How to Rebuild Your Finances After an Evacuation — Step-by-Step

Facing a post-evacuation financial recovery can feel like a tall mountain to climb. You have just gone through an intense situation, juggling everything from housing uncertainties to misplaced documents. Now, it is time to rebuild your money life. Think of this as a journey we are on together. You certainly do not have to figure it all out overnight, and you are not alone in feeling a bit overwhelmed. This ultimate guide aims to help you navigate each step in a calm, systematic way, so you can regain a sense of security and confidence.

Acknowledge the Emotional Aftermath

After an evacuation, you might still feel keyed up with stress, exhaustion, or even relief that the ordeal is over. It is perfectly normal to experience a roller coaster of emotions. At the same time, it is easy to jump straight to crunching numbers, but giving yourself time to process the emotional impact matters too.

- Let Yourself Recover: You have been through something significant. Whether you evacuated due to a natural disaster or a personal crisis, be patient with your emotional energy. Resuming “business as usual” instantly is not always practical.

- Talk It Out: Chat with supportive friends or family members about what you went through. Sometimes, processing feelings can clear mental space to focus on financial tasks.

- Celebrate Survival: You made it. Even if all does not feel perfect right now, give yourself credit for managing a crisis. That sense of resilience is going to serve you well on the road ahead.

By getting your mindset in a better place, you will find it easier to dive into the specific tasks of rebuilding your finances. No need to rush. A steady approach, with self-compassion at the core, can help keep you motivated.

Evaluate Your Current Financial Situation

Before you decide how to rebuild, let’s figure out where you stand. This involves looking at all aspects of your money life, from bank balances to pending bills. Think of it like taking inventory before restocking a pantry.

- Check Your Income Streams: Are you able to return to work, or did your main source of income change? Take note of any new or existing employment, benefits, or temporary assistance programs you are relying on.

- Review Account Balances: Log into each bank, credit card, or investment account. Verify that your funds are where they should be, especially if you have not had consistent internet or phone access during evacuation.

- Note Outstanding Bills or Debts: Some payments may have gone past due when you were displaced. List them out so you can tackle each one intentionally. Do not worry if the list looks daunting. Knowing the total picture is half the battle.

Once you have this overview, you will be better able to set priorities. Maybe you will discover some immediate bills that need attention, or you realize you have enough resources to cover essentials for a few months. Either way, clarity is your friend in this process.

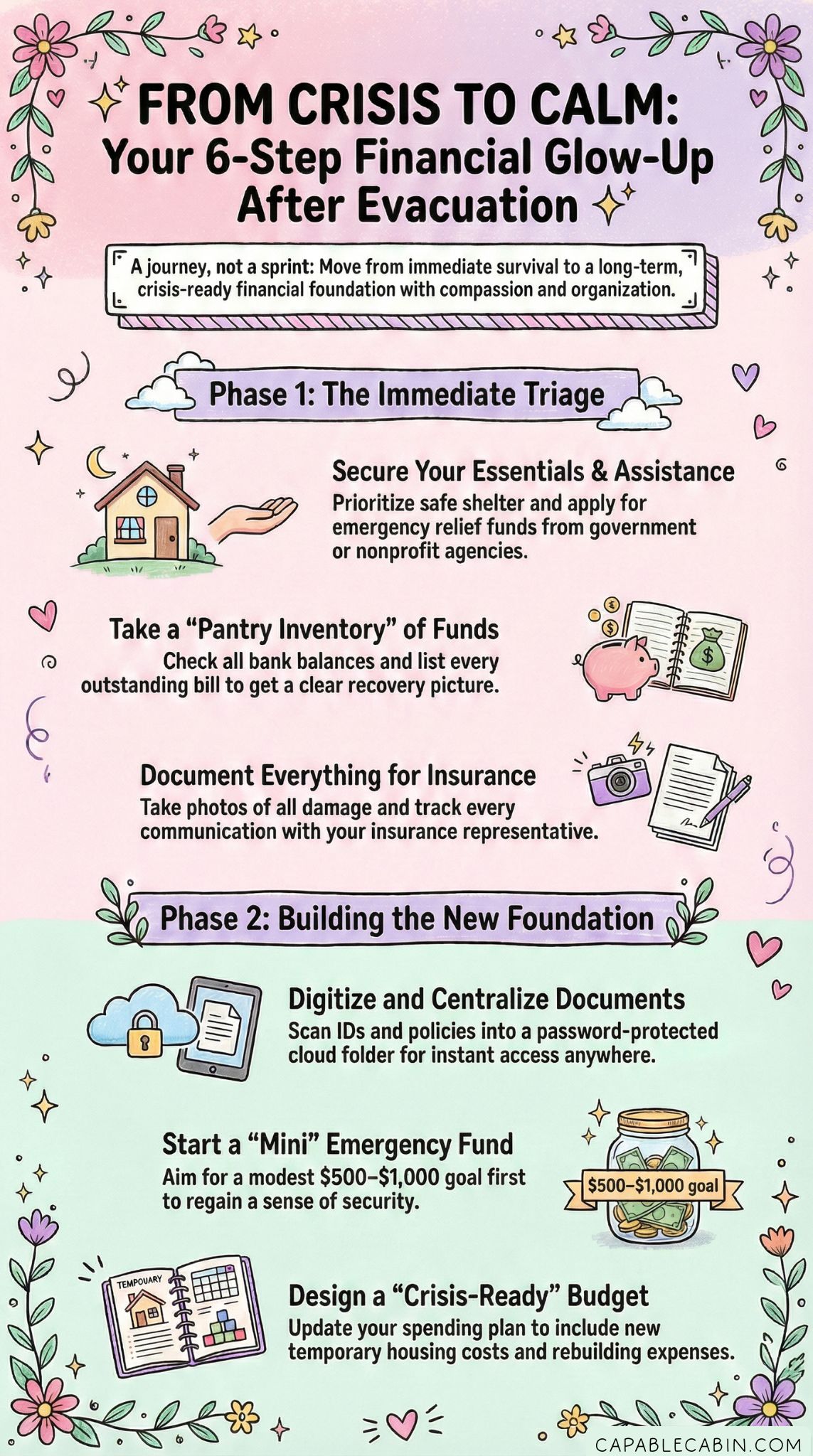

Address Immediate Monetary Needs

For many families, the first step in creating a stable foundation after an evacuation is covering the basics: food, housing, and healthcare. These everyday expenses can feel urgent, especially if you returned home to find damage or needed to stay somewhere else temporarily.

- Secure Shelter: If you are not yet able to return to your home, look into short-term housing solutions. Some local or government programs offer vouchers or temporary placements. Keep receipts and documentation for reimbursement or insurance claims later.

- Apply for Assistance: Depending on the nature of the crisis, you may qualify for emergency relief funds or donations from nonprofit organizations. Though it might feel humbling to ask for help, these resources are there for moments like this.

- Rebuild Routine Expenses: Even if the evacuation turned your life upside down, try to re-establish a normal flow of paying for groceries, utilities, and any household supplies. This routine can help you feel more grounded.

It is OK to tap into an evacuation emergency fund if you have one set aside for times like this. If you do not, do not stress. We will talk about how to build and maintain one soon. For now, focus on keeping your family safe, fed, and sheltered.

Review Insurance Policies And Claims

When aiming for a smooth financial recovery after an evacuation, insurance can be your backbone. Whether it is homeowner’s, renter’s, or even car insurance, filing and following up on claims is crucial. This step may feel like the least exciting, but it can unlock the resources you need.

- Document Damage Thoroughly: If you can safely return to your residence, take videos and photos of everything—from structural damage to lost personal items. These visual records strengthen your claim.

- File Claims Promptly: Many insurance providers have strict deadlines. Even if you feel uncertain about the scope of damage, open a claim as soon as possible. You can always update details as you go.

- Track Communication: Keep notes on every call or email exchange with your insurance company, including the name of the representative and the date of contact. Having this record makes it easier if you encounter disputes or need to escalate an issue.

- Explore Additional Coverage: Sometimes, coverage extends to unexpected areas, like hotel stays or meals if you are displaced. You might discover you are eligible for more than you initially realized.

If you are unsure how to approach the claims process or want extra tips on maximizing coverage, you might find guidance in evacuation insurance claims. And do not forget, if you faced a pandemic-related evacuation or encountered disruptions during a global crisis, you could learn from resources like pandemic financial planning for navigating similar challenges.

Organize Important Financial Documents

Sorting out key paperwork is essential for both your immediate and long-term money life. After an evacuation, some documents may have gone missing, or perhaps you never had them backed up digitally. This is your chance to gather, replace, and protect what you need.

- Gather Core Documents: Focus on IDs, birth certificates, passports, insurance policies, and bank statements. If you cannot locate originals, contact the issuing agency for replacements.

- Secure Digital Copies: Scan or photograph essentials, then store these files in a password-protected folder. You can even use cloud-based services as extra backup. If you want more tips, check out evacuation digital finances.

- Create a Central Folder: Whether you use a physical binder or an encrypted drive, keep everything in one dedicated spot. This reduces the chance of losing important papers again if you need to evacuate a second time.

Any time you find duplicates, label them and keep them safe. You may also discover that your pre-evacuation plan could have been stronger. That is all part of learning. If you want to prepare for future crises, consider building a financial evacuation go bag with all these essentials gathered in a single, quickly accessible place.

Rebuild Your Savings Step By Step

Having an emergency fund can be a lifesaver, especially after an evacuation. If yours was depleted—or never existed—do not worry. You can start fresh. The first deposit might be small, but it is symbolic of your commitment to restoring stability.

Set Mini Goals

- Try aiming for a modest target first, such as $500 or $1,000, depending on your monthly expenses. It is less intimidating than shooting straight for a six-month safety net.

Automate Contributions

- If possible, set up automatic transfers from each paycheck. Even $25 or $50 adds up over time.

Make Savings Visible

- Keep a clear line in your budget for your fund. Seeing it there can serve as a reminder not to skip contributions.

Use Windfalls Wisely

- Tax refunds, insurance payouts, or gifts could jumpstart your fund. Before putting these sums elsewhere, consider directing some (or all) to emergency savings.

When your fund begins to grow, it can give you the breathing space to handle unexpected expenses without plunging into debt. If you need more specific strategies, you could explore a financial recovery emergency fund approach that focuses on systematically rebuilding your cushion.

Deal With Debt And Credit

Debt management is often overlooked during a crisis, but staying on top of loans or credit card balances matters more than ever. Late payments can damage your credit score, which can affect your ability to access favorable lending terms in the future.

- Prioritize High-Interest Debt: If your credit card has a high interest rate, consider focusing extra payments there first. Every little bit helps reduce the total amount you owe.

- Negotiate Or Defer If Needed: Some lenders offer grace periods or emergency relief for those affected by evacuations or natural disasters. It might feel intimidating, but reach out and explain your situation.

- Check Your Credit Report: Make sure everything on your report is accurate. After an evacuation, mistakes can happen if mail was lost or accounts were not updated. You do not want errors harming your financial rebound.

A strong credit history can open doors to better rates on mortgages, auto loans, or even small business financing if you plan to rebuild a livelihood that was disrupted. Even if your finances are in flux, paying attention to your credit can save you money in the long run.

Craft A Refined Budget

With changed circumstances, your old budget might not make sense anymore. You might be dealing with temporary housing costs, medical bills, or renovations. Creating a realistic, updated budget is like drawing a new road map for your money journey.

- Revisit Fixed vs. Variable Costs: Your rent or mortgage may have changed if you had to relocate. Meanwhile, utility expenses might look different if you are staying somewhere temporarily. Separate your essential fixed costs from variable day-to-day expenses.

- Factor in Evacuation Bills: Do you need to repay relatives who helped you with travel or accommodation? Budget for it, even if you pay them back in small increments.

- Include Rebuilding Expenses: If you need home repairs, set aside funds specifically for that. Even if the cost is large, seeing it in your budget helps you plan.

- Reassess Subscriptions And Extras: In a post-evacuation season, you might want to temporarily pause memberships or streaming services to free up money for immediate priorities.

Do not forget, if you want to plan for future emergencies, you can explore an evacuation budget breakdown or budget evacuation planning. These resources can help you create a more flexible, crisis-ready budget that still supports your daily life.

Explore Support And Assistance

Nobody travels this path alone. It is okay—beneficial, even—to lean on community resources or government support to speed up your financial recovery post-evacuation. Some programs are time-sensitive, so keep an eye on deadlines and eligibility requirements.

- Government Programs: Federal or state agencies sometimes offer grants, low-interest loans, or temporary housing assistance after disasters. Check official websites or visit local community centers to see what is available.

- Nonprofit Aid: Organizations like the Red Cross, local churches, or community nonprofits provide supplies, meals, or even financial support. While it might be tough to ask for help, remember that these groups are there to bridge gaps in times of crisis.

- Community Fundraisers: Sometimes, neighborhoods or social circles rally around those impacted by evacuations. If someone sets up a fundraiser on your family’s behalf, be open to that generosity. You can also pay it forward later when you are back on your feet.

- Legal Aid: If you face landlord disputes, insurance claim denials, or complicated contract issues, free or low-cost legal aid might be available. Clearing these hurdles can save you from unexpected costs.

It can be comforting to know that others want you to succeed. Support networks not only alleviate some financial pressure but also remind you that you are part of a caring community.

Build Long-Term Resilience

Right now, you might be focused on simply getting through the next few weeks. But once the dust settles, it is worth planning for your future. By taking these steps, you can emerge stronger than before, with lessons learned shaping a more resilient financial life.

Strengthen Your Emergency Plans

You have seen what can happen if you need to evacuate on short notice. Drawing up a financial crisis action plan can help you respond quickly and confidently next time. Outline key steps such as where your family will stay, how you will safeguard important documents, and which support networks you can tap into.

Update Your Insurance Coverage

Assess any gaps in your current policies. Perhaps you’ve discovered that your homeowners’ insurance doesn’t cover as much as you expected, or that you lack flood insurance in a high-risk area. Use these insights to secure more comprehensive coverage. Also, keep receipts of any rebuilding expenses, as they can help adjust your policy in the future.

Diversify Income Streams

Many families find that having multiple forms of income, such as a main job and a side business, creates an extra layer of protection if a crisis hits again. That extra income can feed straight into your emergency savings or help you pay off any remaining debt from the evacuation.

Maintain a Community Network

Evacuations often highlight how critical it is to have neighbors, friends, or family who can step in with help. Keep a contact list—both physically and digitally—so it is easy to call, text, or email your support circle if a crisis reoccurs.

Practice Mindful Spending And Saving

As you step away from crisis management and toward recovery, it is tempting to try to rebuild everything at once. Yet, mindful spending and saving can ground your efforts and keep you from feeling overwhelmed.

- Embrace a Simple Lifestyle: For a while, you might cut back on non-essentials to replenish your savings. This might mean cooking more meals at home, using public parks for leisure, or swapping pricey entertainment for free community events.

- Reward Yourself the Smart Way: A little treat here and there can do wonders for morale, but it does not have to break the bank. Even a small celebration can remind you that you are making progress and deserve recognition.

- Check In Regularly: Schedule weekly or monthly check-ins with yourself (or your family) to see how your spending patterns line up with your financial goals. Adjust as needed, and give yourself grace if certain costs fluctuate.

By staying mindful of your cash flow, you preserve the gains you have worked hard to achieve. This is not about living in constant scarcity, but about rebuilding from a place of awareness and balance. Over time, you might even find that you feel more empowered and stable than you did before the evacuation.

Embrace Financial Education And Coaching

If the evacuation flipped your perspective on how delicate finances can be, you are not alone. Maybe you realized you want a deeper understanding of money management. Seeking education or coaching can accelerate your recovery and help you reach goals you once thought were out of reach.

- Read Books And Blogs: There are plenty of accessible resources about budgeting, investing, and crisis-proofing finances. Even short articles can offer big insights.

- Take Courses: Some community centers or online platforms provide free or low-cost classes. Whether it is budgeting 101 or advanced investing, knowledge is power.

- Hire a Financial Coach: If you can afford it, a professional advisor can help you chart a course specific to your family’s needs. They often have experience dealing with crisis recovery and can spot overlooked areas.

- Share What You Learn: Teaching others, even informally, makes the knowledge stick. It also builds a supportive environment if you have family or friends who might face a similar crisis in the future.

When we continuously learn and grow, we set ourselves up for lasting financial stability, regardless of emergencies. It is the ultimate form of self-care, nurturing the security of your entire household.

Keep the Momentum Going

Life after an evacuation is rarely a straight line. You might have setbacks, sudden expenses, or moments where you question your progress. That is natural. The important thing is to keep moving forward, one step at a time.

Revisit Your Goals

- Outline what you want your money life to look like in one month, six months, and a year. Regularly revise those goals based on real-time changes.

Celebrate Wins

- Did you manage to rebuild a three-month savings cushion? Paid off a credit card? Mark these milestones. Acknowledging success fuels further successes.

Seek Guidance When Needed

- If new dilemmas pop up—like unexpected medical bills or job transitions—do not hesitate to consult a professional or reach out to supportive communities.

Stay Prepared

- Consider setting up or revisiting your evacuation financial planning. That way, if another crisis arises, you will be ready with a clear plan and the resources to act quickly.

A major evacuation can change your perspective on everything—your career, your home life, and especially your finances. Yet, it also offers a chance to emerge stronger, knowing you have weathered a significant storm. By focusing on post-evacuation financial recovery, you are making an investment in your peace of mind and in your family’s future stability.

At each stage of this journey, remember that it is not about being perfect. It is about taking small, consistent steps in the right direction. You have already shown immense resilience by getting through the evacuation; now it is time to apply that same spirit to rebuilding your finances. With the right blend of perseverance, planning, and support, you will move forward from this challenge and create an even more secure foundation than you had before. Keep going—you have got this.