Your Digital Financial Go-Bag: How to Access Money During an Evacuation

When a sudden crisis arises, and you need to evacuate, having a plan for your evacuation digital finances can be the difference between feeling secure and feeling utterly overwhelmed. Managing your money from afar might sound complicated, but trust me, you’re not alone. We’ve all been there, wondering whether we’ll have access to funds, important financial documents, and any accounts we rely on daily. But here’s the good news: if you prepare in advance, you can handle the unexpected with far less stress. In this piece, we’ll walk side by side and explore how to set up, protect, and maintain your digital finances so you can keep looking forward, even when the ground beneath you shifts.

Recognize The Need For Preparedness

None of us like to dwell on worst-case scenarios, but thinking about potential emergencies is the first crucial step. When a fire, hurricane, or any other disaster forces you to evacuate in a hurry, the last thing you want is to scramble for funds. So let’s acknowledge why being financially ready for evacuations is so important.

A crisis can strike at any time. That might mean you have to leave your home, possibly for days, weeks, or even months. You’ll likely need to pay for transportation, lodging, and daily necessities that can pop up unexpectedly. If you’re not set up with digital access to your accounts, you might find yourself stuck without a reliable way to pay for these costs, let alone manage your usual bills.

Take it from anyone who’s faced a sudden evacuation: planning your finances ahead of time can soothe your worries and free you up to handle more pressing concerns, like ensuring your family’s safety. Think of digital préparation as a way of packing an online “go bag” so you can keep moving forward, even in chaos. The moment you recognize that everyday life can be upended in a snap, you start seeing the importance of laying a strong financial groundwork.

Here are a few reasons why proactive steps matter:

- Immediate Access: You won’t be fumbling around for debit cards, checks, or cash in case of an emergency.

- Reduced Stress: Knowing you can cover lodging, food, and other basics can reduce panic during an already stressful situation.

- Faster Recovery: A functional digital financial setup shortens the gap between being displaced and getting back on your feet.

Through this journey, try to stay positive. Preparing now means peace of mind later, so let’s keep going one step at a time.

Understand The Value Of Digital Tools

When you think about how to safeguard your resources, it’s easy to visualize physical envelopes stuffed with cash or a safe-deposit box full of paper documents. But digital tools can be a real lifesaver when physical copies become inaccessible. By shifting some of your systems online, you can prevent big headaches later.

Let’s break down why transitioning to digital can help:

- Convenient Access Anywhere: As long as you have a device and a secure internet connection, you can log in and manage your accounts from anywhere in the world.

- Real-Time Updates: Digital banking services often update in real time, helping you track your spending and balance in the moment, which is critical when funds might be tight.

- Minimizing Paper Clutter: During an evacuation, you have limited space to pack. Going digital can reduce the time you spend sorting through paper statements or collecting receipts.

Still, you might worry about security. It’s a valid concern. In an emergency, the last thing you need is to have your bank information compromised. That’s why we’ll talk about using multifactor authentication, secure connections, and strong passwords later on. Digital doesn’t have to mean reckless, and with a bit of forethought, you can have both convenience and safety.

And remember, going digital doesn’t mean you toss out every physical backup. A hybrid system—where some documents live securely online while others remain stored safely—can serve you best. We’ll figure out that balance together, so you don’t feel like you’re diving into the deep end of digital finances without a plan.

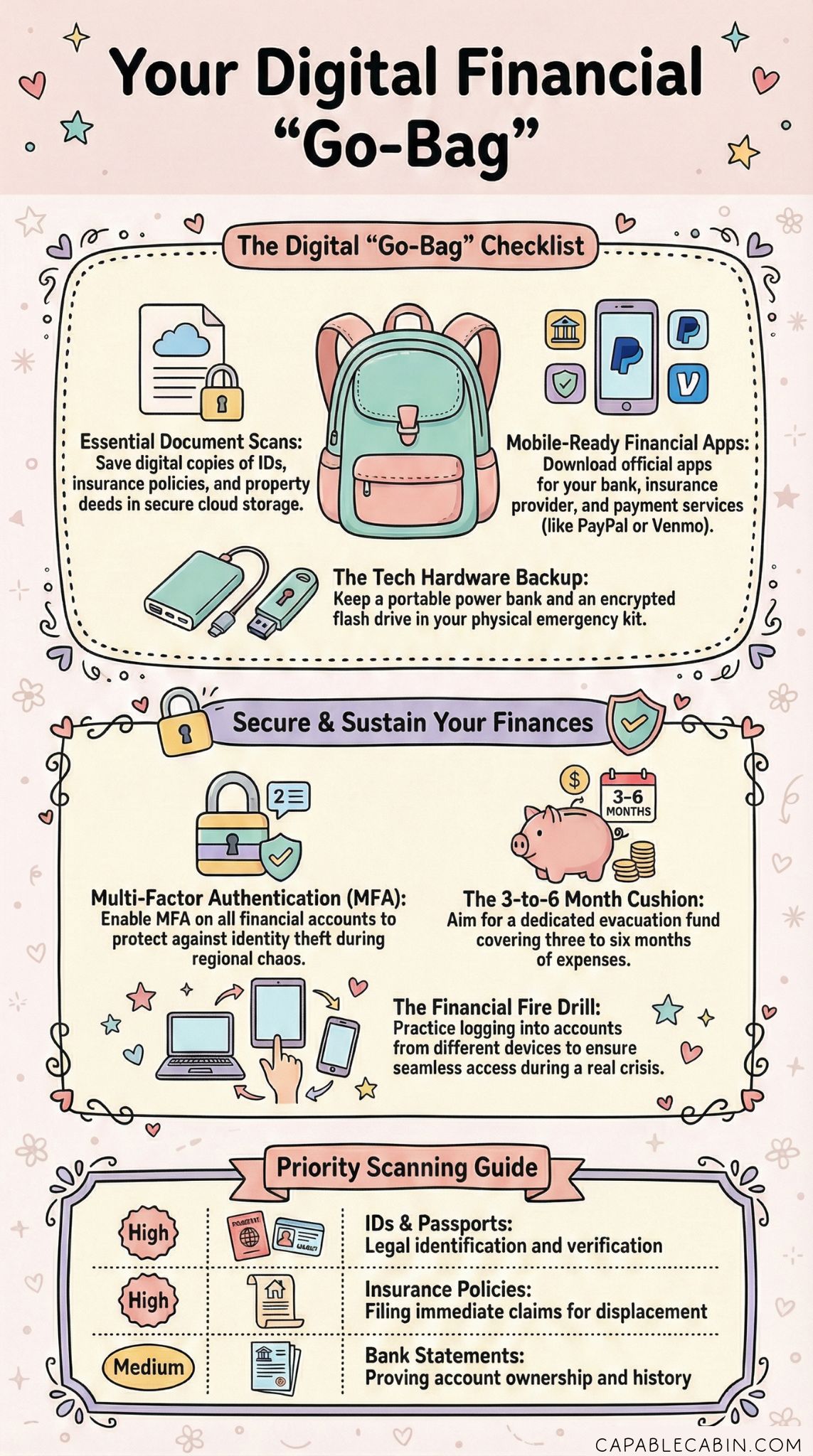

Identify Key Financial Documents

Before anything else, it helps to know exactly which documents are vital for your day-to-day life and for potential recovery efforts. After all, you don’t want to discover you’re missing an essential file when you’re hundreds of miles from home.

Consider collecting these key documents:

- Bank statements and account numbers

- Insurance policies (home, health, vehicle, life)

- Identification papers (passport, driver’s license, birth certificates)

- Property deeds or rental agreements

- Credit card details and loan information

- Health records or medical insurance details

You might need a mix of physical and digital copies. Physical documents can be irreplaceable if you need legal verification, while digital scans or photos can be your immediate fallback if the originals get destroyed or left behind. You never know what an emergency might throw at you, which is why it can be wise to keep duplicates.

How To Store Them

- Use password-protected folders in cloud storage services.

- Keep physical papers in a waterproof, fire-resistant bag or safe.

- Store duplicates with a trusted friend or family member if possible.

Documents like birth certificates, social security cards, and marriage licenses can be tricky to replace. Scanning them and uploading to a secure folder gives you a backup plan if the originals are damaged. But also remember: security is key. Protecting your personal info in a password-protected environment can guard you against identity theft, which unfortunately can become more common during times of region-wide chaos.

If you’re wondering how to further organize and plan for which documents to prioritize, you might find resources like a financial crisis action plan useful. That way, if you’re pressed for time, at least you’ve got a roadmap of what’s essential.

Set Up Secure Online Access

Having your documents and bank info ready is one side of the coin. The other is ensuring you can log in and manage your finances without jumping through a million hoops. Emergencies can strike when you least expect them—imagine losing your wallet during an evacuation, or having your phone battery die just when you really need it.

Best Practices for Online Banking

- Strong Passwords: Go for passphrases that blend uppercase, lowercase, numbers, and symbols. Avoid personal details that can be guessed.

- Multifactor Authentication (MFA): Enable MFA wherever possible. That typically means you’ll receive a text code or use an authenticator app for a second form of verification.

- Device Security: Keep antivirus software updated on any device you use to access your bank or online wallet. Stay alert for phishing emails too.

If possible, set up multiple ways to access your accounts—for example, your phone, your partner’s phone, and a laptop. That way, one device malfunction doesn’t cut you off completely. Even if you’re traveling from one shelter to another, you can usually get secure Wi-Fi somewhere, log in, and handle urgent payments.

This is also an ideal time to contact your bank or financial institution to ask about emergency protocols. Some banks provide immediate replacement cards or freeze accounts quickly if security is compromised. Understanding these procedures in advance puts you one step ahead when chaos hits.

Build An Emergency Fund

Nothing offers a sense of relief in a crisis like having a dedicated cushion of savings. Being able to tap into extra funds without going into debt can make all the difference if you’re displaced from your home. Let’s talk about creating or growing your emergency fund in straightforward steps.

Why It Matters

You often hear the advice to stash at least three to six months’ worth of expenses in an emergency fund. That might sound intimidating, but think about how many costs could hit you at once if you have to evacuate:

- Hotel or temporary housing fees

- Increased transportation costs (fuel, bus fares, or longer commutes)

- Food and other daily essentials, often at inflated prices during a crisis

- Unplanned medical expenses if someone gets ill or injured

Simplify Your Savings Approach

- Automate Deposits: Set up an automatic transfer to your savings account on payday. Even small amounts add up.

- Separate Location: Keep these funds in an account separate from your everyday checking—so you’re not tempted to dip into it.

- Digital Accessibility: Make sure your emergency fund is in an account you can access online or through a mobile app.

If your goal is specifically tied to evacuation planning, consider a dedicated evacuation emergency fund. Having a separate pot labeled just for evacuation expenses clarifies exactly how that money should be used.

We get it—being told to save more during tight times might feel like a tall order. But remember it’s not about being perfect. Even setting aside a small monthly contribution is a step forward. Over time, those small steps compound into a safety net, one that can allow you to pay for immediate needs and cover lodging or transportation without piling on credit card debt.

Prepare A Mobile Go-Kit

When you think about preparing for an evacuation, you might picture a physical backpack stocked with flashlights, snacks, and first-aid supplies. But a financial go-kit is just as crucial, especially because you might be doing everything from check deposits to utility bill payments using digital tools.

Digital Items To Include

- Secure Banking Apps: Download your bank’s official app, payment apps (e.g., PayPal, Venmo), or investment apps.

- Budget Tracking Tools: Apps that let you record expenses in real time, so you’re aware of where your money goes in a crisis.

- Document Scans: Keep a folder (password-protected) on your phone or secure cloud with your scanned IDs, insurance details, or property records for quick reference.

Sure, these aren’t physical items, but think of your phone and these apps as your front-line hub for finances. If your phone is lost or unusable, having a backup device or at least the login details stored in a secure place ensures you can still connect to your bank or credit card company.

Physical Supplements

- Power Bank: A portable charger can be a lifesaver if power outages leave you unable to charge your devices.

- Flash Drive: If you prefer a second digital backup—just in case you have no internet—keep it encrypted and password-protected.

It’s about finding balance. You don’t want to rely so heavily on your phone’s memory that a dying battery cuts you off from everything. At the same time, you want immediate digital access to your resources when you need it most. Having multiple redundancies—your phone, a flash drive, and a secure online vault—means you’re covered from all angles.

Consider Safe Backup Strategies

We’d all love for emergencies to be predictable, but the truth is, you might end up in a location without stable internet or phone service. That’s where a robust backup plan becomes essential, ensuring you’re not locked out of your finances entirely.

Backup Ideas

- Trusted Contact: Pick someone you trust—like a close friend or family member—who can temporarily manage certain aspects of your finances if you lose access. This person might keep a physical copy of critical documents or have limited power of attorney for emergencies.

- Alternative Devices: If you own multiple devices (like a tablet or an older phone), keep them updated with your financial apps. Store at least one securely in a different place in case your main device gets damaged.

- Paper Copies: Yes, going digital is fantastic, but a small binder with printouts of your vital accounts, phone numbers, and policy info can come in handy when technology fails.

Think of backups as layered protection. Maybe you’ve already secured your primary phone with passcodes and fingerprint access. That’s a great start. But if it runs out of battery or you can’t get online, it’s valuable to have an alternative. You’re essentially building a resilient web of resources so that one breakdown doesn’t shatter your entire system.

Encryption and Passwords

Always protect your backups with passwords or, if possible, encrypt the data. It’s easy to misplace a flash drive or drop a piece of paper in the rush of an evacuation. Ensuring your personal info is locked down keeps opportunistic scammers from taking advantage of a chaotic situation.

Collaborate With Loved Ones

Disasters often bring people together, and evacuation planning can be a group effort. If you have a partner, kids, or extended family, tapping into that network can remove some of the burden from your shoulders. Plus, you’re less likely to overlook details when multiple pairs of eyes are on the plan.

Family Financial Meetings

Sit down every few months—especially if you live in an area prone to wildfires, hurricanes, or floods—and discuss each person’s role:

- Who’s Grabbing What? Maybe you’re in charge of digital backups and the financial evacuation go bag, while your partner is responsible for the physical documents.

- Who Handles Bills? Ensure at least two people know how to log in to pay essential bills or communicate with landlords, mortgage companies, or insurance providers.

- How To Stay in Touch? In case phone lines are down, explore alternative communication apps or designate an out-of-town contact.

Spreading The Knowledge

Kids, if they’re old enough, can benefit from understanding the basics: what an emergency fund is, why you keep online passwords locked down, and how to identify fraudulent messages. Grandparents or older relatives might need extra help setting up their smartphones to access their accounts. By bringing everyone into the loop, you create a supportive network that can function even if you’re split up or traveling separately.

Take a moment to consider the peace of mind that comes from knowing your sister, your spouse, or a close friend also knows the plan. You don’t have to shoulder the entire burden by yourself. We’re all in this together, and a community approach means a stronger net of support in tough times.

Stay Alert To Financial Scams

Unfortunately, crises can attract scammers who prey on vulnerable individuals. If you’re displaced, you may already be feeling stressed, emotional, and worried about money. That state of mind can make it easier to fall for phishing attempts or bogus “offers” that promise quick solutions for your problems.

Warning Signs

- Unsolicited Calls or Emails: A stranger contacts you out of the blue, asking for bank details, offering a loan, or claiming to be your financial institution. Legitimate help rarely comes in that form without you initiating contact.

- Pressure to Act Quickly: Many scams rely on fear tactics, telling you to “submit info now” or you’ll lose something valuable.

- Requests for Odd Payment Methods: If someone insists on payment in the form of wire transfers, gift cards, or cryptocurrency, it’s often a red flag.

Keep in mind, even if your bank calls about something important, they shouldn’t ask you for sensitive details they should already have. It’s perfectly okay to hang up, find the official number, and call back to verify legitimacy. Double-checking might feel tedious, but it protects your resources.

Proactive Measures

- Set your phone to filter unknown callers or send them to voicemail.

- Periodically review your statements to spot any suspicious activity.

- Use official apps rather than clicking on emailed links that might be phishing attempts.

Being cautious doesn’t mean living in constant fear. It’s just a reminder that when times are hectic, a little extra vigilance can go a long way toward keeping your evacuation digital finances secure.

Adopt A Long-Term Mindset

It’s easy to think of financial preparedness as a one-and-done task—pack a bag, store some documents, and call it a day. But real resilience involves ongoing maintenance. You’ll need to review your plan regularly, especially if your life circumstances change. That could mean getting a new job, moving, or having another baby.

Regular Check-Ins

- Update Passwords: Aim for every three to six months, or immediately if you suspect a breach.

- Rebalance Budget: If your income or expenses shift, reevaluate how much you’re contributing to your emergency fund or your evacuation budget breakdown.

- Review Insurance: Make sure your current insurance policies still match your needs. If you relocate, that could change what coverage you need.

Evacuations can also lead to claims and questions about rebuilding or repairing property. Keeping your documents and finances in shape sets you up for smoother evacuation insurance claims. Plus, you’ll find it simpler to handle any post evacuation financial recovery if your documentation is organized and up to date.

Encouraging Good Habits

Building new habits can be challenging, but each small step counts. If you falter or forget to change your passwords one month, that’s okay—just pick back up and do it next month. Over time, these incremental improvements compound and bolster your overall security.

A long-term view also helps with your mental well-being. You won’t be sprinting to piece together a plan at the last possible moment, and you’ll avoid the guilt or stress that comes from feeling unprepared. It’s a marathon, not a sprint, and steady progress is still progress.

Plan For Financial Recovery

Not all emergencies end the moment you reach a safe place. Sometimes, the real work begins afterward, particularly in terms of financial rebuilding. By anticipating how you’ll handle the aftermath, you reduce the risk of feeling overwhelmed once the initial crisis subsides.

Possible Recovery Steps

- Document All Expenses: Keep digital records of every cost incurred during your evacuation—fuel, lodging, food, repairs. This not only helps you maintain a budget, but if an organization or insurer compensates some costs, documentation speeds up the process.

- Tap Into Resources: Local governments or relief agencies may offer grants or low-interest loans. If you’re uncertain where to start, consult a financial recovery emergency fund approach or speak with a local nonprofit for guidance.

- Review Credit Reports: Emergencies sometimes lead to missed payments or high balances, which can affect your credit. Check your reports and dispute any inaccuracies as soon as possible.

Seeking Professional Help

If your home was severely damaged or you’ve lost high-value property, you might consider talking to a certified financial planner or counselor who specializes in disaster recovery. They can point you toward resources, highlight tax benefits, or guide you on negotiations with lenders. Don’t be shy about asking for help—when you’re rebuilding, professional guidance can save time, money, and emotional strain.

Revisit Evacuation Financial Planning

Remember, you don’t have to reinvent the wheel every time. A thorough evacuation financial planning strategy can give you a template you can adjust as you go. Think of that plan as a living, breathing document, one you revisit periodically to make sure it still matches your reality.

Here’s a quick cheat sheet of what an updated plan might address:

- Which accounts need immediate digital access

- A breakdown of your monthly expenses plus a margin for emergencies

- A checklist for your physical and digital “go bag” items

- Procedures for contacting your financial institutions

- A timeline for building or replenishing emergency funds

Keep the plan in a secure but easily accessible place—maybe a password-protected folder in your cloud drive. That way, even if you’re on the road, you can open it up, see what tasks remain, and check off the steps you’ve already taken.

Incorporate Budget Evacuation Planning

Your baseline expenses will evolve over time. If you’re a family of four, your grocery bill today might be quite different a year from now. Similarly, your insurance premiums, utility costs, and housing situations can shift. It’s wise to embed a budget evacuation planning framework into your overarching preparedness strategy.

Steps to Fine-Tune Your Budget

- Track Normal Expenses: Identify your regular monthly costs (rent, food, utilities, insurance) so you know exactly what you need to maintain if displaced.

- Add a Safety Buffer: Emergencies often bring hidden costs. Factor in an extra 10-20% for incidentals or price spikes.

- Prioritize: If finances are tight, decide which bills you’ll undoubtedly pay first—like insurance or a mortgage—and which can be postponed temporarily.

Working on this budget with a partner or a trusted friend can keep you accountable. They might see items you’ve overlooked or have fresh ideas for cutting costs. Once you’re comfortable with a preliminary budget, you’ll have a clearer sense of how much to set aside or how to adjust if you face a tough situation.

Consider How To Protect Your Credit

When chaos hits, missing a bill payment or two might seem insignificant. But if you let it slip for too long, it can dent your credit score and bring future challenges—like higher loan interest or trouble qualifying for a rental. Protecting your credit should be part of your comprehensive plan.

Tips for Safeguarding Credit

- Auto-Pay: Enroll in automatic bill payments for at least the minimum due. This ensures you don’t forget during an evacuation.

- Notify Lenders: If you anticipate late payments, call or email creditors proactively. Many lenders are willing to work with you if they know you’re facing an emergency.

- Monitor Frequently: Use a credit monitoring service or check your score monthly. Keeping tabs will help detect any unauthorized activities.

If your credit does take a hit, a proactive approach to rebuilding is key. Promptly catching and disputing errors, paying down balances, and setting a fresh payment schedule can help you bounce back faster than you might expect.

Lean On Community Resources

If finances are already tight, you might wonder how you can manage another layer of preparedness without feeling squeezed. Sometimes local community resources—like non-profit financial counseling centers or cooperative banks—can provide guidance free of charge or at a reduced cost. You can also look for community workshops on evacuation financial planning, which might offer practical advice tailored to your region’s common hazards.

Examples of Community Support

- Volunteers or community shelters that offer free meals, reducing your daily expenses while you’re displaced

- Religious or neighborhood groups that organize group savings plans, so everyone has a small pot of money to draw on when facing hardship

- Government-run programs that help with temporary housing or cover some medical bills

Tapping into these can lighten your financial load and give you more bandwidth to focus on immediate concerns. There’s no shame in seeking help; these programs exist for exactly these types of emergencies. Plus, you may find that giving back to these groups—when you’re back on your feet—can become a rewarding part of your community life.

Practice Your Evacuation Drills

You might feel confident about your plan on paper, but real life often throws curveballs. Doing a practice run helps catch any gaps before they become critical. Think of it like a fire drill, but for your finances. There’s no need to wait for an actual emergency to see if your plan works.

How A Practice Run Might Look

- Simulate “What If?” Imagine you must leave home for 48 hours. Do you know exactly where to find your key documents?

- Test Access: Try logging into your financial accounts from a different device or location. Does everything work smoothly?

- Check Communication: Send a quick message to your backup person to confirm they know what to do if you can’t manage your accounts.

- Time It: See how long it takes to grab your physical and digital go-bag essentials. Is it feasible if you have to leave in under an hour?

Keep notes on what went well and what could improve. Maybe your cloud storage passwords aren’t as easy to recall under pressure, or you realize you never updated your emergency contact info on your insurance policy. Identifying these issues now helps you fix them so that, if the day comes, you’ll be one step ahead.

Stay Flexible And Resilient

Here’s the truth: no matter how well you plan, life has a funny way of surprising you. That’s not meant to scare you but to help you embrace the idea of flexibility. Being prepared isn’t about meticulously controlling every outcome, but rather giving yourself the tools and options you need to adapt to unexpected circumstances.

Think of your evacuation digital finances as a safety net that lets you pivot quickly while maintaining a sense of financial continuity. That might mean you go from accessing your money on your phone to switching to a backup laptop, or from paying bills in person to paying them primarily online.

Remember, you don’t have to figure this out alone and you definitely don’t have to get it perfect on the first try. As you refine your strategy over time, it becomes second nature—just another part of your overall emergency preparedness routine.

Keep The Momentum Going

Once you’ve set up your digital finances for an evacuation scenario, the key is regular maintenance. It might feel like a lot in the beginning, but the payoff is peace of mind. You’ll have confidence knowing that if you’re told to leave at a moment’s notice, you’re not leaving your financial life behind.

Here are a few parting reminders to help you keep moving forward:

- Revisit Your Setup Quarterly: Schedule a reminder on your phone. Review your accounts, passwords, and documents to ensure they’re still accurate.

- Stay Current on Technology: Updating devices and apps can prevent security vulnerabilities. It might also offer new features that streamline your life in an emergency.

- Celebrate Small Wins: Did you finally upload scans of important documents? Or perhaps you saved your first $100 in an evacuation-focused fund? High-five yourself and share your progress with loved ones.

If you find yourself yearning for more guidance or feeling unsure about something specific—like how to handle evacuation insurance claims or ways to create a budget evacuation planning spreadsheet—don’t hesitate to reach out for help. Seek out resources, talk to experts, or touch base with friends who’ve gone through a similar process.

Above all, remember this: you’re taking a proactive stance for yourself and your family. By setting these steps in motion, you’re ensuring that a crisis does not rob you of your financial stability. You’re forging a path to stability, even when life feels unsteady. And that is something truly worth celebrating every step of the way.