Budget Evacuation Planning: A Practical Guide to Affordable Emergency Preparedness

When you think about emergency situations, it’s natural to worry about the cost of getting prepared. After all, between everyday expenses and life’s curveballs, it can feel like there’s little room left in your wallet. That’s why budget evacuation planning is so important. You deserve the peace of mind that comes from knowing you and your family can leave quickly and safely if the need arises, without draining your bank account. Let’s walk through how you can build a solid plan that protects your finances, keeps you focused, and helps you navigate potential upheavals with more confidence. We’re in this together.

Embrace Budget Evacuation Planning

So here’s the thing: thorough preparation doesn’t have to mean mega-expenses. A well-structured evacuation plan prioritizes simplicity and resilience. When you keep your finances in check, you’re reducing stress and ensuring that you have enough savings for other essentials along the way.

• Start With A Basic Checklist: Think about your absolute necessities: food, water, medication, important documents, and a safe place to stay. Write them down, and highlight items you already have on hand.

• Focus On Your Life Situation: Are you caring for children, older relatives, or pets? Each of these factors affects how you plan and what you spend.

• Set Realistic Expectations: You don’t need the fanciest gear to stay safe. Sometimes, repurposing items you already own (like sturdy totes instead of expensive duffel bags) can work wonders for your evacuation kit.

The main goal is to allocate funds directly to what matters most—your family’s well-being. Even if you’re working with tighter finances than you’d like, small steps taken now can bring big benefits when an emergency hits.

Understand Potential Risks

Before you dive into assembling supplies or setting aside money, it’s a good idea to figure out which emergencies you’re most likely to face. When you know your risks, you can tailor your plan and cut costs by focusing on realistic situations, rather than stocking up for every worst-case scenario under the sun.

Identify Common Local Threats

• Natural Disasters: Depending on where you live, hurricanes, tornadoes, wildfires, or earthquakes might top the list. Research your area’s most frequent weather-related issues so you can pack and plan accordingly.

• Health Crises: As many of us have learned, illnesses and pandemics can spring up and reshape our lives overnight. Consider safeguards like extra medications and important details from pandemic financial planning so your family’s well-being and finances are protected.

• Industrial Accidents: Factories or chemical plants nearby can pose hazards if there’s a spill or a gas leak. Identifying such threats in advance helps you plan any special gear or early evacuation routes.

Assess Your Household’s Unique Needs

• Age & Health: Pregnant women, babies, older adults, or anyone with a chronic condition could require specific supplies. Budget for these needs first and foremost.

• Mobility Constraints: If someone uses a wheelchair or needs extra time loading up, adapt your plan. Expecting delays helps you avoid costly last-minute transportation solutions.

• Pets & Service Animals: Don’t forget a stash of pet food, portable carriers, and any veterinary records you might need.

By focusing on the emergencies most likely to impact you, it becomes easier to see where your money should go. You avoid buying gear you’ll never use, and you can dedicate your limited funds to high-priority items or services.

Gather Essential Documents

Evacuation usually means you have to leave home quickly, sometimes with little notice. Having your paperwork organized and readily accessible is a vital step—but it doesn’t have to be pricey.

Store Documents Securely

You can use simple plastic folders or zippered pouches to keep items like birth certificates, passports, insurance policies, and financial documents together. Many discount stores offer waterproof and tear-resistant folders for a few dollars. If you prefer a digital approach, consider scanning or taking photos of each critical document and saving them in a secure cloud storage solution. For a more robust digital setup, you can explore evacuation digital finances to keep track of online banking and electronic funds in an emergency.

Prioritize The Must-Haves

• Identification: Driver’s licenses, passports, or any government-issued IDs.

• Medical Details: Immunization records, prescriptions, and allergy information.

• Legal & Financial Papers: Home or renter’s insurance, lease agreements, car titles, and bank statements.

• Emergency Contacts: Keep a written list in case your phone dies.

Cut The Cost

• Go Paperless: Rather than making endless copies, just scan or snap a picture. Make sure you use encrypted, password-protected apps or services.

• Reuse Old Binders: If you have leftover binders or folders from school or work, repurpose them as your document organizer. Label sections clearly with markers or colorful tape.

You can’t always predict how you’ll feel or what you’ll remember under stress. Having your crucial paperwork in one portable space can save you from financial headaches later, like delayed insurance claims or difficulty accessing funds.

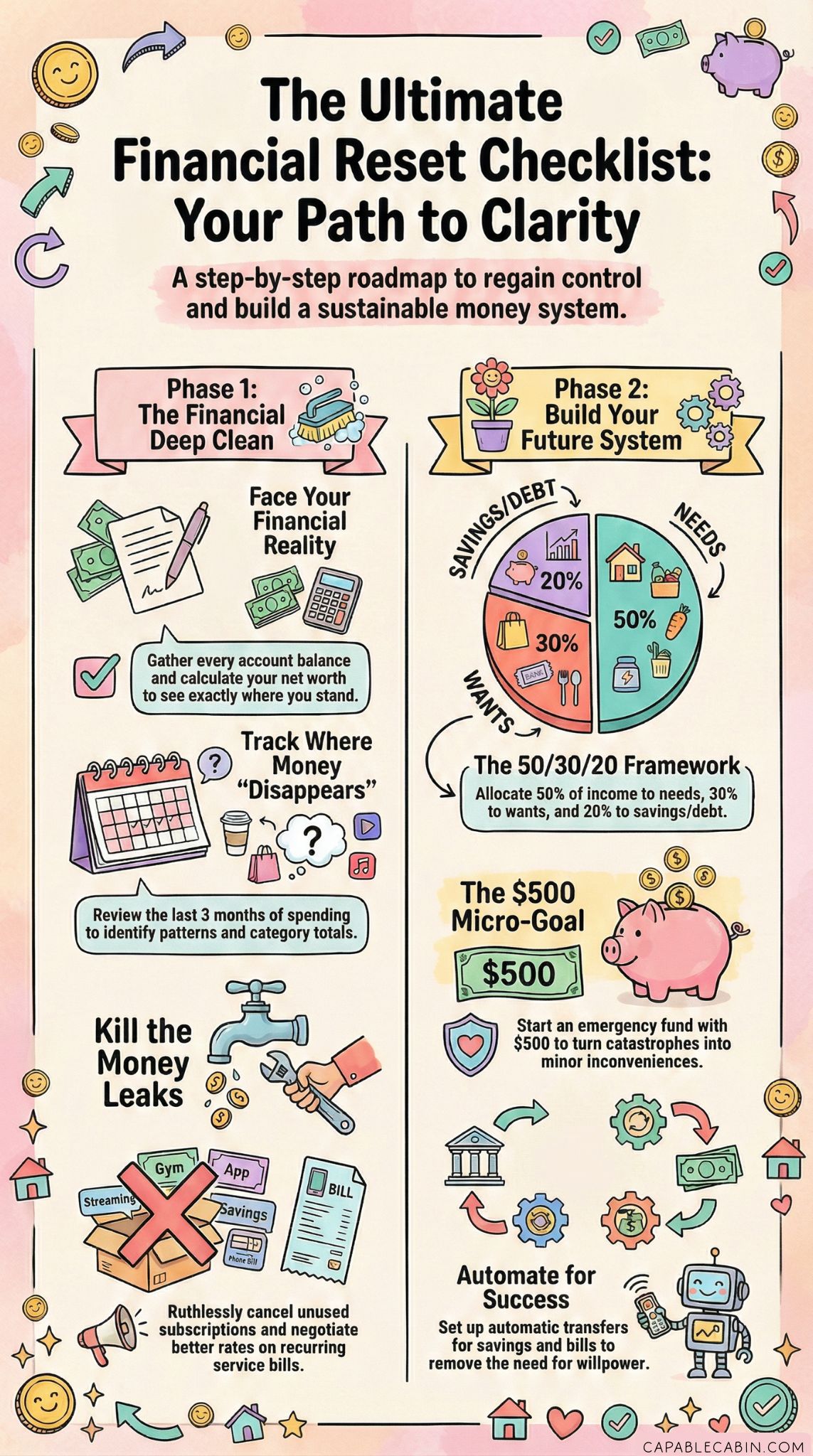

Build a Low-Cost Emergency Fund

You don’t need thousands of dollars saved to benefit from an emergency fund, even if that’s often recommended. Every single dollar you set aside can relieve stress and protect you during a crisis. If you’re wondering how to get started without overwhelming your budget, here are a few tips.

Start Small And Steady

• Automatic Transfers: Set up an auto-transfer for a modest amount—maybe $5 or $10 a week—directly into a savings account. You’ll be surprised by how quickly it grows.

• Spare Change Strategy: Use cash? Toss your change in a jar. Use cards? Rely on apps that round up your purchases to the next dollar, funneling the difference into a savings pot.

Designate Multiple Funds

You might not be only dealing with evacuations in life. There could be medical costs, car repairs, or family emergencies as well. Create a basic financial recovery emergency fund for everyday surprises, and a separate evacuation emergency fund specifically for crisis scenarios that require you to pack up and go.

Stretch Your Budget

• Cancel Unused Subscriptions: If you’re not streaming something regularly, that’s a few dollars a month you can redirect to your emergency fund.

• Negotiate Bills: Call your utility or phone company and see if they can offer a discount or a new deal. It feels uncomfortable, but you’d be surprised by how often a polite request pays off.

• Buy In Bulk Mindfully: For items like canned goods or toiletries, buying in bulk can be cheaper in the long run, especially during sales. Keep an eye on coupons or loyalty programs.

Even if you’re only able to stockpile a small sum, it’s worth celebrating. A little cushion goes a long way toward covering expenses like temporary lodging, gas, or additional safety measures.

Collect Affordable Supplies

Emergency supplies can quickly get expensive, especially when you see brand-name preparedness kits. Yet, plenty of trustworthy, lower-cost options exist. The key is knowing what you need most, and focusing on finding deals that fit your budget.

Shop Strategically

• Dollar Stores: You’ll often find discounted first-aid items, cleaning supplies, and basic tools. Just check expiration dates on items like batteries.

• Thrift Shops: Secondhand shops can be goldmines for sturdy backpacks, blankets, pots, and cooking utensils—everything you can use to piece together your kit.

• Seasonal Sales: Keep track of off-season clearances. Camping gear, for instance, can get steeply discounted at the end of summer.

Build Your Go Bag Over Time

Instead of feeling you have to buy everything at once, gather your gear slowly. This spreads out the cost and gives you time to watch for sales or special offers. If you need tips on a financial approach to assembling your kit, consider building a financial evacuation go bag. This can guide you on pairing physical items with critical money-related documents.

Focus On Must-Have Items

- Three Days’ Worth Of Non-Perishable Food: Think canned soup, protein bars, or dried fruit.

- Sufficient Drinking Water: Aim for a gallon per person per day, at least for a couple of days.

- Medications and First-Aid: Ensure you have enough of your or your family’s prescriptions. Add bandages, antiseptics, pain relievers, and any specialized medical gear.

- Light and Power: Flashlights, battery packs, and a hand-crank radio if you can swing it.

Staying flexible and open to gently used or budget-friendly items can help you put together a robust emergency supply kit without derailing your financial stability.

Plan Evacuation Routes And Shelters

When you need to leave home quickly, time is precious. Mapping out your evacuation routes in advance and knowing where you’ll stay can prevent you from spending on last-minute, overpriced solutions. Plus, clarity on where you’re heading eases a lot of the stress that comes with rushing.

Chart Your Exits

• Multiple Options: Don’t rely on only one path out of town, especially if it’s a main highway that might get clogged. Look for side roads or alternate highways in case your primary route is blocked.

• Family Meeting Points: Choose easy-to-find locations where everyone in your household can regroup if you get separated. It might be a local park or a friend’s driveway.

Budget For Lodging

• Free Shelters: Many municipalities open shelters during emergencies. Knowing their addresses ahead of time can save you a hefty hotel bill.

• Friends and Family: A phone call or text in advance goes a long way. Let your loved ones know you might crash at their place if things go south. A supportive network can be more valuable than any pricey hotel reservation.

• Low-Cost Motels: If you can’t stay with friends, keep a shortlist of motels that are known to be cheaper—especially ones a bit outside the main city, since peak-demand costs can surge in central areas during a crisis.

Keep An Evacuation Budget Breakdown

If you’re worried about how quickly evacuation expenses add up—gas, lodging, extra food—it’s smart to check out or create your own evacuation budget breakdown. Outline potential costs for leaving home for a couple of days so you’re not caught off guard when booking accommodations or grabbing essentials on the go.

Protect Your Financial Assets

Evacuation doesn’t mean your financial responsibilities go on pause. Having a plan for your money mid-crisis ensures you can handle unexpected bills or emergency repairs without dipping into long-term savings. It also helps you get back on your feet faster once you return home.

Keep Digital Access Handy

• Online Banking: Make sure you have secure app or website logins for your bank, credit cards, and any loan accounts. This allows you to pay bills even if you’re miles away from home.

• Cloud Storage Of Receipts: If you buy crucial supplies or pay for repairs, save the receipts digitally. This documentation is essential for insurance or evacuation insurance claims later on.

• Secure Passwords: Use a password manager so you don’t have to remember complicated login info under stressful conditions.

Guard Against Fraud

• Notify Creditors: If you’re on the run from a hurricane or wildfire, let credit card companies know. They can keep an eye out for suspicious transactions.

• Freeze Credit (If Needed): If you worry about your personal data, a credit freeze can stop thieves from opening accounts in your name.

Stay On Top Of Insurance Details

• Health Insurance: Keep digital copies of your insurance card and check if you’re covered for medical care out of state or in a different region.

• Property Insurance: Knowledge of your coverage for floods, fires, or natural disasters is crucial. Understand your deductible and the claims process so you can request help promptly when you return.

A little bit of legwork beforehand can help you dodge stress, late fees, or identity theft during an already chaotic time.

Return And Recover Wisely

The journey doesn’t end once the crisis has passed. Returning home involves assessing damage, handling repairs, and figuring out how to piece your daily life back together. Having a cost-conscious approach that ranks what you need to do first and helps you save money as you rebuild.

Evaluate Damages Methodically

• Safety Check: If you suspect structural harm, gas leaks, or water damage, call professionals before going inside. Don’t risk your safety by rushing in.

• Photo Documentation: Snap pictures of every damaged area, no matter how minor. This visual record is invaluable for insurance claims.

• Prioritize Repairs: Start with what’s vital for habitability—roof issues, plumbing, or electricity. Cosmetic fix-ups can often wait.

Seek Aid And Information

Organizations like the Federal Emergency Management Agency (FEMA) in the U.S. or international relief agencies can sometimes provide financial help, temporary housing, or grants for essential repairs. Friends and neighbors might also have spare tools or equipment to lend. If you need more focused steps on handling the financial aftermath, reference a post-evacuation financial recovery guide that walks you through the next phases.

Revisit Your Budget

After you’ve seen the real cost of a crisis, be ready to tweak your savings strategy or spending habits. Adjust line items like groceries or entertainment for a while if it means you can pay for necessary repairs without taking on too much debt. If large-scale recovery is needed, consider building a financial crisis action plan to outline your long-term steps and guard your budget against future uncertainties.

Maintain Ongoing Preparedness

Let’s be real: no one wants to think about emergencies all the time. However, once you’ve laid the groundwork for an evacuation plan, keeping it up to date is easier than starting from scratch later. Regular check-ins help ensure your gear, funds, and strategies all remain relevant.

Update Your Plan Regularly

• Seasonal Tweaks: Each change of season can introduce new weather patterns, new routines with work or school, and different needs for your household. Note adjustments to your routes, supplies, or emergency contacts.

• Practice Runs: Schedule a family “drill” or a short “what if” scenario to see if your plan works. Even a simple talk-through can reveal gaps in your preparedness.

Refresh Supplies

Non-perishable food still expires eventually. Batteries drain over time, and clothing items you stashed away might no longer fit your children. Set a reminder to check your stash every six months to a year. Replace or donate items accordingly, remembering that doing so now can prevent bigger expenses later.

Keep Strengthening Your Financial Cushion

• Increase Contributions: If your income grows or your expenses shrink, consider boosting your weekly or monthly contributions to your emergency fund.

• Explore Insurance Options: Keep an eye on policy changes, coverage updates, and events that affect your insurance rates.

• Engage Your Community: Sometimes, local groups host workshops or share resources on low-cost disaster prep. Joining these can anchor you to supportive networks that swap tips, supplies, or moral support.

Through consistent, small steps, you build a powerful foundation that can handle sudden upheaval. And if you stumble? That’s okay. Pick up where you left off and keep your momentum going.

Final Thoughts

At the heart of any effective plan is the realization that money doesn’t have to be a barrier to safety. Whether you’re stockpiling supplies slowly, building a modest evacuation emergency fund, or reviewing your routes and backup lodging, each action counts. By staying creative, watching for deals, and involving the whole family in decision-making, you’re setting yourself up for a smoother path through whatever crisis life throws your way.

Remember, you don’t have to overhaul your entire budget overnight. Incremental progress—like setting aside a few extra dollars each week or updating the phone numbers in your emergency contact list—can make a tremendous difference down the road. It’s all about pacing yourself, celebrating each win, and knowing that a tight budget isn’t a dead end. You have tangible ways to protect your household financially while still providing the care and support your loved ones need during tough times.

Most importantly, you’re not alone. Everyone has their own journey of saving, planning, and adapting. When it’s time to act, trust that the consistent effort you’ve put in prepares you for a smoother, more confident exit if you ever need to leave home in a hurry. You’ve got this, friend—each step you take toward budget evacuation planning makes your family safer and your financial future stronger. Here’s to hoping you’ll never have to use it, but feeling ready if you do.