The 30-Day Emergency Fund Challenge: Save $500 Fast

Ever feel like it’s impossible to sock away any extra cash—especially when life tosses you surprise expenses left and right? I totally understand. Sometimes you look at your bank account and think, “How can I possibly stash anything away for an emergency?” But here’s the thing: starting small is not only doable, but it can also be surprisingly motivating. That’s where a 30-day challenge to save $500 can make a huge difference. Let’s walk through a friendly, step-by-step approach to help you build a quick financial cushion. No matter how tight your budget seems or how busy life gets, you can do this. We’re in it together, one day at a time.

Embrace The 30-Day Challenge

We’re calling this an “emergency fund challenge” for a reason: having a dedicated fund for urgent scenarios can keep you afloat when your car suddenly needs new tires or when your child’s doctor bills show up right after payday. By focusing on a 30-day sprint, you create a sense of urgency. That slight intensity can help you set aside money you never realized you had. Think of it as a sprint toward peace of mind.

Why $500 Matters

You might be wondering, why aim for $500 and not $1,000 or some other figure? Well, $500 is a solid chunk of change that can handle everyday emergencies like an unexpected vet bill or a smaller car repair. Sure, you can ultimately work toward a 1000 emergency fund or even more. But starting with $500 in 30 days can give you the spark you need to keep going. Once you hit this initial milestone, you’ll have both the confidence and proof that your saving strategy works.

How This Challenge Benefits You

- It builds positive momentum. Saving can feel like a giant mountain, but chunking it into a 30-day project gives you a clear finish line.

- It helps you adopt daily (or near-daily) saving habits. Rather than waiting until a crisis hits, you’ll already have a cushion ready.

- It protects you from relying on credit cards with high interest rates whenever a mini-emergency pops up.

The Mindset Shift

This 30-day journey is also about changing how you view and manage money. Instead of thinking, “I’ll never have enough,” or “I’ll try to save later,” you’ll say, “I’m saving right now, with the resources I do have.” That mindset shift alone is powerful because it teaches you to prioritize your future well-being. Even if the process feels challenging at first, you’ll be amazed at how small daily changes can add up to something bigger than you expected.

Understand The Importance Of Saving

If you’re already convinced you need to save more but can’t figure out how, you’re not alone. Most of us know saving is important, yet life gets in the way. Between groceries, utility bills, and the occasional treat, you might feel like there’s never enough leftover. But that leftover is exactly what we’re going to create together.

Different Types of Savings

When we say “emergency fund,” we’re talking about a specific stash of money dedicated strictly to unexpected events. It’s separate from your regular savings or checking account. If you’re curious about broader differences, you can check out emergency fund vs savings. In a nutshell, your emergency fund is like a safety net you never touch unless it’s absolutely necessary. Think of it as your financial fortress against the unknown.

Why Families Benefit Most

Families—especially those with kids—face surprising costs all the time: a sudden field trip expense, a broken appliance, that always-fun “I need new shoes again, Mom!” moment. You’ve probably seen it firsthand. Having an emergency fund ensures these surprises don’t derail your entire budget. And if you’re a single parent? This can be even more critical. Finances are tough enough to juggle on your own. A cushion buys you peace of mind, letting you focus on enjoying family time instead of stressing over every possible “what-if.”

The Risk of Doing Nothing

Without a financial backup plan, a single unexpected bill can lead to debt or even a reliance on quick-fix solutions like payday loans. And once that cycle starts, digging out can be incredibly tough. That’s why we’re emphasizing this 30-day challenge: it sets you on a path toward security. It may not solve everything immediately, but it starts the process. Over time, you can expand this short sprint into something bigger, like a 3-month emergency fund or more.

Plan Each Day Strategically

One of the most helpful parts of a 30-day sprint is that you can plan for each day. That’s right—rather than vaguely saying, “I’ll save some money this month,” you’ll have a daily roadmap. Let’s break it down so you can see how manageable it really is.

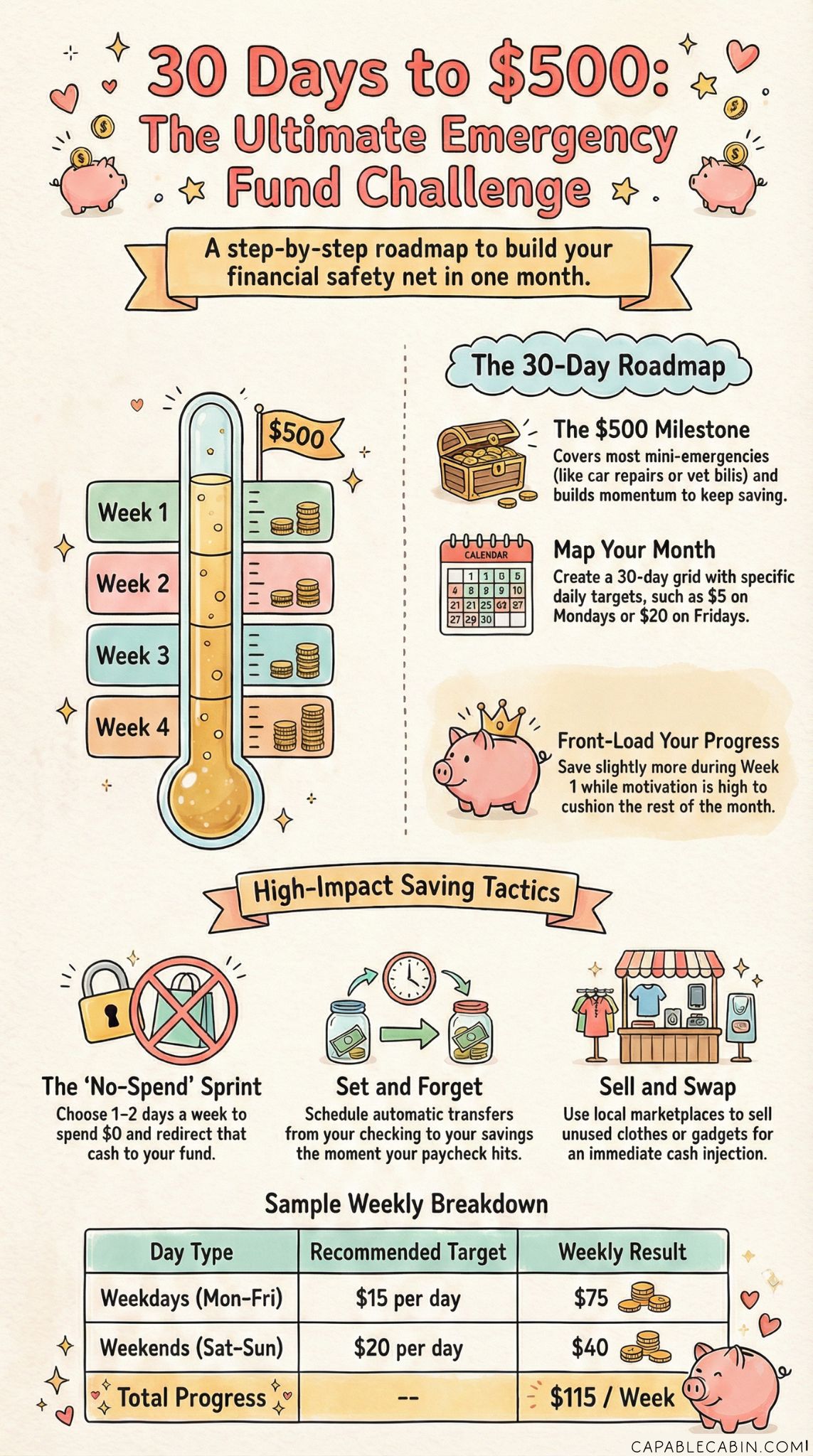

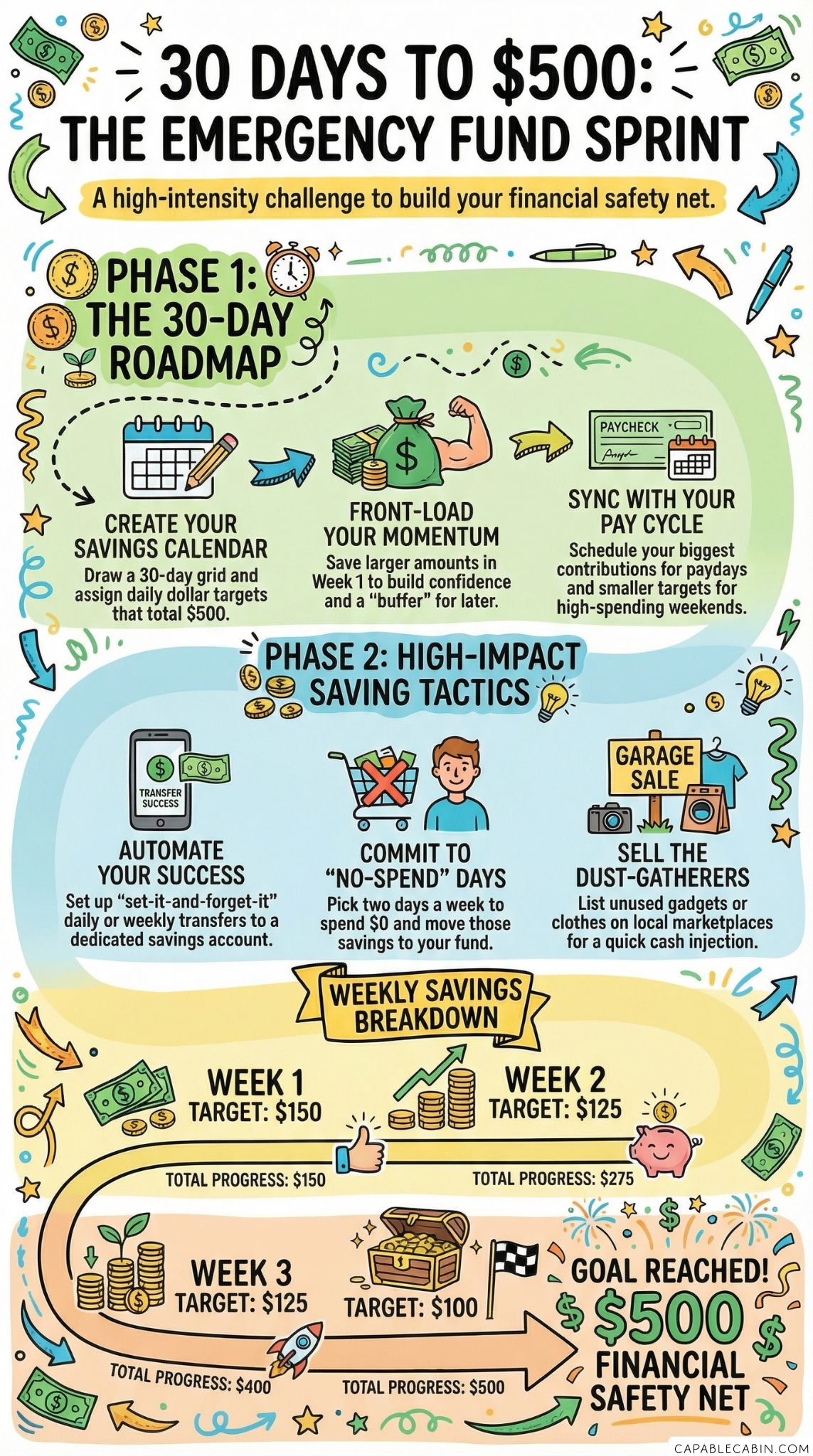

Create a Simple Calendar

Start by drawing out a calendar grid on a piece of paper or in a spreadsheet. Label each day from 1 to 30. Make a daily savings goal—like $5 on Monday, $10 on Tuesday—and so on, until you reach $500 total. This helps you see exactly where you’re headed. If you hate the idea of a strict plan, consider giving yourself a daily range instead: for example, $0–$20, with a weekly total you must hit by each Sunday.

Prioritize the First Week

The beginning is your chance to build momentum. You’ll have excitement on your side, so use it. In that first week, try to deposit slightly more (as your budget allows) to cushion the rest of the month. If you can wedge in even $50 or $75 early on, you’ll feel a surge of confidence that can carry you through the remaining days.

Consider Weekends vs. Weekdays

If you get paid on Fridays, that’s probably your best moment to sock away a chunk. On Saturdays and Sundays, you might spend more on family outings, so plan smaller amounts for those days. This approach keeps you realistic about how your spending habits shift throughout the week.

Implement Practical Savings Tactics

Now for the fun part—actual ways to free up those extra dollars. Every small tweak matters, so let’s explore a few methods that can help you inch toward your daily targets. Before you know it, these actions will become habits, and that’s what really transforms your finances over the long haul.

1. Automatic Transfers

One of the easiest methods is to set up an automatic transfer from your checking to a dedicated savings account the moment your paycheck hits. This “set it and forget it” strategy removes the temptation to spend that money. Many banks let you schedule these in advance. You could opt for $5, $10, or $15 per day, depending on your overall goal.

2. Cash Envelope Method

If you’re someone who needs a tactile reminder—like physically seeing how much money you have left—try using envelopes. Each envelope represents a different daily or weekly target. At the end of the month, deposit your total into a separate savings account or keep a portion of it at home. (While you’re at it, check out ways people keep emergency cash at home safely, just in case you want a little buffer for those truly last-minute issues.)

3. Commit to a “No-Spend” Day

Pick one or two days a week to spend absolutely nothing. That means making meals with whatever is in your fridge, skipping the coffee run, and saying “not today” to online shopping. The money you would have spent on those days goes straight to your emergency fund. It can be surprisingly fun to get creative with the resources you already have.

4. Sell or Swap Unused Items

Got clothes, kitchen gadgets, or kids’ toys that are still in decent shape but just gathering dust? Sell them on a local marketplace or plan a swap meet with friends. You can put the earnings directly into your challenge fund. Plus, decluttering your space tends to bring a sense of calm—like you’re starting fresh in more ways than one.

Address Common Stumbling Blocks

Let’s be real: saving money for a 30-day project can get tricky. There might be days when you’re forced to spend on an urgent repair or a family event you can’t skip. Here are a few tips for navigating those rough patches without losing hope.

Dealing With Unexpected Costs

Don’t let a surprise bill derail the entire challenge. If you’re slammed by an unexpected expense, adjust your plan. Maybe you need to take a day off from stashing $10 and settle for $2 or $3 instead. The important thing is to keep moving forward, even if it’s a smaller step.

Handling Low-Income Weeks

If your work hours fluctuate or you receive variable paychecks, you might have a tough time meeting the same daily goal throughout the month. Instead, consider the total $500 you want by Day 30. Maybe you front-load a bigger chunk on the higher-pay weeks, then lighten up on the leaner weeks. Flexibility is key.

Family Commitments

Birthday parties, relative visits, or sudden potluck events can throw off your budget. Whenever possible, plan for these costs in your monthly overview. If your sister’s birthday is in the second week of the challenge, assign a slightly lower saving target for that week to accommodate a small gift or family meal. You’re simply shifting funds around, not abandoning the plan altogether.

Keep The Inspiration Flowing

Doing anything daily for 30 days can feel like a marathon, even if we’re focusing on a short sprint. It’s perfectly normal to start out enthusiastically, only to feel the energy fizzle by Week 2. Don’t worry—a small boost can keep you going.

Use Visual Trackers

Sometimes, seeing your progress can be super motivating. Create a thermometer chart or a simple bar graph. Color in sections for every $10 or $20 you save. Watching that bar rise can give you an emotional lift when you’re tempted to skip a day.

Buddy Up With Friends

Just like finding a gym partner can keep you accountable, roping in a buddy for your emergency fund challenge can make the whole experience more fun. This might be a family member or a good friend who also needs a financial jumpstart. Check in with each other. Compare notes. Share success stories or setbacks. This shared journey can be your secret weapon against procrastination.

Remind Yourself of the “Why”

Whenever you feel your motivation slipping, circle back to the reason you’re doing this at all—your family’s safety net, your own peace of mind, or simply avoiding high-interest debt. Print out a photo of what you’re saving for, whether that’s a future house, a new fridge, or just a stress-free mindset. Place it somewhere you’ll see it daily, like your bathroom mirror or your phone background.

Expand Your Savings Beyond 30 Days

Once you complete your 30-day push, you might think, “Okay, I did it—now what?” The real beauty of this challenge is that it can be extended or adapted to fit long-term savings goals. After all, emergencies don’t end when the month is up. Here are ways to transform this quick win into an even bigger financial triumph.

Aim for the Next Milestone

If $500 is your stepping-stone goal, why stop there? Maybe your next milestone is $1,000, or you’re ready to tackle a year-long emergency fund challenge. You already have the blueprint. Just spread it out over more months or increase your daily target if your income allows.

Consider Different Account Options

By now, you might be curious where you should keep your money for the long haul. Some people prefer a simple high-yield savings account that’s easy to access during a real emergency. Others keep a portion at home for ultra-urgent cases. If you’re looking for more insights, head over to where to keep emergency fund. The main rule is to make sure you don’t mix your emergency stash with your everyday spending account. Keeping the money out of sight can help you avoid dipping into it.

Reassess Your Budget

With your $500 cushion in place, you can step back and see which parts of the 30-day plan worked best for you. Did you like automated transfers, or did you thrive on the cash envelope system? Were there certain spending habits you cut out—like daily coffee trips—and never really missed? Use these insights to refine your monthly budget. Over time, you’ll notice that you can consistently save, creating a more stable financial foundation.

Manage Mindset And Motivation

If you’ve ever felt guilty or ashamed about not saving enough in the past, know that you’re not alone. Money stress weighs on so many of us, but shame rarely motivates lasting change. Instead of beating yourself up over things you wish you’d done sooner, focus on how this challenge is laying the groundwork for a better tomorrow.

Overcoming Perfectionism

Sometimes we believe we have to save flawlessly—no slip-ups—or it’s not worth doing. That mindset can keep you stuck. One off-day or missed deposit isn’t the end of your challenge. Adjust, move forward, and don’t sweat the occasional shortfall. A steady pace, even if imperfect, gets you closer to your goal.

Celebrating Small Wins

Did you manage to put away an unexpected $20 from a clothing sale? That’s awesome. Treat it like a big deal—because it is. Give yourself a pat on the back and, if it feels right, share your progress with friends or family. Positive reinforcement reminds you that these small actions truly matter.

Working Through Setbacks Together

We all encounter setbacks—a sudden car emergency, a medical bill, or a drop in work hours. The key is how you respond. You’re now equipped with a plan and a supportive mindset. If one corner of your strategy fails, pivot to a different approach. If your kids need more supplies this week, adjust your daily goals and make up for it when you can. Keep the bigger picture front and center.

Explore Creative Ways To Save

Sometimes you need a few fresh ideas to keep the momentum going. Here are some less conventional methods to give your challenge a fun twist.

Encourage Family Participation

If you have kids who are old enough, involve them in the savings challenge. Maybe you create a coin jar and let them drop in spare change they find around the house. Turn it into a friendly game. This can teach your children about financial responsibility while getting their buy-in too.

Incorporate Micro-Hustles

If you have a skill—like writing, knitting, or graphic design—consider taking on a small freelance gig for the month. Or maybe you offer weekend babysitting to neighbors for a fair rate. It doesn’t have to be permanent, just something to bulk up your daily savings goals. Even an extra $20 a week adds up to $80–$100 by the end of the challenge.

Check Subscriptions and Memberships

One sneaky way money leaks from our accounts is through unused memberships. Love those streaming services but only watch one or two shows a month? Consider canceling or downgrading your subscriptions for 30 days. Put the money you save directly into your emergency fund. The best part: if you don’t end up missing them, that could become a permanent change.

Protect Your Savings From Impulse Spends

Let’s face it: retail therapy can be tempting, especially when you’ve had a tough day. But every unnecessary splurge chips away at the cushion you’re building. Here’s how to guard your challenge money from impulsive spending.

24-Hour Rule

Before making any unplanned purchase, give yourself a full 24 hours to think about it. Often, you’ll realize that the initial urge was fleeting. If you still want it after a day, and you can afford it without dipping into your emergency stash, go for it. Otherwise, skip it and deposit the amount you would have spent.

Limited Access to Funds

Storing your funds out of immediate reach can help. Some families maintain a separate account or even prefer using a financial emergency binder for important documents and instructions on how to access saved funds only for real emergencies. That extra step of transferring money from one account to another can make you think twice before you spend it.

Lean on Support

If you’re feeling tempted by a big sale or a random gadget, talk it through with your savings buddy. Sometimes, just spelling out why you think you need that product can help you realize it’s not crucial. That outside perspective is golden, especially when you’re trying to stay dedicated to your 30-day challenge.

Evaluate Your Progress Weekly

A month might feel like a long time, but checking in at the end of the challenge is often too late. Instead, evaluate your progress weekly. By doing so, you can spot problems early and make mid-challenge tweaks.

Note Wins and Losses

Use a simple note on your phone or a bullet journal to track how you did each day. Highlight any day you exceeded your goal and note what made that possible. Also, mark days you fell short and think about why that happened. Did you forget to account for a family outing? Did you give in to a random splurge? This weekly debrief can inform the next set of days.

Track Patterns

If you notice a trend—maybe you save more on weekdays than weekends—that’s a clue. Could you rebalance your approach? For instance, maybe you’re able to save $15 each weekday but only $5 on a busy Saturday. Adjust your schedule accordingly. The goal is to reduce stress, not amplify it.

Plan Adjustments

If you’re off track, don’t panic. Simply recalculate what you need to do in the remaining days. Perhaps you can add an extra $5 here or there, or skip a small luxury next week. These micro-adjustments can get you back on course, allowing you to finish strong by Day 30.

Guard Your Fund After The Challenge

Congrats, you’re making real progress. Once you’ve completed the emergency fund challenge, you have a $500 safety net ready to cushion life’s curveballs. So how do you ensure you don’t blow it on something non-essential next month? Let’s talk about maintaining that financial boundary.

Avoid Raiding the Fund

It’s tempting to peek at that pot of money and think, “Hey, I could pay for a spontaneous weekend getaway.” Resist that urge—remember your fund is for emergencies only. If you need a vacation boost, try launching a separate savings category. Think of your emergency fund like a fortress wall. You only breach it if the situation is genuinely urgent.

Replenish After Use

If you do have to dip into it, make a plan to rebuild immediately. An unexpected medical bill may eat up $200, but you can jump right back into a smaller challenge. Setting aside even $20 or $30 a week can help you rebuild emergency fund reserves. The key is to treat any withdrawal as temporary. Your fund is meant to bounce back swiftly.

Stay Aware of Inflation

As time goes on, $500 might not cover as much as before. Keep an eye on rising costs. Groceries, utility bills, and basic services might get pricier. If you can swing it, aim to grow your emergency stash. You might explore strategies in inflation emergency fund to ensure your safety net keeps pace with the changing economy.

Tackle Bigger Financial Goals

Having $500 set aside is amazing, but emergencies can run higher than that. This 30-day jumpstart can lead to a larger, more robust plan for long-term security. Here are a few ways to expand your approach without losing momentum.

Build a 3-Month Backup

A full 3-month cushion might sound overwhelming right now, but it’s a common recommendation for households. It covers major expenses if you lose a job or face a serious setback. You don’t have to tackle it all at once. You can do multiple sprints or a slower, steady approach. Check out how to get started in our start emergency fund resources or add monthly sprints until you’re comfortable with the size of your cushion.

Balance Debt Repayment and Savings

If you have high-interest debt, you might wonder whether you should prioritize paying it off or building your fund. In many cases, you might want to do both simultaneously. Examine your debt’s interest rate and weigh it against the importance of having cash on hand for emergencies. If you’re stuck, see emergency fund vs debt for guidance on striking that balance.

Automate for the Long Haul

You’ve likely used auto-transfers during the 30-day challenge. Keep that routine going. Even if you drop the contribution from $10 a day to $10 a week, consistent deposits will eventually compound into something significant. Simply having that process in place rewires you to be a saver, not just a spender.

Learn From Emergency Fund Mistakes

We all slip up. Sometimes we set money aside, only to tap it for a shopping spree. Other times, we find ourselves leaving the fund in a low-interest account where it’s not growing at all. That’s okay. What matters is recognizing these pitfalls and taking steps to correct or avoid them in the future. For some common pitfalls, check out emergency fund mistakes. Knowledge is power, friend.

Overextending Yourself

One major mistake is committing to a savings plan that’s too strict. If your daily targets are so high that you can barely afford groceries, you risk burning out or resorting to credit cards when shortfalls happen. It might look ambitious on paper, but in practice, it’s unsustainable. Aim for a plan that challenges you without pushing you past your financial limits.

Failing to Revisit Goals

Another risk is letting the funds sit untouched for years without revisiting how much you actually need. Life circumstances change—kids grow up, you might buy a home or switch jobs, the cost of living fluctuates—and your emergency fund should reflect those changes. Periodic check-ins ensure your saving efforts match your reality.

Forgetting Short-Term Needs

Also be careful not to ignore upcoming short-term expenses, like holiday gifts or back-to-school supplies. Skipping that budget line altogether can lead to surprises. Instead, carve out a small portion for predictable events. That way, you’re not forced to raid your emergency fund for routine expenses.

Use Additional Challenges And Tools

Once you catch the challenge “bug,” you might realize you enjoy it—yes, for real. Saving in short sprints can be fun and motivating, especially if you’re the type who loves crossing items off a list. Consider layering other mini-challenges or tools to strengthen your financial safety net.

Try the $5 Savings Challenge

The 5 savings challenge is a simpler variant: every time you get a $5 bill—or whenever you see fit—you stash it away. It won’t majorly disrupt your budget, and you’d be surprised how quickly those fives add up. Use it as a companion to your 30-day push.

Organize Your Financial Documents

Having a financial cushion is only part of the emergency-preparedness puzzle. You want to store important papers—like insurance policies or medical records—in a secure place. Many people create a financial go bag or a financial emergency preparedness kit with all the essentials. That way, if you need them quickly, you’re not scrambling while stressed.

Look Into Envelope Systems

We touched on the idea of envelopes for daily savings, but some families go all-in on the emergency fund envelope system for ongoing budgeting. Each envelope corresponds to a category: groceries, utilities, fun money, and so on. A separate envelope (or set of envelopes) holds your emergency fund. This tangible, visual approach can be a game-changer if you want to avoid swiping a card constantly.

Celebrate Your Achievement

Remember how we started? With the desire to accumulate $500 in 30 days. By the time you reach day 30, don’t forget to celebrate. You’ve built a cushion that stands between you and life’s unexpected hits. Whether that means a mini pizza party at home or a quiet acknowledgement with a close friend—go for it. Recognizing your wins fuels your motivation for whatever comes next.

Reflect on the Journey

Pause for a moment and think about how you felt on Day 1 vs. Day 30. Maybe at first you were anxious or doubtful. Now, you’re more confident, knowing you can prioritize saving even when life is hectic. That’s a huge deal. This 30-day challenge isn’t just about the money—it’s about proving to yourself that you can adapt and thrive under new financial habits.

Share Your Story

If you’re comfortable, share your story with a broader community or a friend who’s also struggling to set aside money. Hearing firsthand experiences—like how you put $10 aside by skipping your usual streaming subscription or how you sold your old baby stroller—might spark someone else’s journey. And as you share, you reinforce your own commitment to this stronger, more resilient lifestyle.

Look Toward New Goals

This challenge could be the beginning of a larger shift in how you approach finances. Maybe you’ll aim to stack another $500, or you’ll go bigger and try a 60-day or 90-day challenge next. Or you can start exploring a deeper stash, like building a half-year fund. The possibilities are endless once you realize how flexible and resourceful you can be.

Final Thoughts: Keep Building Your Safety Net

The 30-day emergency fund challenge is a powerful jumpstart to your financial preparedness. You’ve learned how to plan daily saving targets, pivot when life throws curveballs, and keep up the momentum—sometimes even enjoying the process along the way. Whether you’re still eyeing a bigger goal, like a full 3-month cushion, or you want to combine this saving strategy with reducing debt, you now have a framework to guide you.

Most importantly, remember that saving is a journey, not a one-time event. If you stumble—maybe a surprise expense wipes out half your cushion—try not to get discouraged. Lean on the same techniques you used during these 30 days: break large goals into smaller, manageable parts, celebrate each steady improvement, and keep sight of why you’re doing this in the first place.

Financial stress doesn’t need to dominate your life. You have the tools, the mindset, and the determination to build a buffer that protects you and your loved ones when unexpected bills show up. So take a moment to high-five yourself (literally, if you want). You’re already well on your way to creating lasting change in your financial world—one pocket of savings at a time. And if you ever want to push further, explore resources like a year-long emergency fund challenge or re-evaluate your emergency fund amount. Keep going, friend, because you’ve just begun a journey that can transform your future security. You’ve got this!