop up, and priorities shift. That $500 starter emergency fund you create today might evolve into a start emergency fund for a larger goal tomorrow. Or maybe you’ll decide to keep rolling it into bigger savings challenges, eventually working your way up to a multi-thousand-dollar security blanket. Either way, that initial $500 can become the launch pad for something bigger.

Share And Celebrate Wins

One secret to keeping up the good work: celebrate the wins—no matter how modest they might appear. When you deposit $20 and the total hits $100, treat yourself to a small victory dance or maybe share the news with a supportive friend. Eventually, those little “Yes, I did it!” moments melt into a huge sense of pride and relief. There is no shame in giving yourself a pat on the back for each milestone met.

Empower Those Around You

If you have friends or family who are also looking to save, invite them to join your journey. Sometimes, hearing about someone else’s progress is just the inspiration you need. The accountability and support you give each other can go a long way. Plus, sharing tips and budgeting hacks is a great way to continuously improve. You might even swap ideas on how to grow your emergency fund or maintain a financial preparedness checklist as a group effort.

When To Revisit Your Fund

Life can change quickly, so plan to revisit your fund at least once or twice a year. Are there new expenses on the horizon, like a child heading off to college or an elderly parent moving in? Reassess your short-term and long-term goals accordingly. Sometimes $500 is enough to keep you from sliding into debt, but as you build momentum, you may want to push that number higher to match new responsibilities.

Embrace The Journey

If you’re still on the fence, let this reader-friend pep talk sink in: a starter emergency fund is more than some line item in your financial plan. It represents freedom from the anxiety of small emergencies. It gives you the power to say, “We’ve got this,” when your washing machine suddenly conks out or your little one needs a last-minute prescription. And it’s not just about you—it can protect your whole family from stress and uncertainty.

Sure, you might slip up sometimes and skip a deposit. Maybe you’ll discover a new hidden expense that sets you back for a month. That’s normal. The important thing is to pick yourself up and stay the course. Each deposit—no matter how tiny—moves you closer to having a reliable safety net. Over time, those deposits become second nature you won’t even think about them. And that’s when you’ll realize: you’ve formed a positive, life-changing habit.

Final Words Of Encouragement

Please remember, there’s no single right way to build your starter emergency fund. What matters is that you do it in a way that fits your comfort level and life circumstances. If you prefer old-fashioned envelopes, go for it. If you love your online banking app, make the most of that. Heck, if you want to keep a giant coin jar in your kitchen, that can work too. The process might look different for every individual, but the end result—feeling stable and prepared—is universally empowering.

Whether your journey to $500 takes a few weeks, a few months, or even longer, know that every step forward is a step worth taking. You deserve to feel secure and confident about your finances. And guess what? You are entirely capable of getting there. So let’s lock arms—figuratively speaking—and march together toward simpler, more stress-free days. That $500 might be the start of something that really does change everything in your life. You have what it takes. Keep going, and celebrate each milestone along the way!