Emergency Fund or Debt? Most People Get This Backwards

Understanding “Emergency Fund vs Debt”

Ever find yourself staring at your bills, then glancing at your savings account, and thinking, “Which should I tackle first?” Trust me, you’re not alone. Many of us wonder which is more important: building an emergency fund or paying down debt. In the face of juggling finances for your family or personal goals, it’s easy to feel unsure about what should take priority. Yet getting real clarity on this “emergency fund vs debt” puzzle can set the tone for your entire financial journey. Let’s walk through it together.

Before we dive in, here’s a friendly reminder: you’re allowed to go at your own pace. Everyone’s situation is unique, so it’s okay if your approach looks a bit different than someone else’s. The key is knowing that your money choices can offer peace of mind instead of constant stress. So let’s explore how emergency funds protect you, why debt payments matter, and how to find a balance that fits your life.

Recognizing the Role of an Emergency Fund

Just say the words “emergency fund,” and you might picture a small savings cushion set aside for those unexpected moments—like when the car decides to break down right before a road trip. If you’ve ever had to scramble for cash at the worst possible time, you know how important it is to have money ready for life’s curveballs.

Why It Helps You Sleep Better

This cushion is not just about covering sudden expenses. It’s also about reducing the dread that comes from worrying whether you can handle a surprise bill. Having an emergency fund is like gifting yourself a psychological safety net. When you know you can cover sudden medical fees or home repairs, it lightens the mental load. It’s one less thing to keep you up at night.

When It Comes In Handy

- A sudden job loss can leave you scrambling for monthly bills

- A medical bill that’s bigger than you anticipated

- A family emergency that requires last-minute travel

- Surprise car or household repairs

In moments like these, you want a financial cushion. The size might vary depending on your lifestyle, but a common benchmark is aiming for at least three months of essential living expenses. That chunk might sound daunting right now, but remember, you can build it gradually. If you want a starting point, you might explore some starter emergency fund approaches to get going.

Understanding Why Debt Feels So Heavy

Debt can sometimes feel like a giant weight on your shoulders. Each month, you watch a slice of your paycheck shrink under interest or monthly payments. Whether it’s credit card debt, student loans, or a car loan, debt can easily chip away at your sense of financial freedom.

The Cost Of Carrying Debt

Credit cards and certain loans often come with high interest rates. If you only pay the minimum, interest costs stack up over time. Before you know it, you’ve paid significantly more than the principal. That’s money that could have gone to your kids’ school supplies, a well-deserved vacation, or your emergency savings.

Emotional Toll Of Owing Money

- Feeling like you can never catch up

- Guilt or frustration each time a bill arrives

- Fear you’ll never get out from under it

These emotions are real, and none of us deserves to live with that constant worry. If you can find ways to knock down even a portion of your debt sooner, you’ll likely free up extra room in your budget and your headspace.

Balancing Both Priorities

Let’s talk about how these two goals interact: your emergency fund protects you from new debt, and paying off debt releases more money to save later. It’s a constant dance between shielding yourself from future unexpected costs and lightening the load you already have. But how do you know which to do first?

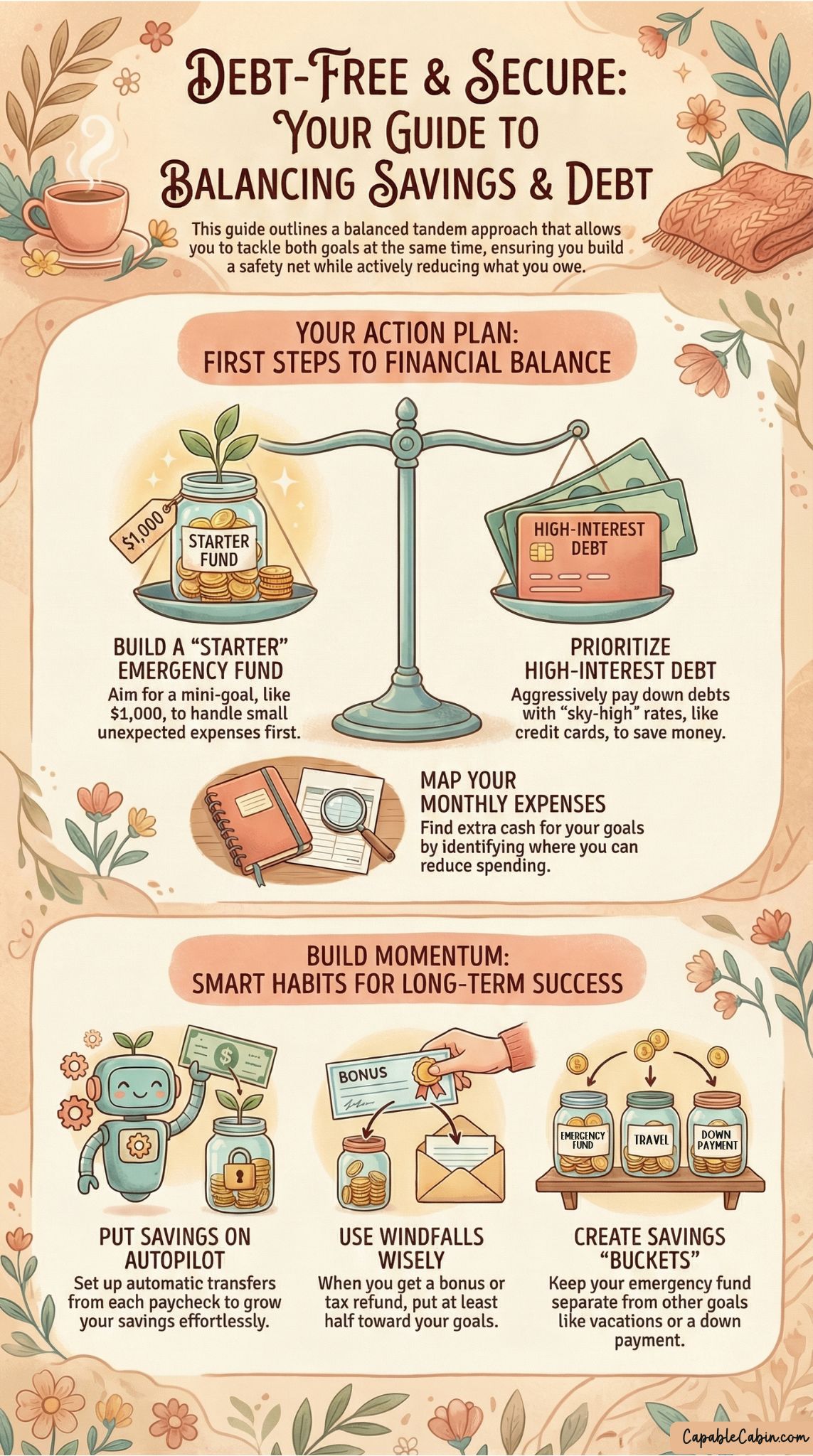

The Magic Of A Two-Track System

One approach is building a small cushion while paying down debt. This might look like funneling a chunk of your income toward a modest emergency fund (often something like $1,000 or another beginner-friendly amount) while simultaneously chipping away at your highest-interest debt. Some people like to tackle these goals in small, doable increments each month—like putting 70% of your extra funds toward the debt and 30% toward your savings until you reach that initial emergency target. From there, you can take bigger strides toward debt payoff.

Avoiding Debt Inflation

It’s no fun to whittle down that credit card balance only to swipe it again if an unforeseen expense pops up. A starter emergency fund can help you avoid relying on credit when life throws you an unplanned bill. If you’d like specific tips on smaller chunks of savings, you can explore the 1000 emergency fund approach, which a lot of families find easier to manage at first.

Figuring Out Your Personal Financial Goals

It’s easy to talk about numbers, but real-life finances are about more than that. They involve your family’s comfort, your peace of mind, and your future hopes. Setting personal priorities is key. Let’s break this down:

Short-Term Goals

- Paying the electric bill on time

- Building a small savings buffer for car repairs

- Handling any urgent debt that’s about to incur late fees

Long-Term Goals

- Establishing a larger emergency reserve, maybe three to six months of expenses

- Paying off high-interest debt—think credit cards or personal loans

- Planning for bigger dreams: college savings, a home purchase, or a comfortable retirement

Remember, even $10 a week toward your savings or debt gets you closer to your goals. Little measures can add up a lot faster than you think. Over time, you can ramp up those contributions as your financial situation improves.

Evaluating Different Types Of Debt

Not all debt is created equal. For instance, credit card debt might have an interest rate of 20% or more, whereas a mortgage might hover around 4% or 5%. Knowing the differences can guide you when deciding what to tackle first.

High-Interest Debt

- Typically, credit cards and payday loans

- Drains your finances fast due to hefty interest rates

- An early priority if you can spare the funds

Moderate-Interest Debt

- Often, personal loans or car loans

- Rates vary, but can be more manageable

- Can be tackled after urgent debt

Low-Interest Debt

- Includes federal student loans or mortgages for most people

- Usually can remain lower on your priority list

- Make on-time payments, but focus extra funds on more pressing balances

If you focus first on your highest-interest debt, you’re potentially saving more money over time. That said, you still want a small emergency fund available so you don’t risk going backward into deeper debt.

Creating A Clear Step-By-Step Plan

Think of this as your financial blueprint, where each stage aims to build momentum rather than overwhelm you. Here’s a flexible plan:

Start A Basic Emergency Cushion

You don’t need thousands saved overnight. Even $500 can be a safety net if you’re stretched thin. If you’d like to challenge yourself, the 5 savings challenge might be a fun way to gather small amounts quickly.Identify Your Highest-Interest Debt

Write down all your debts with their interest rates. Pick the account that’s costing you the most per month in interest. Consider paying more than the minimum on that debt, while making the required minimum payments on others.Balance Contributions

Aim to put a designated amount toward growing your emergency fund—especially if it’s still modest—while allocating the bulk of extra money toward the high-interest debt. For example, in one budget cycle, you might decide that any extra paycheck money goes 30% to emergency savings, 70% to the top-priority debt.Celebrate Small Wins

Every time you reduce your debt by a milestone (like $500 or $1,000) or add $100 to your emergency fund, take a moment to reflect on how far you’ve come. It’s easy to zoom in on what’s left to do, but noticing each step builds confidence and keeps you motivated.Expand The Fund

Once your highest-interest debt is manageable—or if it’s gone entirely—shift some of that money into boosting your emergency fund to three months (or more) of expenses. If you’re curious about optimal amounts, take a look at some guidelines on emergency fund amount.

Dealing With Unexpected Income

Let’s say you receive a tax refund, a bonus, or a gift. Should you throw it at debt or your emergency fund? It often depends on what’s most pressing at that moment. Maybe you’re just shy of a comfortable savings buffer, or maybe you have a credit card bill with a hefty interest rate burning a hole in your budget. That extra income can make a notable dent in either. Sometimes, you might choose to split it: half to the emergency fund, half to debt. Pick what eases your worries the most.

The Emotional Grip Of Financial Stress

It’s not just about the numbers. Emotions weave through every financial decision. When you’re up to your ears in debt, you might feel pressured or frustrated, which adds to a desire for quick results. However, neglecting your emergency fund entirely can leave you vulnerable. Strike a balance:

Overcoming Guilt

You might feel tempted to put every spare dollar into your debt. That’s noble, but if an emergency arises and you have zero savings, you could end up relying on your credit cards again, which might restart the cycle.

Embracing Self-Compassion

It’s okay if you can’t wipe out your debt in record time. Some journeys are slower, and that’s natural. Choose a pace that keeps you from slipping back into debt. Encourage yourself like you would a good friend—remind yourself you’re doing your best in a tough situation.

Real-Life Stories

Picture a family who had $10,000 in high-interest credit card debt. They decided to stash $1,000 in an emergency reserve right away, then direct everything extra toward paying off that card. After about eight months, they finished off the balance. Then, with the card no longer hanging over their heads, they raised their emergency savings goal to $5,000. They said having that starter fund gave them the confidence to get aggressive with the debt, without worrying they’d be stuck if something broke down around the house.

Or consider a single mom who felt torn between stacking up her emergency fund or paying off her auto loan faster. She put a small portion each month into a savings envelope to reduce the temptation to spend it. Over time, she chipped away at her loan and built her financial safety net. It took patience, but it felt empowering, too.

Setting Achievable Goals And Timelines

Since we’re big on gentle, step-by-step progress, let’s chat about building realistic timelines. You might aim to pay off a certain debt in six months or save three months’ expenses in a year. But the real magic happens when you protect yourself from feeling overwhelmed. So if setting aside $300 monthly is unworkable, cut it in half. It’s okay to adjust.

Use Bite-Sized Challenges

Short-term challenges can be motivating. For instance, the emergency fund challenge or year-long emergency fund challenge can break down saving increments week by week or month by month. That sense of camaraderie and structure might help you stay on track when life tries to distract you.

Refresh Your Goals Regularly

Your life changes—maybe you have a baby, switch jobs, or move to a bigger place. Revisit your savings and debt strategies every few months. If your income’s increased, you can step up your plan. If you’re suddenly facing higher expenses, you might need to slow down or reorganize. It’s all part of the process.

Mistakes To Avoid While Juggling Savings And Debt

Let’s take a moment to look at common pitfalls, because awareness can make all the difference.

1. Neglecting A Starter Fund Entirely

Yes, you want to crush that debt, but going in with zero savings can backfire. You might just land in more debt if an emergency crops up.

2. Putting Everything On Credit Cards

It’s tempting to rely on credit cards whenever you’re short on cash, but that can snowball quickly. Make sure you have an accessible chunk of funds for emergencies. If you’re wondering where to store it, where to keep emergency fund can help you find secure yet accessible places.

3. Draining Your Savings To Pay Debt

It might feel like a heroic move at first, but if your emergency stash goes straight to debt payments, you could end up with zero buffer. Then you might just recreate the cycle of charging new expenses.

4. Overestimating Your Monthly Contributions

Being overly ambitious is great for a pep talk, but if it leads to burnout or skipping groceries, you risk giving up. Find a comfortable but solid amount you can handle every month.

5. Underestimating Emotional Health

Financial stress can influence your mood and your relationships. If you find debt or lack of savings weighing you down, it can help to talk to a trusted friend or a professional counselor. You’re building a stronger mindset, not just a more stable financial life.

Building A Support System

We’re not designed to handle financial burdens alone. If you have a partner, friend, or relative you trust, share your goals and concerns. Ask for their perspective on balancing “emergency fund vs debt.” Sometimes just talking through a scenario helps you realize what approach feels right. You could even challenge each other to reach mini-milestones.

You can also look into community resources—some churches or local nonprofits offer financial literacy programs or support groups. And if you ever crave a more structured approach to your overall preparedness, a financial preparedness checklist keeps essential tasks front and center.

Organizing Your Finances In One Place

Staying organized is half the battle. With multiple credit cards, various bills, and different savings goals, it’s easy to lose track. One idea is creating a “financial hub,” which might be an app or a binder. Some families choose a financial emergency binder to hold important documents, account numbers, and goals. This setup helps you keep everything in one spot, so you’re not rummaging around for statements or forgetting due dates.

Benefits Of Tracking Your Progress

- You see exactly where your money is going

- You can celebrate mini-milestones visibly

- It’s easier to spot when you’re overspending

A visual chart or a simple checklist on your fridge can be surprisingly motivating. When you watch that debt figure go down or your savings go up, it fuels momentum.

Handling Emergencies Without Undoing Progress

The bitter truth with finances is that unexpected events happen even when you’re prepared. You might break a tooth during your busiest week, or your child’s laptop might crash right before an important assignment. The question then becomes: how do you handle it without destroying your progress?

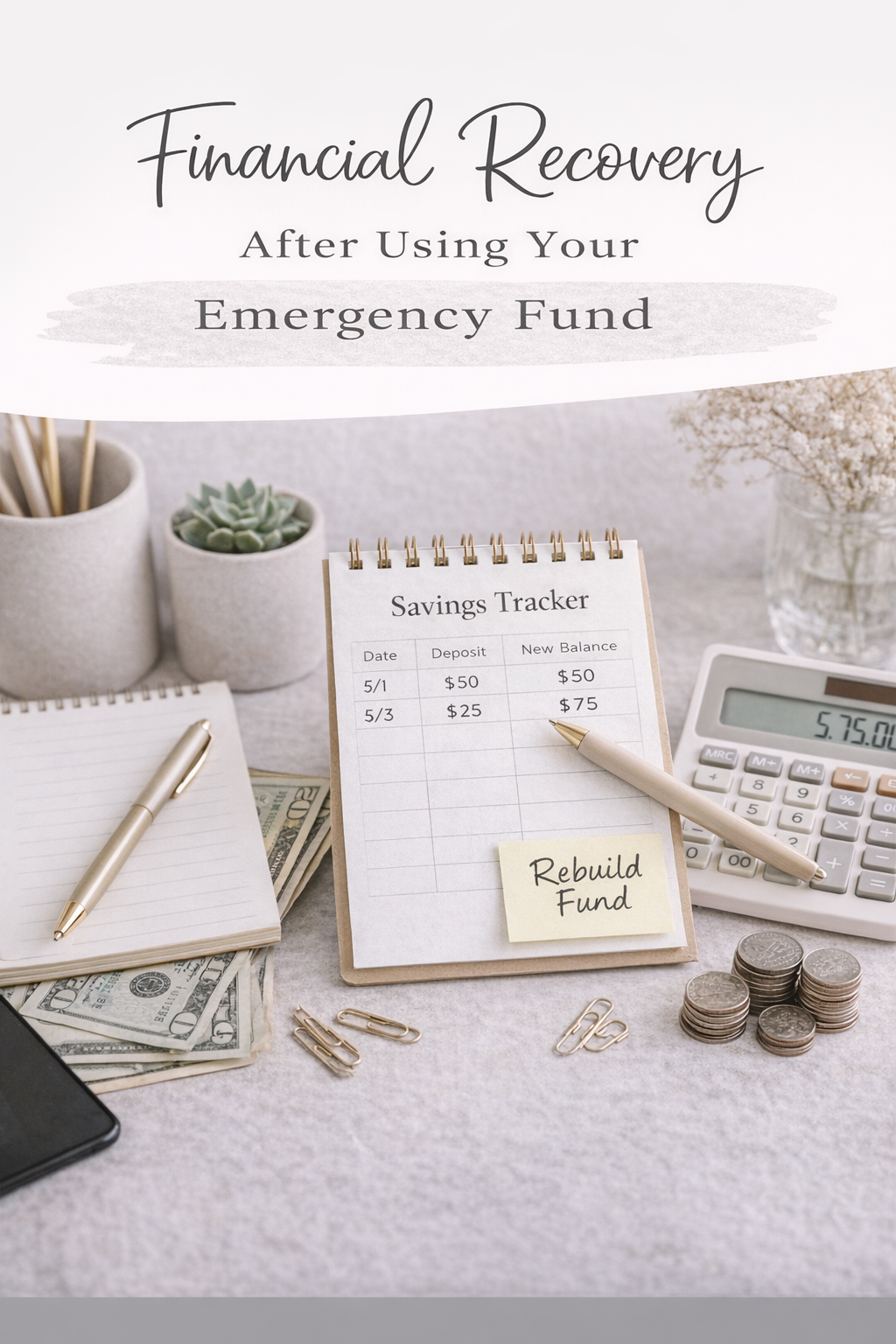

Utilizing Your Fund Wisely

If you’ve built at least a small safety net, use it strategically for genuine emergencies. But avoid draining it entirely for non-essential costs. You might like to keep a small stash of emergency cash at home for times you can’t quickly access electronic accounts. And if you do dip into your emergency savings, plan on how you’ll rebuild it. You can check out ideas on how to rebuild emergency fund so you’re not caught off guard again.

Paying Yourself Back

Once the emergency passes, channel a portion of your regular budget back into replenishing what you spent. Treat it like a bill. The idea is that you stay protected for the next unforeseen cost.

Combining Tactics For Faster Results

We all love a sense of achievement, so if you’re itching to speed up your progress, consider layering strategies:

Automate Your Savings

Have an automatic transfer set up for each payday. Even if it’s a modest amount, you’ll thank yourself later. Automation also makes it less tempting to skip.Use Cash-Envelope Systems

For some folks, physically seeing money can help limit overspending. A emergency fund envelope system might keep your savings tangible.Track Your Habits

Are you making impulse buys? Maybe you can cut back on certain indulgences for a month, funneling that money into your emergency stash or a larger debt payment.Renegotiate Bills

If you lower your cell phone or insurance costs, you can direct those savings to your debt or fund. It’s a small but steady way to see progress.

Adjusting For Life Changes

Your financial plan is never set in stone. Family dynamics shift, job situations evolve, and personal goals expand. While “emergency fund vs debt” might have a certain answer today, circumstances might change in six months.

Seasonal Expenses

Maybe back-to-school shopping is around the corner, or the holiday season pops up. Give yourself permission to throttle back on debt payments temporarily if you want to boost holiday savings. Then return to your main plan once you’ve passed that peak spending period.

Inflation Concerns

If prices on everyday goods and services rise, you might need to re-evaluate how you budget. You might also want a bigger cushion if you’re worried about cost hikes. Check out inflation emergency fund if you’re dealing with soaring prices and want to plan accordingly.

Revisiting The Priority Question

So which one truly comes first—your emergency fund or your debt? The honest answer is both, but you can sequence them in smaller, more achievable layers. Start with a solid (even if small) emergency buffer. Then chip away at your highest-interest debt. Once you’ve made a dent in that debt, circle back and fortify your emergency savings to a more robust level. It’s a balancing act, yes, but it keeps you from feeling trapped when life throws a curveball.

The Power Of Flexibility

Some people prefer going “all in” on paying off debt, aside from meeting their monthly bills. Others insist on having a certain cushion, even if they pay a bit more in interest. Ultimately, you do what helps you sleep at night and keeps your family protected. If you stick to a plan, you’ll see progress on both fronts.

Staying Motivated Over The Long Haul

Your financial journey is more of a marathon than a sprint. There are days when you’ll feel on top of the world, and others where you might slip into old habits. That’s okay. Keep these reminders in your back pocket:

Reflect On Your “Why”

Maybe you crave financial freedom or want to stop worrying about unexpected bills. Keeping that “why” in mind can push you through tough spots.Lean On Others

Enlist friends or loved ones to keep you accountable. Swap stories and tips. Financial challenges are easier when you know you’re in good company.Celebrate Every Milestone

Indulge in a small treat or a relaxing activity whenever you hit a goal (like paying down a chunk of debt or boosting your emergency fund). It builds positive reinforcement.Take Breaks If Needed

If life feels overwhelming, it’s okay to dial back on aggressive financial moves for a short period. Just don’t abandon your plan entirely. Even maintaining progress—rather than accelerating it—can be a win.

Putting It All Together

Balancing an emergency fund and tackling debt might sound like a juggling act, but you’ve got this. You can prioritize both in a way that fits your life and respects your emotional well-being. Establishing a small savings cushion keeps financial stress from knocking you down, while paying off debt steadily frees up your future income.

And here’s the real takeaway: each month you put a little towards debt and a little towards your emergency buffer, you’re telling yourself and your family, “We’re investing in our peace of mind.” That’s truly invaluable. On days you feel stuck or doubt your progress, remember that positive change often happens in small steps. With each saved dollar and each paid-down bill, you’re making strides.

We’re all in this together, rooting for your financial well-being. Keep focusing on what you can do today, let go of perfection, and allow yourself room to breathe. You’ve learned which debts to address first, how to build a comfy safety net, and some ways to stay motivated along the way. Take it one week at a time, and know that your future self will thank you for the steps you take now.

After all, an emergency fund is your safety harness, and eliminating debt is your path to stronger freedom. Striking the right balance will help you stand on steadier ground, no matter what life brings. So go ahead. Map out your plan, celebrate each mini-victory, and watch your confidence grow. You’re making real progress—one day, one decision at a time.