The Complete Evacuation Money Guide: Financial Survival When You Have to Leave

Ever worry about what happens to your finances if you suddenly need to evacuate? That’s the heart of evacuation financial planning, and it can feel overwhelming at first. Maybe you’ve got a family counting on you, and the stakes feel high. Trust me, I’ve been there. The thought of picking up and leaving on short notice due to a storm, a wildfire, or another crisis can bring on sleepless nights. You start imagining all the costs: travel expenses, lost wages, emergency lodging. It’s enough to make your head spin.

But here’s the good news: you don’t have to navigate this on your own. There are tried-and-true steps that can help you protect your money, your peace of mind, and your loved ones when a crisis strikes. In this ultimate guide, we’ll walk through how to set up financial safety nets, organize essential documents, and stay flexible in an ever-changing world. Evacuation doesn’t have to mean chaos and financial strain. By taking a few smart, proactive measures, you’ll be able to leave quickly, return safely, and recover more smoothly. So let’s tackle each step as if we’re two friends sorting it out together. Ready? Let’s do this.

Understand Evacuation Financial Planning

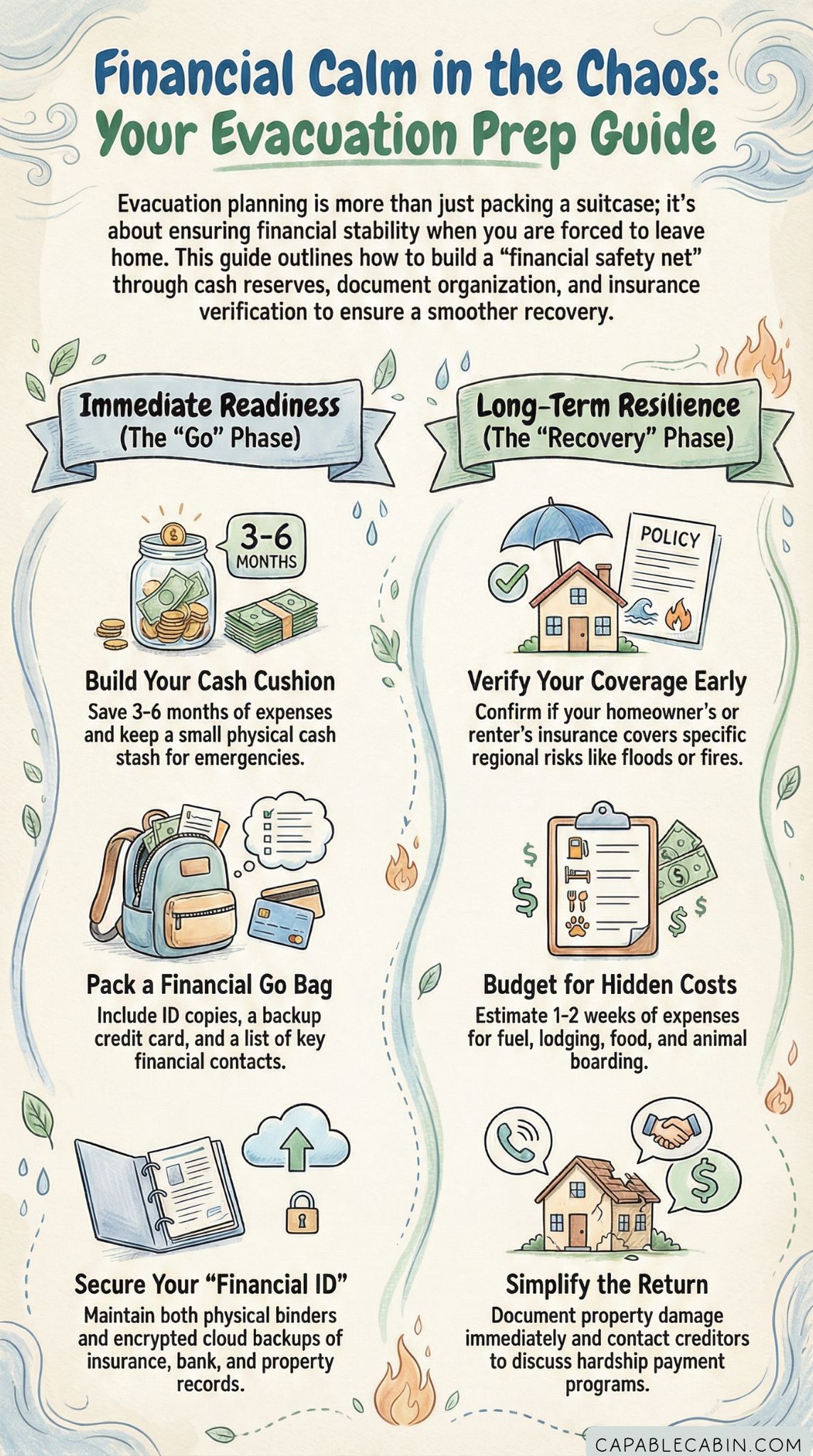

Before we dive into the nuts and bolts, let’s talk about why evacuation financial planning matters. If you’ve ever faced a crisis—maybe a hurricane warning or a local emergency order—you know that preparing for the physical side of evacuation is only half the battle. The other half is making sure your wallet, bank accounts, and financial backups are in order.

- People often assume they can grab a few essentials, hop in the car, and figure out expenses later. Unfortunately, that “later” can balloon into weeks or months of confusion if you’re not equipped with a plan.

- Having a clear financial roadmap lets you handle costs for shelter, food, and basic needs without draining your long-term savings.

- It also ensures that you have critical documents on hand, so you can prove your identity, file insurance claims, and handle urgent transactions wherever you land.

When you plan finances for an evacuation, you’re essentially giving yourself and your family a safety cushion in unfamiliar circumstances. It’s about creating a streamlined approach that says, “Yes, we can handle this.”

If you’re new to this whole process, you might consider carving out time to develop a financial crisis action plan. This plan outlines all the critical moves you’d make if a sudden crisis forced you to leave or drastically alter your daily routine. You don’t have to do it perfectly right away—small steps are often enough to give you genuine peace of mind.

Assess Potential Risks

We all live with different environmental and community hazards. Perhaps you deal with frequent storms, while another family worries about wildfires or flash floods. Identifying your specific vulnerabilities is a key step in evacuation financial planning because it shapes your priorities. If you’re unsure where to begin, a quick chat with your insurance provider or local emergency management office can shed light on the most likely threats in your region.

Here’s a thought: make a bullet list of every natural or industrial hazard that could affect you:

- Hurricanes or tropical storms

- Wildfires

- Flash floods or heavy rainfall

- Earthquakes

- Industrial accidents (like chemical spills)

- Pandemics or widespread health crises

From there, ask yourself how each scenario might impact your finances. Would you lose work hours? Potentially need hotel stays? Need extra gas money to get out of town? By reviewing these possibilities, you’re better prepared to budget for an evacuation. If you haven’t already, it might help to research pandemic financial planning too, especially if a health crisis could prompt you to leave home unexpectedly.

Above all, remain flexible. Risks and local conditions can change rapidly, and the best strategy is to keep your plan updated each time you learn something new. Each time you refine your evacuation plan—maybe you find a safer route or discover a better app to track emergencies—you can also refine your financial approach.

Establish Your Emergency Fund

An emergency fund is the cornerstone of any evacuation financial plan. If you have quick access to cash, you can cover lodging, food, fuel, and other urgent expenses the moment you have to leave. A sturdy emergency fund typically holds three to six months’ worth of living costs. But if that seems intimidating, start smaller. Even setting aside a few hundred dollars can make a world of difference if you need to evacuate on short notice.

Where you keep those funds matters too. Some people prefer a mix of a financial recovery emergency fund stored in a bank account plus a smaller, physical cash stash at home. It might feel old-school, but when ATMs are down or card readers aren’t working, a bit of ready cash can cover the basics. Consider having at least a portion of your money in a separate bank account you don’t touch day to day, so you’re not tempted to spend it.

No matter how tight your monthly budget is, treat this fund like a non-negotiable expense—just like your utility bill. You can automate a small transfer from each paycheck to keep it growing steadily. If you’re already saving for an evacuation emergency fund, great job. Just be sure it’s easily accessible, so you’re not scrambling for your login credentials during a crisis. Trust me, speaking from experience, the last thing you need in an emergency is an “account locked” message when time is of the essence.

Gather Necessary Documents

When you’re in the middle of an evacuation, having the right documents on hand can save you headaches—and money. In stressful times, you don’t want to fumble around searching for birth certificates, insurance papers, or proof of residence. Focus on collecting both physical and digital copies of critical records, so you have multiple layers of backup.

Here are some documents you’ll likely need:

- Identification: Driver’s license, passport, Social Security cards

- Financial: Bank statements, investment account details, loan documents

- Insurance: Home, renters, auto, health policies

- Property Records: Mortgage, lease agreements, vehicle titles

- Medical: Prescriptions, immunization records, contact details for doctors

Once you have these items together, consider placing physical copies in a secure folder or binder. That same binder might also hold your financial evacuation go bag essentials, like emergency cash and a backup credit card. To keep your sensitive info protected, you can use sealed plastic bags or waterproof pouches—helpful if floods or heavy rain are in your area.

Let’s delve into digital options in a moment, but remember, documents are basically your “financial ID” when you’re away from home. The more organized you are upfront, the smoother it’ll be to make lodging reservations, file evacuation insurance claims, or prove you reside in a certain city if local aid becomes available.

Protect Digital Assets

We live in a digital world, which can actually make evacuation financial planning a bit easier. When you have secure online access to bank accounts, credit cards, and important files, you can stay on top of your finances even if you’re miles away from your house. The key is to balance convenience with security.

That’s where evacuation digital finance protocols come into play. Start by setting up:

- Online Banking: Make sure you have updated login credentials for every bank and credit card you use.

- Cloud Storage: Store scans of your most important documents in a password-protected folder; ideally, use a platform that also offers two-factor authentication.

- Password Manager: Keep all your usernames and passwords secure in one place, so you’re not relying on scattered sticky notes or your memory in a crisis.

You’ll also want to practice safe online habits: use strong passwords (a combination of letters, numbers, and symbols) and enable multi-factor authentication wherever you can. If your phone ends up lost or damaged during an emergency, having backup access to your financial portals is invaluable. Maybe that’s an encrypted file on a USB drive or a secondary email address that you can log into from anywhere.

The true benefit of digitizing your finances is that you won’t have to rummage through your suitcase for an important statement or receipt. And if physical documents ever get damaged, you’ll still have proof-of-identity and proof-of-insurance on the cloud. It may seem like extra work now, but it often spells huge relief later.

Review Insurance Coverage

Insurance might be the last thing you want to think about, but it’s vital to evacuation financial planning. When you’re forced to flee, certain insurance policies can cover living expenses, temporary housing, and even property losses. Whether you rent or own, confirm what natural disasters and crises your policy actually covers.

Here’s a checklist of what to look at:

- Homeowner’s or Renter’s Policy: Check whether it includes coverage for floods, wildfires, earthquakes, or other regional risks. If these aren’t standard, an extra rider might be necessary.

- Auto Insurance: If you rely on your vehicle to evacuate, make sure your policy covers damage from severe weather or other hazards you’re likely to face.

- Health Insurance: Understand your network’s reach. If you evacuate out of state, you’ll want to confirm you can still get care without astronomical fees.

- Life Insurance: Not something we love to think about, but if you’re the primary earner for your household, it offers an extra layer of security.

When you’re going through your policies, note any deductibles or coverage limits. If you realize certain assets aren’t covered, this is your chance to make adjustments. Request clarifications from your insurance company if needed, and ask about expedited claims processes in emergency scenarios. Sometimes, insurers have special hotlines or online claim forms for disasters. Keep that info handy so you can handle evacuation insurance claims quickly if you need to.

Above all, don’t wait until the last minute to check your coverage. Insurance can be a financial lifesaver, but only if you fully understand what it does—and doesn’t—protect.

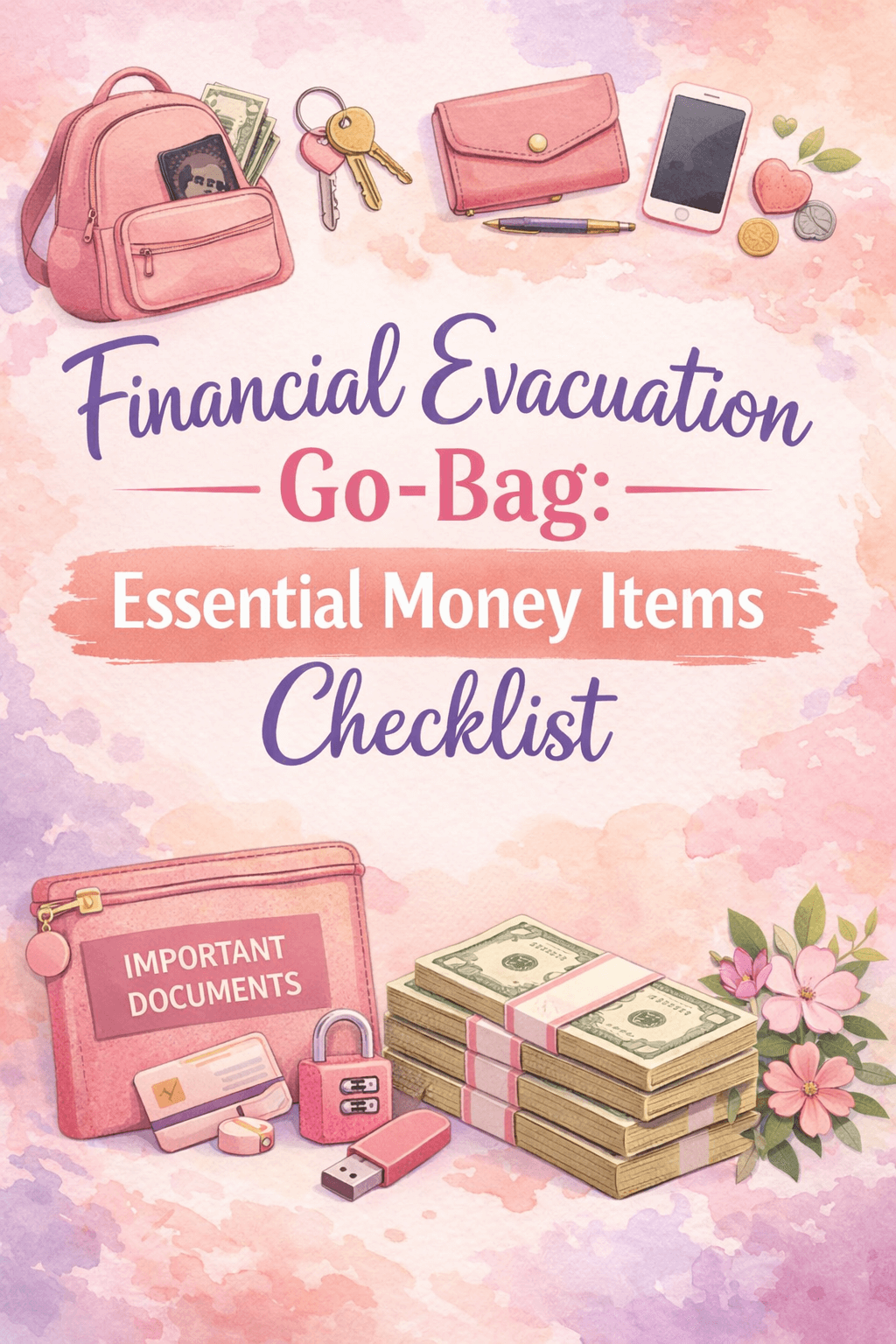

Assemble A Financial Go Bag

You might have heard of a basic “go-bag” filled with flashlights, bottled water, and first-aid kits. A “financial go bag” is similar, but specifically focuses on the money side of your evacuation plan. Think of it as a compact toolkit for quick, hassle-free access to your most essential financial documents, cards, and small valuables.

What goes inside it?

- A copy of your ID and perhaps your spouse’s or partner’s ID

- A backup credit or debit card (separate from the one you use daily)

- Some cash in small denominations

- Contact information for banking, insurance, and other key services

- A simple breakdown of your monthly expenses, so you know what bills to expect if you’re gone longer than planned

For ease, tuck these into a secure folder or bag within your larger emergency kit. Not sure where to begin? Check out a financial evacuation go bag list for detailed suggestions. You might also consider a portable phone charger and an external battery bank to keep your devices powered if you lose electricity.

This bag is your lifeline when you’re on the move—kind of like a safety net for your finances. If you’ve ever tried to buy groceries or gas in a different town, only to realize your card was declined or flagged for fraud, you’ll appreciate having a second or third payment option. And the physical documents mean you don’t have to scramble if your phone battery dies and you can’t access digital files.

Budget For Evacuation Costs

Evacuation often comes with a slew of hidden expenses: gas for a long drive, a last-minute hotel room, extra meals on the road, pet boarding fees, and more. This is where a budget evacuation planning approach can be a game-changer. By creating a dedicated “evacuation budget,” you’ll have a clear picture of the cash flow you need if you suddenly have to leave home.

Try grouping your potential evacuation expenses into categories:

- Transportation: Fuel, car maintenance, tolls, or flights if driving isn’t an option

- Accommodation: Hotel rooms, extended-stay motels, or even short-term rentals

- Food: Restaurant meals, groceries, bottled water

- Personal Needs: Medications, personal care items, pet supplies

- Miscellaneous: Extra phone chargers, laundry, child entertainment

Once you’ve listed these, estimate how much you’d need for about one to two weeks away, as many emergency evacuations last at least that long. This is where an evacuation budget breakdown can be handy. If you realize the total is higher than expected, it’s a sign you may need to beef up your savings or reallocate funds. It’s all about reducing surprises. Trust me, nothing adds more stress during an evacuation than checking your bank balance and realizing you can’t cover a night or two of hotel bills.

By giving yourself a cushion for these costs, you minimize the risk of high-interest credit card debt. As you refine your budget, communicate these decisions with family members or anyone else who might be financially impacted. When everyone’s on the same page, it’s easier to maintain a sense of unity and confidence in a crisis.

Plan For Post-Evacuation Recovery

Once the crisis subsides and you’re allowed to return home, that doesn’t mean the financial strain magically disappears. Sometimes you’ll come back to damaged property, utility outages, or lost wages if your workplace was also affected. Having a roadmap for what happens after the evacuation is just as important as preparing to leave.

A few things to consider:

- Document Damage: Take photos and videos of your home or belongings as soon as it’s safe. This can speed up claims with your insurance company.

- Prioritize Repairs: Address urgent issues first, such as securing a broken window or fixing a leaky roof, so you don’t rack up additional damage.

- Seek Assistance: If your community has relief programs, apply as soon as possible. Local aid or nonprofit organizations often offer grants to help cover unexpected costs.

- Notify Creditors: Contact your credit card companies, mortgage lender, or landlord if you need to delay or adjust payments due to the crisis. Many creditors have hardship programs.

You might also want to create a post evacuation financial recovery checklist so you’ll know exactly which bills need attention and which claims you’ve already filed. It’s easy for tasks to get lost in the shuffle when you’re inspecting your home’s damage or searching through piles of mail after a chaotic week.

Remember that emotional recovery is just as important. Evacuations can be mentally draining, and your decisions might feel clouded by stress or exhaustion. But by taking these organized steps—documenting damage, reaching out to creditors, seeking local resources—you’ll have a structured way to rebuild without letting financial troubles linger.

Stay Flexible And Informed

Crisis situations can evolve quickly, so it’s crucial not to think of your evacuation financial plan as a one-and-done deal. Keep an eye on weather alerts, community evacuation updates, and economic news that might affect your region. You could sign up for local text alerts, follow credible emergency management social media accounts, or even use apps that track changing conditions in real time.

If you see signs of a possible evacuation looming—like a severe weather watch or civil unrest—start taking small steps immediately. Pull out your financial evacuation go bag, top off your gas tank, and review your short-term budget. Maybe you’ll need to tweak your plan for a new type of disaster; for instance, a wildfire strategy might differ from a flood scenario. Stay nimble. If you’re curious about broader preparedness, you might also look into budget evacuation planning strategies that adapt to multiple crisis situations.

Finally, don’t hesitate to update family members or close friends about your plans. The more people who know where you’re headed and how to help, the more support you’ll have. It could be as simple as texting your new location to a trusted neighbor or letting relatives know which hotel you’ll be staying in. In uncertain moments, communication is your best ally.

Conclusion

Evacuation financial planning isn’t about being paranoid or expecting the worst. It’s about giving yourself, and those who depend on you, the confidence to act quickly and maintain stability in an emergency. By assessing your unique risks, building a dedicated emergency fund, gathering important documents, and crafting a flexible budget, you create a robust system that can withstand the unexpected.

Remember, you don’t have to tackle it all in one go. Pick one area—maybe setting up a separate fund or gathering digital copies of crucial papers—and start there. Every proactive step is a vote of confidence in your future security. And if you ever find yourself facing an evacuation, you’ll be equipped to leave swiftly, protect what matters, and recover once it’s safe to return. Sure, it might feel like extra effort now, but at the end of the day, you’ll rest easier knowing you’ve done everything you can to keep your family and your finances on solid ground.

We’ve all been in situations where life throws a curveball, and the difference often lies in how prepared we are when it happens. So go step by step, lean on your support network, and remember: you’re not alone in this. With each piece of planning you manage, you’re another step closer to a confident, secure future—even when you’re on the road to somewhere unexpected. You’ve got this.