Financial Recovery After Using Your Emergency Fund

If you’ve recently found yourself digging into your savings to handle an unexpected financial crisis, trust me, you’re not alone. Life has a way of throwing curveballs—whether it’s a family emergency, evacuation scenario, or sudden medical bills—and sometimes your carefully built safety net takes a direct hit. This guide is here to help you move forward with a plan for financial recovery, emergency fund rebuilding, so you and your loved ones can feel supported every step of the way. We’re in this together, and by the time you finish reading, you’ll have a clear path to regain stability and prepare for whatever comes next.

The journey can feel daunting. You might be overwhelmed by the thought of replenishing your funds while juggling normal household expenses. Maybe you have kids to care for, or a mortgage to pay, or you’re feeling the ripple effects of a major life change. You might even wonder if it’s truly possible to bounce back. Gyms, coffee shops, and even neighbors often armchair-coach “financial success,” but what you really need is a practical, compassionate guide to steer you from this moment to the next. That’s what we’ll do here, step by step.

Expect to gain insights on assessing where you stand right now, prioritizing your obligations, and finding creative ways to rebuild your savings. We’ll also talk about how to leverage your community, handle emotional stress, and secure extra income streams if that’s something you need. Along the way, we’ll keep things casual and honest—like chatting with a friend who’s faced a similar challenge and come out the other side okay. So let’s roll up our sleeves and get started.

Recognize The Importance Of Financial Recovery

Before anything else, it helps to take a breath and acknowledge the emotional weight that comes with using up your emergency fund. You spent months (or years) building it, only to see it shrink much faster than anticipated. This can leave you feeling vulnerable and questioning your next move. Still, recognizing the importance of rebuilding is a significant first step. It’s how you create a foundation that will support you when new crises arise.

You Need A Buffer

- That extra cash cushion isn’t just a nice-to-have—it’s a form of self-protection. After a crisis, the last thing you need is further stress from debt collectors, late fees, or the inability to handle a new surprise expense.

- By intentionally prioritizing your recovery, you’re offering yourself peace of mind that “future you” will be better equipped to handle challenges.

You Restore Confidence

- When your emergency stash is low, you might feel on edge about everything from car repairs to a short-term job loss. Rebuilding your savings helps restore your confidence in day-to-day decisions.

- This is especially vital if you have a family counting on you. Kids, partners, and even extended relatives feel more stable when they know there’s a plan in place.

You Prevent A Downward Spiral

- Imagine another financial hiccup popping up. If your fund is tapped out, you might start relying on high-interest credit cards or payday loans. That path can quickly escalate into a cycle of debt.

- Recovering your funds early reduces the likelihood of falling into deeper holes you could spend years climbing out of.

If you had to dip into your savings because of a chaotic event—maybe you evacuated due to a natural disaster—remember that you’re also able to learn from the experience. You’ve now seen firsthand how crucial an evacuation emergency fund can be. Rebuilding can become part of your broader plan for future situations, whether that includes evacuation financial planning, or a financial crisis action plan that keeps you prepared.

Keep in mind that this is a process, not an overnight fix. Recognizing the importance of recovery sets you on a path of resilience. The next steps will show you exactly how to walk that path.

Assess Your Post-Emergency Situation

Once you’ve acknowledged that you need to recover your finances, the next step is to figure out exactly where you stand. This can be a bit uncomfortable—you may have avoided looking at your bank statements, credit card bills, or spending patterns. Trust me, I’ve been there, and it’s rarely pretty. But clarity is everything. When you know precisely what’s going on, you can make a plan that’s both realistic and motivating.

Review Current Savings And Debt

Start by taking a close look at your bank accounts:

- Checking the balance, if you have recurring bills or direct deposits.

- Savings balance, which might be painfully low at this point.

- Any other assets or forms of emergency cash lying around (like a certificate of deposit ready to mature).

Simultaneously, list out your debts:

- Credit card balances (along with interest rates).

- Mortgage or rent obligations.

- Auto loans.

- Outstanding medical bills.

This snapshot can feel overwhelming, especially if you had to cover a major evacuation or are just coming off unexpected medical expenses. However, it gives you a transparent starting point.

Calculate Monthly Expenses

Gather your monthly fixed costs, such as:

- Rent or mortgage

- Utilities

- Insurance premiums

- Childcare or school fees

- Transportation (gas, public transit, car payments)

- Groceries

Then add your variable expenses:

- Clothing

- Leisure (like streaming subscriptions or dining out)

- Personal care items

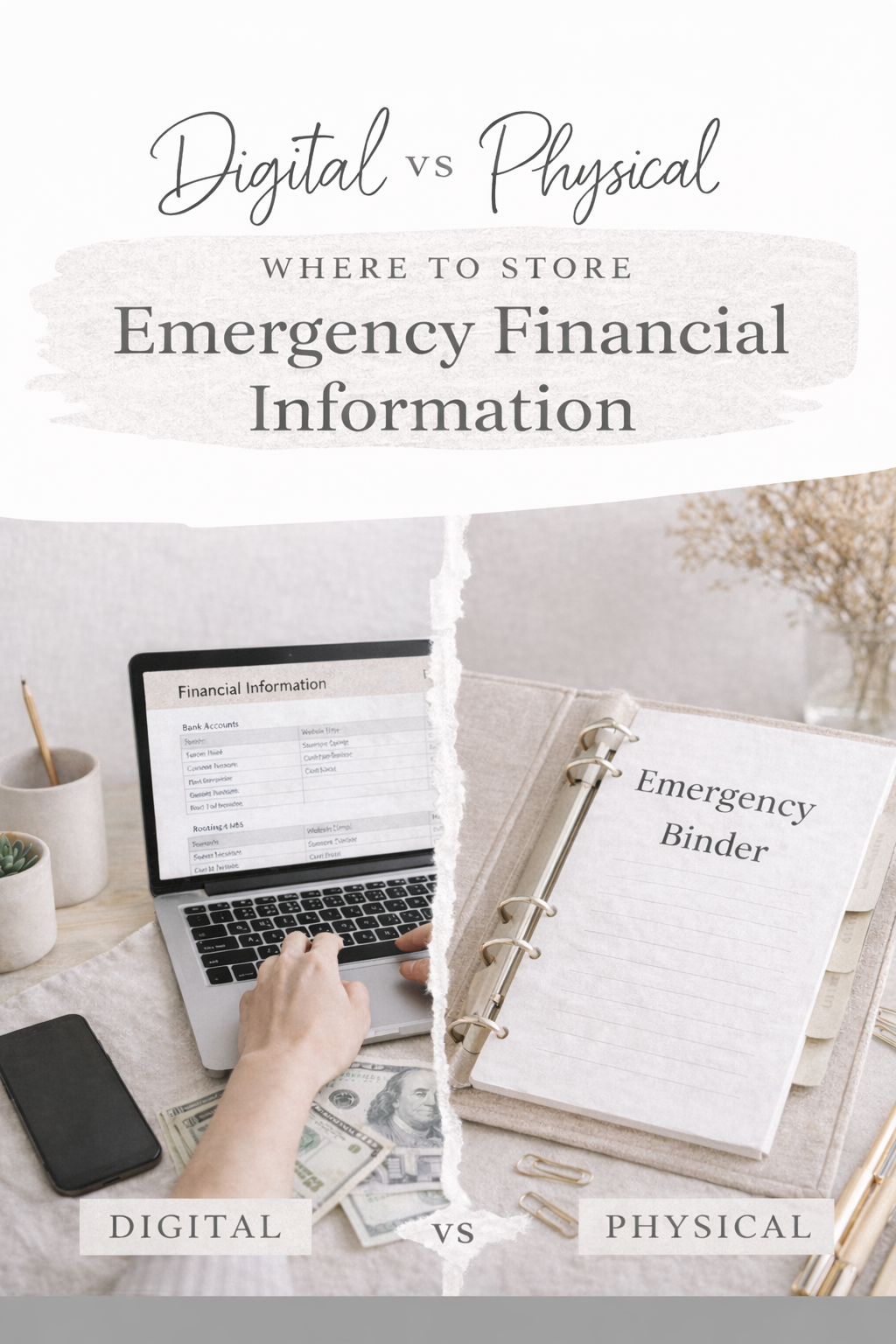

In a crisis or evacuation scenario, costs may have temporarily spiked. If you had to relocate for a while, keep track of money spent on accommodations, food, and extra travel. It can also be helpful to revisit this data when considering evacuation digital finances, as having quick online access to your accounts can provide immediate clarity on your incoming and outgoing funds if you’re ever displaced.

Identify Ongoing Obligations

Next, list any recurring tasks or financial responsibilities. Maybe you’ve started helping extended family who faced a catastrophe, or you’ve set up recurring donations to a cause you believe in. There’s no right or wrong here—just note everything down. Once you see the full picture, you’ll be able to decide which commitments are essential and which might be deferred until you’ve had a chance to rebuild.

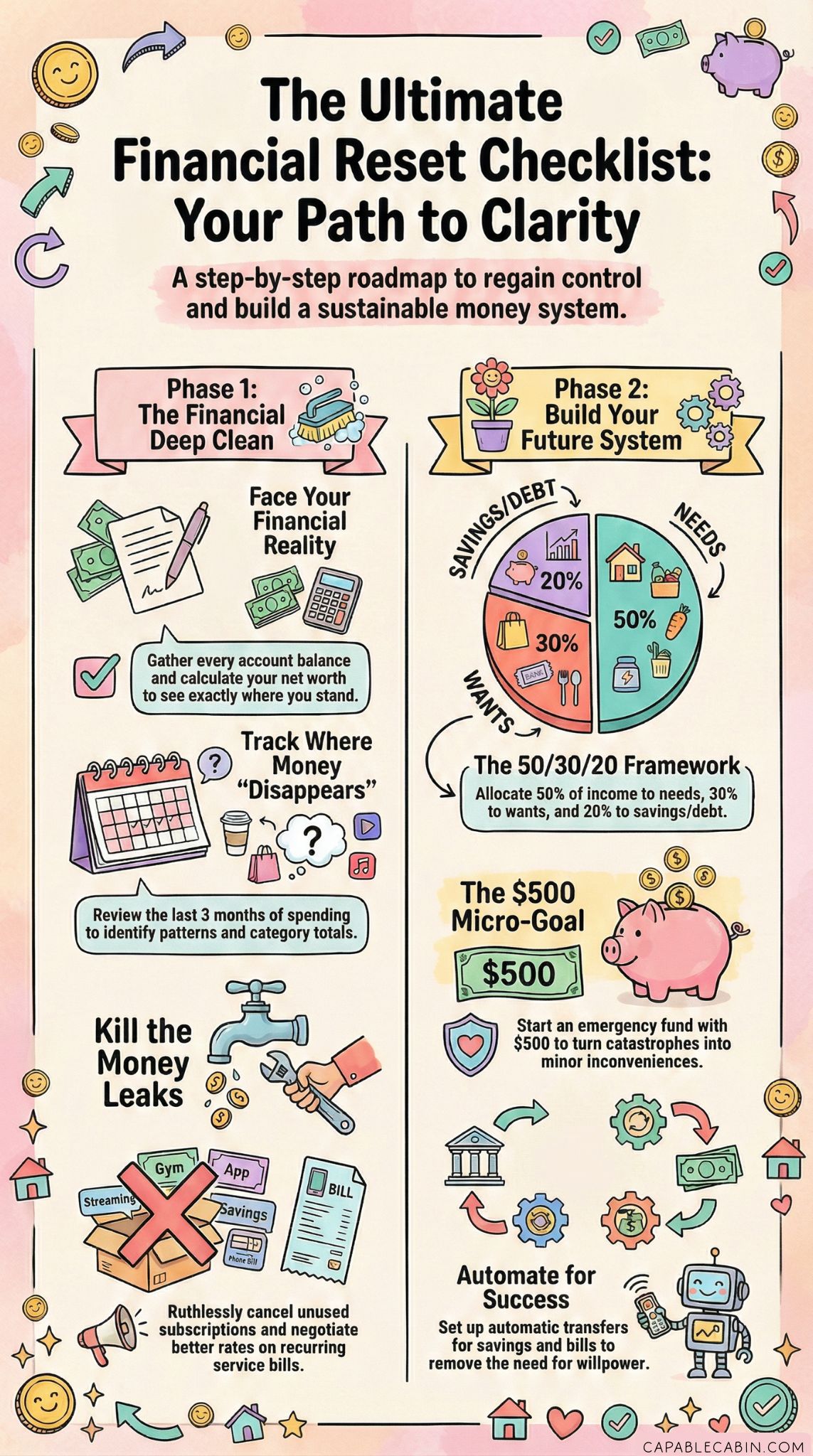

Spot Potential Problem Areas

Take a moment to reflect on where your money seems to “disappear.” Maybe it’s impulse spending after a stressful day, or a monthly membership you rarely use. Often, these small leaks can add up, leaving you scrambling to catch up on bigger priorities. Recognizing these patterns is the first step toward plugging the holes.

When you can see each puzzle piece—debt, income, ongoing bills, and possible future obligations—it becomes much simpler to form a realistic plan. That clarity is invaluable, especially as you move forward with rebuilding your fund in a way that suits your life. The sooner you face the facts, the sooner you can course-correct.

Create A Thoughtful Repayment Plan

When your emergency fund is depleted, it’s not just about saving again. You may also owe money to credit cards or personal loans you used to handle the crisis. Working on both brass-tacks debt repayment and savings replenishment at the same time can feel intimidating, but it’s absolutely doable. By crafting a thoughtful repayment plan, you can tackle high-interest debts, set aside money for emergencies, and gain momentum toward a more secure financial standing.

Prioritize Debts And Savings Side By Side

It might sound contradictory to save money while also paying off debts, but doing both can be empowering. If you pour every spare cent into debt repayment, you risk having nothing for emergencies. If you focus solely on savings, high-interest debt could snowball out of control. Strike a balance:

- Identify high-interest debts (credit cards, personal loans).

- Dedicate a certain portion of your monthly budget to chip away at these aggressively.

- Set aside a small but consistent amount to rebuild your emergency fund.

By combining these efforts, you’re steadily decreasing your liabilities while safeguarding yourself against new emergencies.

Choose Your Payment Method

There are various debt repayment strategies, including:

- Snowball Method: Pay off your smallest debts first for quick wins, then roll that amount into the next bigger debt.

- Avalanche Method: Pay off the debt with the highest interest rate first to save the most on fees, then move to the next highest rate.

- Hybrid Approach: Combine elements of both to suit your personal preferences.

Whichever method you choose, stick to it. Consistency is key. Each time you knock out a debt, you’ll feel more confident adding extra funds to your savings bucket.

Negotiate With Creditors

If your crisis or evacuation caused you to miss payments on bills or loans, try reaching out to creditors to discuss a payment plan. They might lower your interest rate, reduce your monthly minimum, or offer a deferred payment schedule. It can be nerve-wracking to pick up the phone, but many lenders would rather work with you than see your account go into default.

Consider Post-Evacuation Costs

Reflect on how your repayment plan fits into possible post-crisis expenses. For instance, if you needed to evacuate recently, you might still have some pending obligations like insurance claims or property repairs. It might help to check out evacuation insurance claims or post-evacuation financial recovery for strategies on navigating that process. Including these costs in your budget ensures you don’t fall behind on one front while focusing on another.

Above all, remember this plan is a living document. Life doesn’t always follow a straight line. Be prepared to adjust, refocus, or tighten the budget in other areas as necessary. By having a roadmap, you’re making sure your actions are deliberate rather than reactive, which is a major stress reliever.

Explore Creative Ways To Save

Saving money is often easier said than done, especially if you’re already dealing with leftover bills from a crisis or a period of reduced income. But there are creative ways to keep your pockets from feeling perpetually empty. It’s about more than clipping an occasional coupon—it’s about redesigning certain aspects of your life to preserve as many resources as you can for your rebuilding plan.

Rethink Your Budget Categories

Start by looking at the largest non-essential expenses in your budget. These might be things like:

- Premium streaming services

- Unused gym memberships

- High-end phone contracts

- Frequent takeout or coffee runs

Give yourself permission to trim these areas at least temporarily. You don’t have to slash them entirely (unless you want to), but adjusting them could free up unexpected sums each month.

Embrace Secondhand And Swaps

For families, especially, clothes and household items can be a steady drain on your wallet. Instead of buying new items, consider:

- Thrift stores, which can be goldmines if you’re patient.

- Clothing swaps with neighbors or friends, where everyone brings items they no longer need.

- Local buy-nothing or free-cycle groups to snag essentials at no cost.

These strategies can help you zero in on the difference between what’s necessary and what’s just nice to have. Every saved dollar can go directly into refilling your emergency fund.

Get Into Meal Planning

Food often becomes a budget black hole, because it’s so easy to splurge when you’re tired or stressed. Consider these meal-planning tips:

- Plan all your meals for the week at once, then make a shopping list.

- Stick to that list to avoid impulse buys.

- Cook in larger batches to save time and money. Freeze extra portions for the busy nights when you’d normally order in.

This not only saves money but also helps your family stay organized. Having ready-made meals on hand is helpful if you ever face another sudden crisis. You can also look into the costs associated with budget evacuation planning, so you’ll know how to stock up effectively without overextending your resources.

Use e-Coupons and Cash-Back Apps

Finally, if you prefer a more modern approach to saving, consider using:

- Cash-back apps or browser extensions that apply discounts at checkout.

- Digital coupons from grocery or pharmacy apps.

- Earn reward points on your credit card to offset certain purchases.

The key is to keep it simple. You don’t need to become an extreme couponer. Just pick one or two tools that you find easy to use. Remember, every little bit you save helps you move forward on your journey.

The beauty of trying new, creative ways to save is that it can feel more like an experiment and less like punishment. You’re giving yourself room to discover new habits that might stick long after your financial recovery is complete.

Secure Additional Income Streams

When money feels tight, you might want to do more than just reduce expenses. Earning extra income can speed up your efforts to replenish savings and pay off debts. Plus, having more than one income stream is often a powerful move against future disasters, whether they are financial crises or evacuation scenarios. Let’s explore how you can bring in a little more cash without sacrificing your sanity.

Consider Side Gigs

We live in an age where side-hustles abound. Whether you have a knack for website design, tutoring, or dog walking, there’s a market for it. The key is to choose gigs that align with your schedule and energy level:

- Freelance services (writing, graphic design, consulting)

- Rideshare or delivery services

- Pet sitting or childminding

- Local communities needing errands or yard work

A well-chosen side hustle might add a small but significant stream of income each month. Suddenly, those initial steps toward your recovery fund can pick up real momentum.

Tap Into Hobbies

Maybe you’re already talented at baking or crafts. Could you turn those talents into a small business? Platforms that facilitate online sales (like local community boards or small artisan websites) allow you to showcase your skills. If you love creating homemade goods or customizing children’s clothing, you might find a loyal customer base in your own neighborhood.

Upgrade Your Work Credentials

If you have the time and resources, consider investing in skills or certifications that can help you earn more in your current job or qualify for a better-paying position:

- Online courses in coding, digital marketing, or project management

- Certifications for specialized skills like accounting software

- Workshops that help you lead a team or manage projects effectively

It can feel counterintuitive to invest in yourself when you’re recovering financially, but strategic skill-building could pay off in higher earnings down the line. Some employers even reimburse educational courses, so don’t forget to check with your HR department.

Explore Government And Community Programs

Depending on where you live, there may be programs that provide temporary assistance or help with job placement. This might include:

- Local workforce development centers

- Federal or state-run job training programs

- Emergency relief funds for those who have evacuated, especially if you faced a natural or regional crisis

Sometimes, you just need a stronger network or a little assistance to jump-start your earning potential. If that’s the case, lean on community resources for guidance.

Ultimately, boosting your income isn’t simply about getting a bigger paycheck. It’s about cultivating resilience. By stretching your capacity to earn, you’re better equipped to handle future uncertainties and keep your emergency fund intact when life surprises you again.

Use Community And Family Support

No matter how independent you are, rebuilding your finances after an emergency isn’t something you need to shoulder entirely on your own. Leaning on loved ones and your broader community can provide relief—both emotional and financial—that eases the transition. This step is often overlooked because we’re taught to solve money issues in private. Yet, collaborating with people who care about you can provide much-needed breathing room.

Tap Into Family Support

Family members, including parents or siblings, might be in a position to help. This doesn’t necessarily mean a direct loan. They might:

- Offer childcare so you can take on extra work hours.

- Lend a hand with meal prep or errands.

- Invite you to family dinners more often so you don’t have to spend as much on groceries.

It can be tough to admit you need help, especially if you’re used to being the caretaker. But remember, collaboration is normal. If you’re married or have older kids, share your financial goals with them. Give them tasks or let them take the lead in certain areas, so everyone has a stake in your collective recovery.

Seek Community Resources

Local organizations and nonprofits can connect you with programs designed to help families recover from emergencies. This could mean:

- Access to discounted utility rates.

- Assistance with rent or mortgage for a short period.

- Free or low-cost financial counseling services.

If your emergency was evacuation-related, you might have a specialized support network in your region. Check out local disaster-relief centers, or coordinate with community groups that focus on evacuation budget breakdown. Sometimes, just knowing where to look for help is half the battle.

Build A Support Network

Whether it’s a Facebook group for moms in your area, a local church community, or a workshop you attend, pick at least one group where you can share ideas, ask questions, and maybe even find folks to team up with on cost-saving measures. You’d be surprised how often a casual conversation leads to something tangible—like a neighbor offering a used washing machine when yours breaks down. This type of communal help can save both money and headaches.

When you have a community rallying around you, you’re more likely to get back on your feet faster. Sometimes, the strongest remedy for financial stress is simply knowing there are people who understand and want to help. Take solace in that collective reassurance.

Consider Professional Guidance

Sometimes, you just want someone in your corner who can look at your financial life objectively. If you’re feeling especially overwhelmed by debt, have limited experience with financial planning, or are dealing with complicated scenarios like insurance claims or ongoing medical bills, professional guidance might be a game-changer.

Financial Advisors Or Planners

Working with a certified financial planner can help you:

- Prioritize your goals, from paying off a mortgage to saving for your kids’ education.

- Figure out the wisest way to rebuild your emergency fund without neglecting debt obligations.

- Set realistic timelines and monthly targets that keep you motivated.

Yes, hiring an advisor can cost money, but the right expert might save you far more than their fee by helping you avoid costly mistakes. If you’re uneasy about the cost, look for financial advisors who offer sliding-scale fees or free consultations.

Credit Counseling Services

If you’re dealing with high-interest credit card debt or considering consolidation, a reputable credit counseling service can negotiate with lenders on your behalf. They may secure:

- Lower interest rates

- Fee waivers

- Extended payment schedules

Just remember to do your research. Not all credit counseling agencies are created equal. Look for accredited, nonprofit organizations that have transparent fee structures. A good counselor will help you design a plan that doesn’t leave you reliant on temporary fixes. This collaborative approach can help you replenish your savings steadily while tackling your debt.

Emergency Preparedness Specialists

If your situation is closely tied to natural disasters or other large-scale emergencies, you might benefit from specialists who understand pandemic financial planning or evacuation financial planning. These experts focus on how families like yours can navigate everything from official evacuation orders to lodging costs, insurance claims, and small business disruption if you have one. They’ll guide you in creating a blueprint that helps you recover from the current crisis and prepare for the next. This specialized advice can be invaluable when you’re building back your finances with evacuation or disaster scenarios in mind.

A professional might be the missing piece that ties your entire plan together. By getting that expert opinion, you’re effectively saying, “I’m ready to do what it takes to protect my family’s financial future.” There’s absolutely no shame in asking for that kind of support—sometimes, it’s exactly what you need to turn a tough situation around.

Build Resilience For Future Crises

Getting back on your feet after draining your emergency fund is a big deal, but don’t stop there. You want to emerge stronger, ready to handle whatever new storms might appear on the horizon. Think of this phase as designing a safety net around your safety net—layers of protection that help you handle emergencies with more composure the next time around.

Create A Multi-Layer Emergency Fund

It may be helpful to split your savings into short-term, mid-term, and long-term buckets. For instance:

- Short-term: A small cushion in your checking account to tackle minor surprises like car repairs.

- Mid-term: Your main emergency fund, ideally in a high-yield savings account you can’t dip into easily.

- Long-term: Investments or retirement accounts that you won’t touch unless things get really serious.

This layering means you’re not forced to plunder a single pot of money for every small hiccup.

Strengthen Your Insurance Coverage

It’s hard to overstate the importance of health, auto, life, and homeowner’s or renter’s insurance. If you live in an area with frequent evacuations, you may also need specialized insurance to cover flood or wildfire damage. Even if you feel stretched thin, it’s worth considering some form of coverage that aligns with your biggest risks. If you ever need to file insurance claims, you’ll be thankful that you spent the time and resources to get the right policy.

Have A Plan For Evacuations And Disasters

Revisiting your evacuation or crisis plan after you’ve recovered is crucial. Maybe you discovered you needed a financial evacuation go bag but didn’t have one. Or you underestimated how pricey a temporary relocation can be and want to build a more robust evacuation budget breakdown. Updating these plans and even practicing them can reduce confusion and cost if you ever have to act under pressure again.

Maintain Essential Documents

Keep digital copies of everything important—ID cards, insurance policies, birth certificates—somewhere secure and encrypted. This helps you expedite processes like evacuation insurance claims if the worst happens. A little organization now can spare you a huge headache later.

Building resilience is about learning from what you’ve gone through. When you deliberately fortify the holes exposed by your last emergency, you’re setting your future self up for success. It’s a powerful act of self-protection.

Embrace Ongoing Growth And Stability

With your emergency fund on the mend and your confidence slowly returning, it’s time to think about growth. While your top priority might be to restore what you lost, you don’t want to stop there. You can use your renewed focus to explore long-term financial well-being, which includes saving for milestones like a child’s education, a dream home, or retirement.

Invest For The Long Haul

Once you have a comfortable cushion, consider opening an investment account. Even modest monthly contributions can yield significant returns over time because of compound interest. You don’t have to be a stock-market wizard to get started. Look into index funds, robo-advisors, or target-date funds that simplify the process. The key is consistency, not perfection.

Engage Family In Goal-Setting

You’ve likely heard the saying, “What gets measured gets managed.” If you have a partner or older kids, set collective goals:

- A down payment on a new home

- A family vacation fund

- College savings

- A small business startup fund

Getting everyone involved not only shares the load but also keeps you motivated. After all, you’re not just rebuilding to survive—you’re rebuilding to thrive.

Keep Reviewing And Tweaking

Over time, your job may change, your family might grow, or your priorities might shift. Schedule a regular (say, quarterly) check-in to look at your budget, savings, and investments. Ask yourself:

- Am I still on track to meet my immediate savings targets?

- Does my debt repayment plan need refining?

- Do I need to adjust my side hustle or consider another income avenue?

These periodic check-ins help prevent complacency. The goal isn’t to micromanage your money, but rather to stay connected so small problems don’t become overwhelming later.

Celebrate Small Wins

It’s easy to focus on how far you have yet to go, but take time to acknowledge even the tiniest steps forward:

- Hitting your first $500 in savings

- Paying off a credit card balance

- Reducing your grocery bills for three months in a row

Every milestone matters. Each one is proof that your efforts are making a difference. By celebrating, you reinforce positive habits and keep your motivation levels high. You’re walking the talk of financial stability, which is something to be proud of.

Next Steps Toward Confidence

Recovering after tapping your emergency fund can feel like trudging uphill. But with each step you take, you’re regaining lost ground and building new resilience. It’s not about doing everything perfectly—it’s about doing something consistently and compassionately for yourself and your family.

Give yourself credit for coming this far. You took a giant step simply by acknowledging you need a plan and seeking out practical strategies, from paying off high-interest debts to rebuilding your savings one dollar at a time. Remember, it’s okay to tweak your approach. Life will throw new surprises at you, and that’s exactly why you’re putting these solid measures in place.

If you’ve been through an evacuation or another major crisis, go easier on yourself. Being financially prepared doesn’t mean you’ll never face challenges. It means you’ll be ready to cope when those challenges show up. Whether that means exploring a financial crisis action plan, adding a second income stream, or connecting with your family for added support, you have options. You’re not stuck, and you’re certainly not doing it alone.

Keep looking ahead and remember that each step—no matter how small—brings you closer to the peace of mind you deserve. You’re building a future in which an unexpected expense or crisis doesn’t derail your world, but merely tests how prepared you’ve become. So here’s to you, your family, and your journey forward. You’ve got this, and every move you make now is another testament to your resilience and strength.