How Much Emergency Cash Families Really Need Before an Evacuation

Imagine you’re rushing to gather your essentials in the middle of the night, with a storm warning blaring over the radio. Or maybe you’re evacuating due to a fast-moving wildfire that’s inching closer to your home.

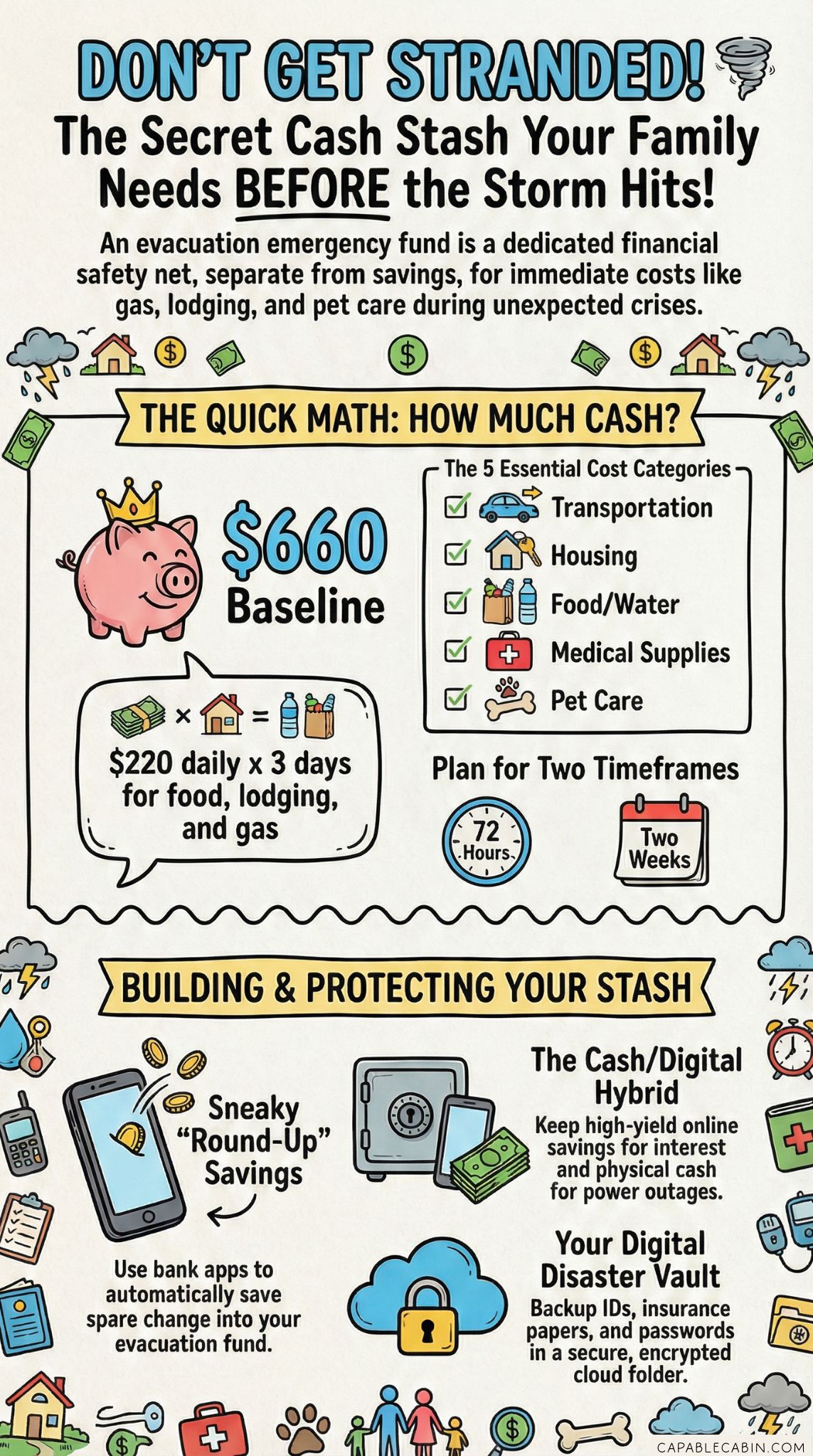

All sorts of scenarios can make you think, “Do I have enough money set aside for this?” That’s where creating an evacuation emergency fund comes in—a dedicated financial safety net that helps you cover unexpected costs during a forced relocation, natural disaster, or any crisis that compels you to leave home quickly.

Trust me, you’re not alone if you’re feeling overwhelmed trying to figure out how much to save or where to even begin. Let’s walk through it step by step in a calm, approachable way, so you can feel better prepared and more secure.

At its core, an evacuation emergency fund is about one thing: ensuring you have enough resources to handle immediate needs when you’re uprooted. Everything from gas money, temporary shelter, food, medical supplies, and even pet care can add up quickly.

Without a plan, you risk diving into high-interest debt or depleting any other savings you might have set aside for other life goals. Because we’re focusing on families, this article will zero in on tactics that can work for you, your partner, your kids—even your extended family if they rely on you.

You deserve peace of mind knowing you can handle whatever life throws your way, and this guide will help you get there.

So let’s look at what your evacuation emergency fund should look like, how to create it, and ways to keep it flexible enough to pivot if changes or surprises pop up. By breaking it down into manageable steps, you’ll see that preparing is not as daunting as it might seem. Let’s explore each piece of the puzzle together, so you can turn your concerns into a solid plan.

Recognize The Importance

We’ve all seen headlines about families caught off-guard by fast-moving disasters or sudden evacuations. And it’s not always a massive event—sometimes, it’s a local fire, a storm, or even an industrial accident near your neighborhood.

In moments like these, a solid financial cushion can be as critical as any physical supply you pack. If you’re still questioning whether you really need an evacuation emergency fund, remember that emergencies come in all shapes and sizes. The earlier you begin, the better off you’ll be, because crisis situations rarely give you time to build savings on the spot.

Why This Fund Is Special

Many people already have a general emergency fund—three to six months of living expenses—and that’s a wonderful start. But an evacuation emergency fund serves a distinctly urgent purpose.

It covers costs that might not fit neatly into your standard budget, such as extra gas or transportation, temporary lodging, or even a sudden jump in grocery prices if supply lines are disrupted. In a pinch, you need ready-to-go cash that doesn’t require you to dip into your usual monthly obligations or other long-term savings goals.

Emotional Security For Your Family

Money aside, you’re also easing emotional stress. Knowing that a stash of funds is available helps you make calm, thoughtful choices under pressure. Instead of panicking and thinking, “How are we going to pay for a hotel room?” or “What if the ATM network is down?”, you’ll have a plan.

When you’re stressed, kids and other family members often feel it too, which can fuel chaos. But if everyone sees that you’ve set aside resources, they’ll likely feel safer and more cooperative in a tense situation. It’s about safeguarding peace of mind as much as it’s about finances.

Balancing Confidence And Realism

None of us wants to predict bad outcomes, but it’s part of being prepared. Building a dedicated financial crisis action plan is a way to actively manage uncertainty.

You’re not trying to manifest disasters by talking about them; you’re simply acknowledging that unplanned events happen more often than we’d like. The good news is that this type of proactive thinking can make you more resilient in everyday life, too.

Once you have your evacuation emergency fund established, you’ll notice a shift in how you handle other financial hiccups—like sudden car repairs or unexpected medical bills—because you’ve already practiced setting aside funds with a clear purpose.

Estimate Your Needed Amount

Real talk: every family’s financial needs differ. A retiree couple may need far less than a family of five with pets. So how do you arrive at a number that feels right for you? One way is to calculate very specific evacuation costs, from fuel to lodging to meals and medicine.

Another is to mirror the approach you might use for a financial evacuation go bag—take a quick inventory of everything you’d need if you had to leave home and cover extra expenses for at least a few days. Let’s break it down in a fairly simple way so you can create a total estimate.

Basic Cost Categories

- Transportation: This includes fuel for your cars or the price of bus, train, or flight tickets if you need to go a longer distance.

- Housing: Think hotels, motels, campgrounds, or a short-term rental if you need more than a night or two.

- Food And Water: Yes, you can pack non-perishables, but you’ll likely have to buy fresh meals and additional drinking water on the road.

- Medical And Health: If any family member relies on prescription meds or special equipment, factor in costs like refills, copays, or device chargers.

- Pet Care: Boarding or travel crates, plus any emergency vet care.

Time Frames Matter

It helps to plan for two time frames: the first 72 hours and then up to two weeks. Many evacuations are relatively short, but there are situations—like hurricanes or extensive wildfire damage—where you might be away from home for an extended period. The 72-hour approach is a good baseline, ensuring you can pay for immediate essentials without diving into panic mode.

Use A Budget Breakdown

If the list above feels intimidating, try looking at an evacuation budget breakdown strategy. This approach essentially itemizes your initial outlay (like lodging for two nights) and multiplies it by the number of days you think you’ll be away. Let’s say you calculate it might cost around $100 per day for your family’s food, plus around $100 for lodging, plus $20 in gas or public transportation. Over three days, that’s $660. Over a week, that’s more than double. By the time you add in potential pet boarding and medical costs, you’ll see how essential it is to park enough money in your specific evacuation fund.

Remember, these numbers won’t be fixed in stone—family size, geographic location, and even the season can cause variations. But having a ballpark figure to work toward will keep you from getting too unsure about how much is enough.

Plan For Different Emergencies

Sometimes, a crisis can be laser-focused, like a single road closure forcing you to find another route. In other situations—like major hurricanes or global health crises—you might encounter widespread disruptions that affect your finances in unexpected ways. If you’ve experienced pandemic financial planning, you already know how unpredictable life can be. So, let’s talk about planning for multiple layers of emergencies, from short-notice evacuations to more prolonged, complicated scenarios.

Short-Notice Evacuations

This could be anything from a neighborhood gas leak to a nearby wildfire. When local authorities say, “You need to leave now,” you’ll want to have immediate cash on hand so you can pay for a taxi, fill up your tank, or grab a last-minute hotel room. These short-notice situations might only last a couple of days, but they can still rack up unexpected expenses quickly.

- Grab-And-Go Strategy: Have a small stash of cash in your emergency kit, along with your ID, credit cards, and vital paperwork.

- Rapid Lodging Options: Jot down a list of budget-friendly motels or friend’s houses that are within reachable distance.

Extended Crises

Then you have events like major hurricanes, earthquakes, or widespread flooding, where large areas might be affected, resources can be limited, and you could be on the move for an extended period. In these scenarios, hotels and gas stations might be packed, ATMs can run out of money, and supply chains might slow to a crawl. If you’ve built your evacuation emergency fund robustly, you’ll be able to weather the chaos with fewer sleepless nights.

- Community Resources: Keep handy the contact info for local relief agencies. Even if you have money, resources can sometimes be scarce.

- Backup Destinations: Identify a couple of alternative places to stay if your first option is overrun with other evacuees.

Overlapping Situations

Every so often, you might face a perfect storm—like a natural disaster that collides with a personal financial setback. For example, if a major hurricane hits just as you lose your job, you’re dealing with two emergencies at once. In this case, your evacuation financial planning merges with your day-to-day money management. And if you prepare for one scenario well, it often creates a buffer for others. It’s all interconnected in the broader picture of resilience. By diversifying your readiness—thinking about short-term emergencies, long-term crises, and personal financial stability—you’re building a stronger support system for you and your family.

Planning for different emergencies might seem like it’ll ramp up your anxiety. Actually, most families find that once they map out a few “what if” situations, the fear subsides. You gain clarity. You know what you need to stash away and why. This planning doesn’t have to consume hours of your week. Even an hour or two of brainstorming can bring you major relief and control over a chaotic situation. Trust me, it’s worth it.

Build A Cash Reserve

Now comes the step we often dread—figuring out exactly how to fund this plan. It’s something we all wrestle with because budgeting can feel stressful, especially when you’re juggling everyday bills and other priorities. But take heart. The idea is to start slow and consistent, just like you might with a gym routine. You don’t have to funnel every spare dollar into your evacuation emergency fund at once; you just need to build it up steadily.

Where To Begin

If you haven’t already considered a budget evacuation planning approach, that’s a fantastic place to start. This basically means looking at your existing budget, trimming or pausing certain non-essentials, and redirecting those amounts into your evacuation fund. Sometimes the shift can be small—maybe skipping a subscription you barely use or cooking more meals at home. These simple changes add up over a few months.

- Round-Up Savings: Some banks let you “round up” your purchases to the nearest dollar and deposit the difference into a savings account. This is a sneaky but highly effective way to gradually boost your fund without feeling the sting of a large lump sum leaving your checking account.

- Automatic Transfers: Set up a weekly or monthly auto-transfer from your checking to a separate evacuation savings account, even if it’s just a small amount each time.

Aim For Realistic Milestones

As tempting as it is to say, “I need thousands of dollars right now,” start by setting smaller milestones. Maybe your first goal is $500, which can handle one urgent hotel night and a bit of gas money. Once you hit that, aim for $1,000, which might cover a few nights away plus food. Incremental goals help you see progress and discourage you from getting overwhelmed. Plus, you’ll rack up small victories that encourage you to keep going.

Keep It Accessible, But Not Too Accessible

Here’s a potential pitfall: if you treat your evacuation emergency fund like petty cash, you risk dipping into it for non-emergencies. Yet, if you lock it away in an account that’s too hard to access, you won’t be able to withdraw it quickly when you need it most. A high-yield online savings account is usually a sweet spot—your money is separate from your everyday checking, but you can still transfer the funds in a pinch. If you’re worried about technology going down during a crisis, keep a portion of that cash on hand (in a secure place) so you’re never left empty-handed.

Coordinate With Family And Friends

If you have older parents or family members who lean on you, it may be worth discussing a shared approach. For instance, you could agree to pool resources in the event of a disaster, or at least plan out how you’ll help each other. That way, you don’t bear the entire financial brunt alone if you’re taking responsibility for more than just your immediate household. Talk about it openly. The more clarity you have, the less confusion and stress you’ll face under real pressure.

Secure Your Digital Assets

When building your evacuation emergency fund, it’s easy to focus on tangible cash. But in our digital world, you also want to make sure you have quick, safe access to your electronic money sources and important documents. If your credit or debit cards stop working because of a network outage or your phone dies and you can’t log in to your bank account, you can find yourself in a tight spot. Protecting your digital finances is kind of like a modern version of stashing away cash under the mattress—only now you have to think about passwords, data backups, and secure apps.

Have Multiple Payment Options

We rely on credit cards and digital payment apps for just about everything. But what if the power goes out or the data lines are blocked? To avoid panic, keep multiple payment methods at the ready. That could be:

- Physical Debit And Credit Cards: Different accounts so you’re not stuck if one bank experiences technical issues.

- Mobile Payment Apps: These can come in handy, especially if you’re splitting hotel or supply costs with others, provided the internet is still running.

- Cash On Hand: Even in our digital age, crisis situations can make cold, hard cash king.

Protect Essential Financial Documents

Personal IDs, insurance papers, tax forms, bank statements—losing track of these can severely hamper your ability to get financial relief or prove your identity. Consider scanning these documents into PDFs, storing them securely (password-protected, ideally), and backing them up on the cloud or on an encrypted flash drive. That way, if you lose the physical copies, you can still retrieve digital versions. You might find more comprehensive tips under evacuation digital finances, which explores how to maintain secure, quick access to your most important records.

Safeguard Logins And Passwords

Yes, it’s a headache to manage all your passwords. But think of how much bigger the headache will be if when you’re trying to rent a car or book a last-minute flight, you can’t remember your bank’s login or your credit card’s security questions. A password manager can simplify your life by storing all of your credentials in one ultra-secure “vault.” Just make sure you remember the master password, and keep a backup in a safe place or with a trusted person.

Make A Digital Finance Plan

Just as you have a plan for your physical emergency kit, map out what you’ll do if digital systems become temporarily unusable. Who would you call? Which bills need immediate attention? For example, you might have auto-pay set up for important things like renters or homeowners’ insurance. If your bank’s systems go down, can you still make payments? Sketching out a digital finance plan ensures you’re not scrambling under pressure. It’s another layer of security in your readiness approach.

Maintain And Update Fund

Establishing an evacuation emergency fund isn’t a “set it and forget it” type of deal. Life changes—maybe you move to a different region that’s prone to hurricanes, or you get a promotion that raises your income but also your living costs. Even your family size can shift if you welcome a new baby or offer to care for aging parents. That’s why it’s important to circle back periodically and make sure your fund still matches your needs.

Regular Check-Ins

Put a simple reminder on your calendar—maybe quarterly or twice a year—to look at your evacuation budget and see if anything needs adjusting. Have hotel prices jumped in your region? Are your kids older and require different resources, like more space or separate meals? Could your job situation change, prompting a bigger or smaller safety net? These are the kinds of questions that keep your plan fresh.

Incorporate New Lessons

Every once in a while, you’ll pick up tips that make you say, “I wish I’d known this sooner!” That’s normal. Maybe you recently discovered a more efficient way to book emergency lodging, or you found an app that helps you source local shelters or volunteer housing. Roll these insights into your ongoing strategy. You might even check out guides like post evacuation financial recovery to see how families are handling the aftermath of major disasters. These stories can be eye-openers, reminding you to revise your own fund if you see a potential gap.

Don’t Skip Annual Reviews

If the idea of quarterly reviews exhausts you, at least do an annual deep dive. Think of it like an annual doctor’s appointment for your finances. During that time, update your lines of credit, confirm your bank’s emergency policies, and make sure you have the newest contact numbers for local agencies. This might also be the moment to see if your evacuation financial planning has changed if you relocated or your kids have started college. A year can fly by, and what was “good enough” last summer might not cut it this year.

Communicate With Loved Ones

All of this updating doesn’t matter much if you’re the only person who knows about it. Even if you prefer to handle finances on your own, it’s a good idea to share the basics with at least one trusted family member. If you’re incapacitated or separated during an evacuation, they’ll need to access the money or know where to find vital documents. Everyone’s stress level plummets if there’s a plan that other heads of household or adult children can follow.

Prepare For Insurance Claims

Insurance can be a powerful ally if something happens to your home or personal belongings while you’re away. Yet, filing insurance claims in the aftermath of an evacuation can get complicated fast—especially if you’re not prepared. That’s why part of your evacuation emergency fund strategy should include an understanding of how policies, premiums, and claims typically work under chaotic conditions.

Gather Policy Details Ahead Of Time

It’s way easier to file a claim when you know exactly what your insurance policy covers. Does it include lodging costs if your home is uninhabitable? Are you covered for flood damage specifically? The moment you decide to create an evacuation fund is also a great time to chat with your insurance agent about potential coverage gaps. If you have a handle on these details now, you won’t waste precious time trying to figure them out when something actually happens.

Document And Inventory Your Possessions

Take photos or videos of your home, focusing on valuable items—furniture, electronics, sports equipment—for proof of ownership. If you keep receipts, store them alongside your policy info. That way, if you need to file an evacuation insurance claims form, you can show exactly what you lost and its value. Many insurers expedite claims if they can easily see before-and-after evidence, reducing the chance you’ll have to hound them for reimbursement.

Coordinate Insurance With Cash Reserves

Even if your insurance covers most of the damage, you might still have to pay a deductible—or wait for the insurance settlement to come through. A big part of your evacuation emergency fund is bridging that gap so you’re not racking up credit card debt while waiting on compensation. In some situations, your insurance company might provide an advance on your claim. It helps if you’re aware of that possibility ahead of time, so you can request it.

Pro Tip: Keep Contacts Handy

Store the phone numbers and emails of key insurance reps, claim adjusters, and your agent in your phone. Better yet, back those up in a password-protected doc as well. Remember that, under high-stress evacuation circumstances, your phone might die or get misplaced. Also keep that info in your physically assembled kit. When the unexpected hits, you never want to scramble for contact details.

Stay Flexible And Prepared

Here’s the thing: no matter how much you plan, life throws curveballs. Even if you set aside a solid evacuation emergency fund, real events rarely unfold like a script. They can come at the worst possible times, or in unexpected forms. That’s why cultivating a mindset of “financial flexibility” is so important. You don’t have to be perfect at planning or have a massive fortune. You just need to be ready to pivot when circumstances change.

Embrace Adaptability

Your usual strategy might dictate saving a fixed sum each month. But if you lose a job, you’ll need to dial things back until you’re working again. Or if you suddenly find a side hustle that increases your income, you can double down on your contributions and accelerate your savings rate. Whatever happens, adapt and shift. That’s the essence of being truly prepared. Think of it like adjusting the sails on a boat—you can’t control the wind, but you can control how you respond.

Expect Emotional Ups And Downs

Feeling anxious or second-guessing your plan when new challenges arise is normal. Maybe you discover a new hazard in your area or you go through a minor crisis that drains part of your fund. Take a breath. Remember that you can rebuild. The more times you adapt, the more resilient you become. That resilience is what helps you handle not just evacuations, but day-to-day burdens too. You might also tap into a financial recovery emergency fund if you’re blindsided by unexpected losses. Each step teaches you how to become even better at weathering financial storms.

Keep Communication Open

If you have a partner or co-parent, or even older kids who contribute financially, keep them in the loop. Periodic chats can prevent resentment or misunderstanding about who’s contributing what. They also allow everyone to spot potential issues or come up with innovative solutions to boost the fund. Sometimes a teenager might say, “Hey, I’ll get a summer job,” and contribute a portion toward the family’s safety net. That kind of teamwork cements a sense of shared responsibility.

Build In Room For Extras

Realize that during an evacuation, unplanned costs pop up—maybe your kids are out of school, so you need extra childcare, or a relative has to stay with you and you cover their expenses. When you’re planning your evacuation fund, add a buffer for life’s random curveballs. Sure, there’s no perfect math for this. But if you estimate $1,500, maybe shoot for $2,000, just to give yourself breathing room.

Conclusion

Let’s face it, preparing for an emergency evacuation of any kind isn’t exactly a fun weekend project. It involves thinking about the worst-case scenarios, juggling budgets, and updating documents you hope you never actually need. But there’s a bright side here. By carving out an evacuation emergency fund, you’re gifting yourself a priceless sense of security. When crisis hits, you’ll be able to say, “I’m not completely thrown off balance because I’ve already taken steps to handle this.”

We’re all in the same boat of navigating uncertain times—be it floods, wildfires, hurricanes, or sudden economic downturns. And it’s perfectly normal to feel nervous about what you can’t control. But having a plan in place puts at least some of that control back in your hands. You won’t eliminate every shred of stress, yet you’ll reduce that frantic, last-minute scramble for resources. You’ll also develop a deeper confidence in your own ability to protect what matters—your home, your family, and your well-being.

Get started with baby steps, and soon you’ll see your fund grow into a reliable cushion. Align your planning with your actual needs and your family’s particular situation, factor in some wiggle room, and check in regularly to keep your goals updated. Even if you never have to execute that evacuation plan, you’ll have gained a stronger overall financial footing. And that’s always a win.

So gather your loved ones, talk it through, and make the best decisions for everyone’s benefit. You don’t have to do it perfectly—just do it consistently, with an open mind. And remember, you’re not alone in this. Plenty of families have gone from feeling unsure to building the exact kind of peace of mind you’re hoping for. With each smart, small step, you’re making it far more likely that, when an emergency does come knocking, you’ll be ready to open the door and move forward with clarity and strength. Keep going—you’ve got this.