72-Hour Evacuation Budget Breakdown: Real Costs for Families

Evacuation budget breakdown. Just hearing these words can spark images of last-minute scrambling, frantic packing, and urgent expenses piling up faster than you can count. Trust me, you’re not alone if you’ve felt that tense knot in your stomach at the thought of managing emergency finances. We’re all in this together, so let’s walk through a clear, relatable process to help you handle a 72-hour evacuation scenario without feeling overwhelmed. Think of this as a friendly chat where we break down the actual costs, share practical tips, and help you prepare for tough moments—so you can keep your family safe and your mind at ease.

Embrace Your Evacuation Budget

Here’s the thing: planning ahead is key. When you evaluate your evacuation budget breakdown now, you’re less likely to be caught off guard or overspend down the line. Emergencies rarely roll out the red carpet, so it helps to know where your money needs to go at a moment’s notice. You don’t have to figure this all out in a day, and there’s no perfect formula for everyone. Instead, we’ll walk through the core budget items you’ll want to consider.

But first, take a deep breath. Budgeting can feel intimidating, especially when it’s for something as nerve-racking as a financial crisis or forced departure from home. Sometimes the mere thought of gathering numbers and receipts is enough to make you want to shut down. If that’s you, I get it. Let’s take it step by step together, breaking down the structure of potential expenses so you’ll feel grounded once you see the big picture.

Even if you think you don’t have much wiggle room, remember that knowledge is power. Pinning down each expense category—lodging, transport, supplies, and more—helps you anticipate actual costs so you can move forward with clarity. And if you ever need more ideas for smoothing out your financial plan, consider peeking at resources like budget evacuation planning or evacuation financial planning for extra guidance. Every step you take now sets you up for a calmer, more controlled response when disaster strikes.

Determine Your Essential Costs

Before you start mapping out your entire budget, let’s define what “essential” really means for you. Yes, we’re talking about an emergency. But you might discover that your family’s unique needs differ from your neighbor’s. By honing in on the absolute must-haves, you avoid stretching your budget further than necessary.

Here are some core categories to consider:

- Food and Water: Think about non-perishable items and bottled water that can sustain you for up to 72 hours. If you have kids, factor in snacks they actually enjoy. No one wants hangry toddlers when you’re already dealing with chaos.

- Medications and Health Supplies: Include regular prescriptions, first-aid materials, and any over-the-counter remedies your family depends on. Make sure they’re up to date.

- Hygiene Essentials: Even in an emergency, staying clean and healthy matters. Soap, disinfecting wipes, feminine hygiene products, and baby supplies (if applicable) should all be on your radar.

- Pet Needs: Our furry friends need attention too—food, bowls, waste bags, or crates, depending on the type of pet.

Set a baseline for each category. This will guide you as you build out the rest of your plan. And keep in mind that essentials can vary based on individual circumstances: for example, if you have a newborn, you’ll need formula or diapers. If you’re caring for an elderly parent, ensure you have the right mobility aids or other assistive devices.

When I talk to friends and relatives about preparedness, they often say, “But I don’t have time to think through all of this!” Believe me, I’ve felt the same rush of panic. Yet every small step from listing out your daily must-haves to collecting cost estimates goes a long way. You’ll thank yourself later when you’re not racing around trying to remember if you have enough medication or baby wipes to last through a hectic evacuation period.

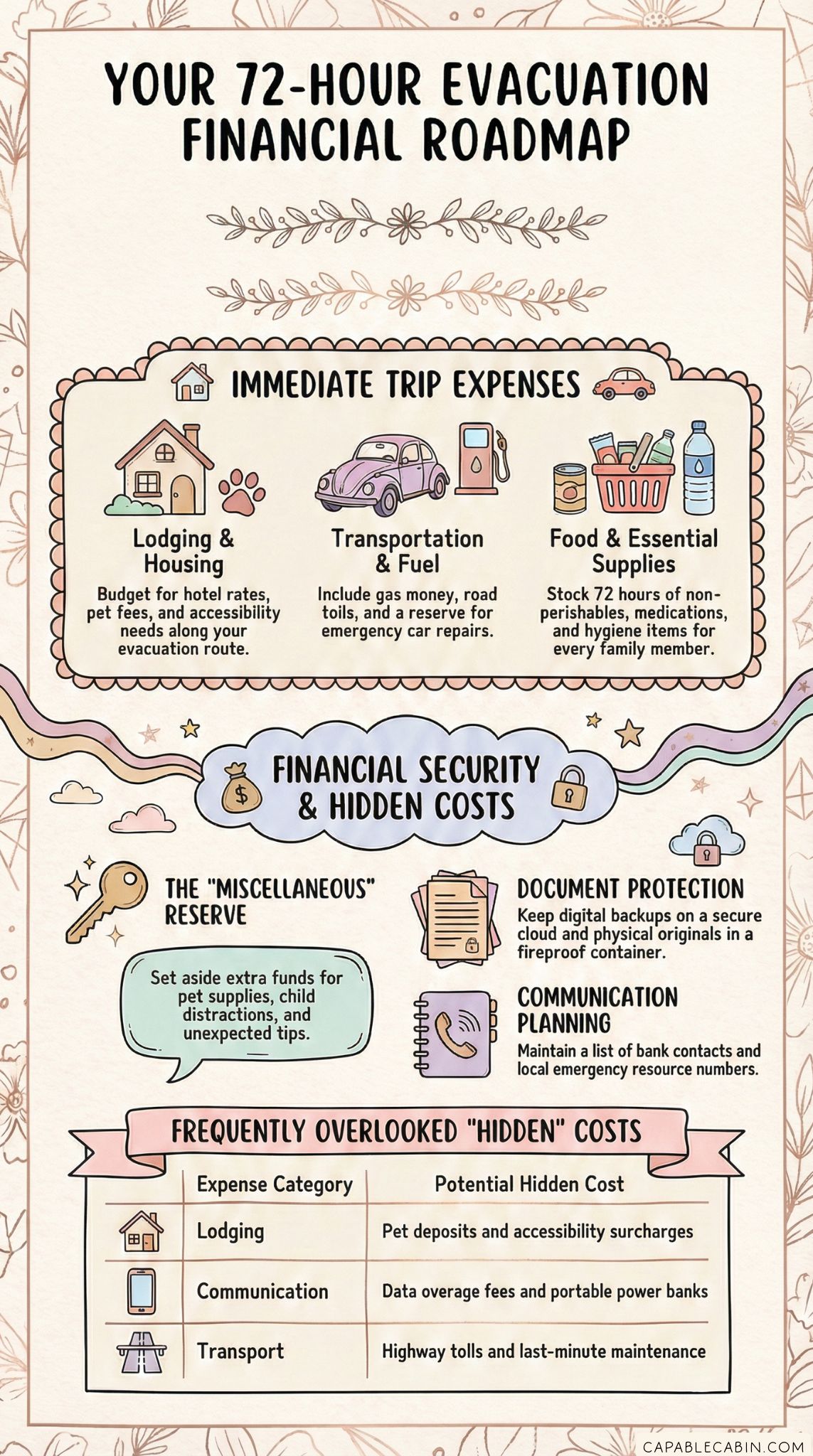

Plan For Temporary Lodging

If you’ve ever tried to book a hotel or Airbnb at the last minute, you know how quickly prices can soar. In an emergency, finding a safe place to stay could become incredibly competitive, especially if many people need shelter at the same time. The key is to factor in lodging expenses sooner rather than later. By building a rough estimate of what a few nights in a hotel or a short-term rental might cost, you’ll have a clearer sense of where to allocate savings.

You might also consider whether staying with friends or family is an option. Even if you think you’d feel uncomfortable imposing, it’s worth having that conversation. Sometimes, the best “budget” plan is a supportive network. But in case that’s not feasible, here’s a quick checklist for your likely lodging costs:

- Hotel or Rental Rates: Prices vary widely by location. Try to find a mid-range estimate for places in your area or in potential evacuation routes.

- Pet Fees: If you’re bringing pets, some hotels charge extra, so add that to your estimate.

- Transportation to the Location: If you have to drive farther to find an affordable location, that might reduce your nightly rate but add to your gas expenses.

Before finalizing your estimates, also think about what your family actually needs in temporary housing. Does anyone need a wheelchair-accessible room? A kitchenette for specific dietary needs? Having answers ready means you won’t waste precious time scrolling through lodging options under duress.

Now, let’s not underestimate how stressful it can be to pack up and move—even temporarily. It helps to keep a small “go bag” of toiletries, a few outfits, and important documents you might need. For guidance on what to pack and how to safeguard your finances on the move, take a peek at the financial evacuation go bag discussion. The more you prep, the better you’ll feel when it’s time to relocate unexpectedly.

Prepare For Transportation

Picture this: the news warns of an impending evacuation, and suddenly the whole neighborhood is on the road. You don’t want to be that person panicking at the gas station, realizing you have no idea how far you can go without refueling. By anticipating your transportation costs, you’ll sidestep a lot of chaos and frustration down the line.

Let’s break down your potential travel expenses:

- Gas Money or Public Transit Fare: Estimate how much fuel you’ll need to reach your planned safe location and beyond. Public buses or trains might also be an option, depending on your city.

- Rental Car or Ride-Sharing: If you don’t have a personal vehicle or if it breaks down at a crucial moment, factor in the potential cost for a rental or ride-share service.

- Emergency Repairs and Maintenance: Consider the possibility of needing a quick car repair or new tires right before you hit the road.

- Road Tolls and Parking: Sometimes highways, bridges, or major evac routes have tolls that can add up quickly.

If you anticipate an extensive trip or a multi-day evacuation route, add in extra funds for lodging along the way. Transport and shelter often go hand in hand, after all. Keep any vehicle-related documents—registration, insurance information—in an easily accessible place. And let’s be real, no one has time to rummage through piles of paper while rushing to evacuate. Being organized here offers relief, even if it feels like a chore up front.

Also, talk to your family or close friends about carpooling options. Sharing travel costs (and emotional support) can be a lifesaver. If you can divvy up gas expenses and rotate driving duties, you’ll not only save money, but you’ll also tackle the trip with a greater sense of community. Yes, it might mean a slightly more crowded car, but in emergencies, unity can be priceless.

Gather Emergency Supplies

Hands down, stocking up on emergency supplies can be one of the more stressful aspects of a 72-hour evacuation plan, especially if you wait until the 11th hour. But the real kicker? Supplies add up financially. It’s easy to overlook how pricey emergency gear can become. Let’s outline some common categories to help keep your budget in check:

- Grab-and-Go Meals: Packaged snacks, dried fruit, or quick protein sources can hold you over until you’re in a stable location.

- Batteries, Flashlights, and Radios: You may already have these scattered around your house, but check if they actually work. Replacing them at the last minute can get expensive.

- Extra Clothing: Stashing away an extra set of comfortable clothes for each family member can save you from unexpected shopping sprees if you end up displaced longer than anticipated.

- Power Banks and Chargers: Having a way to charge your devices is essential. You don’t want to be stuck without communication or navigation when you need it most.

It’s also wise to think about the items that bring your family comfort. Sure, a stuffed animal or a favorite book might not seem crucial in the face of a crisis, but the emotional support is real. In many ways, budgeting for morale is as important as budgeting for physical safety. You never know how long you’ll be in transit or in a temporary shelter, so small comforts go a long way in keeping spirits up.

Another benefit of planning your supply spending early is snagging sales throughout the year. If you notice a store clearance on flashlights or first-aid kits, jump on it. Stretching your prep budget proactively will make that final evacuation sum more manageable. Plus, storing these items in a dedicated container will help you avoid the last-minute rush of gathering scattered supplies.

Manage Unexpected Expenses

We all like to think we’ve accounted for every scenario, but let’s face it, emergencies are unpredictable. From a pet’s sudden illness to a last-minute detour, you could be facing unplanned bills that threaten to derail the entire budget. That’s where a quick “miscellaneous expenses” reserve comes in handy.

Here are a few common surprises people often overlook:

- Communication Costs: Data overages, extra phone chargers, or additional SIM cards if you need multiple lines running.

- Child Distractions: Toys, games, or paid apps to keep restless kids occupied during long waiting periods.

- Optional Insurance: You may find yourself opting for extra travel or medical coverage if the situation escalates.

- Extra Fees and Gratuities: Evacuations can involve rushing to a hotel that requires a deposit or tipping service workers for assistance.

We’re not just being negative by preparing for the worst-case scenarios—think of it like carrying an umbrella on a cloudy day. You might not need it, but if you do, you’ll be grateful you planned ahead.

If an emergency expands beyond 72 hours, you may find yourself needing a broader strategy for recovery and rebuilding. That’s where resources like a financial recovery emergency fund or pandemic financial planning could come into play, especially if you’re dealing with an event that disrupts your income. Setting aside even a small cushion now can save you from a bigger financial headache later.

Protect Necessary Documents

Nothing derails a smooth evacuation budget breakdown faster than losing track of your important paperwork. Birth certificates, insurance policies, mortgage documents, and medical records—these can all become vital if you need to prove your identity or file claims.

So how do you keep these items safe?

- Digital Backups: Scan your documents and store them—securely, of course—on a password-protected cloud service. This way, you’ll have quick access even if you can’t retrieve hard copies.

- Physical Safe: Consider a fireproof and waterproof container for storing originals. Make sure you can grab it easily during an evacuation.

- Multiple Copies: Sometimes, giving a copy to a trusted relative or stashing it in a secure location away from your home offers an extra layer of security.

And let’s not overlook the importance of your financial details. Having bank statements, credit card information, and digital finance tools accessible is pivotal if you need to withdraw or transfer money quickly. For more streamlined tips on organizing digital finance essentials, check out evacuation digital finances. In an uncertain situation, easy access to your funds and personal data brings a surprising amount of peace of mind.

Protecting your documentation goes beyond paperwork, too. If you’ve got valuable family photos or sentimental records you can’t imagine losing, think about digitizing those as well. Emergencies remind us what’s truly important. By preparing your documents and keepsakes, you’re ensuring your family’s well-being goes beyond just the financial realm.

Maintain Your Communication Plans

Sometimes, coordinating your evacuation finances depends on staying connected with relatives, support networks, or professional services. That’s why a robust communication plan is more than just “text me if you need me.” You want clarity about who you’ll call first, how you’ll update each other, and what to do if your usual communication falls through. Without a solid plan, you risk making decisions in a panic, potentially overspending on last-minute alternatives that push you way past your original budget.

Let’s think about practical steps:

- Primary Contacts: Identify immediate family members or friends who can help. Let them know where you plan to go and create a system for checking in (like a quick text or social media message).

- Backup Methods: If you lose cell service or electricity, how else can you get in touch? This might involve battery-powered radios or a meeting place that everyone knows.

- Financial Institutions: Keep your bank’s or insurance provider’s phone number handy in case you need to halt transactions or report lost credit cards.

- Local Updates: Government alerts often come via text or online sources. Know where to look for official announcements so you can pivot plans if your selected evacuation route becomes congested or unsafe.

A big part of communication also involves being transparent about finances within your household. If your spouse, partner, or teenagers don’t know the budget situation, they might inadvertently overspend or overlook certain needs. Holding a quick family meeting can go a long way in aligning everyone’s perspective. It’s not about scaring each other—it’s about being prepared and realistic together.

Create A Long-Term Strategy

The entire point of a 72-hour evacuation budget breakdown is to manage the initial shock of a crisis. But sometimes an emergency is just the beginning. If a disaster displaces you longer than expected, you’ll need a long-term strategy: possibly tapping into a financial crisis action plan or building upon what you already started with your short-term preparations.

Think of long-term planning as an extension of your immediate plans. Maybe you’re brainstorming how to handle mortgage payments if you can’t return home right away or dealing with job interruptions that stretch beyond a week. For these bigger concerns, it’s a good idea to look into:

- Evacuation Insurance Claims: Make sure you understand your policy and the steps to file a claim. You can explore more details at evacuation insurance claims.

- Post Evacuation Financial Recovery: Document all expenses so you can seek reimbursement or assistance programs as needed. Check out post evacuation financial recovery for tips on rebuilding.

- Local Assistance: Many communities offer volunteer-led relief, grants, or other resources to families in crisis. Knowing these resources beforehand can be a major relief.

- Savings and Investments: If you have a retirement account or other investments, you might need to assess whether pulling funds early is worthwhile or necessary.

Long-term strategy also means revisiting these plans regularly. As your family grows or your financial situation shifts, you’ll want to update your estimates and documents. What worked for you five years ago might not reflect your current reality. By scheduling an annual or biannual review, you’ll keep everything fresh and relevant, ensuring you don’t slip into a false sense of security.

Stay Flexible Through Change

Finally, let’s chat about the mindset you’ll want to nurture. Emergencies are unpredictable. You may spend hours fine-tuning your budget, only to realize that the actual crisis looks wildly different from what you envisioned. That’s okay—being flexible is half the battle. The more you embrace the notion that “plans can evolve,” the less likely you are to feel defeated or stuck when something unexpected happens.

Try thinking of your evacuation budget breakdown as a set of guidelines rather than a rigid rulebook. Even if you have to shift funds from one category to another, you’ll still benefit from the time you spent understanding where your money goes. It’s a lot like cooking without a strict recipe. Once you know the basic ingredients, you can improvise when things don’t go exactly as planned.

- Check in With Yourself: Are you feeling overwhelmed? Communicate that to loved ones or a support group. Taking a breath can prevent rash decisions that might cost you more in the long run.

- Ask for Help: Never be afraid to reach out. You might find free or low-cost legal advice, charities offering temporary lodging, or neighbors willing to split the cost of a bulk grocery trip.

- Celebrate Small Wins: Even just saving enough for a couple of nights in a motel is progress. Recognizing little achievements keeps you motivated.

When you look back on this process, remember that emergencies might shake your routine, but they don’t have to define your financial well-being. Each conversation you have—whether with family, friends, community resources, or yourself—brings you one step closer to feeling solid about your plan.

At the end of the day, preparing for a 72-hour evacuation isn’t just about stacking canned goods or hoarding water bottles. It’s about crafting a balanced, realistic budget tailored to your family’s needs. Yes, it can feel like a lot to manage: from hidden costs and crucial documents to the emotional toll of suddenly packing up. But trust me, you’ve got this. We all do, because we’re learning as we go, sharing insights, and building a supportive network along the way.

So keep going, step by step, and don’t hesitate to revisit or adjust your plan as circumstances change. In a crisis, knowing you’ve prepared financially is a priceless feeling. With your budget sketched out and key resources on standby, you can focus on what truly matters—safely guiding your family through whatever life throws at you. And when it’s all said and done, you’ll realize that each small effort you made in advance granted you a bit more calm, clarity, and confidence when you needed it most.