The 3-Month Emergency Fund Your Familys Financial Safety Net

Picture this scenario: your car suddenly breaks down right before a busy week, and you need hundreds of dollars to cover the repair. These moments can shake even the most organized among us—especially if you’re not sure where that money is coming from. That’s where a 3-month emergency fund becomes your much-needed safety net. It’s essentially a dedicated sum of money that covers about three months’ worth of core living expenses, offering your family protection against job loss, unexpected bills, or any curveball that life throws your way. Let’s explore how to build and maintain this financial buffer, so you can face life’s surprises with far less worry and a lot more confidence.

We’ll walk through the basics of why emergency savings matter, how to figure out the right amount for your situation, and all the ways to grow that fund at a pace that fits into your life. You’re not alone in this—many of us have felt that gnawing concern over what would happen if paychecks suddenly stopped or new expenses piled up. Together, we’ll break down the process, step by step, so your family can be prepared for whatever tomorrow brings. Trust me, the peace of mind is worth the effort.

Embrace a 3-Month Safety Net

Let’s start with why having a three-month cushion can transform your financial outlook. You might be wondering, “Why three months and not just one?” The idea is to give yourself enough breathing room to handle emergencies without reaching for credit cards or dipping into savings meant for other goals, like a dream vacation or your child’s college fund. Three months of bare-bones expenses will cover essentials—rent or mortgage, utilities, groceries, and basic bills—if any major disruption strikes.

But more than that, having this buffer provides emotional relief. Think of it as a supportive friend who quietly reassures you whenever you feel anxious about finances. Instead of panicking about how to pay next month’s rent if you lose your job or face an unexpected medical bill, you can turn to your 3-month emergency fund and stay afloat while you plan your next move. This doesn’t eliminate life’s challenges, but it softens the blow and gives you time to regroup.

Why Three Months?

Some people aim for just one month’s worth of expenses, while others prefer six. Three offers a sweet spot: large enough to handle most short-term financial crises, yet achievable enough that it doesn’t feel impossible when you’re starting from scratch. It’s also a milestone you can build upon later—maybe you’ll feel inspired to keep going until you have a six-month nest egg. But trust me, having even these three months of protection can really shift how you handle day-to-day money decisions.

Building On Other Savings Goals

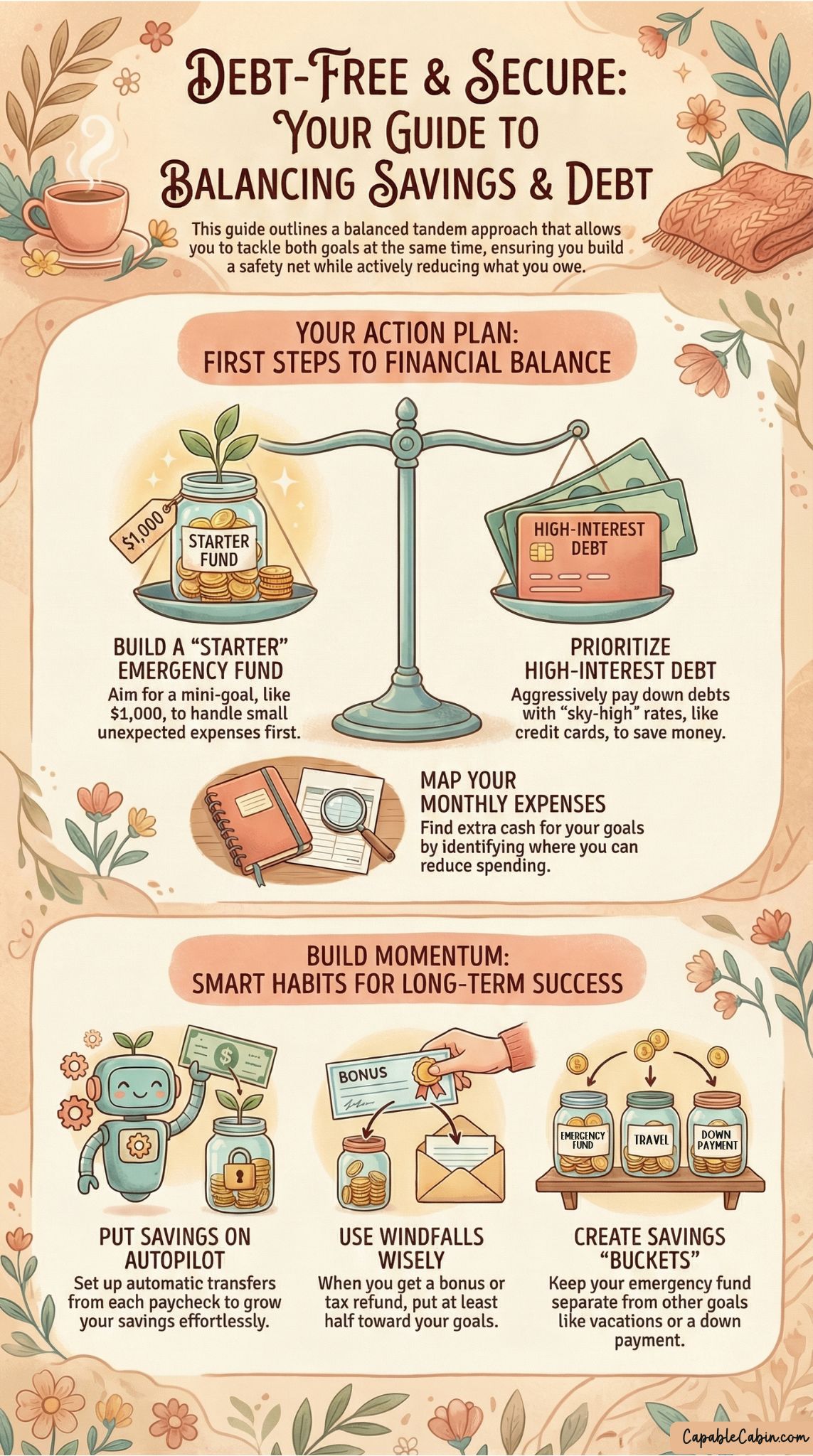

You might already have a $1000 emergency fund or some type of starter emergency fund. Think of a 3-month cushion as the next step. You’re taking that initial chunk of security and expanding it into a more robust safety net. If life has taught us anything, it’s that emergencies rarely give us a heads-up. So, the more prepared we feel, the less likely we’ll get derailed by unfortunate turns.

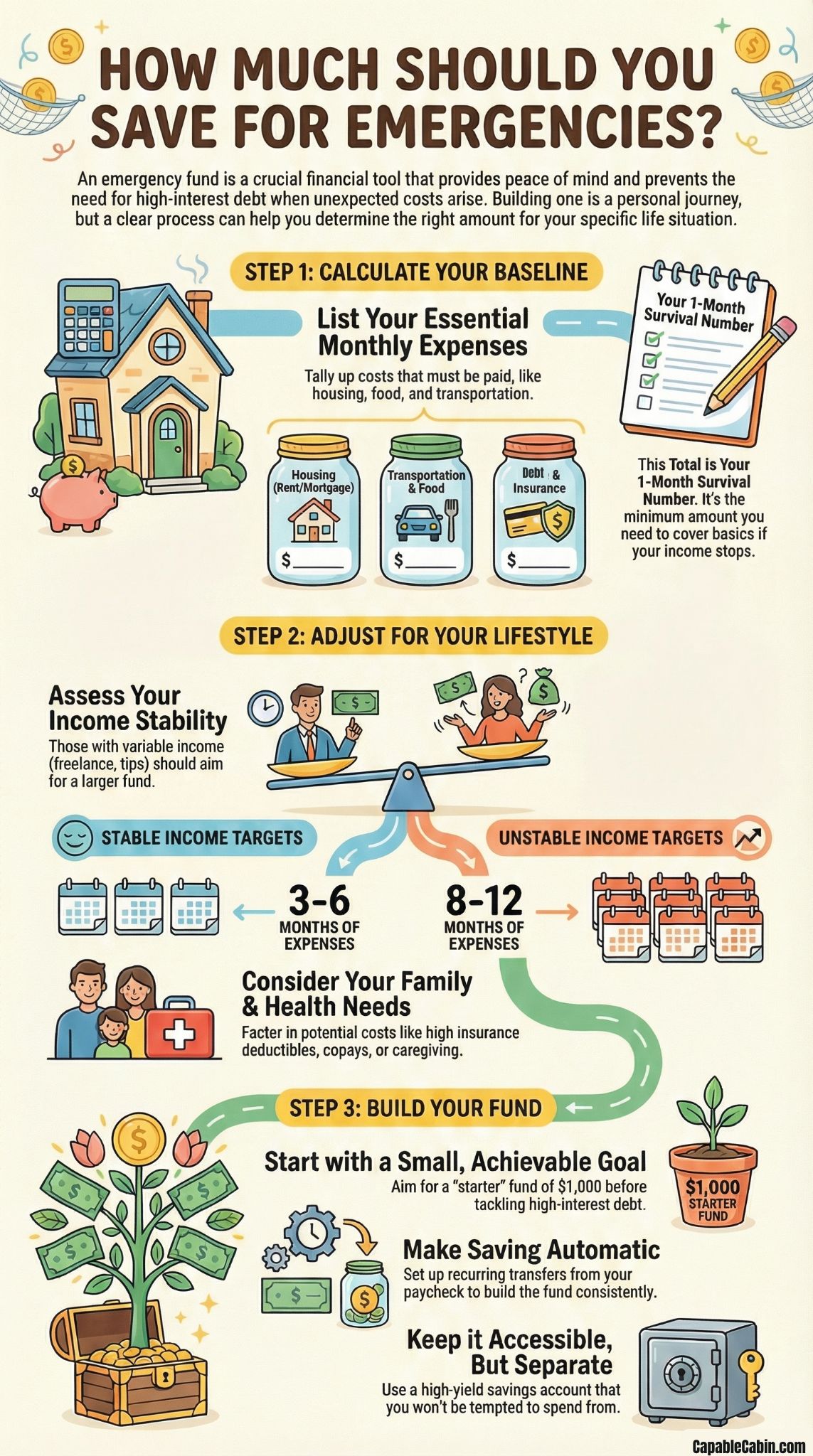

Know Your Core Expenses

Before you decide how much to stash away, it’s good to know exactly what you spend each month. Many of us have a ballpark figure in mind, but until we sit down and itemize everything, it’s easy to overlook smaller bills that quietly chip away at our accounts. So here’s a thought: let’s get to know our monthly spending habits.

- Housing: This often includes rent or mortgage payments, property taxes, and insurance.

- Utilities: Electricity, water, gas, heating, internet, and phone services.

- Groceries: The cost of food at home, toiletries, and any household supplies.

- Transportation: Car payments, insurance, gas, or public transit fees.

- Insurance Premiums: Health, life, or disability insurance—anything that comes out monthly.

- Minimum Debt Payments: At the very least, consider credit card payments, student loans, or any bills you can’t skip without a penalty.

- Child-Related Costs: This might be daycare, school lunches, extracurricular activities, or any other recurring costs for your kids.

These are your essential expenses. If you were in a financial pickle and had to reduce spending drastically, you’d still need to cover these basics. By tallying them up, you’ll get a clearer picture of what three months of bills would look like. Remember, this number doesn’t have to include luxuries—just the absolute must-haves to keep your household running.

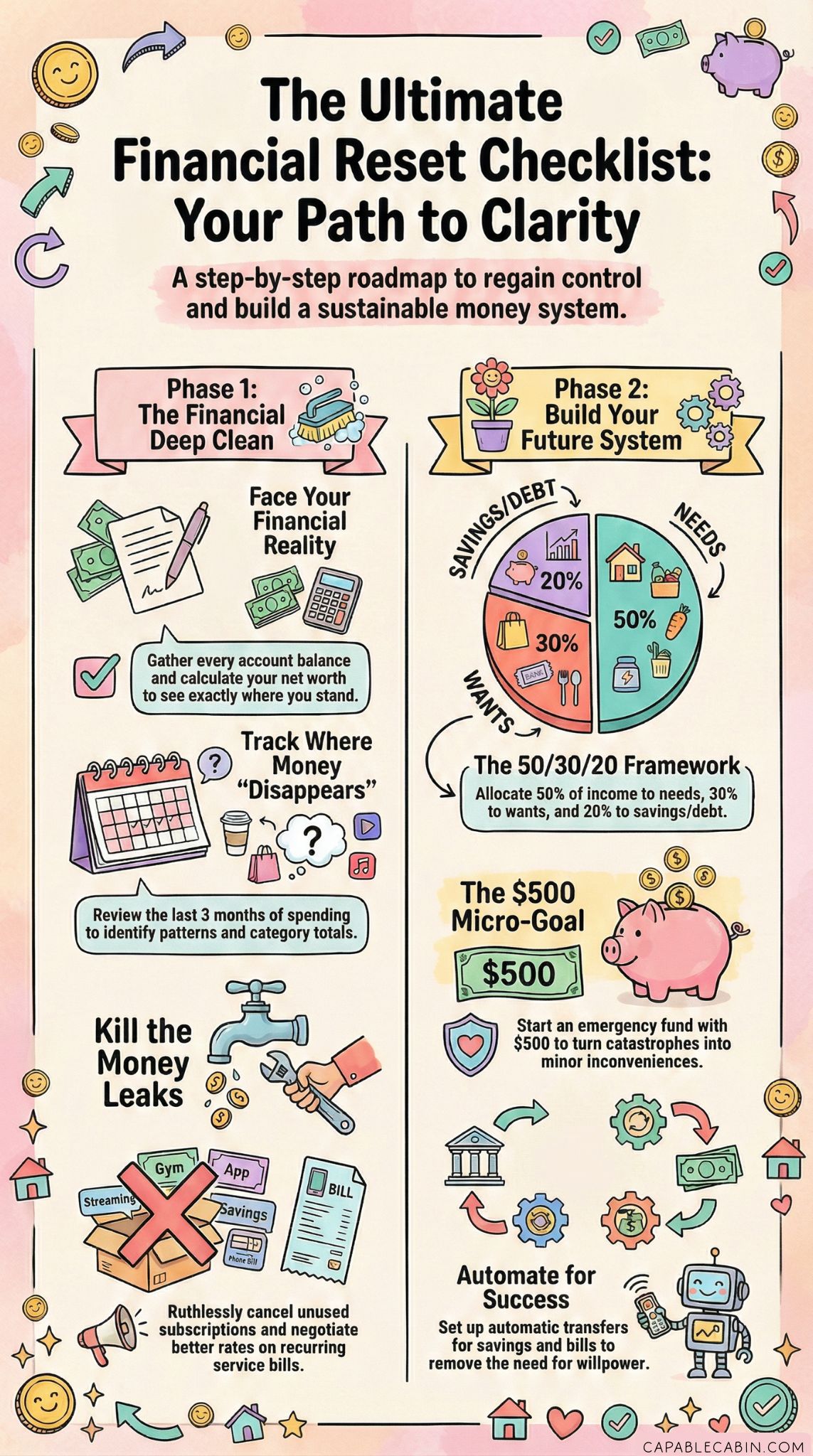

Tracking Your Spending

If you’re not already tracking your spending, a simple spreadsheet or budgeting app can help you see everything in one place. Look back at your last two or three months of bank and credit card statements. It may feel tedious, but the insight is invaluable. You’ll notice patterns, like how much you really spend on takeout or whether those small retail therapy sessions add up more than you expected. This is all about awareness, not judgment. We’re just getting real with ourselves so we can plan effectively.

Adjusting for Creating Your Fund

Once you see how your expenses stack up, you might realize you can trim some costs to make building your 3-month cushion easier. That doesn’t mean you have to give up everything that brings you joy, but maybe you decide to skip that premium subscription service for a while or minimize impulse buys. These small adjustments can make a world of difference. After all, we want to reach our savings goal sooner rather than later.

Calculate Savings Targets

So you’ve got a handle on your essential monthly expenses. Let’s say, for example, they total $3,000. If you multiply that by three, you land on $9,000 as your emergency fund target. That number might feel huge at first glance—but don’t worry, we’re going to break down how to get there in practical, manageable steps.

Breaking It Down Monthly

If you’re aiming for $9,000, you can decide how many months (or paychecks) you want to take to accumulate this amount. You might shoot for a year, setting aside $750 each month ($9,000 divided by 12). Or maybe you have a tighter budget and need two years, so you’d deposit $375 monthly. There’s no right or wrong timeline, as long as you’re consistent.

Going Beyond Initial Targets

Keep in mind, these numbers are a starting point. If you worry about job security or have unique financial circumstances, you might want to aim higher. Conversely, if you already have additional resources, you might find you can reach your target in record time. And if your life situation changes—like a new baby or a move—adjust your monthly expense calculations and check if your fund still accurately reflects three months of living costs.

Dealing With Fluctuations

Expenses aren’t always static. Some families spend more during the winter on heating, while others see bills spike in summer. Anticipating these shifts can help you avoid surprises. If your monthly bills vary widely, you can calculate an average or overestimate to give yourself a comfortable cushion. A little planning goes a long way in ensuring your 3-month emergency fund truly covers your most pressing needs.

Save Consistently and Smart

Now for the fun part—actually watching that emergency fund grow. I get it, setting aside money every month can feel daunting, especially if life already feels like a juggling act. But with a few strategies, you’ll see that building your cushion doesn’t have to be painful.

Automate Your Savings

One of the easiest ways to keep your momentum is automating the process. Schedule a direct deposit from your paycheck straight into a dedicated savings account. When you don’t see that money in your usual checking account, you’re less tempted to spend it. It’s like paying yourself first, a simple routine that can have a big impact in the long run. If you can’t automate for some reason, set a monthly reminder to manually move a set amount into your emergency fund right after you get paid.

Reduce Small Luxuries

We all deserve little treats here and there, but you’ll be surprised how much money you can free up by cutting down on those spur-of-the-moment expenses. Perhaps you skip a few latte runs each week or cook at home more often instead of dining out. Over time, these minor adjustments can add up significantly. If you track these sacrifices mentally, you might say, “That’s one more step toward my 3-month cushion,” each time you skip an impulse buy. A little pat on the back for your discipline goes a long way.

Explore Side Income

Sometimes, saving more simply means you need to bring in a little extra cash. Whether it’s freelancing, selling crafts, or using your hobby to make quick income, any additional money can go straight toward your 3-month buffer. It doesn’t need to be a major career shift—just a small hustle that adds a bit of breathing room in your finances. Sure, it requires time and effort, but think of it as a short-term push for long-term security.

Consider a Fun Challenge

We’re all in this together, right? If you need an extra boost, you might check out a group activity like an emergency fund challenge. Being part of a supportive community gives you motivation and accountability—two powerful ingredients for financial success. Challenges often break savings goals into smaller milestones, celebrating every time you hit a new level. That camaraderie can help you stay committed on the days you’re tempted to dip into your savings for a non-emergency.

Protect Your Growing Fund

You’ve done the tough job of saving, so let’s ensure your emergency cushion stays intact. Sure, it’s tempting to put that money in a high-risk investment for bigger returns, but sometimes safety is more important than high yield. After all, the point of your 3-month emergency fund is to be easily accessible when real emergencies call.

Where to Keep It

Look for a separate savings account—something that’s not too close to your primary checking account, but still accessible if you need the money fairly quick. Many people like high-yield savings accounts at reputable banks or credit unions. For additional options, you could explore a money market account or a cash management account that pays higher interest while allowing limited withdrawals. You’ll want to read up on the benefits and decide which best fits your comfort level. For more insights, peek at ways to figure out where to keep emergency fund.

Balancing Accessibility and Security

You need to be able to reach your funds in a genuine emergency—like needing to replace a broken appliance or paying for a sudden medical procedure. At the same time, you don’t want it so easy to access that you’ll be tempted to grab from it for non-essentials. A good strategy is to keep your emergency fund separate from daily spending. That small barrier often keeps impulsive decisions at bay, but still lets you access money when you truly must.

Avoid Mixing Funds

If you have a general savings or “fun money” stash, avoid blending it with your emergency account. When everything’s lumped together, it can be tougher to track what’s earmarked for real emergencies versus what you can spend on, say, next summer’s vacation. Keep your lines of separation clear, so you always know where you stand.

Keep Momentum Strong

Building an emergency cushion is a journey, not a quick fix. It’s normal to feel enthusiastic at the start, only to wonder a few months down the line if you’re actually getting anywhere. The key is staying motivated and finding ways to continually renew your commitment.

Celebrate Little Victories

Every time you add a certain amount to your fund—say an extra $50 or $200—acknowledge that progress. It might feel small, but those tiny wins add up to something big. Give yourself a mini-reward, like a cheap but fun family movie night or a favorite homemade treat. By marking these milestones, you give your mind ample reason to keep pushing toward that three-month goal.

Revisit Your Budget Regularly

Life is rarely static. A new job, a change in household size, or different monthly bills can all alter your financial picture. So take stock every few months. Are your expenses higher these days? Maybe you moved and your rent jumped up. If so, you might need to adjust your monthly emergency fund contributions. Think of this as a regular check-in, not a chore. You’re just fine-tuning to make sure your plan still works for your family.

Share Your Goals

Sometimes, letting a close friend or partner in on your financial goals helps keep you accountable. Even better if they’re working on their own emergency fund too. You can cheer each other on, compare notes, or commiserate on days when it’s tempting to let things slide. Having social support is a powerful motivator—nobody wants to feel alone on a tough journey.

Challenge Yourself to Grow

Once you hit your three-month target, it’s tempting to say, “Hey, I’m done!” But consider building upon that success. You might check out a year-long emergency fund challenge to move from three months of coverage to six months. Or maybe you pivot your focus to other goals, like paying off debt or saving for a home down payment. As long as you keep the cushion intact for true emergencies, feel free to expand your financial horizons.

Overcome Setbacks Gracefully

We all know the feeling: you’re cruising along, then an unexpected bill arrives and upends your meticulously planned budget. It’s frustrating, but it doesn’t have to spell doom for your hard-earned emergency fund. The key is to shift perspective: you saved that money for situations exactly like this.

Handling True Emergencies

If the car needs a new transmission or a medical bill pops up, that’s what the fund is for. Use it, then plan to replenish it as soon as you can. Think of this withdrawal as a speed bump, not the end of the road. The relief you’ll feel by not juggling debt is worth any extra effort to build your fund back up.

Differentiating Wants from Needs

The tricky part is deciding what qualifies as a true emergency. A legitimate crisis is typically unavoidable—think job loss, urgent repairs, or necessary medical procedures. Meanwhile, if your friend invites you on an impromptu weekend getaway, that’s more of a want than a need. Resist the urge to dip into your emergency savings for something that isn’t vital for your family’s well-being.

What if You Have Debt?

Plenty of people wonder whether they should pay off debt first or stockpile savings. Truth is, it can be a balancing act. For many families, setting aside at least a small emergency stash is crucial, even while tackling debt. Otherwise, a single crisis might force you to rack up credit card bills again. As you continue, you might look into strategies for an emergency fund vs debt approach that works best for you. Often, it’s wise to do both in tandem—build some savings while also chipping away at high-interest balances.

Rebuilding Your Cushion

If a major emergency drains much of your 3-month fund, don’t panic. Revisit your original plan: track expenses carefully, trim non-essentials, and refocus on building back up. You might also peek at resources about how to rebuild emergency fund, which can offer tips and strategies for getting back on your feet more quickly.

Move Forward With Confidence

By now, you’ve seen how a 3-month emergency fund can become a powerful shield against life’s financial twists and turns. But here’s the thing—we’re all in this together, learning as we go. Your confidence in handling finances will grow with each intentional step you take, whether it’s automating monthly savings, finding small ways to cut expenses, or exploring side gigs to boost your income. Let’s maintain that momentum.

Learning to Adapt

We’ve all heard the adage, “Change is the only constant.” Your expenses, job situation, and family obligations might shift from year to year. Being adaptable ensures you can recalibrate your savings strategy anytime life throws you a curveball. That’s the beauty of an emergency fund: it’s meant to be flexible, something you can lean on without going deeper into debt.

Tying In Your Other Goals

Once you have a stable three-month fund, consider branching out. Perhaps next on your list is establishing a financial go bag or creating a financial emergency binder. These tools help keep your critical documents and information organized so you can grab them at a moment’s notice. If you’re keen on exploring broader financial planning, you could investigate a financial preparedness checklist or a financial emergency preparedness kit to keep yourself fully covered on all fronts. Each step of the way, you’re building a stronger safety net—one that extends beyond just having money saved.

Exploring Next-Level Steps

After the security of a 3-month cushion becomes your new normal, you might explore more advanced challenges. For instance, if you found success with an automated approach, you might stretch your goal to 6 or 12 months. The confidence you build here can inspire you to tackle bigger ambitions, like saving for a dream vacation in cash or starting a college fund for your kids. Just remember not to neglect your emergency fund in the process—life’s surprises don’t pause just because you’ve got new dreams.

Practical Tips for Everyday Life

Sometimes, half the battle is remembering these strategies when you’re grocery shopping or scrolling online sales. Keep your emergency fund top of mind with a few daily habits.

- Meal Plan: Instead of impulsively ordering takeout, plan your meals for the week. You’ll likely save money and help your family eat healthier.

- Set Reminders: If you’re manually transferring money to savings, use phone alerts or calendar notifications so you never skip a month.

- Use Cash Envelopes: Some folks swear by a cash-based system to curb overspending. Consider the emergency fund envelope system to keep physical tabs on where your money goes.

- Stay Organized: Knowing exactly how much is in your account—and why it’s there—helps you resist the urge to dip into it. If you need an easy system for crucial documents, check out emergency financial information storage.

Small moves like these, repeated over time, form the backbone of a healthy financial routine. It’s a lot like developing the habit of brushing your teeth—once you’re in the rhythm, it doesn’t feel like work.

Address Common Myths

Building a 3-month emergency fund can sometimes stir up misconceptions. Let’s clear up a few, so you don’t hold yourself back.

Myth 1: “I Don’t Earn Enough”

Yes, most of us wish we had bigger paychecks. But remember, it’s not necessarily about huge deposits, it’s about consistency. Even setting aside $25 or $50 each payday can snowball. As life changes—maybe you get a raise or your monthly bills drop—you can scale up your contributions.

Myth 2: “I’m Already in Debt”

Having some emergency savings is still important. While you might prioritize high-interest debt, putting at least a little aside protects you from turning to credit cards again when an emergency arises. Balance is everything.

Myth 3: “It Won’t Happen to Me”

No one expects job losses, major home repairs, or big medical bills until they happen. It’s not about being pessimistic; it’s about recognizing that emergencies are part of life. And when you’re prepared, you ride out the storm without your peace of mind crumbling.

Look Toward the Future

Having three months of expenses covered might be your starting line, but you can push that boundary if you choose. For instance, you might be interested in an emergency fund vs savings comparison to understand how both fit into your broader goals. Or maybe you’ve realized you want to keep more emergency cash at home for ultra-immediate needs. These are natural progressions once you stabilize your initial three-month fund.

Planning for Inflation

As the cost of living goes up, your emergency cushion might need to grow too. If you want to stay a step ahead, consider checking out tips on an inflation emergency fund, ensuring that today’s savings will still hold value in tomorrow’s economy.

Refining Your Strategy

If your monthly expenses decrease—maybe you’ve paid off your car or done some serious downsizing—you could shift funds to another financial priority. Some folks funnel extra cash into a college fund or retirement. The best part? You have the freedom to adapt once that three-month goal is in the bag.

Stay True to Your Goals

We’ve covered planning, saving, adjusting, and protecting. Yet, one essential piece is your mindset. It’s easy to start strong and then become discouraged if progress is slower than you hoped. But remember, every single deposit brings you that much closer to a cushion that safeguards your family when the unexpected pops up.

Motivation on Tough Days

When sacrifices feel heavy, remind yourself of the bigger picture. Think of the relief you’ll feel the next time the car needs repairs or you face an unforeseen event. Instead of worrying, you’ll have a financial safety net ready to deploy—no panic, no guilt, no hasty credit card balances.

Reward Progress, Not Just the End

It might take months or even years to fully fund your cushion. That doesn’t mean you shouldn’t celebrate along the way. Each milestone is proof you’re building a stronger future. This journey isn’t just about finishing—it’s about growing into someone who can handle financial surprises with poise.

Overcoming Self-Doubt

We’ve all been there, feeling uncertain about how we’ll ever reach a lofty goal like saving three months’ worth of expenses. The truth is, many of us have started from zero. By making small, consistent moves, you can surprise yourself with what’s achievable.

Shift the Narrative

Instead of thinking, “I’ll never save that much,” try “I’m getting closer to my goal every month.” It’s a simple mental reframe that can keep you from giving up. Likewise, if you ever catch yourself feeling overwhelm, step back and remind yourself why this matters—to create peace of mind for your household.

Seek Inspiration

Talk to friends who’ve built up an emergency fund successfully. Join online forums or community groups focused on finances. Hearing stories of real people who turned small steps into big wins can ignite fresh motivation. You might even find a partner for accountability—someone who checks in weekly to see how your saving is going.

Practical Example: A Saving Table

Let’s look at a hypothetical table that shows several saving levels and timelines. Suppose your monthly must-have expenses total $2,500. You want to hit a $7,500 cushion. Here are three pacing options:

| Timeline | Monthly Deposit | Total in 12 Months | Total in 24 Months |

|---|---|---|---|

| Option 1: Fast | $625 | $7,500 | – |

| Option 2: Moderate | $312.50 | $3,750 | $7,500 |

| Option 3: Slow | $156.25 | $1,875 | $3,750 |

If you look at Option 1, you’d complete your 3-month emergency fund in exactly one year. Option 2 gets you there in two years. Option 3 might take four. None of these options are “right” or “wrong.” They show different routes based on your comfort level and daily finances. The important bit is picking a pace you can stick to. If you try to save too aggressively, you might burn out. If you move too slowly, you could lose motivation. Only you know the balance that makes sense for your family.

Maintain Healthy Boundaries

You’ve worked hard to build a comfortable emergency savings. Now, how do you keep it intact when life’s temptations arise? Healthy boundaries mean only using the fund for genuine emergencies—no matter how enticing non-urgent purchases might seem.

Define “Emergency” Clearly

Write a small list of what counts as an emergency. Maybe that’s medical bills, critical car or home repairs, or an unexpected job loss. If you’re married or share finances, sit down and agree so there’s no confusion when the time comes. You might also revisit that list every year as your priorities shift.

Keep Other Goals Separate

Whether it’s a vacation fund, a new gadget, or holiday gifts, keep those savings in a different pot. Splitting your finances this way ensures you clearly see if you’ve saved up for “fun stuff” or if that money is strictly for crisis situations. When the purpose is crystal clear, you’re less likely to borrow from one fund to feed another.

Leveraging Additional Tools

Throughout your journey, you might discover helpful resources that make saving, tracking, and learning easier.

- A starter emergency fund guide if you’re just beginning to tuck away small amounts.

- An emergency fund guide for deeper insights on best practices.

- Emergency fund mistakes to avoid common pitfalls.

- Accessing emergency fund tips so you’re not caught off guard when you truly need the cash.

Exploring these tools can sharpen your strategy and keep you alert to potential stumbling blocks. After all, being proactive beats cleaning up financial messes later.

Expect Life to Evolve

Your financial journey won’t look exactly like anyone else’s. Some families might have irregular incomes, while others face higher-than-average healthcare costs. The beauty of a 3-month emergency fund is that it’s adaptable. You can tweak it to align with your unique circumstances.

Recalibrate as Needed

Once a year—or anytime your income or expenses shift dramatically—take an hour or two to reassess. Are you still aiming for the right monthly target? Is your chosen account offering a decent interest rate? Staying on top of these little details keeps your fund optimized for your current life stage.

Watch for Financial Growth Opportunities

If you end up with an unexpected windfall—like a bonus at work or a generous gift—consider adding a portion to your emergency savings. It’s tempting to splurge, but funneling even 50% of that windfall toward your fund can give you a significant boost. This approach benefits you double: you enjoy a bit of fun with the remainder, but also elevate your long-term security.

Final Thoughts: You’ve Got This

Think of your 3-month emergency fund as a trust-building exercise with yourself. Every dollar you set aside tells your future self, “I’ve got your back.” Let that empower you. When life feels unstable, your cushion can be the difference between panicking and calmly handling the situation. After all, there’s something incredibly reassuring about opening your banking app and knowing you have enough to weather at least a few months of storms.

Remember, you don’t have to sprint to the finish line. Progress is progress—whether it’s a dollar here, ten dollars there, or a chunk you’ve saved from a side gig. The important thing is not giving up when it seems slow or when an emergency forces you to tap into your reserve. Just pick up where you left off and keep moving forward.

So let’s keep this momentum going. Whenever you feel that pull of self-doubt, remind yourself you’re investing in your family’s safety and peace of mind. Each deposit is a small celebration of responsibility and love for those who depend on you, including you. Before you know it, you’ll confidently say that yes, you do have a solid, 3-month emergency fund—and you can sleep a little better knowing it’s there. It might not solve every problem under the sun, but it sure makes life’s financial detours far less intimidating.

Trust me, you’re not alone in this journey. We’re all learning how to protect what we love. So here’s to you, and to building a safer, steadier future—one deposit at a time. Take that deep breath. Roll up those sleeves. You’ve got this.