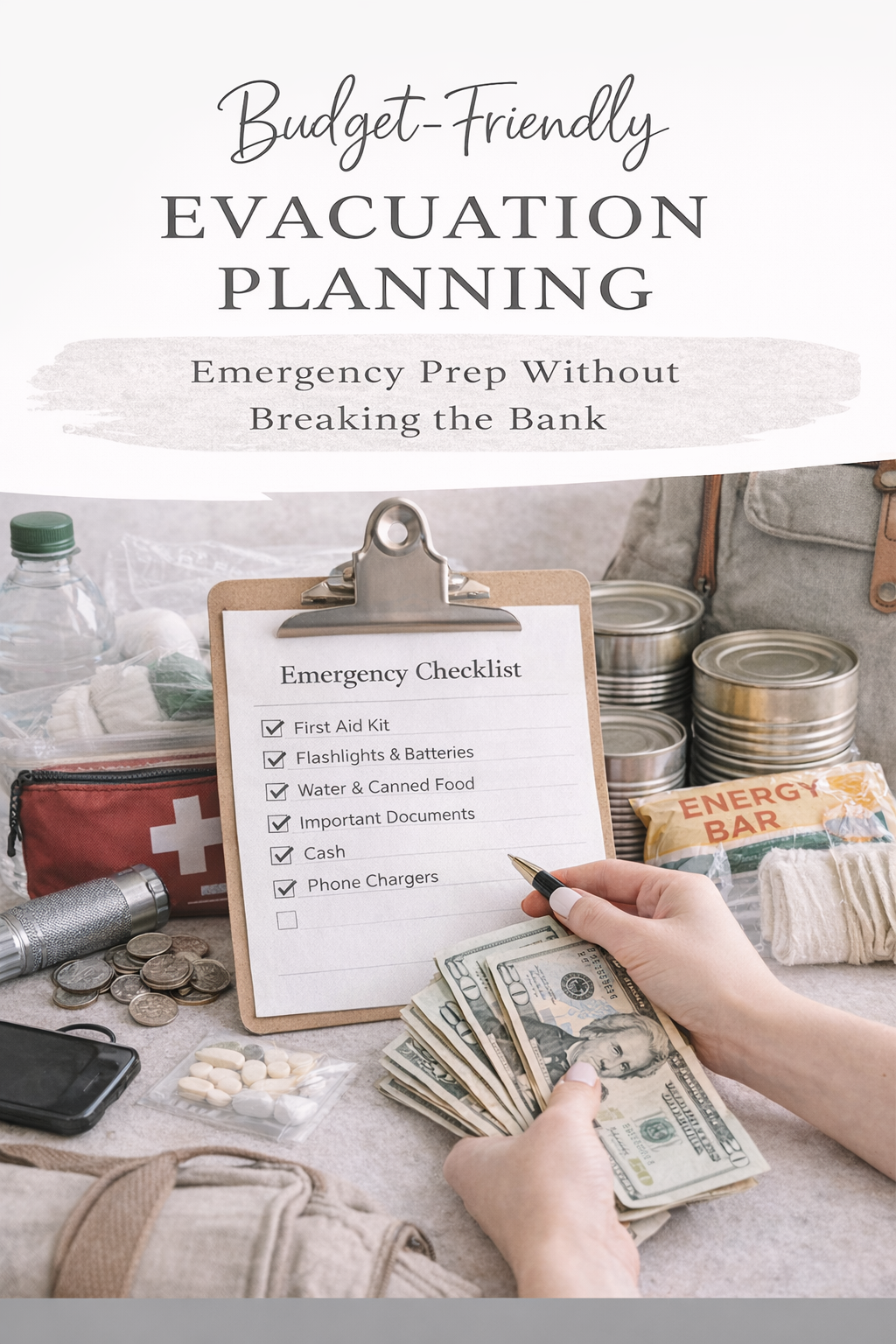

Financial Evacuation Go-Bag: Essential Money Items Checklist

Ever wonder what might happen if you had to leave your home at a moment’s notice? Maybe you’ve seen news stories about families forced to evacuate due to storms, wildfires, or sudden crises. It’s stressful enough gathering children, pets, and a handful of treasured possessions, but one of the scariest challenges is maintaining control over your finances. That’s exactly where a financial evacuation go bag comes in. By keeping all your crucial money-related items in one easy-to-grab kit, you can face an emergency without scrambling to find that misplaced insurance policy or fumbling for your ID under pressure.

Think of this as your trusted companion in uncertain times—a bag that brings you and your family a sense of stability, even when you’re on the run. In this list, we’ll dive into the essential money items you’ll want to stash in your go-bag. Each section highlights a key piece of the puzzle, from proof of identity all the way to a stash of petty cash in small bills. We’re in this together, so let’s get started by mapping out everything you need to ensure your financial world remains standing firm.

1. Acknowledge The Importance Of A Go-Bag

Before we get into the specifics, it helps to understand why a go-bag focused on your finances can be such a game-changer. Emergencies often strike without warning. Whether it’s a natural disaster, a sudden need to relocate due to safety concerns, or an urgent family matter far away, there’s no time to waste. When you’re already juggling your family’s well-being, your stress level can skyrocket if you’re worried about lost or disorganized financial documents.

- Emergencies move fast. If you ever need to evacuate quickly, you won’t have time to gather documents scattered across different folders, drawers, or digital accounts.

- Financial frustration grows under pressure. It’s easy to make mistakes—forgetting the only copy of an insurance contract or losing track of your bank information—when you’re rushing out the door.

- You want to protect your loved ones. Solid financial preparedness helps ensure that your family will have what they need, from proof of identity to quick access to funds.

Of course, no one wants to imagine crises. Still, being prepared is part of feeling secure. A well-assembled bag saves you from that last-minute scramble, cutting down on anxiety when every second counts.

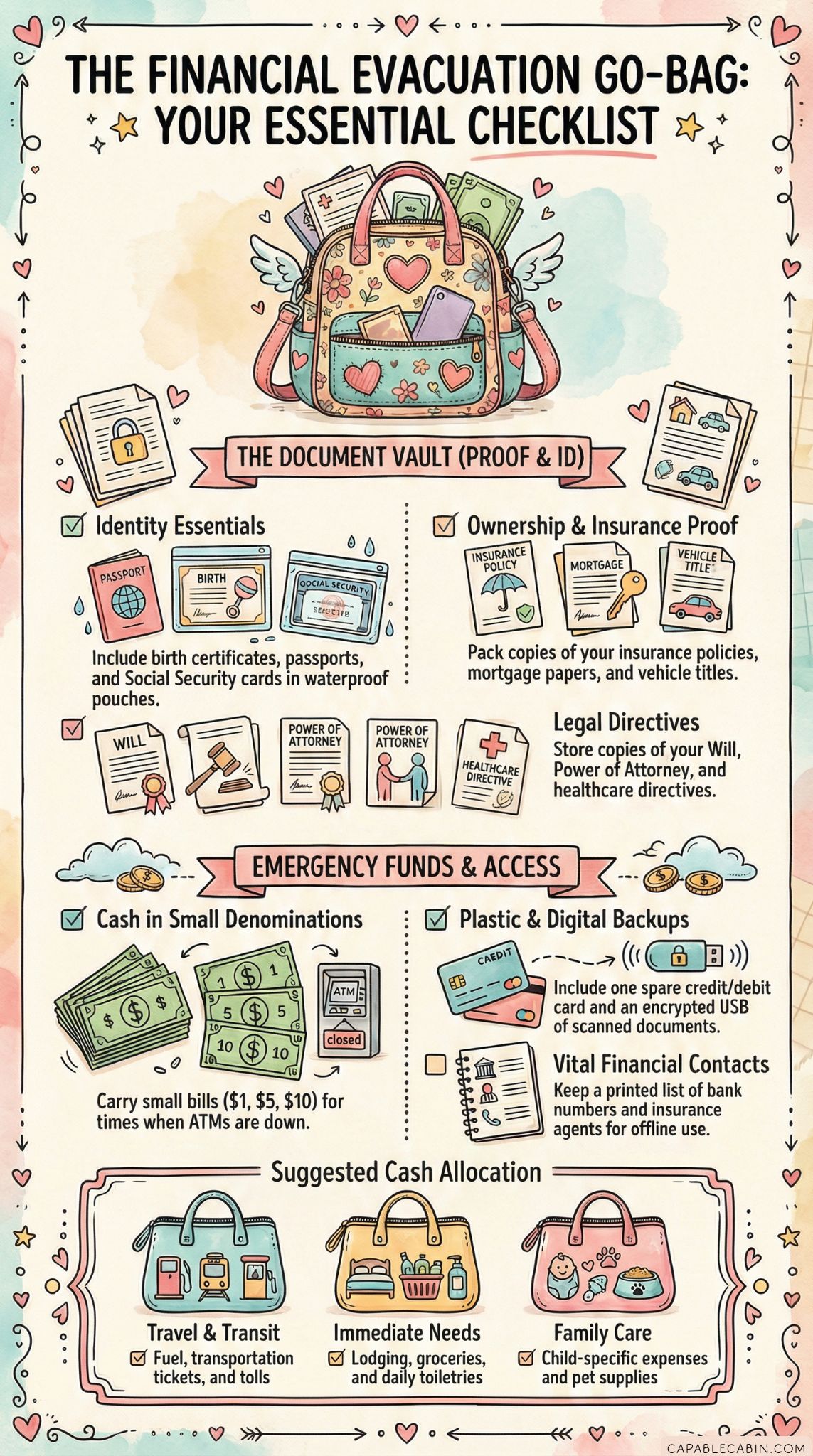

2. Gather Personal Identification Documents

Your personal documents are the foundation of your finances in any scenario. Without them, you could run into serious obstacles: from not being able to receive relief funds to having trouble checking into hotels, boarding an airplane, or proving who you are when seeking assistance. So let’s start with those key forms of ID.

Birth Certificates And Passports

Keep birth certificates and passports in sealed, waterproof folders. If you have children, make sure each child’s documents are included. These items prove your identity and nationality, which may be necessary for crossing state lines or international borders in a crisis.

Social Security Cards

While losing a Social Security card is never fun, having it on hand can be essential for applying for aid or showing proof of identity. A safe way to store them is to slip each card into its own protective sleeve before bundling them together.

Driver’s License Copies

Even if you think you’ll have your wallet with you, it’s still smart to include photocopies of your driver’s license (and that of your spouse or other adult family members). If you somehow misplace your wallet in the evacuation chaos, these copies can serve as partial proof of identity until you sort out a replacement.

Storing these key documents might feel nerve-wracking—after all, you don’t want them roaming around loose. A couple of tips to keep them safe:

- Use a sealed plastic or weather-resistant pouch.

- Label it clearly, so you can pull documents quickly if needed.

- Consider scanning electronic copies and storing them in a password-protected file on a flash drive (more on that later).

Pro tip: If you’re worried about theft, you can store your originals in a safe deposit box, but you’ll still want official or certified copies on hand in your bag for immediate access.

3. Secure Cash On Hand

In a digital world, it’s easy to forget that sometimes you just need physical money. During an emergency, banks could be closed, ATMs might be down, or power outages could make credit card machines useless. Having cold, hard cash in your financial evacuation go bag allows you to buy essential supplies or pay for transportation without worrying about technology working against you.

How Much Cash To Carry

The exact amount may differ based on your family size, region, and personal comfort. Some people like to keep at least a few hundred dollars set aside, while others aim for more, especially if they live in areas frequently hit by hurricanes or wildfires. Think about common evacuation-related costs, like:

- Lodging for a night or two

- Fuel or transportation tickets

- Groceries, snacks, or meals on the go

- Miscellaneous daily items (like diapers, medicine, toiletries)

Denominations Matter

While having large bills sounds convenient, imagine trying to buy a $3 snack with a $50 bill. If electricity is out, that vendor might not have enough change. Pack a variety of smaller bills, such as $1, $5, $10, and $20, to cover different needs. A few rolls of coins can also come in handy, although you might not need too many if you’ve got a good range of smaller bills.

Storage Tips

Separate your cash into labeled envelopes, or at least wrap them in a band with a note indicating the total. This small step saves you from having to count bills frantically in a crisis. Also, consider stashing the envelopes in separate parts of your kit. If something gets lost or stolen, you won’t lose your entire cash supply.

If you’re worried about your emergency stash dwindling because you might borrow from it for day-to-day expenses, treat this bag as off-limits. Think of it as an extension of your evacuation emergency fund or your rainy-day stash. It exists solely for crisis use. That’s the best way to keep everything intact and ready for action.

4. Keep Credit And Debit Cards

Yes, cash is king when power is out or ATMs fail, but credit and debit cards can be indispensable if you’re traveling through areas that still have functioning payment systems. If you’ve ever panicked because you misplaced a wallet while on vacation, you know how important it is to have alternative payment methods.

Spare Cards

You don’t want to overload your purse or bag with too many. However, having at least one spare credit card and one debit card (maybe from different banks) ensures you have a fallback option if your primary card malfunctions or is lost. Keep them secure in a small cardholder or a zippered pocket in your go-bag, so they don’t accidentally slip out.

Contact Information For Your Bank

Jot down your bank’s customer service numbers or store them digitally. If anything happens to your card—like a suspicious charge or a lost PIN—you’ll need to contact your bank fast. Having your bank’s direct line can make the difference between quickly freezing an account or facing further complications.

Storing The PINs

If you’re someone who worries you might forget your PIN under pressure, consider writing a hint or partial digits in a coded form. Don’t write the entire PIN plainly on a sticky note along with your card number, but do keep a subtle reference that helps you recall it. Alternatively, lock the details in a password-protected note on a flash drive, or rely on a small phone-based secure app if that’s safer for you.

In the whirlwind of an evacuation, dealing with financial card woes is the last thing you need. By preparing backups and crucial information, you’ll be able to pay for that unexpected hotel stay or medical expense, no matter how chaotic the situation feels.

5. Include Insurance Details

Insurance might not be the most exciting topic, but in an emergency, it’s absolutely critical. From filing claims after a natural disaster to making sure medical care is covered if someone gets hurt, having immediate access to relevant insurance documents can spare you a mountain of headaches.

Health Insurance Cards

If you’re caring for family members, keep copies (physical and digital) of everyone’s health insurance cards. You might be miles away from your usual hospital or clinic. Having your card on hand helps new providers process coverage, so you’re not paying out of pocket for everything.

Homeowner’s Or Renter’s Insurance

In the wake of a property-related crisis, such as a flood or tornado, that policy number is priceless. Even if you can’t get back into your home or have limited phone service, start the claims process as soon as possible. Store a copy of your policy or a summary with policy numbers, coverage details, and your agent’s contact information.

Vehicle Insurance And Registration

If you’re evacuating by car, or even if your vehicle gets damaged while you’re away, you’ll need quick proof of coverage. Make sure your auto insurance card and vehicle registration are included. Keep them in a separate labeled zip bag within your go-bag to avoid confusion with other papers.

Life Insurance Policies

Life insurance might be an awkward subject, but emergencies can have tragic consequences. At the very least, keep a copy of the policy’s face page that shows the policy number, coverage, and the company’s contact details.

Having these documents can also smooth major transitions if you need to file evacuation insurance claims. If the worst happens, the last thing you want is to fight for coverage simply because you can’t provide the right documentation in time.

6. Prepare Vital Financial Contacts

Let’s say you’re in a shelter or a relative’s home, and your phone battery died. Suddenly, you realize you can’t recall the exact phone number for your financial advisor or the claims department for your insurer. You could go rummaging through emails—provided you have an internet connection—but who wants that hassle in a time-sensitive crisis? This is why you want a physical, printed list of must-have phone numbers, mailing addresses, and websites.

Whose Numbers To Include

- Your bank’s main branch and customer service line

- Credit card company hotlines

- Insurance agent or company claims department

- Mortgage or loan officers

- Trusted financial advisor, if you have one

- Tax preparer or accountant you rely on

Why Print Them

Technology is a lifesaver when it works. But if there’s no signal or your device fails, you might feel stranded. Having a printed copy of these contacts ensures that even if your phone is lost, broken, or out of battery, you can use a borrowed phone to make critical calls.

Consider A Digital Backup

If possible, keep a password-protected contact list on a USB flash drive. Label that flash drive clearly, and store it in a secure pocket or zipped compartment. That way, if you regain digital access, you can just pull up the exact info.

Staying organized with these contacts means you’ll spend less time scrambling and more time focusing on getting your family to safety—and that peace of mind is priceless.

7. Copy Home And Vehicle Documents

Let’s talk about all those other documents that keep your life running smoothly, like a mortgage agreement, lease contract, or car title. Losing them or not having them on hand can slow down your next steps if you’re trying to relocate temporarily, sell a vehicle, or verify ownership of your home in a claims dispute. So if you’re getting your bag ready, add these to your list.

Mortgage Papers Or Lease Agreements

If you own a home, keep a copy of your mortgage statement or property deed. If you rent, have your lease contract on hand. If you need to apply for temporary housing or disaster relief, proof of address and financial obligation can help you receive immediate assistance.

Car Title Or Loan Documents

For many, a vehicle is the main mode of evacuation. If your car gets damaged, or you need to prove ownership, having a copy of the title or loan details is crucial. You never know what might happen during a crisis—maybe you’ll need to sell your car or transfer ownership to a family member out of state.

Maintenance And Warranty Records

While this might seem extra, including major repair receipts or warranty documents can be helpful if you’re traveling far. Suppose your vehicle breaks down, and you need to show proof of a recent repair to get a warranty-covered fix. Having these papers can save you from unexpected costs.

Feel free to keep these documents truncated to just the key pages if you want to save space. But do ensure you’ve got the pages that prove your financial and ownership details. And like everything else, keep them together in a sealed pouch. You’ll be grateful you have them if you need them.

8. Organize Digital Records And Backups

Our world isn’t just about physical papers anymore. Most of us access paystubs, tax returns, and utility bills online now. In an emergency, though, you might not have stable internet or the time to log in to a dozen portals. That’s where digital backups can be a lifesaver.

USB Flash Drive Or External Hard Drive

Load this drive with encrypted copies of your key documents:

- Tax returns (last few years)

- Bank statements

- Insurance policies

- Scans of IDs and passports

- Family medical records or prescriptions

Use strong passwords to protect sensitive files. If possible, invest in an encrypted drive for heightened security.

Cloud Storage As A Backup

If you’re comfortable with it, keep a version of these documents in secure cloud storage, like a locked folder in Google Drive or another reputable platform. It’s a safety net if you lose your physical drive, but remember that in a crisis, internet access could be spotty. That’s why physical backups are so important.

Password Management

It’s no secret we juggle multiple accounts and logins daily. Consider jotting down your most critical usernames in a separate note or, better yet, use a secure password manager. Many managers let you print an emergency kit with recovery codes you can store offline. That way, you’re not left stranded if you can’t recall your complicated 16-digit password for your main email account.

You might also want to check out how to manage your evacuation digital finances if you’re looking for a comprehensive strategy to handle online transactions and account management during or after a crisis. By thinking ahead, you’ll be poised to handle unexpected challenges—whether it’s paying bills on the go or accessing crucial funds remotely.

9. Add Emergency Payment Tools

There’s no single perfect payment tool for every situation. You might think you’re all set with a single credit card and some cash. However, in the swirl of an evacuation, you can find yourself in scenarios where you need alternative options. Imagine a family member needing funds across the country, or you need a secure way to pay a contractor for emergency home repairs. Some extra measures can smooth out these rough patches.

Prepaid Debit Cards

Prepaid cards can be loaded in advance, so you have a predefined amount of money ready to spend. They act like gift cards but allow you to buy from a broader range of places, including online. If your usual accounts get locked or if the bank’s systems go down, having at least one prepaid card can keep you afloat.

Mobile Payment Apps

Apps like PayPal, Cash App, or similar platforms can be a handy fallback. If your phone is working and a merchant or helper can accept mobile payments, you can handle transactions instantly. Just remember to keep your phone charged and your account topped up. A portable power bank in your bag isn’t a bad idea either!

Traveler’s Checks

While somewhat old-fashioned, traveler’s checks still offer a layer of security. If they’re lost or stolen, they can be replaced, unlike some forms of cash. If you’re crossing larger distances or might end up in a place where local banks honor them, it could be worth including a minimal amount in your kit.

When you layer these payment methods, you give yourself more ways to navigate financial roadblocks. You never know where you’ll end up staying or what local resources will be available. Keeping alternative payment solutions in your go-bag is all about flexibility—and that can make a world of difference when every minute seems uncertain.

10. Store Essential Legal Agreements

In addition to financial documents, certain legal papers can prove invaluable if you need to make big decisions under stressful circumstances. Even though it can feel daunting to include them, doing so can protect you from a range of issues.

Power Of Attorney

If for some reason you’re incapacitated or unable to handle your own finances, a durable power of attorney document outlines who can manage your affairs. Imagine you’re hospitalized and need someone else to pay bills or negotiate with insurance on your behalf. Having that authority spelled out ensures that your family is empowered to act fast.

Will And Testament

Yes, it’s tough to think about, but crises can escalate quickly. If you pass away without a will, your family may spend a lot of time and money resolving your estate. Storing a copy with your bag doesn’t mean you expect the worst. It just ensures everyone knows your wishes if things go south.

Living Will Or Advance Healthcare Directive

If you already have a living will, this outlines what kind of medical care you want (or don’t want) if you can’t speak for yourself. In a dire situation, these documents guide healthcare providers and inform your loved ones’ decisions.

Even if you keep original legal documents in a secure location like a safe deposit box, having certified or notarized copies in your evacuation kit means you can still proceed with essential tasks if you’re cut off from your usual storage spot. It’s a measure that can prevent delays and heartaches later on.

11. Plan For Family Needs And Extra Comfort

A financial evacuation go bag doesn’t just center on your banknotes and paperwork. It’s also meant to keep crucial aspects of daily life afloat when you’re away from home. If you have children, an elderly family member, or pets, their well-being hinges on not simply having money, but also the supplies and information that money can’t always buy at the last minute.

Kid Essentials

- Copies of immunization records, which could be required by childcare facilities or schools in other regions

- A small sum set aside for kid-specific travel or lodging expenses

- Contact information for pediatricians, therapists, or other specialists

Pet Coverage

If you have pet insurance (yes, that’s a thing!), keep those documents together. You never know if your furry friend might fall ill during a chaotic move. Consider stashing some emergency vet funds too.

Medication And Prescriptions

You can’t buy certain prescriptions over the counter, so keep a small supply of vital meds in your bag, plus a copy of each prescription and the pharmacy’s phone number. If you have kids on special medication, ensuring you have at least a week’s supply or a way to refill quickly can ease one major worry.

It’s not just about having these items physically present, but about a financial plan to replace or replenish them if needed. If you’re trying to figure out how to budget for everything, check resources like budget evacuation planning, which helps you break down the costs of an evacuation scenario. Knowing that you’ve addressed all family members’ needs makes any abrupt departure feel a bit more manageable.

12. Maintain An Evacuation Budget Plan

It’s one thing to fill a bag with documents and hope for the best. But what about the expenses that pop up after you leave home? That’s where planning a rough evacuation budget can come to the rescue. It covers things like short-term lodging, transportation fees, and daily essentials. You can even think of it as an extension of your financial crisis action plan, tailored specifically for an evacuation scenario.

Possible Budget Categories

- Lodging: Hotels, shelters, or temporary rentals

- Travel: Gas money, bus or train tickets, or airfare

- Food: Groceries or takeout if you don’t have cooking facilities

- Pet Care: Kennels, pet-specific supplies

- Personal Necessities: Toiletries, clothing, children’s items

Keep It Realistic

Try to approximate how much you might spend if you had to vacate for at least a week. Could you cover a couple of nights in a hotel? What if you have extended stay costs or you need to put a deposit on temporary housing? By outlining these hypothetical costs, you’ll be better prepared to handle unexpected price jumps and other curveballs.

Incorporate This Budget Into Your Go-Bag

Include a written note or a simple spreadsheet in your kit, showing estimated costs in each category. In a stressful moment, you won’t want to do the math from scratch. You’ll have a quick guide, which also helps you avoid overspending on the very first day, only to realize you’re short on cash by day three.

If you’re still mapping out how to build or strengthen an emergency fund, consider reading more about the evacuation budget breakdown. It can offer tips on optimizing your finances so that the money you set aside for unforeseen circumstances doesn’t jeopardize your regular household budget.

13. Plan For Recovery And Return

If an evacuation is extended, or if your home is actually damaged, your financial responsibilities don’t just stop when you’ve reached temporary safety. Recovery can be a lengthy, costly process. Having at least a broad plan for how you’ll handle the after-effects is crucial for your overall well-being. It may even shape the items you stash in your bag.

Potential Recovery Costs

- Home repairs or rebuilding

- Replacement of lost valuables (clothes, electronics, furniture)

- Insurance claim deductibles and co-pays

- Temporary living expenses beyond your initial plan

- Re-establishing utilities or services

Building A Roadmap

It’s helpful to outline a step-by-step approach to returning or relocating:

- Assess the damage as soon as it’s safe.

- Contact your insurance provider with up-to-date details.

- Keep track of receipts for every recovery-related expense.

- Document and photograph damage if possible. This helps with claims and reimbursement.

You might also want to bookmark or save references about post-evacuation financial recovery. That way, when you’re ready to rebuild your life, you won’t face a confusing maze of paperwork and phone calls without a plan. Folks often underestimate how long emotional and financial stress can linger after a major crisis. Having a blueprint for returning or restarting helps keep your spirits up and your bank account intact.

14. Keep Your Kit Current And Complete

Putting a financial evacuation go bag together is a remarkable first step. But you know how life goes: documents expire, credit card accounts change, kids grow up, and new financial obligations pop up. If you don’t revise your kit periodically, it might become outdated right when you need it most.

Schedule A Review

Try setting a recurring reminder—maybe every six months—to open your bag, review its contents, and make necessary updates. Check expiration dates on IDs, ensure all your insurance policies are still valid, and confirm contact information if any providers have switched phone numbers.

Rotate Cash And Cards

If your bag includes spare credit or debit cards, ensure you keep track of expiration dates. The same goes for cash: if you’ve dipped in for an emergency run to the store (it happens!), make sure to replace those bills so you’re not caught short later.

Update Digital Files

Don’t forget about your USB flash drive and any cloud storage. You might have changed your bank or updated an insurance policy. Regularly uploading current statements or policy details ensures that the digital files stay in sync with your actual finances.

It might feel repetitive, but each review is a quick check-in to ensure your kit truly reflects your family’s current status. That sense of readiness is what makes all the difference when a real crisis forces you to grab that bag and go.

15. Embrace Prep As A Lifestyle

Building a go-bag (especially one so intensely focused on finances) can feel like a project you do once and forget. But real preparedness is more of an ongoing mindset. It’s about intentionally setting aside time to think through potential scenarios, reevaluate your resources, and add or remove items as life evolves. Rather than letting the unknowns paralyze you, you start to realize how much power you have to shape your response to emergencies.

Regular Check-Ins

On top of your scheduled review, whenever major life changes happen—like a job change, a new addition to the family, or moving to a new area—take that as an opportunity to see if your go-bag needs a refresh. It’s a gentle reminder that your finances aren’t static.

Community And Education

You don’t have to handle financial planning for emergencies alone. If your community organizes workshops on pandemic financial planning or evacuation financial planning, consider attending. These events can provide new insights, resources, or best practices you might not have considered.

Encourage Loved Ones

We’re all in this together, right? If you find the idea of a financial go-bag helpful, spread the word. Whether it’s your elderly neighbors or your adult children who recently moved out, encourage them to build their own kits. This sense of collective readiness can do wonders for community resilience.

Ultimately, the best tip is to keep your mindset flexible. Emergencies don’t follow neat guidelines. You may need to adapt quickly. But with a thorough, well-maintained financial evacuation bag, you’re far more prepared to navigate the journey—wherever it takes you.

You’ve Totally Got This!

Putting together a financial evacuation go bag might seem like a mountain of tasks, but trust me, it’s worth the effort. When you can confidently say you have ID, cash, cards, and all essential financial documents in one grab-and-go spot, the weight on your shoulders lifts. You can use that freed-up mental energy to focus on keeping you and your family safe during an evacuation.

Take it one step at a time. Gather those birth certificates, stash some cash in smaller bills, print a set of vital contacts, and slip in your insurance policies. Celebrate each small win along the way—because every single item you add makes you and your loved ones that much more secure.

Yes, emergencies can be scary. But you’re not alone in that fear. We’ve all felt that pang of uncertainty, wondering how we’d cope if we had to leave home abruptly. By preparing, you’re giving yourself and your family a powerful gift: the ability to handle hard times with a lot less panic. And that, friend, is something truly invaluable.

So here’s to your financial peace of mind, your family’s security, and the feeling of accomplishment you’ll have when you zip up that bag for the first time. Keep it updated, stay flexible, and remember—you’ve got this. And if you ever need a quick refresher on how to organize your finances in a crisis, just know that your go-bag is there, stocked with the security you need to navigate whatever comes next. Safe travels, and stay prepared!